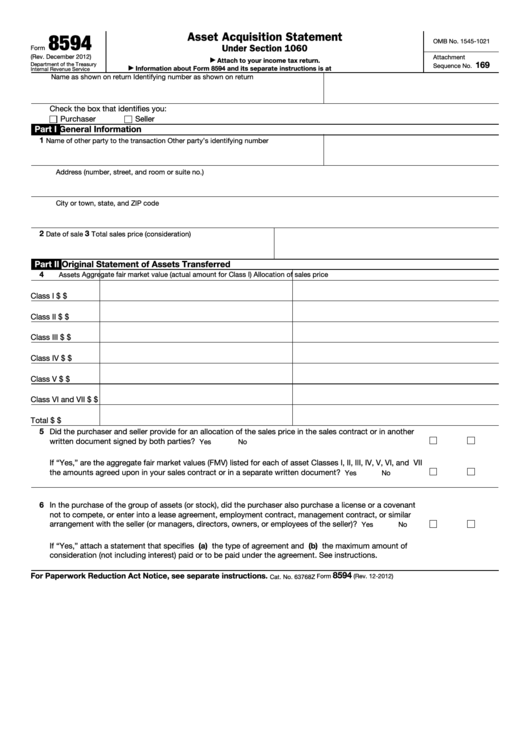

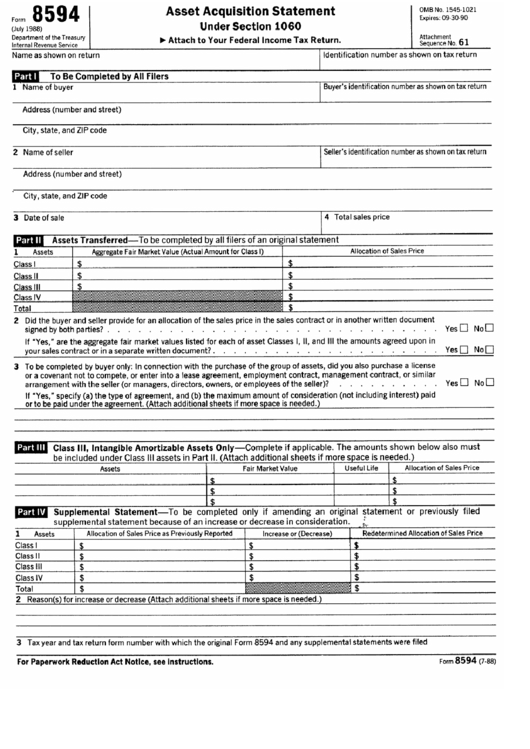

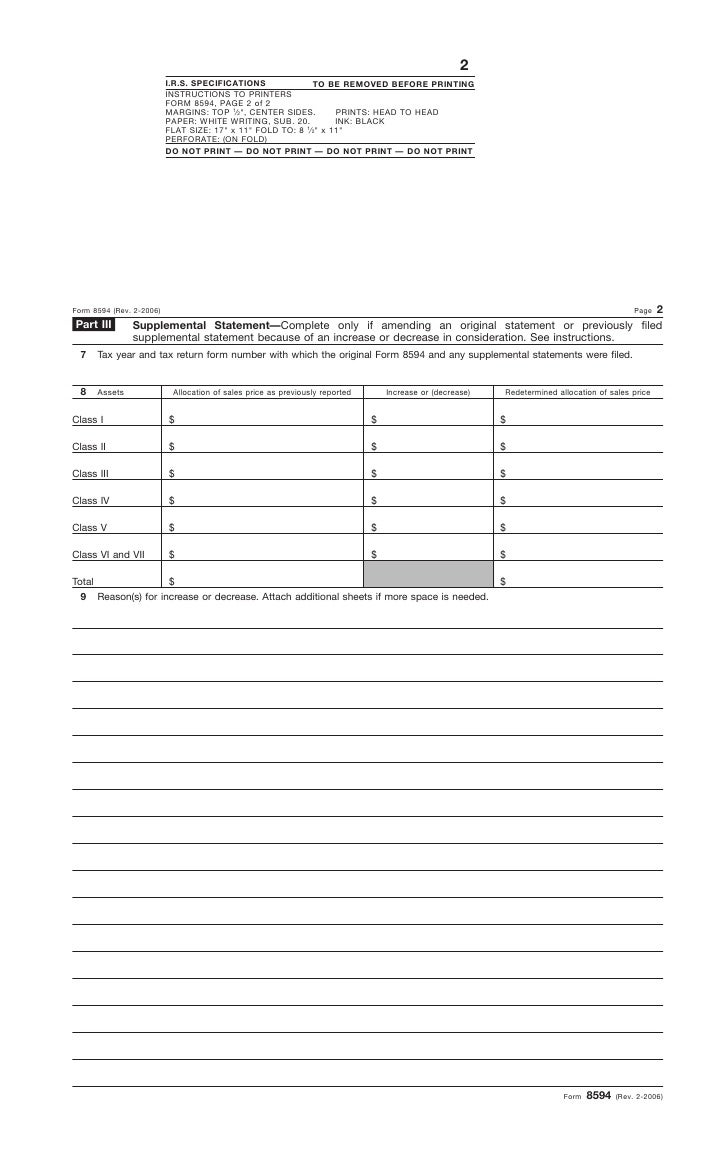

Form 8594 Instructions 2022

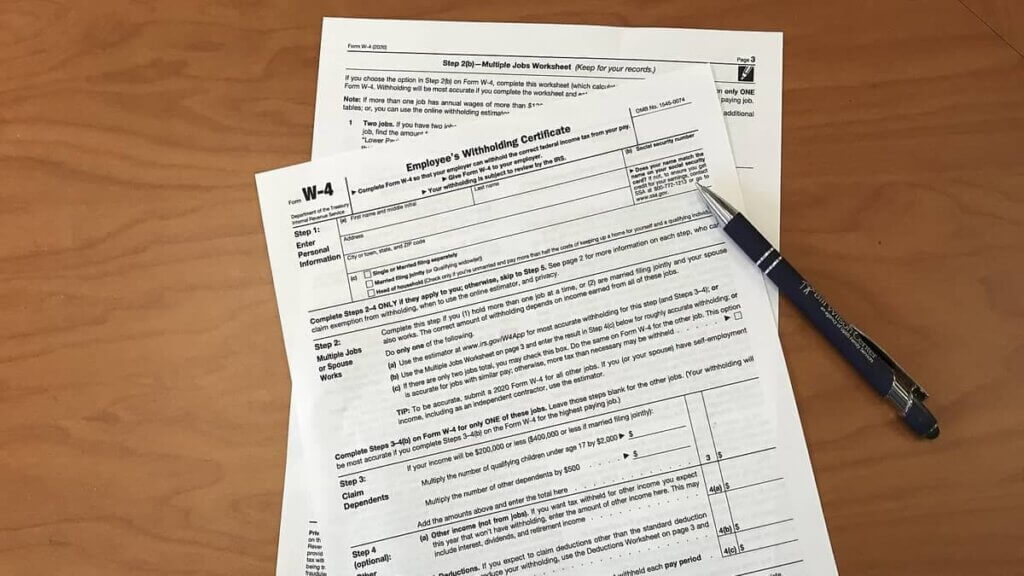

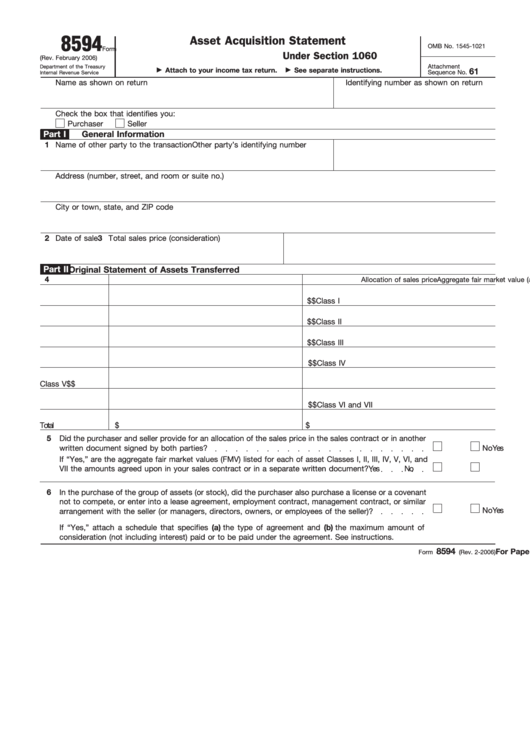

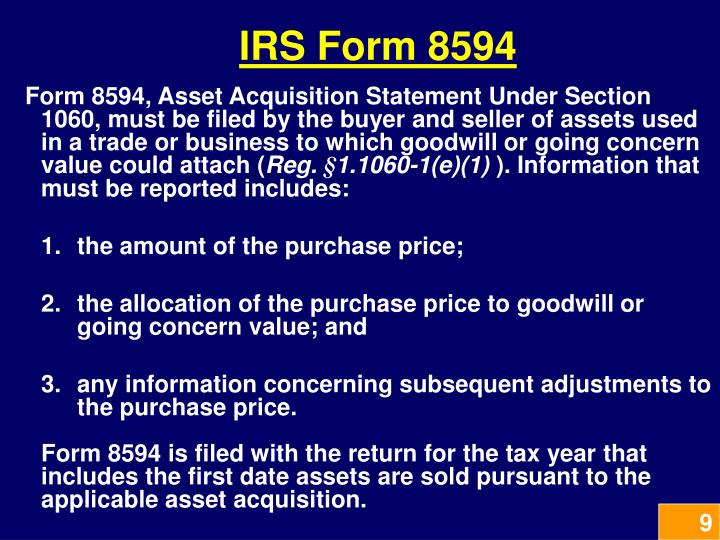

Form 8594 Instructions 2022 - Web both the seller and purchaser of a group of assets that makes up a trade or business must use form 8594 to report such a sale if goodwill or going concern value attaches, or could attach, to such assets and if the purchaser's basis in the assets is determined only by the amount paid for the assets. The form must be filed when a group of assets were transferred (in a trade or business), and if the buyer’s basis in such assets is determined by the amount paid for the assets. Web form 8594 instructions list seven classes of assets. For asset acquisitions occurring after march 15, 2001, make the allocation among the following assets in proportion to (but not more than) their fair market value on the purchase date in the following order: November 2021) department of the treasury internal revenue service. For a particular class of assets, enter. You can print other federal tax forms here. Web instructions for form 8594 the irs instructs that both the buyer and seller must file the form and attach their income tax returns. Both the seller and purchaser of a group of assets that makes up a trade or business must use form 8594 to report such a sale if goodwill or going concern value attaches, or could attach, to such assets and if the purchaser's basis in the assets is determined only by the amount paid for the assets. Enter the date on which the sale of the assets took place.

