Form 8863 Instructions

Form 8863 Instructions - For 2022, there are two education credits. Department of the treasury internal revenue service. What are qualified education expenses? Web to claim aotc, you must file a federal tax return, complete the form 8863 and attach the completed form to your form 1040 or form 1040a. To fill out the 8863 worksheet sample correctly: Completing the form 8863 example correctly is essential for claiming certain student loans on your federal taxes. Web when claiming these credits, students need to use form 8863. Go to www.irs.gov/form8863 for instructions and the latest information. This document is usually provided by the school and shows the amount billed or received for the given year. Web if you plan on claiming one of the irs educational tax credits, be sure to fill out a form 8863 and attach it to your tax return.

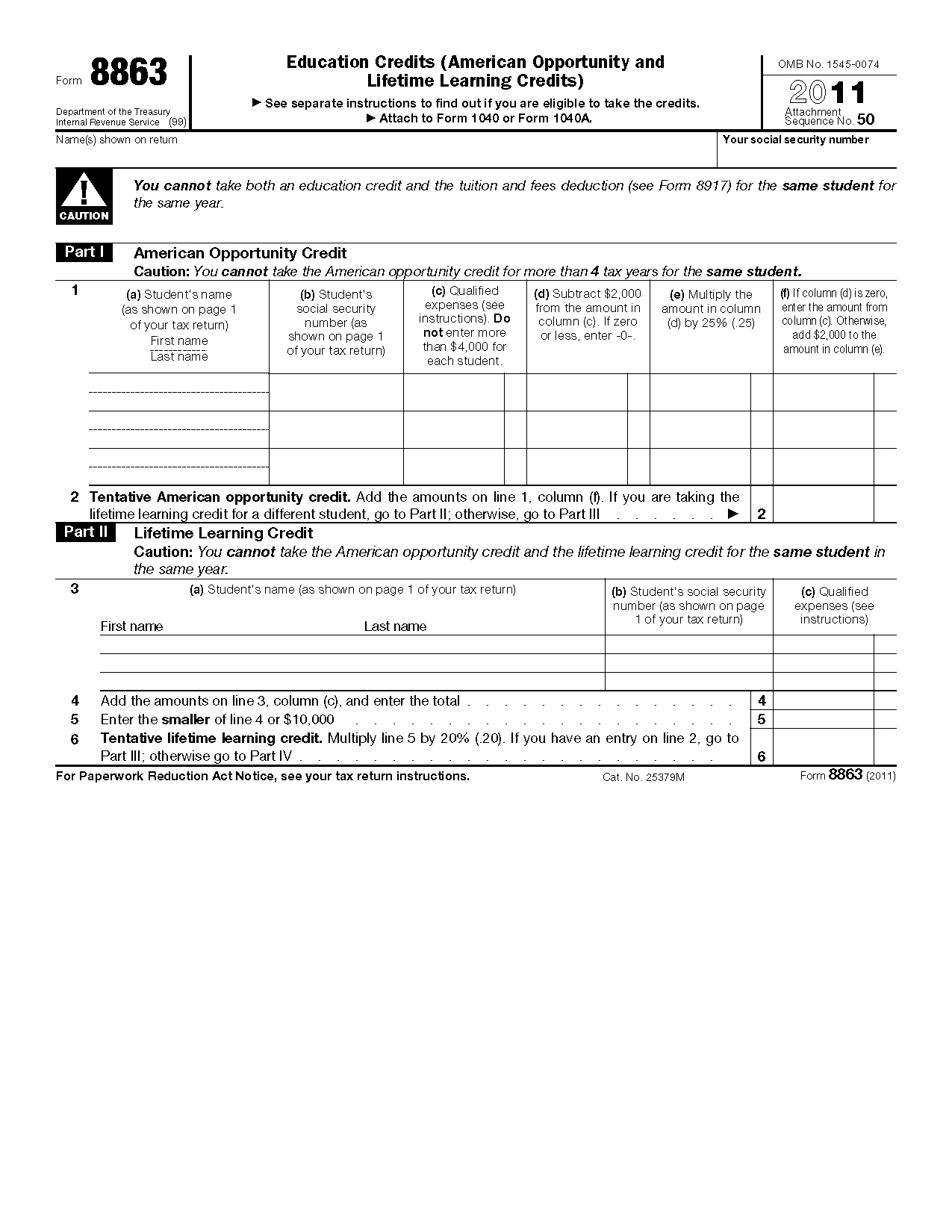

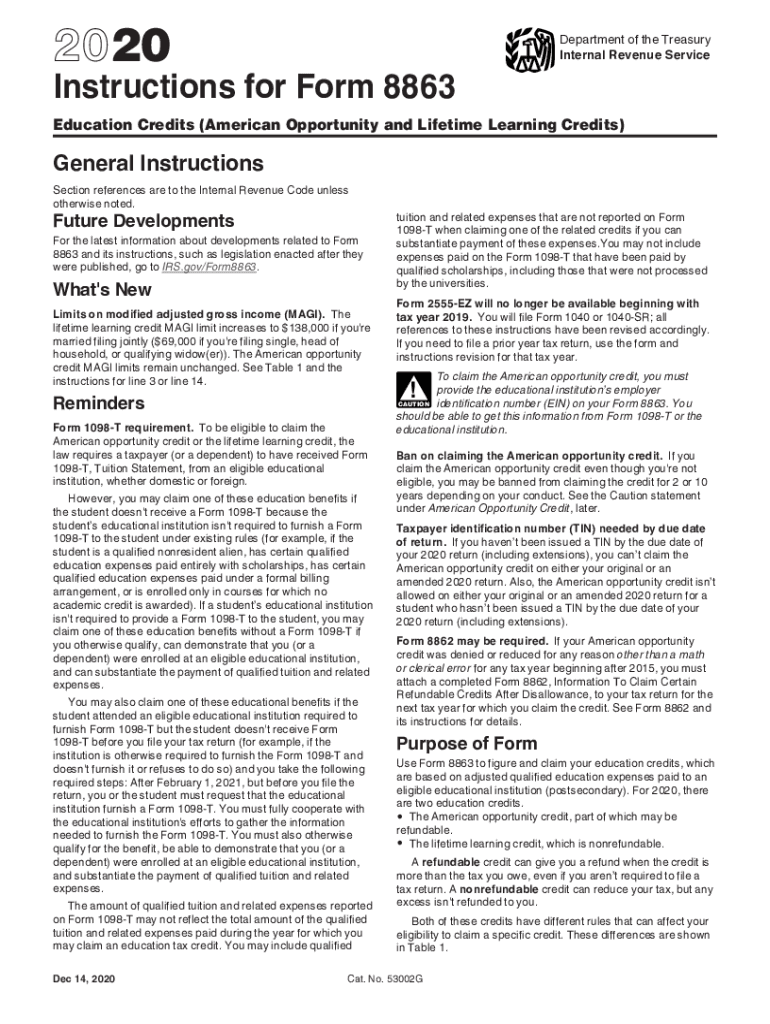

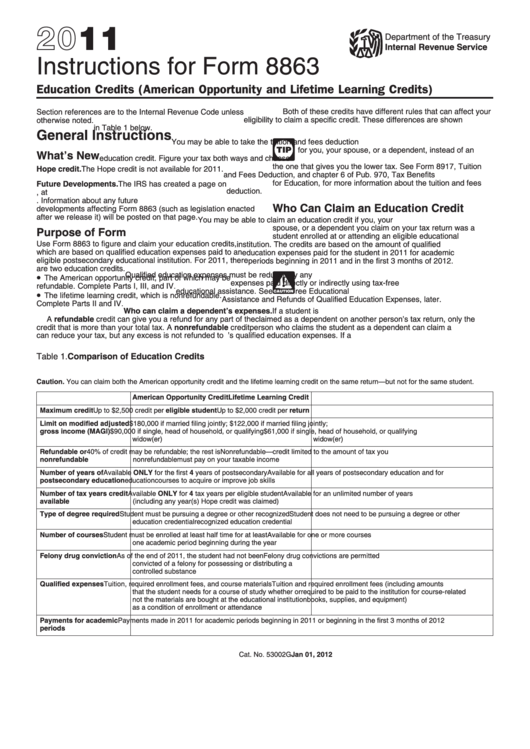

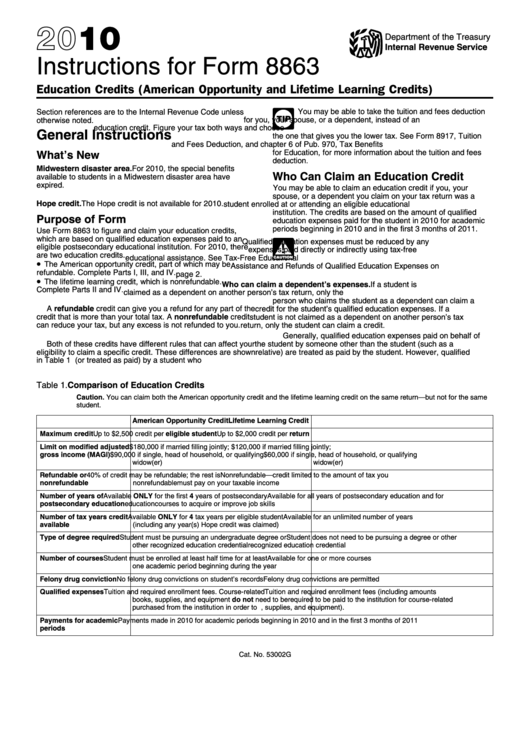

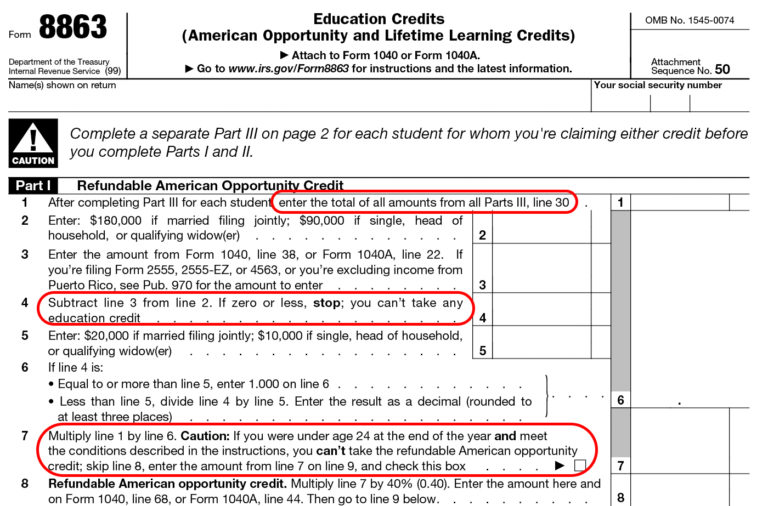

The american opportunity credit, part of which may be refundable. Go to www.irs.gov/form8863 for instructions and the latest information. Web if you plan on claiming one of the irs educational tax credits, be sure to fill out a form 8863 and attach it to your tax return. Use form 8863 to figure and claim your education credits, which are based on qualified education expenses paid to an eligible postsecondary educational institution. What are qualified education expenses? This article will further explain what the form entails, who can file this form, and other facts you need to know. If you can’t find it, or if your school didn’t send you one, it’s possible you can get an electronic copy from your school’s online portal. Use form 8863 to figure and claim your education credits, which are based on adjusted qualified education expenses paid to an eligible educational institution (postsecondary). Web when claiming these credits, students need to use form 8863. This document is usually provided by the school and shows the amount billed or received for the given year.

