Form 8822 Change Of Address

Form 8822 Change Of Address - Web separate form 8822 for each child. Web log in to my social security. Instead, see where to file on this page. Web form 8822 is used to change your mailing address—the place where you receive your mail—which can be different than the address of your permanent home. Tell us in person or by telephone. We'll need you to verify your identity and the address we have on file for you. Select the contact link to enter and update your address and phone information. The irs is not able to update an address from the usps change of address process and is not required to find. Purpose of form you may use form 8822 to notify the internal revenue service if you changed your home or business mailing address or your business location. Use form 8822 to notify the internal revenue service of a change to your home mailing address.

Generally, it takes 4 to 6 weeks to process a change of address. If this change also affects the mailing address for your children who filed income tax returns, complete and file a separate. Web separate form 8822 for each child. Instead, see where to file on this page. If you moved or have otherwise changed your address, filing form 8822 will ensure the irs has the correct address to send communications and payments due to. Web log in to my social security. And this can vary from your permanent home address. If you are a representative signing for the taxpayer, attach to form 8822 a copy of your power of attorney. Web form 8822 is used by taxpayers to notify the irs of changes in home or business mailing addresses or business location. Web this form is used to change the address of your mail, the location where you get to receive your mail.

Web yes, you should update your address with the irs by filing form 8822. If you moved or have otherwise changed your address, filing form 8822 will ensure the irs has the correct address to send communications and payments due to. We'll need you to verify your identity and the address we have on file for you. The irs is not able to update an address from the usps change of address process and is not required to find. Web form 8822 is used by taxpayers to notify the irs of changes in home or business mailing addresses or business location. Web business mailing address or your business location. If you are a representative signing for the taxpayer, attach to form 8822 a copy of your power of attorney. Web form to this address. Web log in to my social security. Purpose of form you may use form 8822 to notify the internal revenue service if you changed your home or business mailing address or your business location.

