Form 8839 Instructions 2021

Form 8839 Instructions 2021 - Information about your eligible child (or children) part ii: Web you have a carryforward of an adoption credit from 2021. Web travel expenses other adoption costs for your expenses to qualify for the credit or exclusion, both of these must apply: Web table of contents how do i complete irs form 8839? You may be able to take this credit in 2022 if any of the. Use this form to figure the amount of your. The credit will begin to phase out for families with modified. Web key takeaways • if you paid qualified adoption expenses to adopt a child, you may be eligible for the adoption tax credit up to a maximum of $14,890 per. Web instructions for form 8839 qualified adoption expenses department of the treasury internal revenue service section references are to the internal revenue code unless otherwise. Web information about form 8839, qualified adoption expenses, including recent updates, related forms and instructions on how to file.

You may be able to take this credit in 2022 if any of the. Web travel expenses other adoption costs for your expenses to qualify for the credit or exclusion, both of these must apply: The adopted child must be under age 18 or. Web form 8839, qualified adoption expenses for tax year 2021 is estimated to be finalized and available in turbotax soon. Information about your eligible child (or children) part ii: Web future developments for the latest information about developments related to form 8839 and its instructions, such as legislation enacted after theyare published, go to. Web table of contents how do i complete irs form 8839? Use form 8839, part ii, to figure the adoption credit you can take on schedule 3 (form 1040), line 6c. Web instructions for form 8839 qualified adoption expenses department of the treasury internal revenue service section references are to the internal revenue code unless otherwise. Please see the turbotax faq here for dates.

Web information about form 8839, qualified adoption expenses, including recent updates, related forms and instructions on how to file. Web key takeaways • if you paid qualified adoption expenses to adopt a child, you may be eligible for the adoption tax credit up to a maximum of $14,890 per. Use this form to figure the amount of your. Qualified adoption expenses are reasonable. Web travel expenses other adoption costs for your expenses to qualify for the credit or exclusion, both of these must apply: Web future developments for the latest information about developments related to form 8839 and its instructions, such as legislation enacted after theyare published, go to. Must be removed before printing. Use form 8839, part ii, to figure the adoption credit you can take on schedule 3 (form 1040), line 6c. Please see the turbotax faq here for dates. The adopted child must be under age 18 or.

LEGO 8839 Supply Ship Set Parts Inventory and Instructions LEGO

Web you have a carryforward of an adoption credit from 2021. Web future developments for the latest information about developments related to form 8839 and its instructions, such as legislation enacted after theyare published, go to. Use form 8839, part ii, to figure the adoption credit you can take on schedule 3 (form 1040), line 6c. The credit will begin.

Form 8839 Qualified Adoption Expenses (2015) Free Download

You may be able to take this credit in 2022 if any of the. The adopted child must be under age 18 or. Please see the turbotax faq here for dates. Qualified adoption expenses are reasonable. Web table of contents how do i complete irs form 8839?

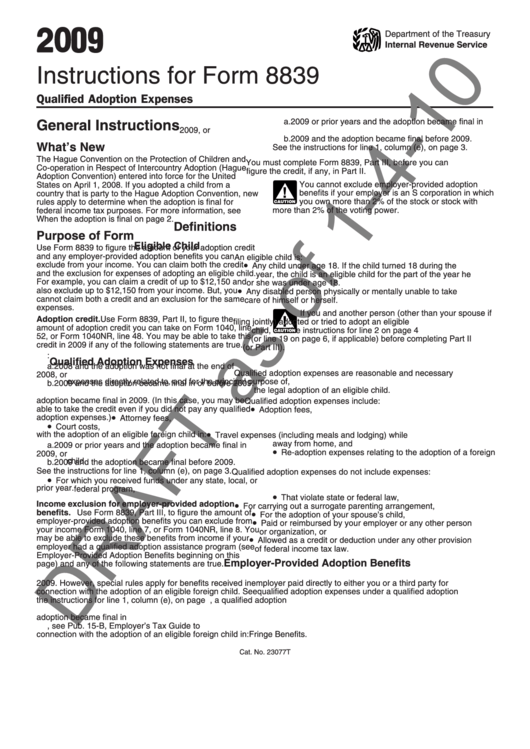

Instructions For Form 8839 Draft 2009 printable pdf download

Qualified adoption expenses are reasonable. Web future developments for the latest information about developments related to form 8839 and its instructions, such as legislation enacted after theyare published, go to. Information about your eligible child (or children) part ii: Web table of contents how do i complete irs form 8839? Web key takeaways • if you paid qualified adoption expenses.