Web form 8863 is used by individuals to figure and claim education credits (hope credit, lifetime learning credit, etc.). Web when claiming these credits, students need to use form 8863. Web if you plan on claiming one of the irs educational tax credits, be sure to fill out a form 8863 and attach it to your tax return. For instructions and the latest information. What are qualified education expenses? Department of the treasury internal revenue service. If you can’t find it, or if your school didn’t send you one, it’s possible you can get an electronic copy from your school’s online portal. Use form 8863 to figure and claim your education credits, which are based on qualified education expenses paid to an eligible postsecondary educational institution. Who can file form 8863? To fill out the 8863 worksheet sample correctly:

Tax Form 8863 Federal For 2016 Instructions 2015 2018 —

Department of the treasury internal revenue service. For 2022, there are two education credits. Web when claiming these credits, students need to use form 8863. Use form 8863 to figure and claim your education credits, which are based on qualified education expenses paid to an eligible postsecondary educational institution. This document is usually provided by the school and shows the.

2020 Form IRS Instruction 8863 Fill Online, Printable, Fillable, Blank

This document is usually provided by the school and shows the amount billed or received for the given year. Who can file form 8863? For 2022, there are two education credits. Go to www.irs.gov/form8863 for instructions and the latest information. Web if you plan on claiming one of the irs educational tax credits, be sure to fill out a form.

Instructions For Form 8863 Education Credits (American Opportunity

Go to www.irs.gov/form8863 for instructions and the latest information. Use form 8863 to figure and claim your education credits, which are based on qualified education expenses paid to an eligible postsecondary educational institution. Web to claim aotc, you must file a federal tax return, complete the form 8863 and attach the completed form to your form 1040 or form 1040a..

Form 8863 Instructions & Information on the Education Credit Form

Department of the treasury internal revenue service. The american opportunity credit, part of which may be refundable. Who can file form 8863? This guide will help you understand the purpose of this document and the information needed to complete it. This article will further explain what the form entails, who can file this form, and other facts you need to.

Instructions For Form 8863 Education Credits (American Opportunity

The american opportunity credit, part of which may be refundable. Web if you plan on claiming one of the irs educational tax credits, be sure to fill out a form 8863 and attach it to your tax return. Department of the treasury internal revenue service. Web irs form 8863 instructions. Who can file form 8863?

Form 8863 Instructions Information On The Education 1040 Form Printable

Scholarships, grants, and school loans; This guide will help you understand the purpose of this document and the information needed to complete it. Use form 8863 to figure and claim your education credits, which are based on qualified education expenses paid to an eligible postsecondary educational institution. Web if you plan on claiming one of the irs educational tax credits,.

Maximizing The Higher Education Tax Credits Turbo Tax

Web form 8863 is used by individuals to figure and claim education credits (hope credit, lifetime learning credit, etc.). Web when claiming these credits, students need to use form 8863. To fill out the 8863 worksheet sample correctly: For instructions and the latest information. Go to www.irs.gov/form8863 for instructions and the latest information.

2012 Form IRS Instruction 8863 Fill Online, Printable, Fillable, Blank

Department of the treasury internal revenue service. Web filling out irs form 8863: Scholarships, grants, and school loans; Web irs form 8863 instructions. Web when claiming these credits, students need to use form 8863.

