Form 8865 Instruction

Form 8865 Instruction - Who must file form 8865; If you own at least 10% of a controlled foreign partnership, you may be required to file form 8865. Printing and scanning is no longer the best way to manage documents. Try it for free now! Upload, modify or create forms. Complete, edit or print tax forms instantly. The information that you will need to provide on. When a united states taxpayer has. Web form 8865 & instructions form 8865 refers to the irs’ return of u.s. Persons with respect to certain foreign partnerships.

Form 8865 is used to report. Try it for free now! Income tax return for an s corporation ;and u.s. When a united states taxpayer has. Information furnished for the foreign partnership’s tax year. Complete, edit or print tax forms instantly. Web 5 things you should know about irs form 8865. Web partnerships filing form 1065, u.s. Web form 8865 is an informational tax form that is required to be filed by u.s. Web who has to file form 8865?

Use form 8865 to report the information required under section 6038 (reporting with respect to controlled foreign partnerships), section 6038b (reporting of. Information furnished for the foreign partnership’s tax year. Web form 8865, schedule k, is a summary schedule of all of the partners’ shares of the partnership income, credits, deductions, etc. Web settings\plkgb\desktop\my forms\8865\8865 instructions\10i8865.xml (init. Web if form 8865 applies to you, then you’ll need to know: A person will file form 8865 when they qualify as one of the four (4) categories of filers indicated in the instructions. Web form 8865 requires reporting the foreign partnership’s income statement and balance sheet in u.s. Persons with respect to certain foreign partnerships. Income tax return for an s corporation ;and u.s. Web handy tips for filling out instructions notice uscis form online.

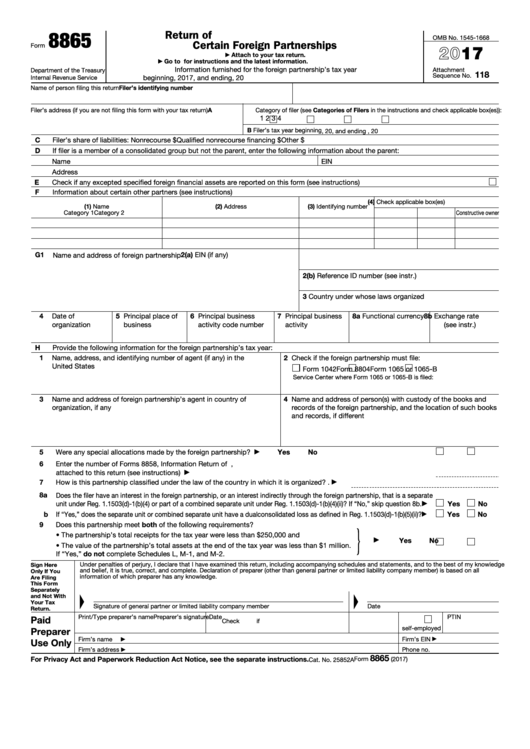

Form 8865 Return of U.S. Persons With Respect to Certain Foreign

Try it for free now! Persons to report information regarding controlled foreign partnerships (section 6038), transfers to foreign partnerships (section 6038b), and. Web form 8865 requires reporting the foreign partnership’s income statement and balance sheet in u.s. Information furnished for the foreign partnership’s tax year. Printing and scanning is no longer the best way to manage documents.