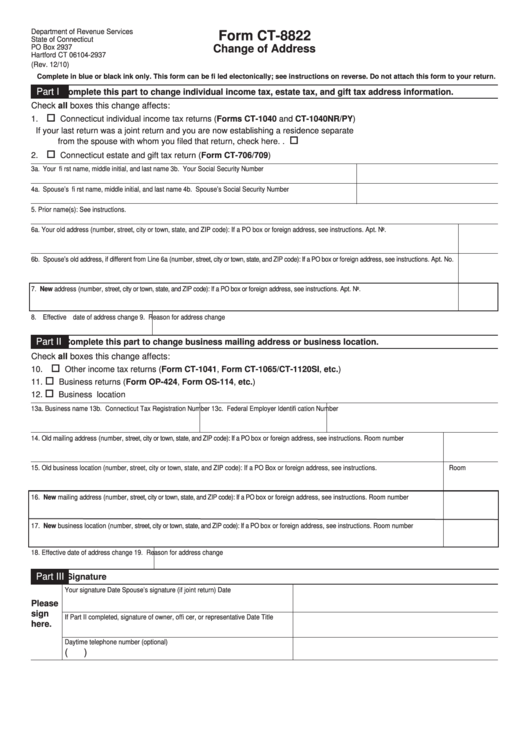

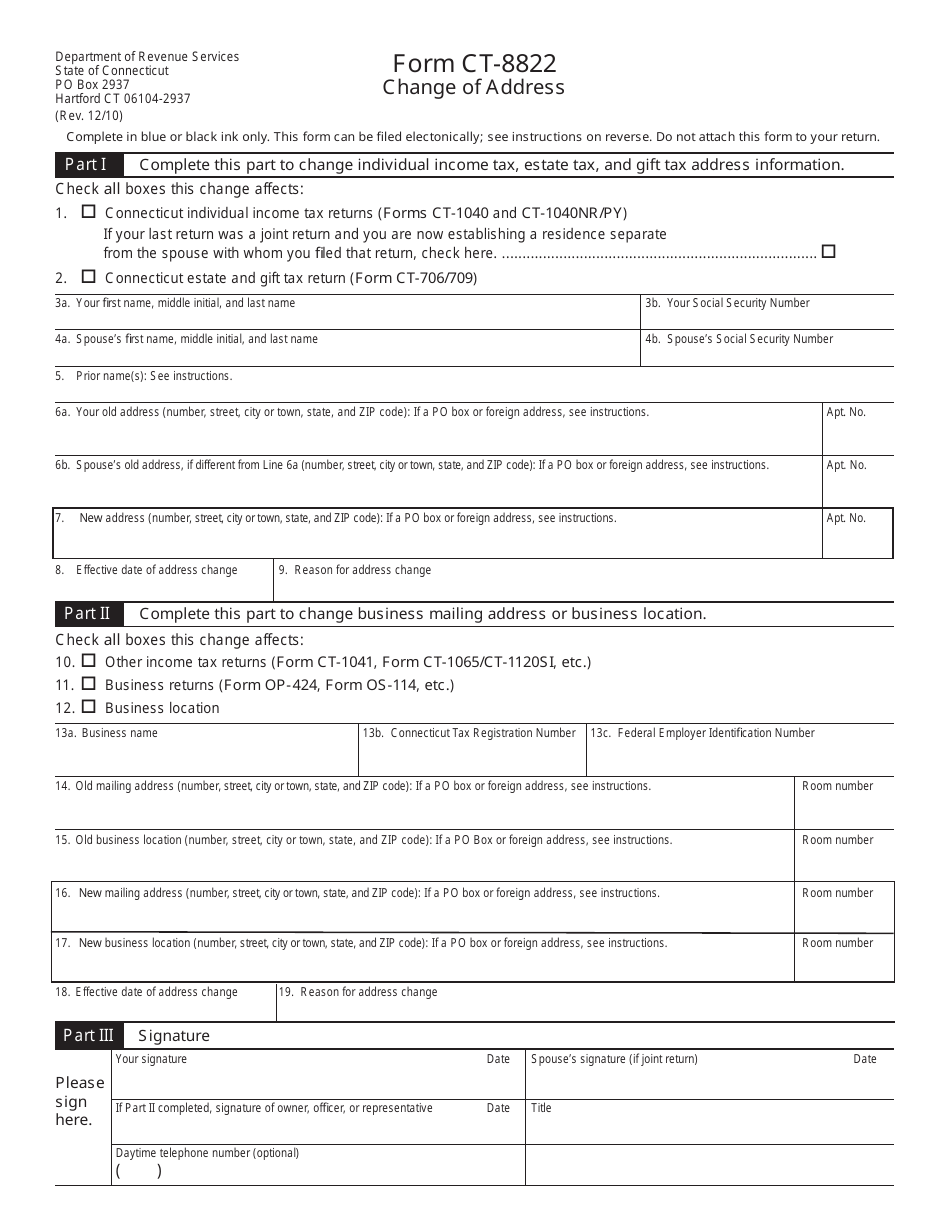

Form Ct8822 Change Of Address Connecticut Department Of Revenue

Web business mailing address or your business location. If you are a representative signing for the taxpayer, attach to form 8822 a copy of your power of attorney. The irs is not able to update an address from the usps change of address process and is not required to find. Review and verify your information, select submit. Changing both home.