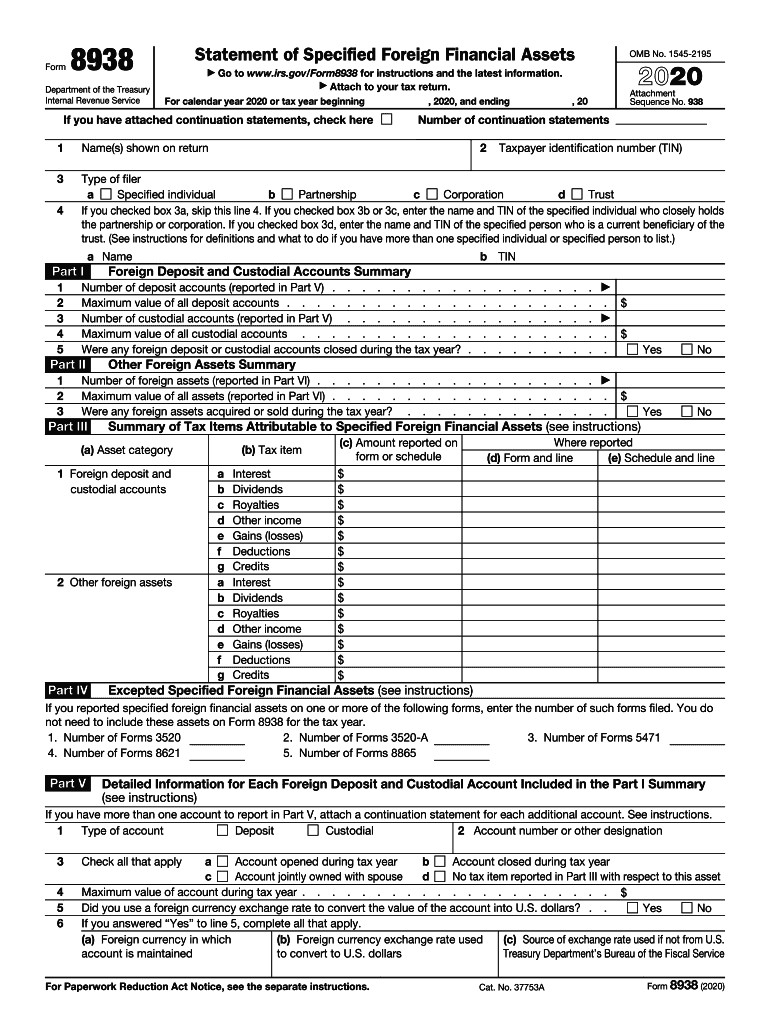

form 8938 Fill out & sign online DocHub

Web form 8839, qualified adoption expenses for tax year 2021 is estimated to be finalized and available in turbotax soon. You may be able to take this credit in 2022 if any of the. Web future developments for the latest information about developments related to form 8839 and its instructions, such as legislation enacted after theyare published, go to. Use.

LEGO instructions Technic 8839 Supply Ship YouTube

Web travel expenses other adoption costs for your expenses to qualify for the credit or exclusion, both of these must apply: The credit will begin to phase out for families with modified. Use this form to figure the amount of your. Information about your eligible child (or children) part ii: Must be removed before printing.

How to Take Adoption Tax Credit for Failed Adoption Pocket Sense

Web future developments for the latest information about developments related to form 8839 and its instructions, such as legislation enacted after theyare published, go to. Use this form to figure the amount of your. The credit will begin to phase out for families with modified. Information about your eligible child (or children) part ii: Web for 2021 adoptions (claimed in.

Form 8839Qualified Adoption Expenses

Web for 2021 adoptions (claimed in early 2022), the maximum adoption credit and exclusion is $14,440 per child. Web instructions for form 8839 qualified adoption expenses department of the treasury internal revenue service section references are to the internal revenue code unless otherwise. Web you have a carryforward of an adoption credit from 2021. Web form 8839, qualified adoption expenses.