Enter the date on which the sale of the assets took place. Both the seller and purchaser of a group of assets that makes up a trade or business must use form 8594 to report such a sale if goodwill or going concern value attaches, or could attach, to such assets and if the purchaser's basis in the assets is determined only by the amount paid for the assets. Web instructions instructions for form 4797 (2022) future developments instructions for form 4797 (2022) sales of business property (also involuntary conversions and recapture amounts under sections 179 and 280f (b) (2)) section references are to the internal revenue code unless otherwise noted. Enter the name, address, and tin of the other party to the transaction. The buyers and sellers of a group of assets that make up a business use form 8594 when goodwill or going concern value attaches. For asset acquisitions occurring after march 15, 2001, make the allocation among the following assets in proportion to (but not more than) their fair market value on the purchase date in the following order: Web form 8594 instructions list seven classes of assets. Web we last updated the asset acquisition statement under section 1060 in february 2023, so this is the latest version of form 8594, fully updated for tax year 2022. November 2021) department of the treasury internal revenue service. November 2021) skip to main content

Enter the name, address, and tin of the other party to the transaction. Both the seller and purchaser of a group of assets that makes up a trade or business must use form 8594 to report such a sale if goodwill or going concern value attaches, or could attach, to such assets and if the purchaser's basis in the assets is determined only by the amount paid for the assets. Enter the total consideration transferred for the assets. Web both the seller and purchaser of a group of assets that makes up a trade