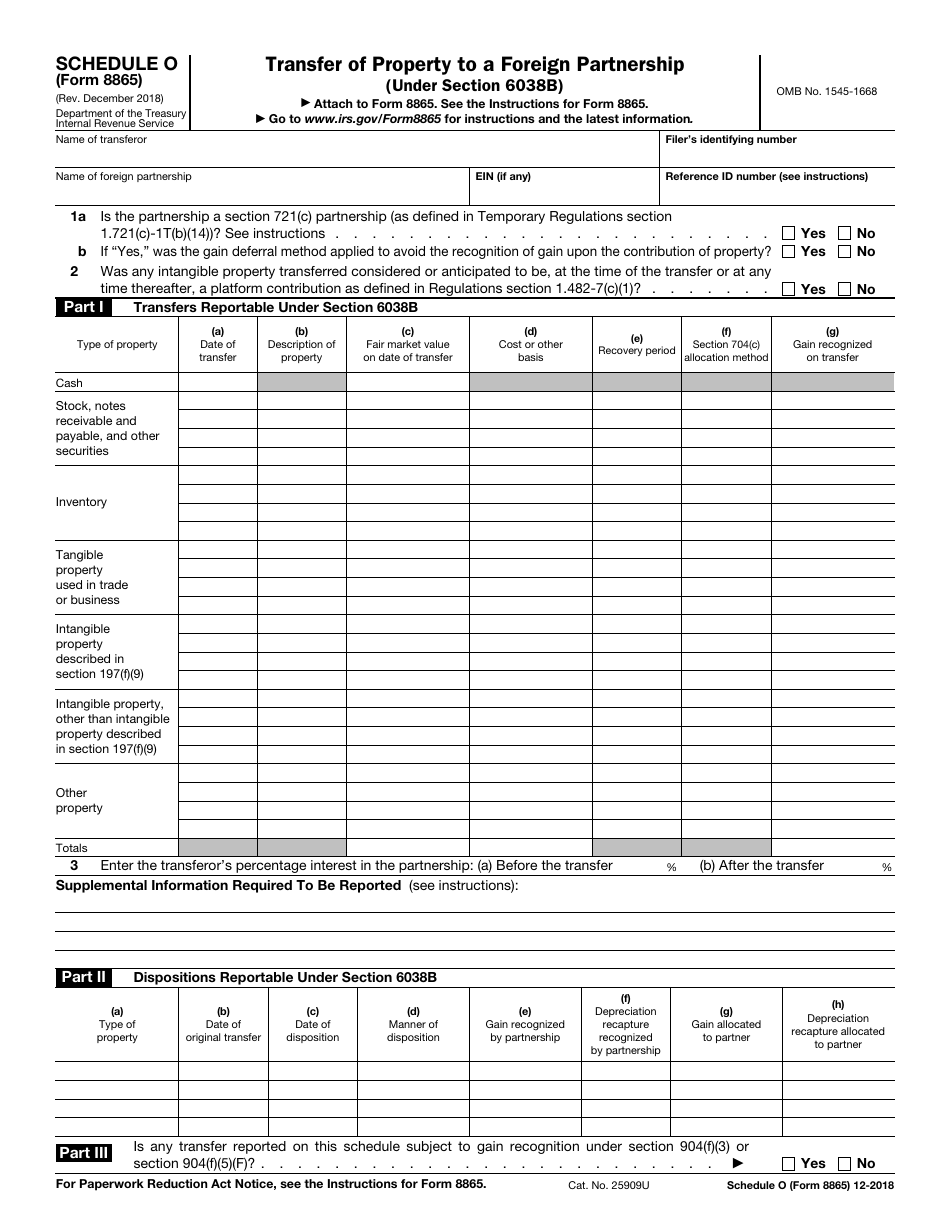

IRS Form 8865 Schedule O Download Fillable PDF or Fill Online Transfer

What the irs defines as a partnership; The purpose of the form is to allow the irs to record. Persons with respect to certain foreign partnerships. Complete, edit or print tax forms instantly. A person will file form 8865 when they qualify as one of the four (4) categories of filers indicated in the instructions.

