Form 8621 Irs

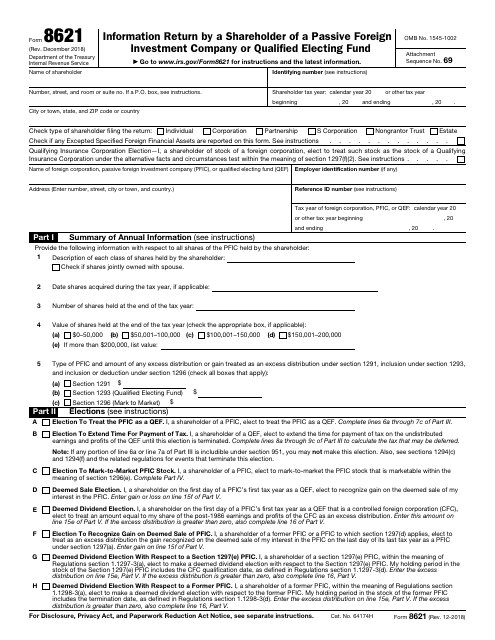

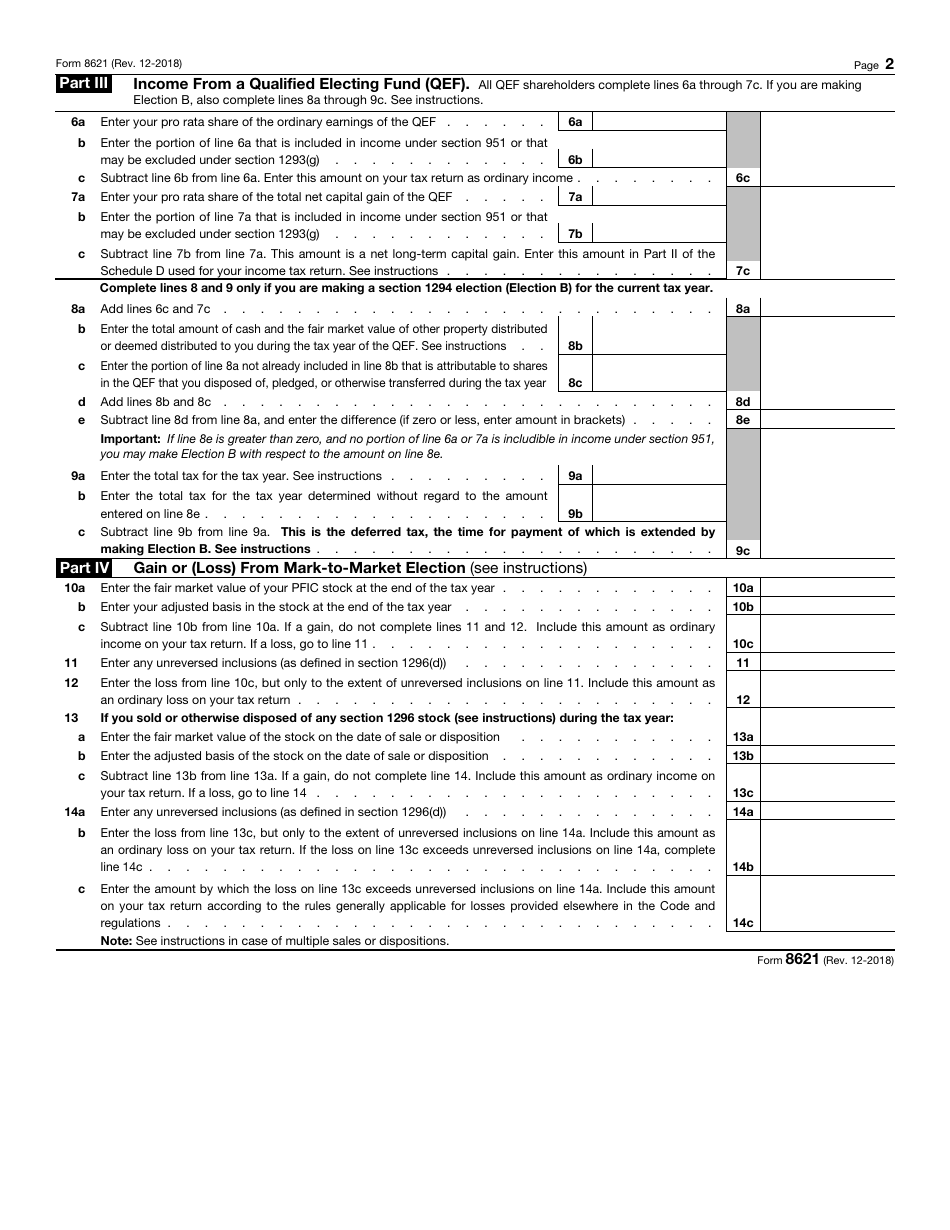

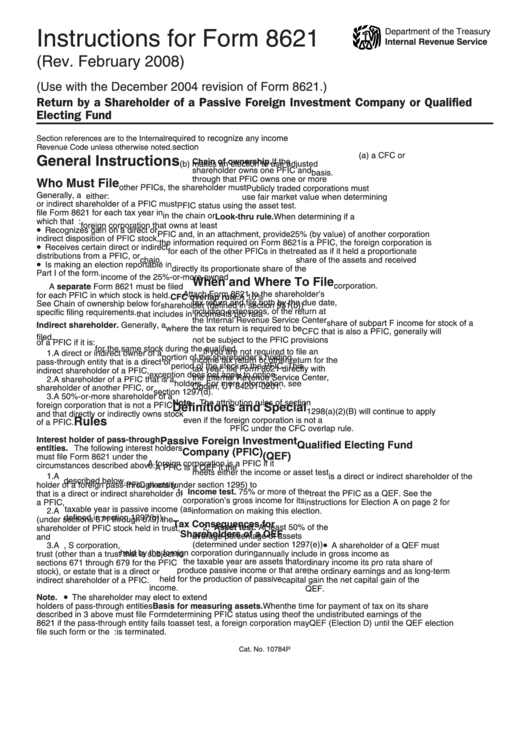

Form 8621 Irs - Web the form 8621 is used by us person taxpayers to report ownership in passive foreign investment companies. Common examples include foreign mutual funds and holding companies. Without a doubt, form 8621—information return by a shareholder of a passive foreigninvestment company or qualified electing fund is one of the hardest irs tax forms to fill out. Passive foreign investment companies are taxed by the irs through a special form called form 8621. Unlike the fbar for example, the form 8621 is very complex — if for no other reason than. Web the form 8621 is used by us person taxpayers to report ownership in passive foreign investment companies. Web form 8621, file it if you own shares of a passive foreign investment company (pfic). The irs would consider a foreign entity a passive foreign investment company (pfic) if it meets either the income or asset test. Individuals, corporations, estates and trusts who are us residents or us citizens. Receives certain direct or indirect distributions from a pfic, 2.

In the case of a shareholder of a former pfic, after 3 years from the due date, as extended, of the tax return for the tax year that includes the termination date, or Attach form 8621 to the shareholder's tax return (or, if applicable, partnership or exempt organization return) and file both by the due date, including And (4) allow a u.s. Person that is a direct or indirect shareholder of a pfic must file form 8621 for each tax year under the following five circumstances if the u.s. This form is used to report income from foreign mutual funds, also referred to as passive foreign investment companies. Tax form 8621, information return by a shareholder of a passive foreign investment company or qualified electing fund, is used to report income from foreign mutual funds, also referred to as passive foreign investment companies (pfics). Web tax form 8621 is also referred to as the information return for shareholders of passive foreign investment companies. Web pfic and form 8621 feb 11, 2021 the pfic rules apply to us persons. Recognizes gain on a direct or indirect disposition of pfic stock, 3. Web that annual report is form 8621 (information return by a shareholder of a passive foreign investment company or qualified electing fund).

