Form 7203 Instructions 2022

Form 7203 Instructions 2022 - Current revision form 7203 pdf instructions for form 7203 (print version) pdf recent developments none at this time. The draft form includes a new item d. Basis limitation (7203) stock basis at beginning of year this entry is mandatory to generate the form. Web s corporation shareholders use form 7203 to figure the potential limitations of their share of the s corporation’s deductions, credits, and other items that can be deducted on their individual returns. December 2022) s corporation shareholder stock and debt basis limitations department of the treasury internal revenue service attach to your tax return. Solved • by turbotax • 99 • updated january 13, 2023 form 7203 is used to calculate any limits on the deductions you can take for your share of an s corporation's deductions, credits, and other items. Web 29 july 2022 are you curious about irs form 7203? Web generate form 7203, s corporation shareholder stock and debt basis limitations. Form 8582, passive activity loss limitations; The draft instructions for form 7203 were posted by.

Form 8582, passive activity loss limitations; Web the draft form 7203 for tax year 2022 makes only two changes to the 2021 form: And form 461, limitation on business losses. Web when should i file form 7203? December 2022) s corporation shareholder stock and debt basis limitations department of the treasury internal revenue service attach to your tax return. Web generally, this analysis and the completion of new form 7203, s corporation shareholder stock and debt basis limitations, for impacted taxpayers will be required by oct.15, 2022 so time is of the essence. Current revision form 7203 pdf instructions for form 7203 (print version) pdf recent developments none at this time. The draft instructions for form 7203 were posted by. Web s corporation shareholders use form 7203 to figure the potential limitations of their share of the s corporation’s deductions, credits, and other items that can be deducted on their individual returns. Web generate form 7203, s corporation shareholder stock and debt basis limitations.

Web 29 july 2022 are you curious about irs form 7203? This form is used by s corporation shareholders to figure out the potential limitations of their share of the s corporation’s deductions, credits, and other items that can be deducted on their returns. Web when should i file form 7203? Solved • by turbotax • 99 • updated january 13, 2023 form 7203 is used to calculate any limits on the deductions you can take for your share of an s corporation's deductions, credits, and other items. Current revision form 7203 pdf instructions for form 7203 (print version) pdf recent developments none at this time. The new form is required to be filed by an s corporation shareholder to report shareholder basis. Web the draft form 7203 for tax year 2022 makes only two changes to the 2021 form: The draft instructions for form 7203 were posted by. Basis from capital contributions made or additional stock acquired during year Form 8582, passive activity loss limitations;