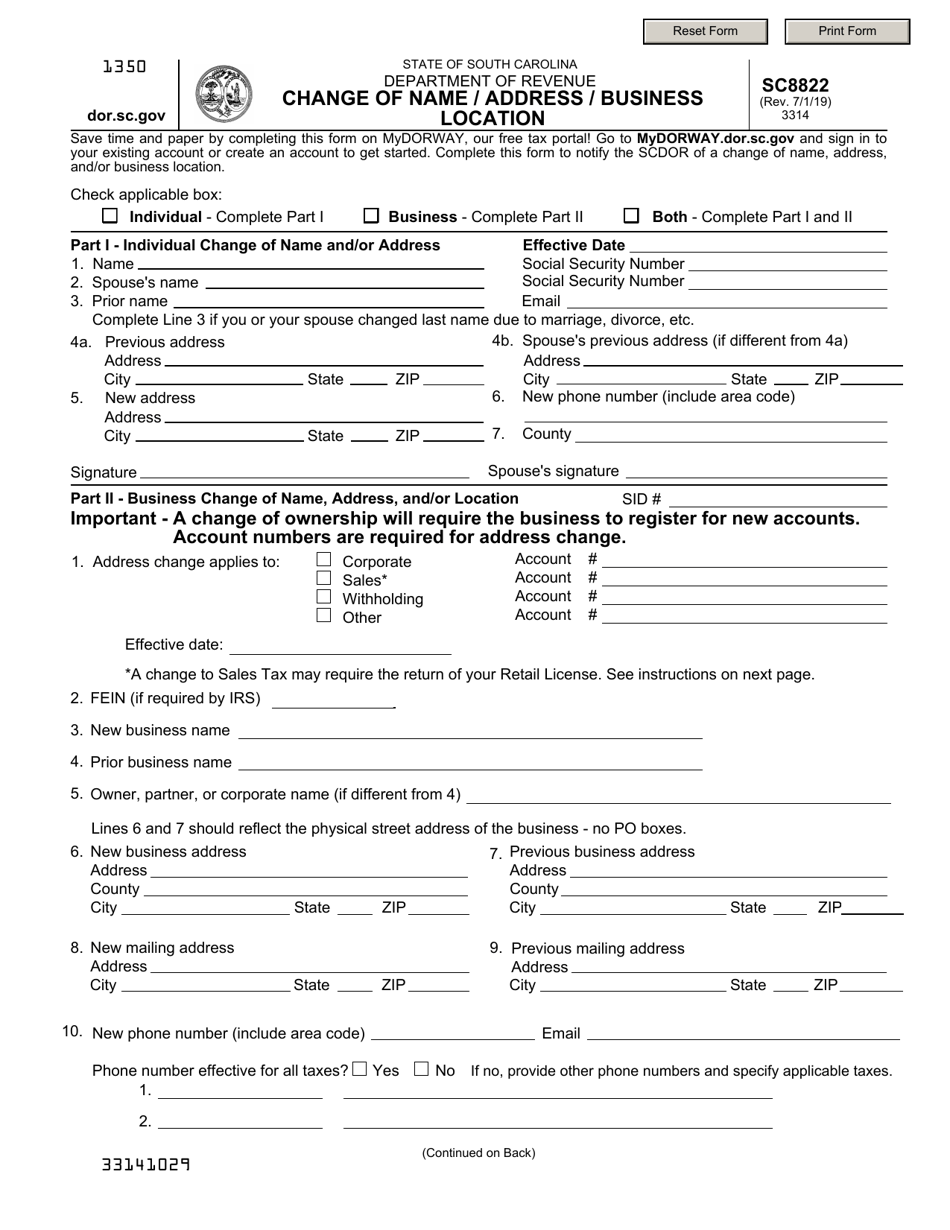

Form SC8822 Download Fillable PDF or Fill Online Change of Name

Web form to this address. Generally, it takes 4 to 6 weeks to process a change of address. Web this form is used to change the address of your mail, the location where you get to receive your mail. Web form 8822 is used to change your mailing address—the place where you receive your mail—which can be different than the.