Such form should be attached to the shareholder’s us income tax return, and may need to be filed even if the shareholder is not required to file a us income tax return or other return for the tax year. Individuals, corporations, estates and trusts who are us residents or us citizens. Common examples include foreign mutual funds and holding companies. Web pfic and form 8621 feb 11, 2021 the pfic rules apply to us persons. Web information about form 8621, information return by a shareholder of a passive foreign investment company or qualified electing fund, including recent updates, related forms, and instructions on how to file. Web when and where to file. Shareholder to make the election by attaching the form 8621 to its amended federal income tax return for the tax year to which it relates, if the u.s. Attach form 8621 to the shareholder's tax return (or, if applicable, partnership or exempt organization return) and file both by the due date, including extensions, of the return at the internal revenue service center where the tax return is required to be filed. Web the form 8621 is used by us person taxpayers to report ownership in passive foreign investment companies. Shareholders file form 8621 if they receive certain pfic direct/indirect distributions.

U.S. TREAS Form treasirs86212000

On average, it takes between 35 to 40 hours. The irs would consider a foreign entity a passive foreign investment company (pfic) if it meets either the income or asset test. Get started worldwide representation we represent clients nationwide and worldwide in over 80+ different countries. Enter your total distributions from the section 1291 fund during the current tax year.

Fill Free fillable F8621 Accessible Form 8621 (Rev. December 2018

Web unfiled form 8621 means an incomplete tax return unless a person committed fraud and/or has more than $5000 of unreported foreign income or omitted more than 25% of gross income in the return, the statute of limitations the. Get started worldwide representation we represent clients nationwide and worldwide in over 80+ different countries. Web what is irs form 8621.

