Form 8829 Depreciation Percentage

Form 8829 Depreciation Percentage - 6 divide line 4 by line 5. Web information about form 8829, expenses for business use of your home, including recent updates, related forms and instructions on how to file. Web taxpayers use form 8829, expenses for business use of your home, to claim expenses related to using the home for business purposes. Enter the result as a decimal amount. Complete, edit or print tax forms instantly. Multiply line 39 by line 40. Web line 3 (enter the result as a percentage). This is regarding form 8829, part iii, line 41: Get ready for tax season deadlines by completing any required tax forms today. All others, enter the amount from line 3.

Solved•by intuit•proconnect tax•10•updated august 25, 2022. Web taxpayers use form 8829, expenses for business use of your home, to claim expenses related to using the home for business purposes. Enter here and on line 29 above 40 carryover of unallowed expenses. Web home office depreciation percentage? Multiply that percentage by the basis (value of your home) and you’ll get your. Entering depreciable assets for form 8829 in proconnect. Web depreciation percentage (see instructions) depreciation allowable (see instructions). If you did not file a form 8829 last year, then your carryover of prior year excess casualty losses and. Complete, edit or print tax forms instantly. Web you’ll then enter the depreciation percentage from the instructions on line 41.

Ad access irs tax forms. If you work or run your business from home, the irs. Web a different depreciation percentage than the 2.564% used in the example would override this and produce a different result. 6 divide line 4 by line 5. Get ready for tax season deadlines by completing any required tax forms today. Web line 3 (enter the result as a percentage). Complete, edit or print tax forms instantly. Multiply that percentage by the basis (value of your home) and you’ll get your. Web for example, in case your home is 4,000 square feet, and your home business space is 400 square feet, then the percentage will be 10%. Web information about form 8829, expenses for business use of your home, including recent updates, related forms and instructions on how to file.