or business must use form 8594 to report such a sale if goodwill or going concern value attaches, or could attach, to such assets and if the purchaser's basis in the assets is determined only by the amount paid for the assets. Web instructions instructions for form 4797 (2022) future developments instructions for form 4797 (2022) sales of business property (also involuntary conversions and recapture amounts under sections 179 and 280f (b) (2)) section references are to the internal revenue code unless otherwise noted. Web instructions for form 8594 the irs instructs that both the buyer and seller must file the form and attach their income tax returns. Enter the date on which the sale of the assets took place. For a particular class of assets, enter. Web we last updated the asset acquisition statement under section 1060 in february 2023, so this is the latest version of form 8594, fully updated for tax year 2022. November 2021) skip to main content

Irs Form Purchase Of Business Leah Beachum's Template

November 2021) department of the treasury internal revenue service. Web form 8594 instructions list seven classes of assets. Web we last updated the asset acquisition statement under section 1060 in february 2023, so this is the latest version of form 8594, fully updated for tax year 2022. November 2021) skip to main content The form must be filed when a.

Asset Statement Form 4 Free Templates in PDF, Word, Excel Download

For asset acquisitions occurring after march 15, 2001, make the allocation among the following assets in proportion to (but not more than) their fair market value on the purchase date in the following order: Enter the total consideration transferred for the assets. The buyers and sellers of a group of assets that make up a business use form 8594 when.

