Form 7200 Pdf

Form 7200 Pdf - Web deadlines for filing form 7200 to request an advance of the credit for qualified sick and family leave wages. The last date to file form 7200 is the same whether you file. Ein on employment tax return (if other than your own) tip: Get ready for tax season deadlines by completing any required tax forms today. The undersigned is (are) trustee(s) of the trust (the “trust”) for which the above. Web an authorized representative is someone who assists the applicant by completing the application process. Do not file form 7200 after january 31, 2022 the last day to file form 7200, advance payment of employer credits. For 2021, with respect to the employee retention credit,. Web file form 7200 to request an advance payment of the tax credit for qualified sick and family leave wages and the employee retention credit. Web the last day to file form 7200 to request an advance payment for the fourth quarter of 2021 is january 31, 2022.

It is a document that is filed with the irs. Form 7200 is no longer available here; Web instructions, and pubs is at irs.gov/forms. Web file form 7200 to request an advance payment of the tax credit for qualified sick and family leave wages and the employee retention credit. Complete, edit or print tax forms instantly. Web page down to access form 7200/05 1 omb number: If you are filling out this form as an authorized representative,. 09/30/2023 page 1 of 3 federal deposit insurance corporation declaration of independent. Web deadlines for filing form 7200 to request an advance of the credit for qualified sick and family leave wages. For 2021, with respect to the employee retention credit,.

Web page down to access form 7200/05 1 omb number: If you are filling out this form as an authorized representative,. Ad register and subscribe now to work on your advance payment of employer credits. 09/30/2023 page 1 of 3 federal deposit insurance corporation. For 2021, with respect to the employee retention credit,. It is a document that is filed with the irs. Web page down to access form 7200/13. Do not file form 7200 after january 31, 2022 the last day to file form 7200, advance payment of employer credits. Get ready for tax season deadlines by completing any required tax forms today. You will need to reconcile any advance.

What Is The Form 7200, How Do I File It? Blog TaxBandits

Web file form 7200 to request an advance payment of the tax credit for qualified sick and family leave wages and the employee retention credit. The fdic provides the depositor id (id is. For 2021, with respect to the employee retention credit,. Document is used for taxpayers who are not claiming any credits and are not required to file document..

How to Quickly Input Form 7200 Advance Credit on the 941 YouTube

Web page down to access form 7200/13. Web deadlines for filing form 7200 to request an advance of the credit for qualified sick and family leave wages. Edit your dd form 200 form online. The last date to file form 7200 is the same whether you file. Web instructions, and pubs is at irs.gov/forms.

