Form 712 For Annuity

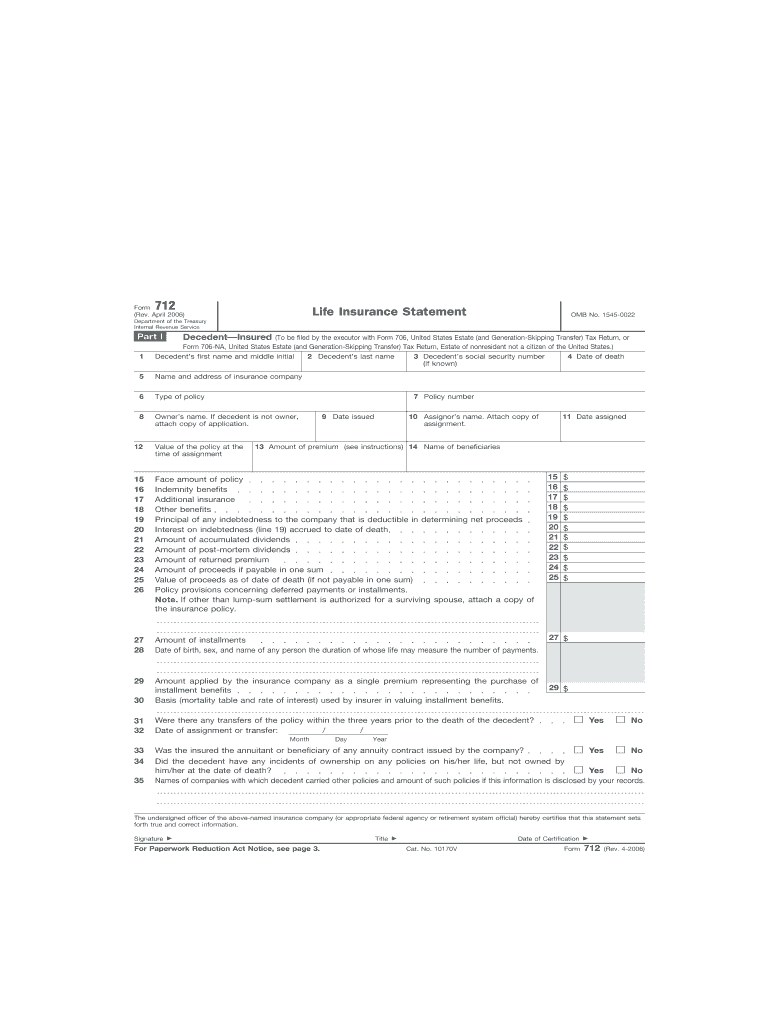

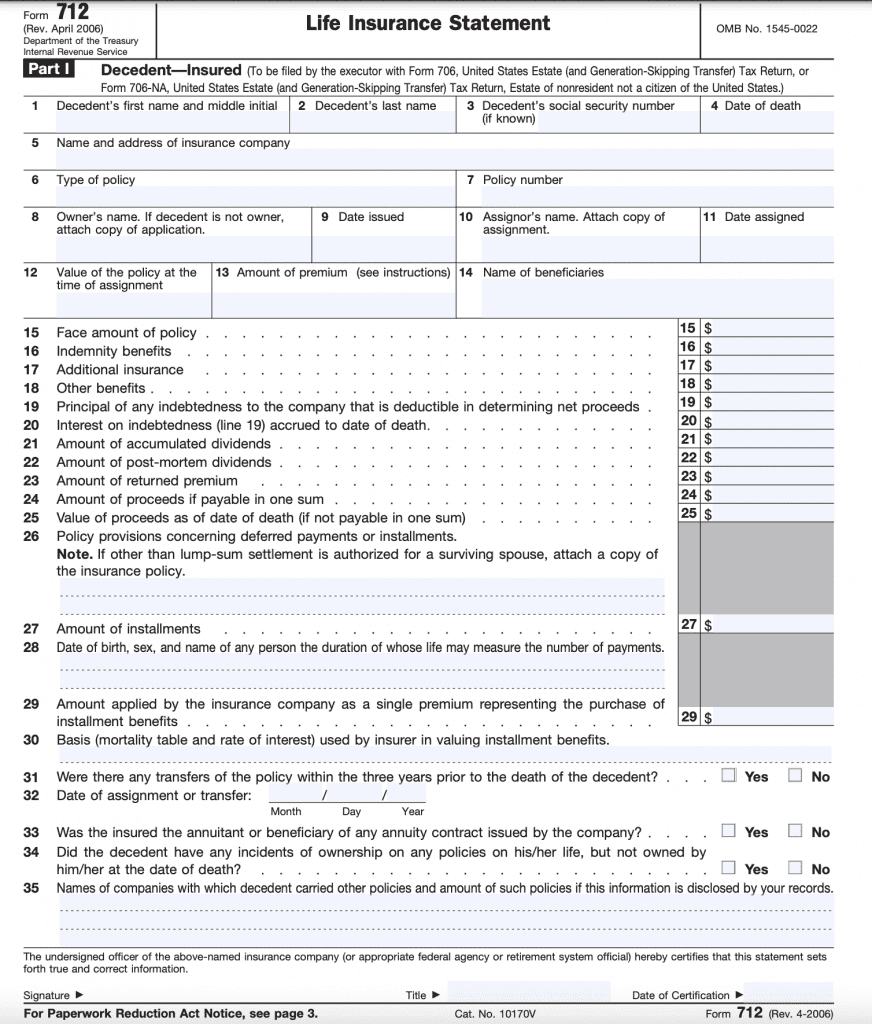

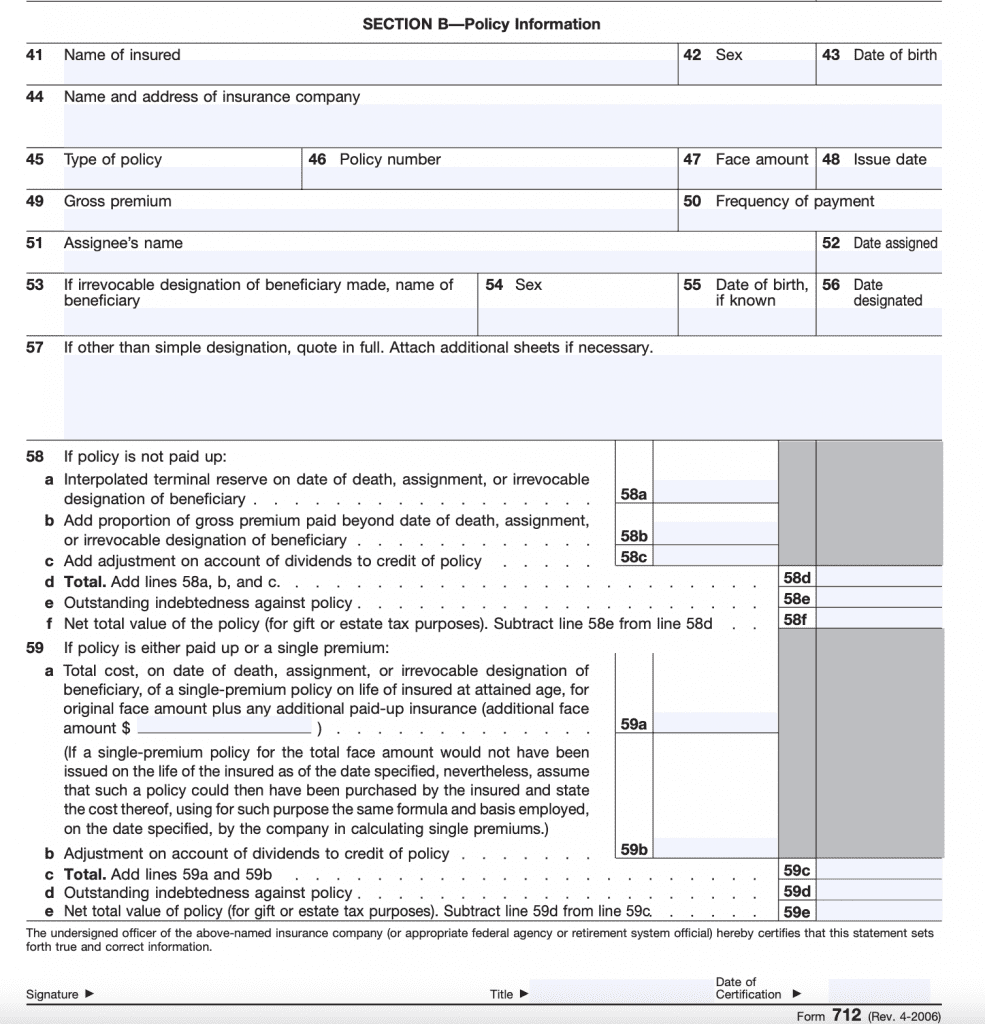

Form 712 For Annuity - Web form 712 reports the value of life insurance policies for estate tax purposes. Trust and power of appointment instruments;. Web information about form 712, life insurance statement, including recent updates, related forms, and instructions on how to file. Estate tax one of an executor's responsibilities is determining the total value of the estate, as estates larger. See statement of financial condition Web retirement tax forms for participants certain securities products and services are offered through pruco securities, llc and prudential investment management services, llc, both members sipc and located in newark, nj, or prudential annuities distributors, inc., located in shelton, ct. This form is not filed by itself, but as an accompaniment to other estate tax forms, most notably irs form 706: Web requested new annuity registration. This form must be signed by all current and new owners or authorized person(s). Web examples include form 712, life insurance statement;