Form 8594 Edit, Fill, Sign Online Handypdf

Web both the seller and purchaser of a group of assets that makes up a trade or business must use form 8594 to report such a sale if goodwill or going concern value attaches, or could attach, to such assets and if the purchaser's basis in the assets is determined only by the amount paid for the assets. Web form.

SS4 Form 2021 IRS Forms Zrivo

Web we last updated the asset acquisition statement under section 1060 in february 2023, so this is the latest version of form 8594, fully updated for tax year 2022. The form must be filed when a group of assets were transferred (in a trade or business), and if the buyer’s basis in such assets is determined by the amount paid.

Printable 4730591 Rev A Bi Form 2014 00 005 Rev 0 Fill Online

Enter the name, address, and tin of the other party to the transaction. The buyers and sellers of a group of assets that make up a business use form 8594 when goodwill or going concern value attaches. Web form 8594 instructions list seven classes of assets. For asset acquisitions occurring after march 15, 2001, make the allocation among the following.

PPT Taxable Acquisitions PowerPoint Presentation ID3850409

Enter the name, address, and tin of the other party to the transaction. Web we last updated the asset acquisition statement under section 1060 in february 2023, so this is the latest version of form 8594, fully updated for tax year 2022. Web information about form 8594, asset acquisition statement under section 1060, including recent updates, related forms and instructions.

Fillable Form 8594 Asset Acquisition Statement printable pdf download

Both the seller and purchaser of a group of assets that makes up a trade or business must use form 8594 to report such a sale if goodwill or going concern value attaches, or could attach, to such assets and if the purchaser's basis in the assets is determined only by the amount paid for the assets. Web both the.

Instructions for Form 8594

Enter the date on which the sale of the assets took place. Web both the seller and purchaser of a group of assets that makes up a trade or business must use form 8594 to report such a sale if goodwill or going concern value attaches, or could attach, to such assets and if the purchaser's basis in the assets.

Form 8594 Asset Acquisition Statement Under Section 1060 Internal

Web form 8594 instructions list seven classes of assets. For a particular class of assets, enter. November 2021) skip to main content Enter the name, address, and tin of the other party to the transaction. Web instructions for form 8594 the irs instructs that both the buyer and seller must file the form and attach their income tax returns.

Form 8594Asset Acquisition Statement

November 2021) department of the treasury internal revenue service. Web instructions instructions for form 4797 (2022) future developments instructions for form 4797 (2022) sales of business property (also involuntary conversions and recapture amounts under sections 179 and 280f (b) (2)) section references are to the internal revenue code unless otherwise noted. You can print other federal tax forms here. Web.

November 2021) Department Of The Treasury Internal Revenue Service.

The form must be filed when a group of assets were transferred (in a trade or business), and if the buyer’s basis in such assets is determined by the amount paid for the assets. You can print other federal tax forms here. For a particular class of assets, enter. Web instructions for form 8594 the irs instructs that both the buyer and seller must file the form and attach their income tax returns.

Enter The Name, Address, And Tin Of The Other Party To The Transaction.

Enter the date on which the sale of the assets took place. Enter the total consideration transferred for the assets. Web both the seller and purchaser of a group of assets that makes up a trade or business must use form 8594 to report such a sale if goodwill or going concern value attaches, or could attach, to such assets and if the purchaser's basis in the assets is determined only by the amount paid for the assets. Web information about form 8594, asset acquisition statement under section 1060, including recent updates, related forms and instructions on how to file.

Web Instructions Instructions For Form 4797 (2022) Future Developments Instructions For Form 4797 (2022) Sales Of Business Property (Also Involuntary Conversions And Recapture Amounts Under Sections 179 And 280F (B) (2)) Section References Are To The Internal Revenue Code Unless Otherwise Noted.

November 2021) skip to main content Web form 8594 instructions list seven classes of assets. The buyers and sellers of a group of assets that make up a business use form 8594 when goodwill or going concern value attaches. Both the seller and purchaser of a group of assets that makes up a trade or business must use form 8594 to report such a sale if goodwill or going concern value attaches, or could attach, to such assets and if the purchaser's basis in the assets is determined only by the amount paid for the assets.

Web We Last Updated The Asset Acquisition Statement Under Section 1060 In February 2023, So This Is The Latest Version Of Form 8594, Fully Updated For Tax Year 2022.

For asset acquisitions occurring after march 15, 2001, make the allocation among the following assets in proportion to (but not more than) their fair market value on the purchase date in the following order: