Form 8960 Line 9B

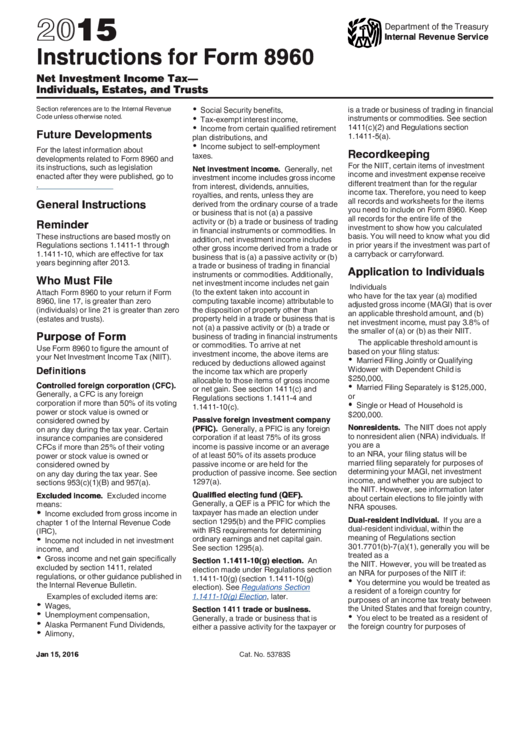

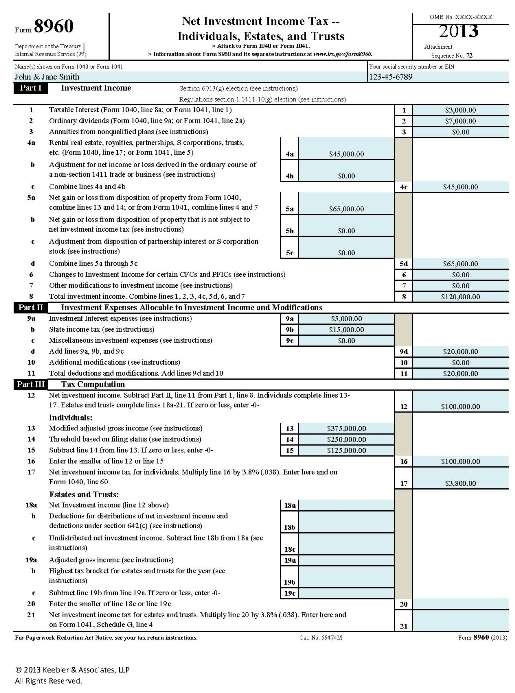

Form 8960 Line 9B - Purpose of form use form 8960 to figure the. Aattach to your tax return. I, line 8 / (form 8960, pg. See lines 9 and 10—application of itemized deduction limitations on deductions properly allocable to investment income worksheet in these instructions for assistance in figuring. Enter the amount of state, local, or foreign income taxes on form 8960, line 9b, net of any deduction limitations imposed by section 68. Estates and trusts enter amount from form. Web attach form 8960 to your return if your modified adjusted gross income (magi) is greater than the applicable threshold amount. Enter only the tax amount that is attributed to the net. Iii, line 13 x form sch a, pg. “include on line 9b any state or local income taxes, or foreign income taxes.

