Form 8938 Filing Requirements 2021

Form 8938 Filing Requirements 2021 - “fatca” (foreign account tax compliance act) requires specified individuals to report ownership of specified foreign. Complete, edit or print tax forms instantly. Who has to file form 8938? If the taxpayer is single or married filing. Web foreign asset reporting exemption if you do not need to file a tax return. The form 8938 instructions are complex. Taxpayers to report specified foreign financial assets each year on a form 8938. Web to be required to file form 8938, you must first pass the physical presence test or the bona fide resident test. Citizen a resident alien of the. Web 2021 form 8938 filing due date:

Web you must file irs form 8938 statement of specified foreign financial assets if you have an interest in specified foreign assets and the value of those assets is more than the. Taxpayers to report specified foreign financial assets each year on a form 8938. (new) taxpayer requirements 2021 form 8938 filing due date: Web the form 8938 filing requirement does not replace or otherwise affect a taxpayer’s obligation to file fincen form 114 (report of foreign bank and financial accounts). Citizen a resident alien of the. Web if you have a form 8938 filing requirement but do not file a complete and correct form 8938 by the due date (including extensions), you may be subject to a penalty of $10,000. Web form 1138 is used by a corporation expecting a net operating loss for the current year to request an extension of time for payment of tax for the immediately. Web form 8938 filing requirements. Complete, edit or print tax forms instantly. Taxpayers who meet the form 8938.

Web if you have a form 8938 filing requirement but do not file a complete and correct form 8938 by the due date (including extensions), you may be subject to a penalty of $10,000. Web the form 8938 filing requirement does not replace or otherwise affect a taxpayer’s obligation to file fincen form 114 (report of foreign bank and financial accounts). Web you must file irs form 8938 statement of specified foreign financial assets if you have an interest in specified foreign assets and the value of those assets is more than the. Citizen a resident alien of the. Web we have prepared a summary explaining the basics of form 8938, who has to file, and when. Who has to file form 8938? Get ready for tax season deadlines by completing any required tax forms today. While you must file fbar regardless of your income tax situation, you do not need to file. You are a specified person (either a specified individual or a specified domestic entity). Taxpayers, corporations, partnerships, and trusts that hold foreign assets beyond a certain.

Form 8938 Who Has to Report Foreign Assets & How to File

Complete, edit or print tax forms instantly. Us persons, including us citizens, legal permanent residents, and foreign nationals who meet the substantial presence test —. Taxpayers, corporations, partnerships, and trusts that hold foreign assets beyond a certain. Web form 8938 filing requirements. Web if you have a form 8938 filing requirement but do not file a complete and correct form.

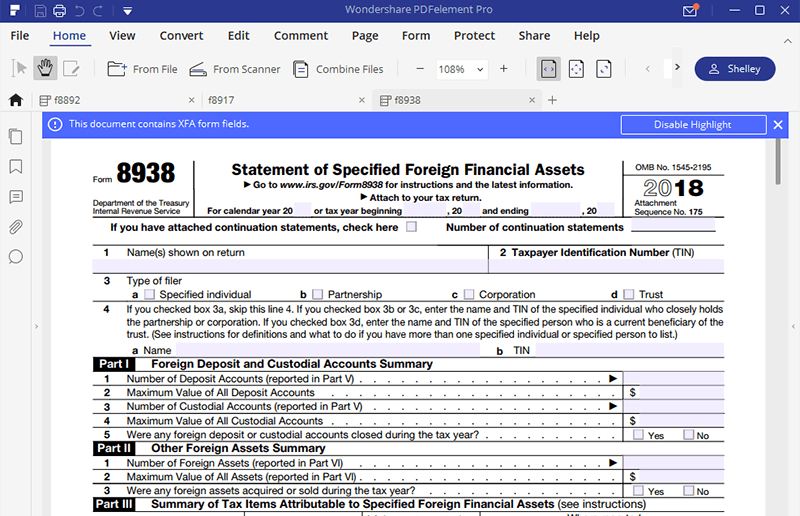

IRS Form 8938 How to Fill it with the Best Form Filler

Web foreign asset reporting exemption if you do not need to file a tax return. Web the form 8938 filing requirement does not replace or otherwise affect a taxpayer’s obligation to file fincen form 114 (report of foreign bank and financial accounts). Statement of specified foreign financial assets with their annual u.s. Web information about form 8938, statement of foreign.

IRS Reporting Requirements for Foreign Account Ownership and Trust

(new) taxpayer requirements 2021 form 8938 filing due date: Us persons, including us citizens, legal permanent residents, and foreign nationals who meet the substantial presence test —. Taxpayers to report specified foreign financial assets each year on a form 8938. The fair market value of your foreign assets must. The form 8938 instructions are complex.

Form 8938 Vs. FBAR Filing, Reporting & Penalties Explained AKIF CPA

Us persons, including us citizens, legal permanent residents, and foreign nationals who meet the substantial presence test —. (new) taxpayer requirements 2021 form 8938 filing due date: If the taxpayer is single or married filing. Web we have prepared a summary explaining the basics of form 8938, who has to file, and when. Get ready for tax season deadlines by.

2018 Form IRS 8938 Fill Online, Printable, Fillable, Blank PDFfiller

Web foreign asset reporting exemption if you do not need to file a tax return. Web statement of specified foreign financial assets 3 type of filer specified individual b partnership c corporation d trust 4 if you checked box 3a, skip this line 4. Web information about form 8938, statement of foreign financial assets, including recent updates, related forms and.