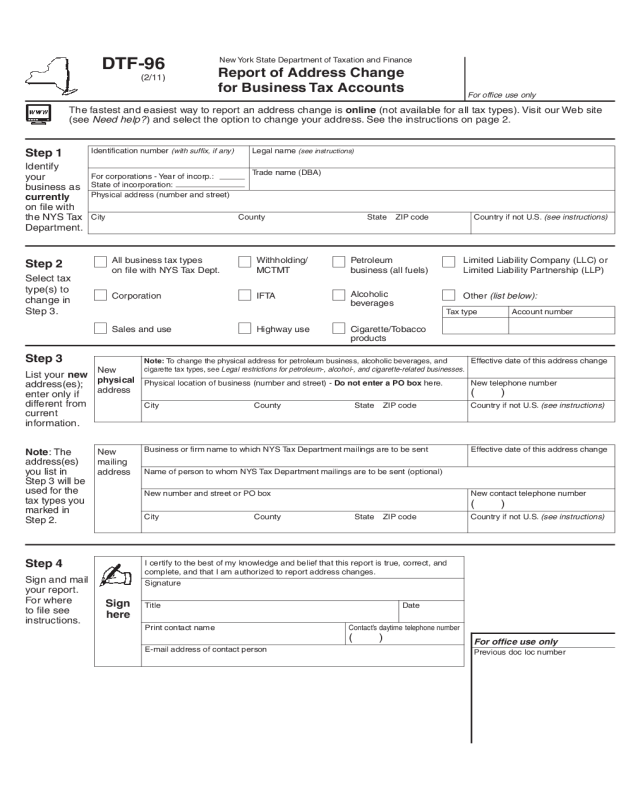

Form 8822 Change of Address (2014) Edit, Fill, Sign Online Handypdf

If you are a representative signing for the taxpayer, attach to form 8822 a copy of your power of attorney. Select when would you like to schedule the update, then select continue. Use form 8822 to notify the internal revenue service of a change to your home mailing address. Select the my profile tab. Web business mailing address or your.

2022 IRS Change of Address Form Fillable, Printable PDF & Forms

If you are a representative signing for the taxpayer, attach to form 8822 a copy of your power of attorney. If you moved or have otherwise changed your address, filing form 8822 will ensure the irs has the correct address to send communications and payments due to. Web form to this address. Generally, it takes 4 to 6 weeks to.

Form 8822Change of Address

And this can vary from your permanent home address. Mail your signed statement to the address where you filed your last return. Review and verify your information, select submit. If you are a representative signing for the taxpayer, attach to form 8822 a copy of your power of attorney. Web yes, you should update your address with the irs by.

Irs Business Name Change Form 8822b Armando Friend's Template

Select the contact link to enter and update your address and phone information. If this change also affects the mailing address for your children who filed income tax returns, complete and file a separate form 8822 for each child. The irs is not able to update an address from the usps change of address process and is not required to.

Form CT8822 Download Printable PDF or Fill Online Change of Address

If this change also affects the mailing address for your children who filed income tax returns, complete and file a separate. Generally, it takes 4 to 6 weeks to process a change of address. Web log in to my social security. And this can vary from your permanent home address. Mail your signed statement to the address where you filed.

Fill Free fillable Form 8822 Change of Address Part I Complete (IRS

The irs is not able to update an address from the usps change of address process and is not required to find. Web form 8822 is used to change your mailing address—the place where you receive your mail—which can be different than the address of your permanent home. Web form to this address. Web form 8822 is used by taxpayers.

Form 8822 Change of Address (2014) Free Download

Web form to this address. If this change also affects the mailing address for your children who filed income tax returns, complete and file a separate. If this change also affects the mailing address for your children who filed income tax returns, complete and file a separate form 8822 for each child. Web this form is used to change the.

Fill Free fillable form 8822 change of address 2015 PDF form

And this can vary from your permanent home address. If this change also affects the mailing address for your children who filed income tax returns, complete and file a separate form 8822 for each child. Select the contact link to enter and update your address and phone information. Tell us in person or by telephone. Web form to this address.

Instead, See Where To File On This Page.

Web form 8822 is used to change your mailing address—the place where you receive your mail—which can be different than the address of your permanent home. We'll need you to verify your identity and the address we have on file for you. Web separate form 8822 for each child. Purpose of form you may use form 8822 to notify the internal revenue service if you changed your home or business mailing address or your business location.

Select When Would You Like To Schedule The Update, Then Select Continue.

If this change also affects the mailing address for your children who filed income tax returns, complete and file a separate form 8822 for each child. Generally, it takes 4 to 6 weeks to process a change of address. Web business mailing address or your business location. If you are a representative signing for the taxpayer, attach to form 8822 a copy of your power of attorney.

Web Log In To My Social Security.

And this can vary from your permanent home address. Mail your signed statement to the address where you filed your last return. Tell us in person or by telephone. If this change also affects the mailing address for your children who filed income tax returns, complete and file a separate.

If You Moved Or Have Otherwise Changed Your Address, Filing Form 8822 Will Ensure The Irs Has The Correct Address To Send Communications And Payments Due To.

The irs is not able to update an address from the usps change of address process and is not required to find. Review and verify your information, select submit. Web yes, you should update your address with the irs by filing form 8822. If you are a representative signing for the taxpayer, attach to form 8822 a copy of your power of attorney.