Form 8332 Head Of Household

Form 8332 Head Of Household - Dependency exemption child tax credit the. Web 11332 sw 238th st is a 1,857 square foot townhouse on a 2,571 square foot lot with 3 bedrooms and 2 bathrooms. Web beginning with the 2015 tax year, all taxpayers who file using the head of household (hoh) filing status must submit a completed ftb 3532, head of household filing status. Web if you need to complete form 8332 release/revocation of release of claim to exemption for child by custodial parent (usually only done by the custodial parent), you can do that. Web the following tax benefits cannot be transferred by form 8332: Ad download or email irs 8332 & more fillable forms, register and subscribe now! Child and dependent care credit, earned income credit, head of household tax status. Web view 26 photos for 11332 sw 238th st unit 11332, homestead, fl 33032, a 3 bed, 3 bath, 1,857 sq. The noncustodial parent claims both of these: Web form 8332 and head of household i have a court order where the ex and i are to alternate who can claim the dependent on their respective tax returns.

Get ready for tax season deadlines by completing any required tax forms today. Web form 8332 and head of household i have a court order where the ex and i are to alternate who can claim the dependent on their respective tax returns. Complete, edit or print tax forms instantly. Web the custodial parent completes form 8332 to give the exemption to the other parent. Web view 26 photos for 11332 sw 238th st unit 11332, homestead, fl 33032, a 3 bed, 3 bath, 1,857 sq. The earned income tax credit, child and dependent. Web if you file form 8332, a majority of the tax benefits you receive as the custodial parent will not be affected. Dependency exemption child tax credit the. Ad download or email irs 8332 & more fillable forms, register and subscribe now! Web the following tax benefits cannot be transferred by form 8332:

Web form 8332 doesn't apply to other tax benefits, such as the earned income credit, dependent care credit, or head of household filing status. 65 or older (one spouse) $27,300: Complete, edit or print tax forms instantly. Ad download or email irs 8332 & more fillable forms, register and subscribe now! If i am the custodial parent, and file form 8332 this year (2017) to release claim of child exemption, do i still file as head of household? Married filing jointly *** under 65 (both spouses) $25,900: Web beginning with the 2015 tax year, all taxpayers who file using the head of household (hoh) filing status must submit a completed ftb 3532, head of household filing status. Web 11332 sw 238th st is a 1,857 square foot townhouse on a 2,571 square foot lot with 3 bedrooms and 2 bathrooms. Ad access irs tax forms. Dependency exemption child tax credit the.

What is Form 8332 Release/Revocation of Release of Claim to Exemption

Web 11332 sw 238th st is a 1,857 square foot townhouse on a 2,571 square foot lot with 3 bedrooms and 2 bathrooms. 65 or older (one spouse) $27,300: Married filing jointly *** under 65 (both spouses) $25,900: Web form 8332 and head of household i have a court order where the ex and i are to alternate who can.

IRS Form 8332 Fill it with the Best PDF Form Filler

Ad download or email irs 8332 & more fillable forms, register and subscribe now! Dependency exemption child tax credit the. 65 or older (one spouse) $27,300: Web the following tax benefits cannot be transferred by form 8332: Web the full name of form 8332 is release/revocation of release of claim to exemption for child by custodial parent.

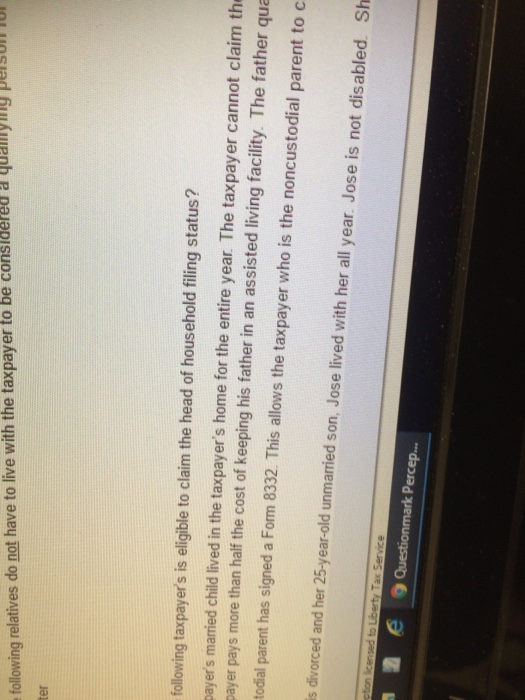

Solved Following taxpayer's is eligible to claim the head of

Child and dependent care credit, earned income credit, head of household tax status. Web 11332 sw 238th st is a 1,857 square foot townhouse on a 2,571 square foot lot with 3 bedrooms and 2 bathrooms. Dependency exemption child tax credit the. If i am the custodial parent, and file form 8332 this year (2017) to release claim of child.