See statement of financial condition Web irs form 712 is an informational tax form that is used to report the value of life insurance policies as part of an estate tax return. Web requested new annuity registration. Web retirement tax forms for participants certain securities products and services are offered through pruco securities, llc and prudential investment management services, llc, both members sipc and located in newark, nj, or prudential annuities distributors, inc., located in shelton, ct. Web information about form 712, life insurance statement, including recent updates, related forms, and instructions on how to file. Ownership changes on riversource® annuities issued in california with the enhanced legacy® or securesource legacy® benefit require the acknowledgment to be initialed. Web form 712 reports the value of life insurance policies for estate tax purposes. Web the purpose of the federal form 712 is to identify the policy's face amount, any accumulated dividends, terminal dividends, the amount of the proceeds, as well as personal information on the insured such as date of birth/death, social security number, and sex. It also asks if the policy was transferred three years prior to the death of the insured. Web irs form 712 is a gift or estate tax form that may need to be filed with the deceased’s final estate tax return.

Web retirement tax forms for participants certain securities products and services are offered through pruco securities, llc and prudential investment management services, llc, both members sipc and located in newark, nj, or prudential annuities distributors, inc., located in shelton, ct. Web the purpose of the federal form 712 is to identify the policy's face amount, any accumulated dividends, terminal dividends, the amount of the proceeds, as well as personal information on the insured such as date of birth/death, social security number, and sex. Web information about form 712, life insurance statement, including recent updates, related forms, and instructions on how to file. Web irs form 712 is an informational tax form that is used to report the value of life insurance policies as part of an estate tax return. See statement of financial condition Ownership changes on riversource® annuities issued in california with the enhanced legacy® or securesource legacy® benefit require the acknowledgment to be initialed. Web requested new annuity registration. This form is not filed by itself, but as an accompaniment to other estate tax forms, most notably irs form 706: Trust and power of appointment instruments;. Web form 712 reports the value of life insurance policies for estate tax purposes.