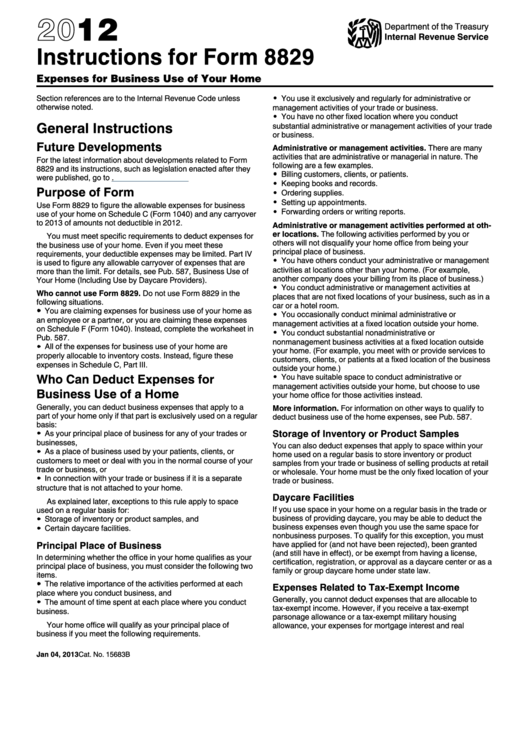

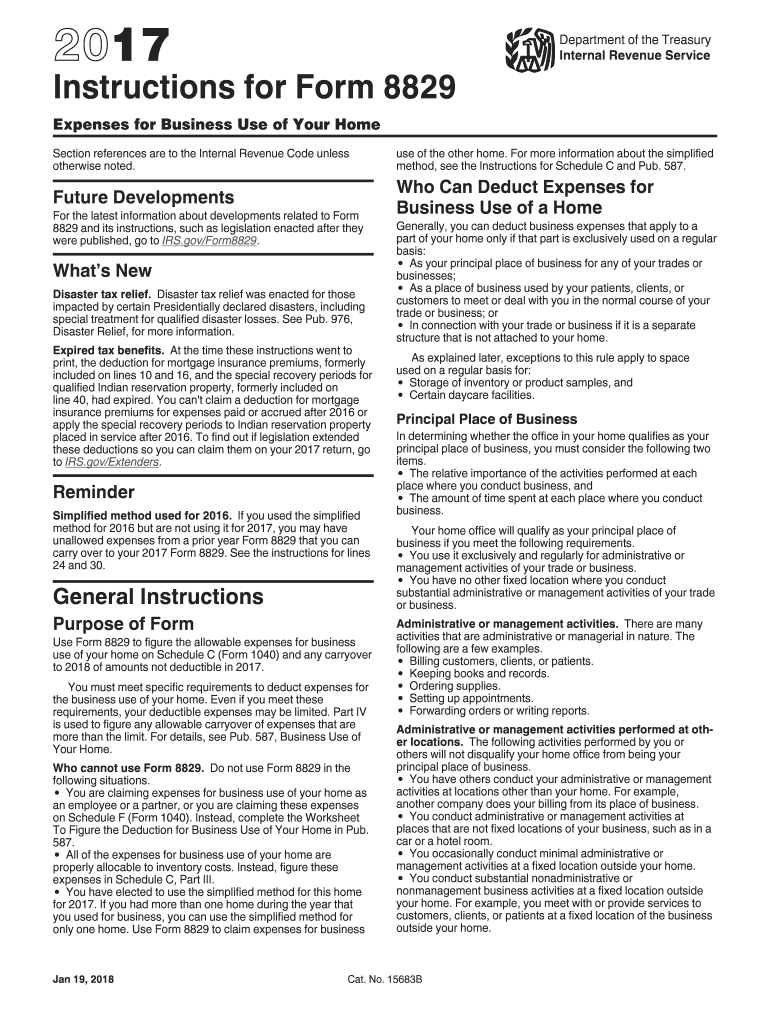

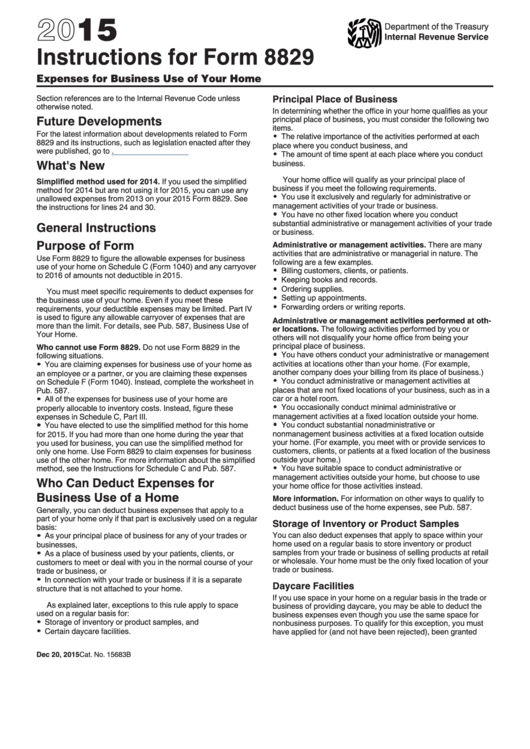

Instructions For Form 8829 Expenses For Business Use Of Your Home

In view, confirm that the software has. 7 % part ii figure your allowable deduction. Web you’ll then enter the depreciation percentage from the instructions on line 41. Multiply that percentage by the basis (value of your home) and you’ll get your. 6 divide line 4 by line 5.