Form 7203 S Corporation Shareholder Stock and Debt Basis Limitations

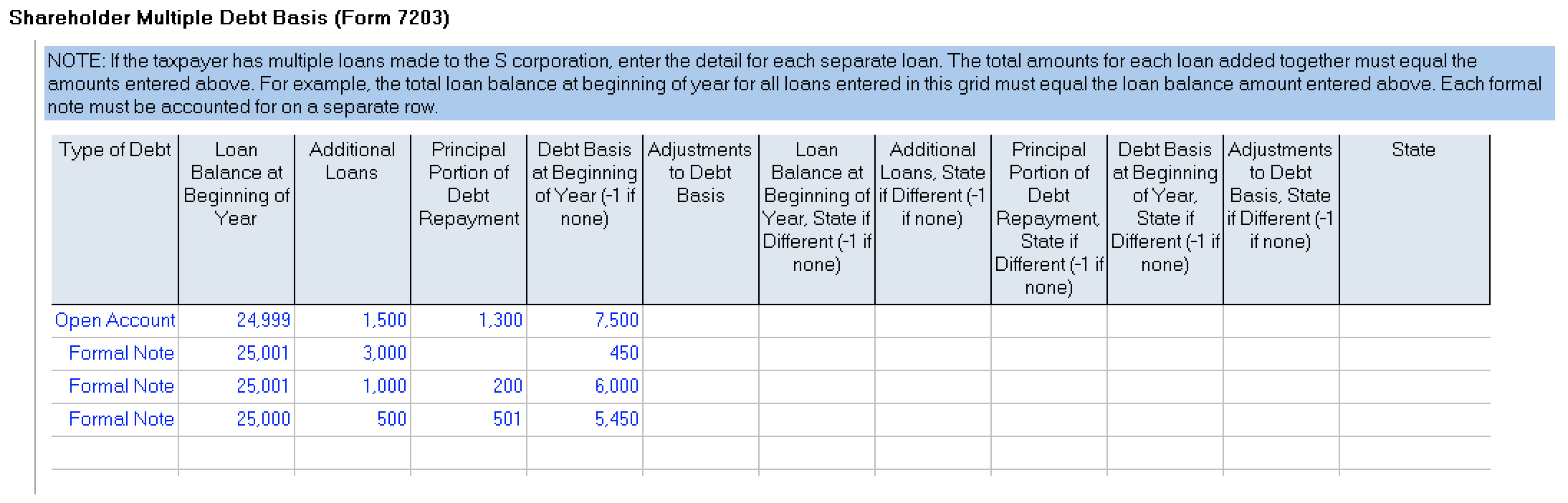

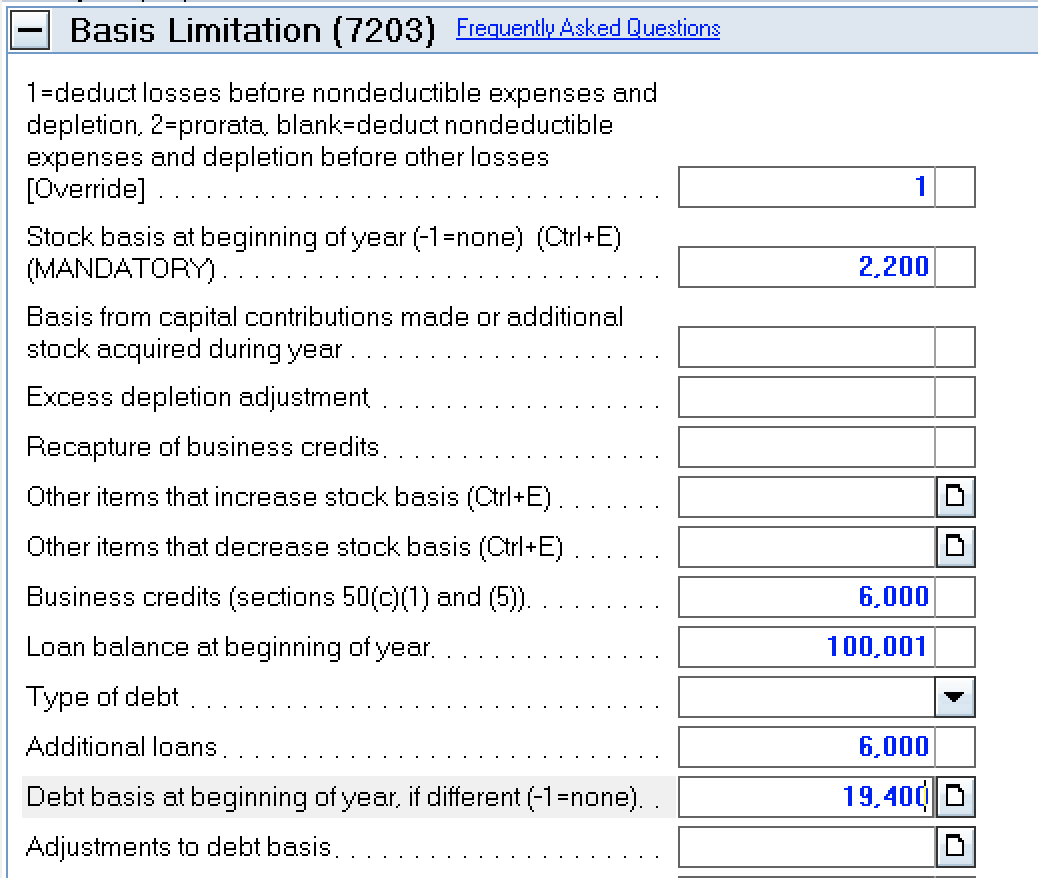

The draft instructions for form 7203 were posted by. Web generate form 7203, s corporation shareholder stock and debt basis limitations. 21, 2022, and will be used to report s corporation shareholder stock basis, debt basis and allowed/disallowed losses on form 1040. To enter basis limitation info in the individual return: The draft form includes a new item d.

More Basis Disclosures This Year for S corporation Shareholders Need

The new form is required to be filed by an s corporation shareholder to report shareholder basis. The draft instructions for form 7203 were posted by. This form is used by s corporation shareholders to figure out the potential limitations of their share of the s corporation’s deductions, credits, and other items that can be deducted on their returns. And.