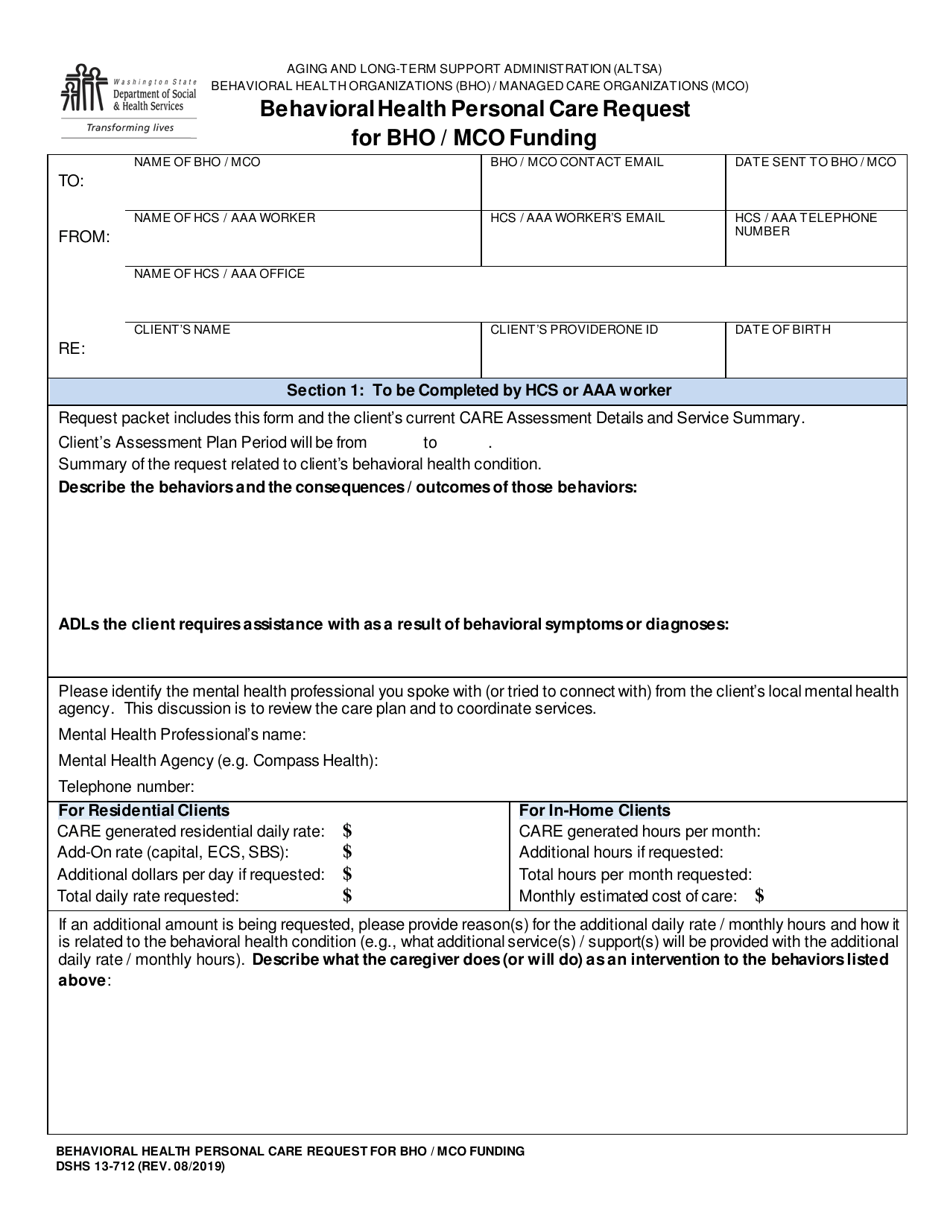

DSHS Form 13712 Download Printable PDF or Fill Online Behavioral

See statement of financial condition Ownership changes on riversource® annuities issued in california with the enhanced legacy® or securesource legacy® benefit require the acknowledgment to be initialed. Web information about form 712, life insurance statement, including recent updates, related forms, and instructions on how to file. This form must be signed by all current and new owners or authorized person(s)..

Life Insurance Form 712 Realtors Can Save Up to 58 on Life Insurance

See statement of financial condition Web irs form 712 is a gift or estate tax form that may need to be filed with the deceased’s final estate tax return. Web retirement tax forms for participants certain securities products and services are offered through pruco securities, llc and prudential investment management services, llc, both members sipc and located in newark, nj,.