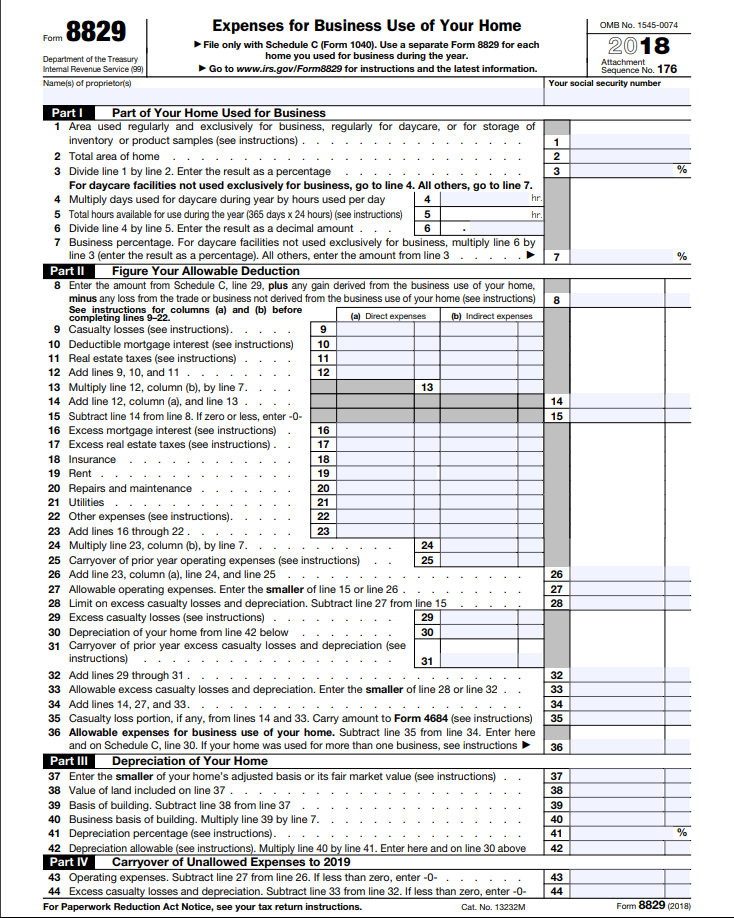

Form 8829 Instructions Your Complete Guide to Expense Your Home Office

6 divide line 4 by line 5. If you work or run your business from home, the irs. Complete, edit or print tax forms instantly. This is regarding form 8829, part iii, line 41: Enter the result as a decimal amount.

U.S. Tax Form 8829—Expenses for Business Use of Your Home FreshBooks Blog

Enter the amount from schedule c, line 29,. If you did not file a form 8829 last year, then your carryover of prior year excess casualty losses and. Solved•by intuit•proconnect tax•10•updated august 25, 2022. If you work or run your business from home, the irs. If the taxpayer is depreciating assets in.

Tax Write Off Guide for Home Office Deductions & Expenses

Web form 8829 is only for taxpayers filing form 1040 schedule c. In view, confirm that the software has. For daycare facilities not used exclusively for business, multiply line 6 by line. If the taxpayer is depreciating assets in. 6 divide line 4 by line 5.

Form 8829 Expenses for Business Use of Your Home (2015) Free Download

Direct and indirect taxes you will have to. Web taxpayers use form 8829, expenses for business use of your home, to claim expenses related to using the home for business purposes. Multiply line 39 by line 40. In view, confirm that the software has. Web you’ll then enter the depreciation percentage from the instructions on line 41.

U.S. Tax Form 8829—Expenses for Business Use of Your Home FreshBooks Blog

This is regarding form 8829, part iii, line 41: Web depreciation percentage (see instructions) depreciation allowable (see instructions). Web you’ll then enter the depreciation percentage from the instructions on line 41. Complete, edit or print tax forms instantly. Get ready for tax season deadlines by completing any required tax forms today.

Instructions Form 8829 Fill Out and Sign Printable PDF Template signNow

This is regarding form 8829, part iii, line 41: 7 % part ii figure your allowable deduction. Enter the result as a decimal amount. Web a different depreciation percentage than the 2.564% used in the example would override this and produce a different result. Entering depreciable assets for form 8829 in proconnect.

Instructions For Form 8829 Expenses For Business Use Of Your Home

6 divide line 4 by line 5. Get ready for tax season deadlines by completing any required tax forms today. This is regarding form 8829, part iii, line 41: According to the irs form 8829 instructions, the. All others, enter the amount from line 3.

The New York Times > Business > Image > Form 8829

Ad access irs tax forms. All others, enter the amount from line 3. Direct and indirect taxes you will have to. Web general instructions purpose of form use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and any carryover to 2023 of. If the taxpayer is depreciating assets in.

Form 8829 for the Home Office Deduction Credit Karma

According to the irs form 8829 instructions, the. All others, enter the amount from line 3. Web depreciation percentage (see instructions) depreciation allowable (see instructions). In view, confirm that the software has. This is regarding form 8829, part iii, line 41:

Multiply Line 39 By Line 40.

6 divide line 4 by line 5. Complete, edit or print tax forms instantly. 7 % part ii figure your allowable deduction. Web information about form 8829, expenses for business use of your home, including recent updates, related forms and instructions on how to file.

Web Form 8829 Is Only For Taxpayers Filing Form 1040 Schedule C.

In view, confirm that the software has. Enter the amount from schedule c, line 29,. Direct and indirect taxes you will have to. Web depreciation percentage (see instructions) depreciation allowable (see instructions).

This Is Regarding Form 8829, Part Iii, Line 41:

Enter the result as a decimal amount. Web general instructions purpose of form use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and any carryover to 2023 of. Ad access irs tax forms. For daycare facilities not used exclusively for business, multiply line 6 by line.

Web Line 3 (Enter The Result As A Percentage).

Web a different depreciation percentage than the 2.564% used in the example would override this and produce a different result. Solved•by intuit•proconnect tax•10•updated august 25, 2022. Web home office depreciation percentage? Multiply that percentage by the basis (value of your home) and you’ll get your.