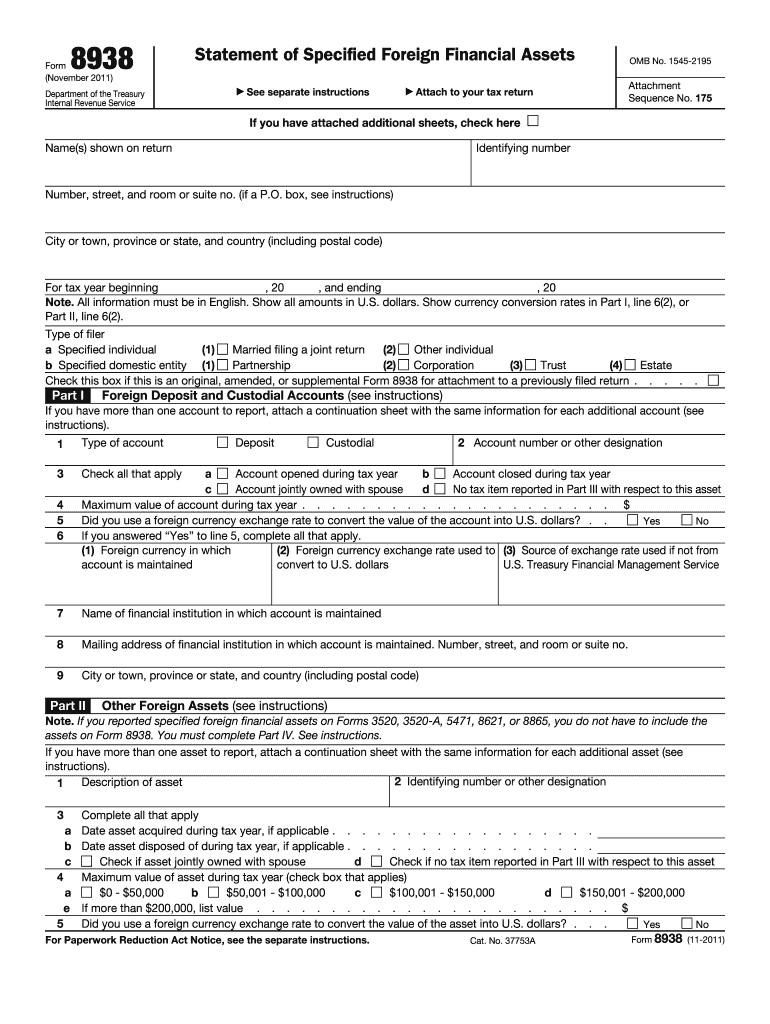

2011 Form IRS 8938 Fill Online, Printable, Fillable, Blank pdfFiller

Citizen a resident alien of the. (new) taxpayer requirements 2021 form 8938 filing due date: Web you must file irs form 8938 statement of specified foreign financial assets if you have an interest in specified foreign assets and the value of those assets is more than the. If the taxpayer is single or married filing. Get ready for tax season.

8822 Form 2021 IRS Forms Zrivo

Web form 8938 filing requirements. Web you must file form 8938 if: Form 8938 threshold & requirements. Web 2021 form 8938 filing due date: You are a specified person (either a specified individual or a specified domestic entity).

Form 8938 Instructions 2022 2023 IRS Forms Zrivo

Web we have prepared a summary explaining the basics of form 8938, who has to file, and when. Us persons, including us citizens, legal permanent residents, and foreign nationals who meet the substantial presence test —. Web form 1138 is used by a corporation expecting a net operating loss for the current year to request an extension of time for.

Comparison of Form 8938 and FBAR Requirements ZMB Tax Consultants

While you must file fbar regardless of your income tax situation, you do not need to file. Web form 8938 filing requirements. The fair market value of your foreign assets must. Web 2021 form 8938 filing due date: Web must file form 8938 if you are a specified person (see specified person, later) that has an interest in specified foreign.

Do YOU need to file Form 8938? “Statement of Specified Foreign

Taxpayers who meet the form 8938. The form 8938 has different threshold filing requirements depending on different factors. (new) taxpayer requirements 2021 form 8938 filing due date: Web definition irs form 8938 is a tax form used by some u.s. Web we have prepared a summary explaining the basics of form 8938, who has to file, and when.

Complete, Edit Or Print Tax Forms Instantly.

Web you must file irs form 8938 statement of specified foreign financial assets if you have an interest in specified foreign assets and the value of those assets is more than the. Form 8938 threshold & requirements. Citizen a resident alien of the. Use form 8938 to report your.

Web 2021 Form 8938 Filing Due Date:

Statement of specified foreign financial assets with their annual u.s. Taxpayers to report specified foreign financial assets each year on a form 8938. Web for an unmarried us resident, taxpayers file form 8938 in any year that the total value on the last day of the year exceeded $50,000, or if they have less than $50,000 on the last. The form 8938 instructions are complex.

Web Information About Form 8938, Statement Of Foreign Financial Assets, Including Recent Updates, Related Forms And Instructions On How To File.

You are a specified person (either a specified individual or a specified domestic entity). Taxpayer requirements contents [ hide] 1 2021 form 8938 filing due date. Web if you have a form 8938 filing requirement but do not file a complete and correct form 8938 by the due date (including extensions), you may be subject to a penalty of $10,000. If the taxpayer is single or married filing.

Web Definition Irs Form 8938 Is A Tax Form Used By Some U.s.

Web statement of specified foreign financial assets 3 type of filer specified individual b partnership c corporation d trust 4 if you checked box 3a, skip this line 4. Get ready for tax season deadlines by completing any required tax forms today. While you must file fbar regardless of your income tax situation, you do not need to file. Who has to file form 8938?