Life Insurance Form 712 Realtors Can Save Up to 58 on Life Insurance

Ownership changes on riversource® annuities issued in california with the enhanced legacy® or securesource legacy® benefit require the acknowledgment to be initialed. Web examples include form 712, life insurance statement; See statement of financial condition Web retirement tax forms for participants certain securities products and services are offered through pruco securities, llc and prudential investment management services, llc, both members.

Form 712 Fill Out and Sign Printable PDF Template signNow

Web examples include form 712, life insurance statement; Web the purpose of the federal form 712 is to identify the policy's face amount, any accumulated dividends, terminal dividends, the amount of the proceeds, as well as personal information on the insured such as date of birth/death, social security number, and sex. Web irs form 712 is a gift or estate.

IRS Form 712 A Guide to the Life Insurance Statement

Web retirement tax forms for participants certain securities products and services are offered through pruco securities, llc and prudential investment management services, llc, both members sipc and located in newark, nj, or prudential annuities distributors, inc., located in shelton, ct. Web requested new annuity registration. Estate tax one of an executor's responsibilities is determining the total value of the estate,.

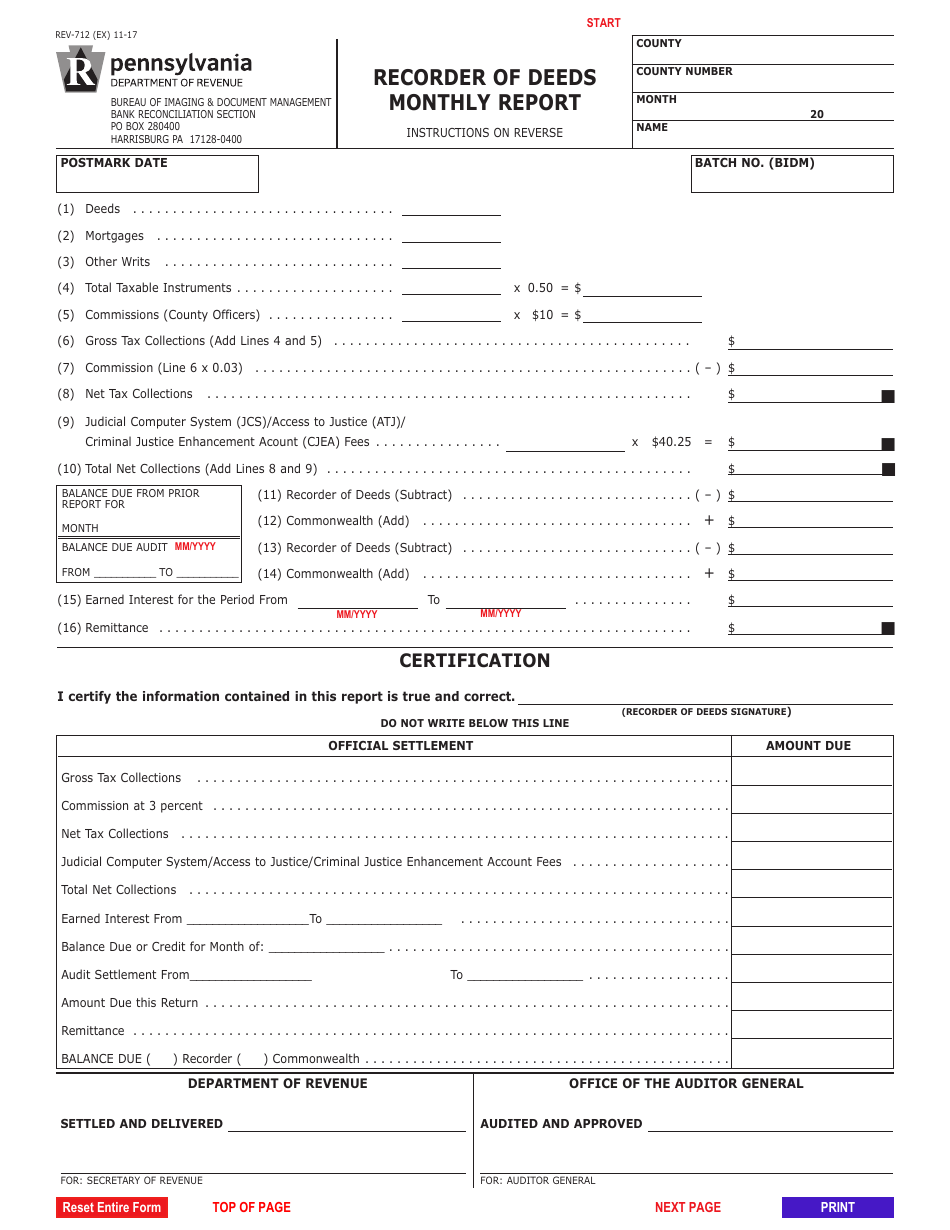

Form REV712 Download Fillable PDF or Fill Online Recorder of Deeds

Web requested new annuity registration. This form must be signed by all current and new owners or authorized person(s). Ownership changes on riversource® annuities issued in california with the enhanced legacy® or securesource legacy® benefit require the acknowledgment to be initialed. Estate tax one of an executor's responsibilities is determining the total value of the estate, as estates larger. Trust.

Form 712 Life Insurance Statement (2006) Free Download

Web form 712 reports the value of life insurance policies for estate tax purposes. At the request of the estate’s administrator/executor, we will complete this form to provide the value of the policy as of the date of death. Web the purpose of the federal form 712 is to identify the policy's face amount, any accumulated dividends, terminal dividends, the.

Ceta Form Bt/1365 13 Mm Manyetik Lokma Uç (Somun Tutucu) 65 Mm

Estate tax one of an executor's responsibilities is determining the total value of the estate, as estates larger. Web requested new annuity registration. Web the purpose of the federal form 712 is to identify the policy's face amount, any accumulated dividends, terminal dividends, the amount of the proceeds, as well as personal information on the insured such as date of.