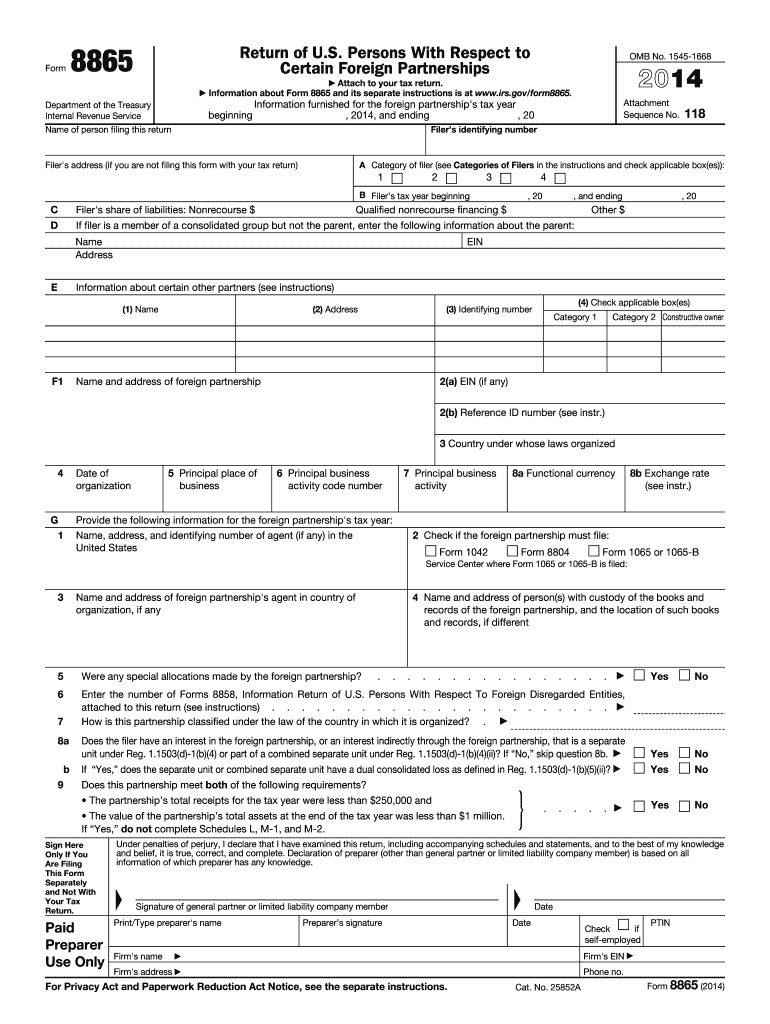

Fillable Form 8865 Return Of U.s. Persons With Respect To Certain

A person will file form 8865 when they qualify as one of the four (4) categories of filers indicated in the instructions. Web where to file in the instructions for form 8832 to determine if you are required to attach a copy of the form 8832 to the tax return to which the form 8865 is being attached. Try it.

8865 Form Fill Out and Sign Printable PDF Template signNow

Web where to file in the instructions for form 8832 to determine if you are required to attach a copy of the form 8832 to the tax return to which the form 8865 is being attached. Web if form 8865 applies to you, then you’ll need to know: Web there are several ways to submit form 4868. Beginning, 2020, and.

Form 8865 Tax Returns for Foreign Partnerships

Complete, edit or print tax forms instantly. Web for instructions and the latest information. Web where to file in the instructions for form 8832 to determine if you are required to attach a copy of the form 8832 to the tax return to which the form 8865 is being attached. Persons to report information regarding controlled foreign partnerships (section 6038),.

Form 8865 (Schedule O) Transfer of Property to a Foreign Partnership

What the irs defines as a partnership; Persons with respect to certain foreign partnerships. Form 8865 is used to report. Beginning, 2020, and ending, 20. Web handy tips for filling out instructions notice uscis form online.

Form 8865 Return of U.S. Persons With Respect to Certain Foreign

Web form 8865 is an informational tax form that is required to be filed by u.s. Use form 8865 to report the information required under section 6038 (reporting with respect to controlled foreign partnerships), section 6038b (reporting of. Income tax return for an s corporation ;and u.s. Taxpayers can file form 4868 by mail, but remember to get your request.