How to complete Form 7203 in Lacerte

Web 29 july 2022 are you curious about irs form 7203? Current revision form 7203 pdf instructions for form 7203 (print version) pdf recent developments none at this time. The draft instructions for form 7203 were posted by. To enter basis limitation info in the individual return: Web the draft form 7203 for tax year 2022 makes only two changes.

Form7203PartI PBMares

Web 29 july 2022 are you curious about irs form 7203? To enter basis limitation info in the individual return: A taxpayer will need to check a box (or boxes) to show how he or she acquired the stock in the s corporation. Web the draft form 7203 was posted by the irs on oct. This form is used by.

How to complete Form 7203 in Lacerte

And form 461, limitation on business losses. Basis limitation (7203) stock basis at beginning of year this entry is mandatory to generate the form. Web generate form 7203, s corporation shareholder stock and debt basis limitations. To enter basis limitation info in the individual return: A taxpayer will need to check a box (or boxes) to show how he or.

Form 7203 for 2022 Not much has changed in the form’s second year

The draft form includes a new item d. This form is used by s corporation shareholders to figure out the potential limitations of their share of the s corporation’s deductions, credits, and other items that can be deducted on their returns. Web when should i file form 7203? The draft instructions for form 7203 were posted by. To enter basis.

Formal Draft of Proposed Form 7203 to Report S Corporation Stock and

Basis from capital contributions made or additional stock acquired during year Web the draft form 7203 was posted by the irs on oct. Go to www.irs.gov/form7203 for instructions and the latest information. Basis limitation (7203) stock basis at beginning of year this entry is mandatory to generate the form. Form 8582, passive activity loss limitations;

IRS Issues New Form 7203 for Farmers and Fishermen

21, 2022, and will be used to report s corporation shareholder stock basis, debt basis and allowed/disallowed losses on form 1040. The new form is required to be filed by an s corporation shareholder to report shareholder basis. Web 29 july 2022 are you curious about irs form 7203? Current revision form 7203 pdf instructions for form 7203 (print version).

Formal Draft of Proposed Form 7203 to Report S Corporation Stock and

Web the draft form 7203 was posted by the irs on oct. And form 461, limitation on business losses. Web when should i file form 7203? Form 8582, passive activity loss limitations; The draft instructions for form 7203 were posted by.

National Association of Tax Professionals Blog

Basis from capital contributions made or additional stock acquired during year 21, 2022, and will be used to report s corporation shareholder stock basis, debt basis and allowed/disallowed losses on form 1040. Web the draft form 7203 was posted by the irs on oct. Web generally, this analysis and the completion of new form 7203, s corporation shareholder stock and.

Basis Limitation (7203) Stock Basis At Beginning Of Year This Entry Is Mandatory To Generate The Form.

Web generally, this analysis and the completion of new form 7203, s corporation shareholder stock and debt basis limitations, for impacted taxpayers will be required by oct.15, 2022 so time is of the essence. The draft instructions for form 7203 were posted by. Solved • by turbotax • 99 • updated january 13, 2023 form 7203 is used to calculate any limits on the deductions you can take for your share of an s corporation's deductions, credits, and other items. Web generate form 7203, s corporation shareholder stock and debt basis limitations.

21, 2022, And Will Be Used To Report S Corporation Shareholder Stock Basis, Debt Basis And Allowed/Disallowed Losses On Form 1040.

The draft form includes a new item d. Basis from capital contributions made or additional stock acquired during year A taxpayer will need to check a box (or boxes) to show how he or she acquired the stock in the s corporation. Web s corporation shareholders use form 7203 to figure the potential limitations of their share of the s corporation’s deductions, credits, and other items that can be deducted on their individual returns.

And Form 461, Limitation On Business Losses.

Form 8582, passive activity loss limitations; Current revision form 7203 pdf instructions for form 7203 (print version) pdf recent developments none at this time. The new form is required to be filed by an s corporation shareholder to report shareholder basis. Web the draft form 7203 for tax year 2022 makes only two changes to the 2021 form:

December 2022) S Corporation Shareholder Stock And Debt Basis Limitations Department Of The Treasury Internal Revenue Service Attach To Your Tax Return.

Web the draft form 7203 was posted by the irs on oct. Web 29 july 2022 are you curious about irs form 7203? This form is used by s corporation shareholders to figure out the potential limitations of their share of the s corporation’s deductions, credits, and other items that can be deducted on their returns. Web when should i file form 7203?