IRS Form 712 A Guide to the Life Insurance Statement

Web information about form 712, life insurance statement, including recent updates, related forms, and instructions on how to file. Web irs form 712 is an informational tax form that is used to report the value of life insurance policies as part of an estate tax return. Web irs form 712 is a gift or estate tax form that may need.

Form 712 Life Insurance Statement (2006) Free Download

Web form 712 reports the value of life insurance policies for estate tax purposes. It also asks if the policy was transferred three years prior to the death of the insured. Web retirement tax forms for participants certain securities products and services are offered through pruco securities, llc and prudential investment management services, llc, both members sipc and located in.

It Also Asks If The Policy Was Transferred Three Years Prior To The Death Of The Insured.

Web form 712 reports the value of life insurance policies for estate tax purposes. Estate tax one of an executor's responsibilities is determining the total value of the estate, as estates larger. This form is not filed by itself, but as an accompaniment to other estate tax forms, most notably irs form 706: Ownership changes on riversource® annuities issued in california with the enhanced legacy® or securesource legacy® benefit require the acknowledgment to be initialed.

Web The Purpose Of The Federal Form 712 Is To Identify The Policy's Face Amount, Any Accumulated Dividends, Terminal Dividends, The Amount Of The Proceeds, As Well As Personal Information On The Insured Such As Date Of Birth/Death, Social Security Number, And Sex.

Web requested new annuity registration. Trust and power of appointment instruments;. Web retirement tax forms for participants certain securities products and services are offered through pruco securities, llc and prudential investment management services, llc, both members sipc and located in newark, nj, or prudential annuities distributors, inc., located in shelton, ct. See statement of financial condition

Web Examples Include Form 712, Life Insurance Statement;

Web information about form 712, life insurance statement, including recent updates, related forms, and instructions on how to file. This form must be signed by all current and new owners or authorized person(s). Web irs form 712 is an informational tax form that is used to report the value of life insurance policies as part of an estate tax return. At the request of the estate’s administrator/executor, we will complete this form to provide the value of the policy as of the date of death.