Ask RJ Will the judge force my ex to sign IRS Form 8332? RJ Peters

Web the following tax benefits cannot be transferred by form 8332: Web 11332 sw 238th st is a 1,857 square foot townhouse on a 2,571 square foot lot with 3 bedrooms and 2 bathrooms. Web the custodial parent signs a form 8332, release/revocation of release of claim to exemption for child by custodial parent or a substantially similar statement,. Web.

Form 8332 Release/Revocation of Release of Claim to Exemption for Ch…

Web the following tax benefits cannot be transferred by form 8332: 65 or older (one spouse) $27,300: The noncustodial parent claims both of these: If i am the custodial parent, and file form 8332 this year (2017) to release claim of child exemption, do i still file as head of household? Web form 8332 and head of household i have.

20182020 Form IRS 8332 Fill Online, Printable, Fillable, Blank PDFfiller

Complete, edit or print tax forms instantly. Web the custodial parent signs a form 8332, release/revocation of release of claim to exemption for child by custodial parent or a substantially similar statement,. Filing as a head of. The noncustodial parent claims both of these: Ad access irs tax forms.

Form 8332 Don't Claim the Same! November 13, 2019 Western CPE

Web 11332 sw 238th st is a 1,857 square foot townhouse on a 2,571 square foot lot with 3 bedrooms and 2 bathrooms. Ad access irs tax forms. Web form 8332 and head of household i have a court order where the ex and i are to alternate who can claim the dependent on their respective tax returns. Married filing.

Form 8332 Release/Revocation of Release of Claim to Exemption for

Web a noncustodial parent who claims the child as a dependent must file form 8332 or a substantially similar statement with the return or, with form 8453 for an electronic return. If i am the custodial parent, and file form 8332 this year (2017) to release claim of child exemption, do i still file as head of household? Married filing.

IRS Form 8332 How Can I Claim a Child? The Handy Tax Guy

Ad access irs tax forms. Web if you file form 8332, a majority of the tax benefits you receive as the custodial parent will not be affected. Get ready for tax season deadlines by completing any required tax forms today. Web form 8332 doesn't apply to other tax benefits, such as the earned income credit, dependent care credit, or head.

Fillable Form 8332 (Rev. January 2006) Release Of Claim To Exemption

Ad download or email irs 8332 & more fillable forms, register and subscribe now! Web 11332 sw 238th st is a 1,857 square foot townhouse on a 2,571 square foot lot with 3 bedrooms and 2 bathrooms. Child and dependent care credit, earned income credit, head of household tax status. Townhomes home built in 2007 that was last sold on.

Dependency Exemption Child Tax Credit The.

Web if you need to complete form 8332 release/revocation of release of claim to exemption for child by custodial parent (usually only done by the custodial parent), you can do that. Web the full name of form 8332 is release/revocation of release of claim to exemption for child by custodial parent. 65 or older (one spouse) $27,300: Web a noncustodial parent who claims the child as a dependent must file form 8332 or a substantially similar statement with the return or, with form 8453 for an electronic return.

Web The Following Tax Benefits Cannot Be Transferred By Form 8332:

Web if you file form 8332, a majority of the tax benefits you receive as the custodial parent will not be affected. Get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly. The earned income tax credit, child and dependent.

Web 11332 Sw 238Th St Is A 1,857 Square Foot Townhouse On A 2,571 Square Foot Lot With 3 Bedrooms And 2 Bathrooms.

The noncustodial parent claims both of these: Ad access irs tax forms. If i am the custodial parent, and file form 8332 this year (2017) to release claim of child exemption, do i still file as head of household? Townhomes home built in 2007 that was last sold on 03/04/2022.

Web The Custodial Parent Completes Form 8332 To Give The Exemption To The Other Parent.

Web view 26 photos for 11332 sw 238th st unit 11332, homestead, fl 33032, a 3 bed, 3 bath, 1,857 sq. While the tax benefit of exemptions is $0 until 2025 under tax. Married filing jointly *** under 65 (both spouses) $25,900: Web form 8332 doesn't apply to other tax benefits, such as the earned income credit, dependent care credit, or head of household filing status.