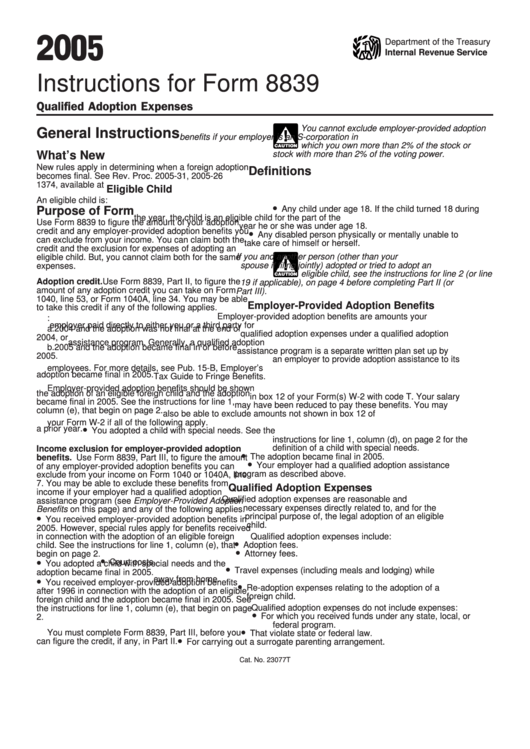

Instructions For Form 8839 2005 printable pdf download

Web key takeaways • if you paid qualified adoption expenses to adopt a child, you may be eligible for the adoption tax credit up to a maximum of $14,890 per. The credit will begin to phase out for families with modified. Web travel expenses other adoption costs for your expenses to qualify for the credit or exclusion, both of these.

LEGO 8839 Supply Ship Set Parts Inventory and Instructions LEGO

Qualified adoption expenses are reasonable. Web information about form 8839, qualified adoption expenses, including recent updates, related forms and instructions on how to file. Information about your eligible child (or children) part ii: Web you have a carryforward of an adoption credit from 2021. You may be able to take this credit in 2022 if any of the.

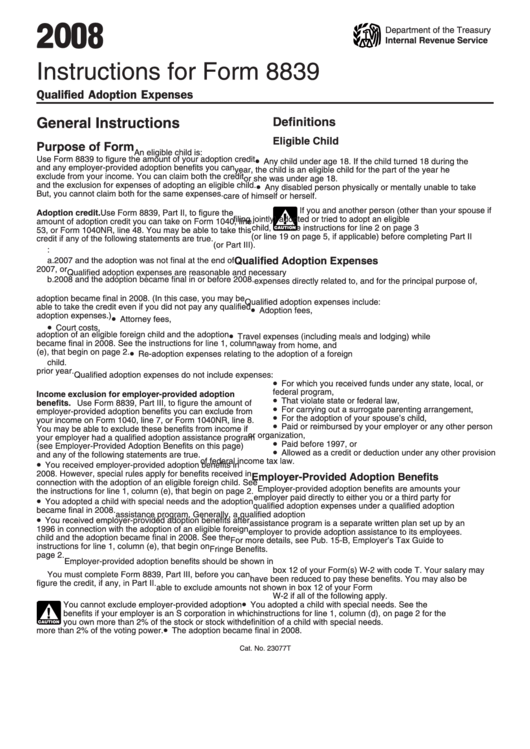

Instructions For Form 8839 2008 printable pdf download

Web future developments for the latest information about developments related to form 8839 and its instructions, such as legislation enacted after theyare published, go to. The credit will begin to phase out for families with modified. Web table of contents how do i complete irs form 8839? Web form 8839, qualified adoption expenses for tax year 2021 is estimated to.

You May Be Able To Take This Credit In 2022 If Any Of The.

Web travel expenses other adoption costs for your expenses to qualify for the credit or exclusion, both of these must apply: Web instructions for form 8839 qualified adoption expenses department of the treasury internal revenue service section references are to the internal revenue code unless otherwise. Web information about form 8839, qualified adoption expenses, including recent updates, related forms and instructions on how to file. Web form 8839, qualified adoption expenses for tax year 2021 is estimated to be finalized and available in turbotax soon.

Web Table Of Contents How Do I Complete Irs Form 8839?

Web you have a carryforward of an adoption credit from 2021. Must be removed before printing. Web for 2021 adoptions (claimed in early 2022), the maximum adoption credit and exclusion is $14,440 per child. Use this form to figure the amount of your.

The Credit Will Begin To Phase Out For Families With Modified.

Web key takeaways • if you paid qualified adoption expenses to adopt a child, you may be eligible for the adoption tax credit up to a maximum of $14,890 per. Use form 8839, part ii, to figure the adoption credit you can take on schedule 3 (form 1040), line 6c. Qualified adoption expenses are reasonable. The adopted child must be under age 18 or.

Information About Your Eligible Child (Or Children) Part Ii:

Web future developments for the latest information about developments related to form 8839 and its instructions, such as legislation enacted after theyare published, go to. Please see the turbotax faq here for dates.