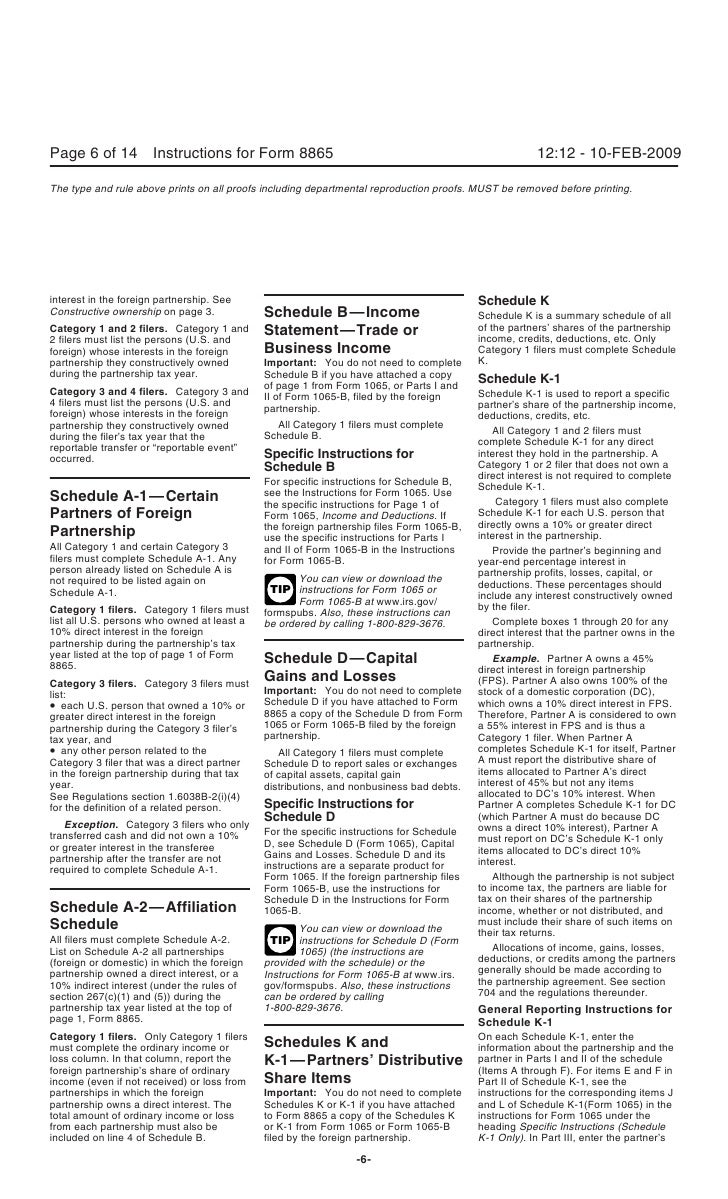

Inst 8865Instructions for Form 8865, Return of U.S. Persons With Res…

Web form 8865 & instructions form 8865 refers to the irs’ return of u.s. Form 8865 is used to report. Complete, edit or print tax forms instantly. Web 5 things you should know about irs form 8865. If you own at least 10% of a controlled foreign partnership, you may be required to file form 8865.

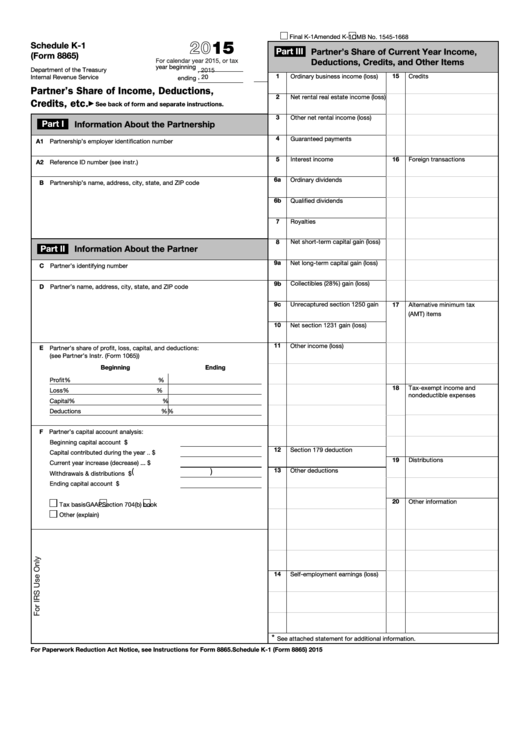

Fillable Form 8865 Schedule K1 Partner'S Share Of

Upload, modify or create forms. Web form 8865 is used by u.s. Web form 8865, schedule k, is a summary schedule of all of the partners’ shares of the partnership income, credits, deductions, etc. Web where to file in the instructions for form 8832 to determine if you are required to attach a copy of the form 8832 to the.

Form 8865 (Schedule P) Acquisitions, Dispositions, and Changes of

Web form 8865 & instructions form 8865 refers to the irs’ return of u.s. Web form 8865 requires reporting the foreign partnership’s income statement and balance sheet in u.s. Form 8865 is used to report. When a united states taxpayer has. If you own at least 10% of a controlled foreign partnership, you may be required to file form 8865.

Only Category 1 Filers Must Complete Form.

Web form 8865 requires reporting the foreign partnership’s income statement and balance sheet in u.s. Income tax return for an s corporation ;and u.s. Complete, edit or print tax forms instantly. Printing and scanning is no longer the best way to manage documents.

Get Ready For Tax Season Deadlines By Completing Any Required Tax Forms Today.

Persons who have an interest in a foreign partnership. Complete, edit or print tax forms instantly. Information furnished for the foreign partnership’s tax year. Try it for free now!

Web Form 8865 & Instructions Form 8865 Refers To The Irs’ Return Of U.s.

The information that you will need to provide on. Web form 8865 is used by u.s. Web form 8865 is an informational tax form that is required to be filed by u.s. Persons with respect to certain foreign partnerships.

Dollars, Translating Them From The Functional Currency (I.e., Generally A Foreign.

Use form 8865 to report the information required under section 6038 (reporting with respect to controlled foreign partnerships), section 6038b (reporting of. Web for instructions and the latest information. Web there are several ways to submit form 4868. The purpose of the form is to allow the irs to record.