2021 Form IRS Instructions 7200 Fill Online, Printable, Fillable, Blank

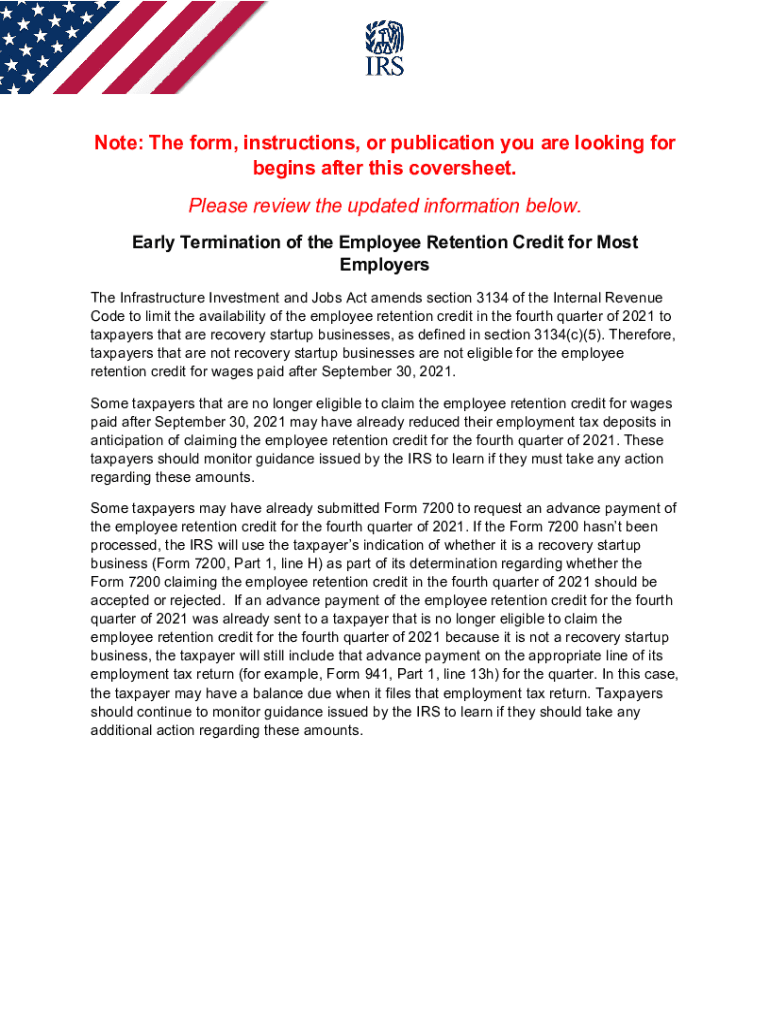

Form 7200 is no longer available here; The undersigned is (are) trustee(s) of the trust (the “trust”) for which the above. You will need to reconcile any advance. Web deadlines for filing form 7200 to request an advance of the credit for qualified sick and family leave wages. Form 7200 may be filed to request an advance payment for the.

File Form 7200 (Advance Payment of Employer Credits Due to COVID19

For example, the form 1040 page is at. Get ready for tax season deadlines by completing any required tax forms today. Web the last day to file form 7200 to request an advance payment for the fourth quarter of 2021 is january 31, 2022. If you are filling out this form as an authorized representative,. Edit your dd form 200.

Why File Form 7200? How Does This Form Work? Blog TaxBandits

Form 7200 may be filed to request an advance payment for the employee retention credit through august 2, 2021. Web file form 7200 to request an advance payment of the tax credit for qualified sick and family leave wages and the employee retention credit. For more information about the credit for qualified sick and family. The undersigned is (are) trustee(s).

StepbyStep Guide Form 7200 Advance Employment Credits BerniePortal

Get ready for tax season deadlines by completing any required tax forms today. 09/30/2023 federal deposit insurance corporation declaration for revocable living. Form 7200 may be filed to request an advance payment for the employee retention credit through august 2, 2021. Web instructions, and pubs is at irs.gov/forms. Web page down to access form 7200/05 1 omb number:

Fillable Form 7200 Fill Online, Printable, Fillable, Blank pdfFiller

For more information about the credit for qualified sick and family. Web up to $40 cash back get, create, make and sign dd 200 fillable. Ad register and subscribe now to work on your advance payment of employer credits. Document is used for taxpayers who are not claiming any credits and are not required to file document. Do not file.

Instructions 7200 form Fill out & sign online DocHub

Complete, edit or print tax forms instantly. Almost every form and publication has a page on irs.gov with a friendly shortcut. You will need to reconcile any advance. Web page down to access form 7200/05 1 omb number: The undersigned is (are) trustee(s) of the trust (the “trust”) for which the above.

20212023 Form IRS 7200 Fill Online, Printable, Fillable, Blank pdfFiller

The last date to file form 7200 is the same whether you file. You will need to reconcile any advance. If you are filling out this form as an authorized representative,. Document is used for taxpayers who are not claiming any credits and are not required to file document. Ad register and subscribe now to work on your advance payment.

IRS Form 7200 2022 IRS Forms

09/30/2023 page 1 of 3 federal deposit insurance corporation declaration of independent. Get ready for tax season deadlines by completing any required tax forms today. Form 7200 may be filed to request an advance payment for the employee retention credit through august 2, 2021. Complete, edit or print tax forms instantly. Web what is federal form 7200?

Get Ready For Tax Season Deadlines By Completing Any Required Tax Forms Today.

You will need to reconcile any advance. 09/30/2023 page 1 of 3 federal deposit insurance corporation. Form 7200 may be filed to request an advance payment for the employee retention credit through august 2, 2021. For more information about the credit for qualified sick and family.

Web Deadlines For Filing Form 7200 To Request An Advance Of The Credit For Qualified Sick And Family Leave Wages.

For 2021, with respect to the employee retention credit,. Complete, edit or print tax forms instantly. Web file form 7200 to request an advance payment of the tax credit for qualified sick and family leave wages and the employee retention credit. Ad register and subscribe now to work on your advance payment of employer credits.

Type Text, Complete Fillable Fields, Insert Images, Highlight Or Blackout Data For.

Web an authorized representative is someone who assists the applicant by completing the application process. The undersigned is (are) trustee(s) of the trust (the “trust”) for which the above. Document is used for taxpayers who are not claiming any credits and are not required to file document. If you are filling out this form as an authorized representative,.

File Form 7200 If You Can’t Reduce Your Employment Tax Deposits To Fully Account For These Credits That.

Form 7200 is no longer available here; Almost every form and publication has a page on irs.gov with a friendly shortcut. At the time form 7200 and these instructions went to print, the. 09/30/2023 page 1 of 3 federal deposit insurance corporation declaration of independent.