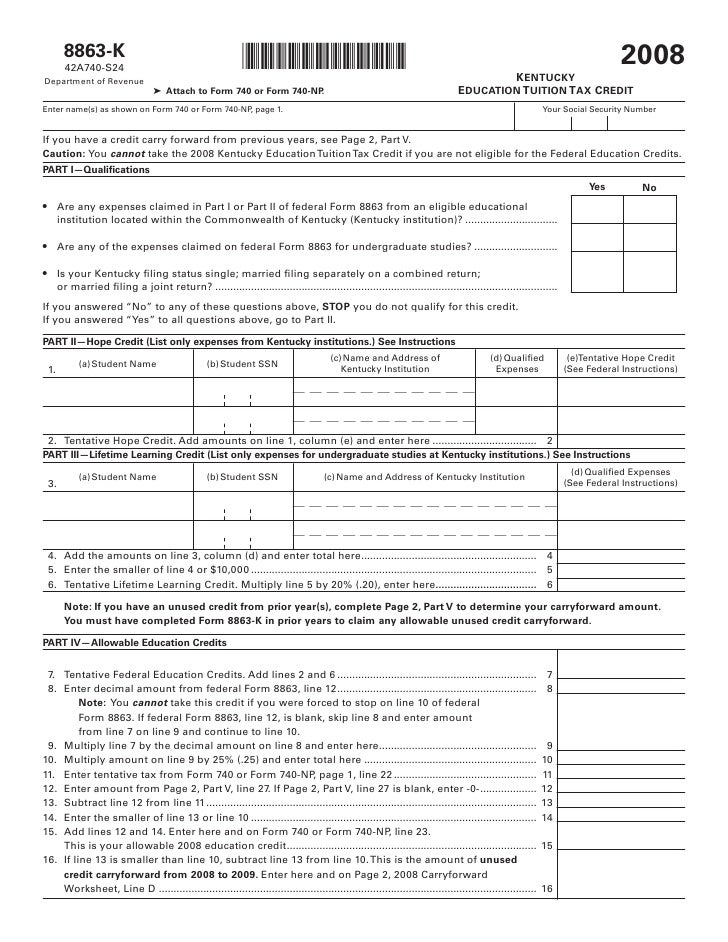

8863K Kentucky Education Tuition Tax Credit Form 42A740S24

Web form 8863 is used by individuals to figure and claim education credits (hope credit, lifetime learning credit, etc.). To fill out the 8863 worksheet sample correctly: Web to claim aotc, you must file a federal tax return, complete the form 8863 and attach the completed form to your form 1040 or form 1040a. Go to www.irs.gov/form8863 for instructions and.

Form 8863 Education Credits (American Opportunity and Lifetime

Web to claim aotc, you must file a federal tax return, complete the form 8863 and attach the completed form to your form 1040 or form 1040a. To fill out the 8863 worksheet sample correctly: Scholarships, grants, and school loans; Web irs form 8863 instructions. Use form 8863 to figure and claim your education credits, which are based on qualified.

This Article Will Further Explain What The Form Entails, Who Can File This Form, And Other Facts You Need To Know.

This document is usually provided by the school and shows the amount billed or received for the given year. What are qualified education expenses? Department of the treasury internal revenue service. Web irs form 8863 instructions.

Scholarships, Grants, And School Loans;

Web if you plan on claiming one of the irs educational tax credits, be sure to fill out a form 8863 and attach it to your tax return. Use form 8863 to figure and claim your education credits, which are based on qualified education expenses paid to an eligible postsecondary educational institution. Web filling out irs form 8863: Who can file form 8863?

The American Opportunity Credit, Part Of Which May Be Refundable.

If you can’t find it, or if your school didn’t send you one, it’s possible you can get an electronic copy from your school’s online portal. This guide will help you understand the purpose of this document and the information needed to complete it. Web form 8863 is used by individuals to figure and claim education credits (hope credit, lifetime learning credit, etc.). For 2022, there are two education credits.

To Fill Out The 8863 Worksheet Sample Correctly:

Web to claim aotc, you must file a federal tax return, complete the form 8863 and attach the completed form to your form 1040 or form 1040a. Web when claiming these credits, students need to use form 8863. Go to www.irs.gov/form8863 for instructions and the latest information. For instructions and the latest information.