IRS Form 8621 Download Fillable PDF or Fill Online Information Return

This form is used to report income from foreign mutual funds, also referred to as passive foreign investment companies. Shareholder to make the election by attaching the form 8621 to its amended federal income tax return for the tax year to which it relates, if the u.s. Such form should be attached to the shareholder’s us income tax return, and.

Completed Sample IRS Form 709 Gift Tax Return for 529 Superfunding

Web what is form 8621 used for? Shareholders file form 8621 if they receive certain pfic direct/indirect distributions. Web information about form 8621, information return by a shareholder of a passive foreign investment company or qualified electing fund, including recent updates, related forms, and instructions on how to file. 3 part v distributions from and dispositions of stock of a.

Form 8621A Return by a Shareholder Making Certain Late Elections to

Attach form 8621 to the shareholder's tax return (or, if applicable, partnership or exempt organization return) and file both by the due date, including extensions, of the return at the internal revenue service center where the tax return is required to be filed. The irs would consider a foreign entity a passive foreign investment company (pfic) if it meets either.

Form 8621 Calculator Introduction YouTube

Unlike the fbar for example, the form 8621 is very complex — if for no other reason than just trying to decipher whether your foreign investment qualifies as a passive foreign investment company or not. Web the form 8621 is used by us person taxpayers to report ownership in passive foreign investment companies. And (4) allow a u.s. Common examples.

IRS Form 8621 Download Fillable PDF or Fill Online Information Return

Person is required to recognize any income under section 1291. Part v for each excess distribution and disposition. Web unfiled form 8621 means an incomplete tax return unless a person committed fraud and/or has more than $5000 of unreported foreign income or omitted more than 25% of gross income in the return, the statute of limitations the. 3 part v.

Instructions For Form 8621 (2008) Internal Revenue Service printable

Web pfic and form 8621 feb 11, 2021 the pfic rules apply to us persons. Attach form 8621 to the shareholder's tax return (or, if applicable, partnership or exempt organization return) and file both by the due date, including extensions, of the return at the internal revenue service center where the tax return is required to be filed. 3 part.

Form 8621 PFIC Reporting Navigating the Highly Complex IRS Passive F…

This form is used to report income from foreign mutual funds, also referred to as passive foreign investment companies. Web what is irs form 8621 used for? Owners of a pfic to report ownership of their passive foreign investment companies on form 8621. Us citizens living overseas invest in foreign investment vehicles, as that’s where they live. Web what is.

Form 8621 Instructions 2020 2021 IRS Forms

Web form 8621, file it if you own shares of a passive foreign investment company (pfic). Web a single form 8621 may be filed with respect to a pfic to report the information required by section 1298 (f) (that is, part i), as well as to report information on parts iii through vi of the form and to make elections.

Web Form 8621, File It If You Own Shares Of A Passive Foreign Investment Company (Pfic).

Unlike the fbar for example, the form 8621 is very complex — if for no other reason than. Unlike the fbar for example, the form 8621 is very complex — if for no other reason than just trying to decipher whether your foreign investment qualifies as a passive foreign investment company or not. Part v for each excess distribution and disposition. Web what is form 8621 used for?

Unlike The Fbar For Example, The Form 8621 Is Very Complex — If For No Other Reason Than Just Trying To Decipher Whether Your Foreign Investment Qualifies As A Passive Foreign Investment Company Or Not.

Web that annual report is form 8621 (information return by a shareholder of a passive foreign investment company or qualified electing fund). Receives certain direct or indirect distributions from a pfic, 2. In the case of a shareholder of a former pfic, after 3 years from the due date, as extended, of the tax return for the tax year that includes the termination date, or Enter your total distributions from the section 1291 fund during the current tax year with respect to the

December 2018) Department Of The Treasury Internal Revenue Service Information Return By A Shareholder Of A Passive Foreign Investment Company Or Qualified Electing Fund Go To Www.irs.gov/Form8621 For Instructions And The Latest Information.

On average, it takes between 35 to 40 hours. Shareholder to make the election by attaching the form 8621 to its amended federal income tax return for the tax year to which it relates, if the u.s. Person is required to recognize any income under section 1291. Shareholders file form 8621 if they receive certain pfic direct/indirect distributions.

Web Information About Form 8621, Information Return By A Shareholder Of A Passive Foreign Investment Company Or Qualified Electing Fund, Including Recent Updates, Related Forms, And Instructions On How To File.

Web a single form 8621 may be filed with respect to a pfic to report the information required by section 1298 (f) (that is, part i), as well as to report information on parts iii through vi of the form and to make elections in part ii of the form. Owners of a pfic to report ownership of their passive foreign investment companies on form 8621. Person that is a direct or indirect shareholder of a pfic must file form 8621 for each tax year under the following five circumstances if the u.s. Recognizes gain on a direct or indirect disposition of pfic stock, 3.