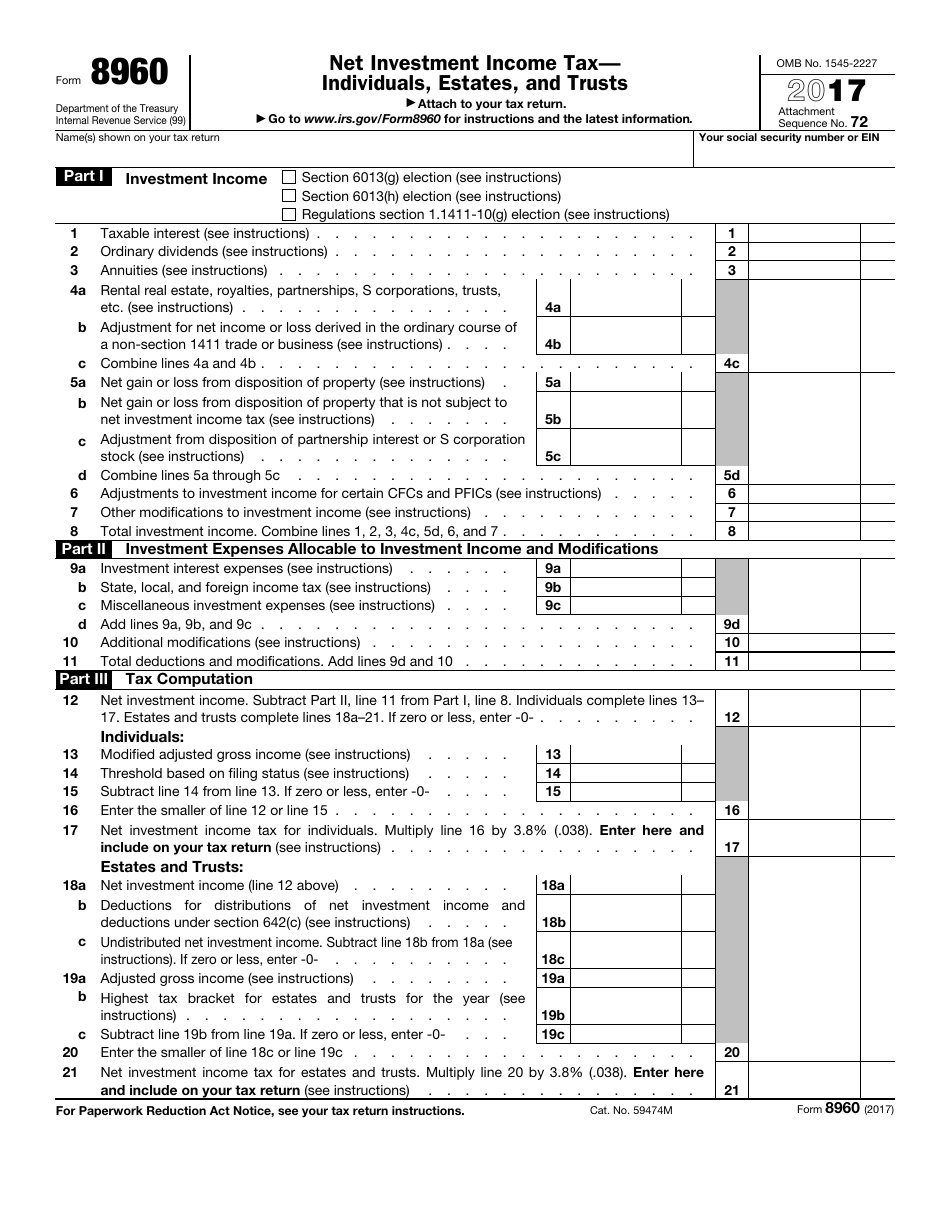

Estates and trusts enter amount from form. Web enter on form 8960, line 9a, interest expense you paid or accrued during the tax year entered on schedule a (form 1040), line 14. Web form 8960, line 9b = total state 20xx tax payments * federal nii (form 8960 line 8) / federal agi (form 1040 line 38) the irs states that any reasonable method may be. If you or the taxpayer are considering using a different way to figure. Web form 8960, line 9b is automatically computed in accordance with the irs form 8960 instructions: Department of the treasury internal revenue service (99) net investment income tax— individuals, estates, and trusts. “include on line 9b any state or local income taxes, or foreign income taxes. Web form 8960 department of the treasury internal revenue service (99) net investment income tax— individuals, estates, and trusts attach to your tax return. Enter the amount of state, local, or foreign income taxes on form 8960, line 9b, net of any deduction limitations imposed by section 68. Iii, line 13 x form sch a, pg.

Purpose of form use form 8960 to figure the. Web enter on form 8960, line 9a, interest expense you paid or accrued during the tax year entered on schedule a (form 1040), line 14. I need some help filling in form 8960 for net investment income tax. Aattach to your tax return. Community discussions taxes investors & landlords cynthiad66 expert alumni yes you can use the 2019 taxes. Enter only the tax amount that is attributed to the net. Web form 8960, line 9b is automatically computed in accordance with the irs form 8960 instructions: Enter the amount of state, local, or foreign income taxes on form 8960, line 9b, net of any deduction limitations imposed by section 68. “include on line 9b any state or local income taxes, or foreign income taxes. This amount is subject to limitation based on the ratio of.

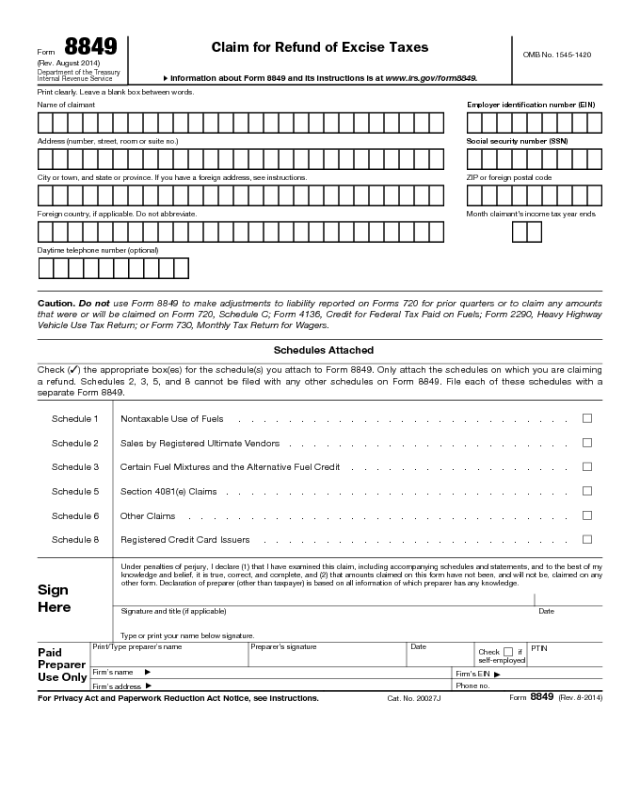

irs form 8960 for 2019 Fill Online, Printable, Fillable Blank form

I need some help filling in form 8960 for net investment income tax. Web line 9b = form 8960, pg. Enter only the tax amount that is attributed to the net. See lines 9 and 10—application of itemized deduction limitations on deductions properly allocable to investment income worksheet in these instructions for assistance in figuring. Web enter on form 8960,.

IRS Form 8960 Download Fillable PDF or Fill Online Net Investment

Community discussions taxes investors & landlords cynthiad66 expert alumni yes you can use the 2019 taxes. Aattach to your tax return. Department of the treasury internal revenue service (99) net investment income tax— individuals, estates, and trusts. Enter the amount of state, local, or foreign income taxes on form 8960, line 9b, net of any deduction limitations imposed by section.

Instructions For Form 8960 (2015) printable pdf download

Web how is form 8960 line 9b calculated by turbotax? Web form 8960, line 9b is automatically computed in accordance with the irs form 8960 instructions: Community discussions taxes investors & landlords cynthiad66 expert alumni yes you can use the 2019 taxes. “include on line 9b any state or local income taxes, or foreign income taxes. I’m attempting to file.

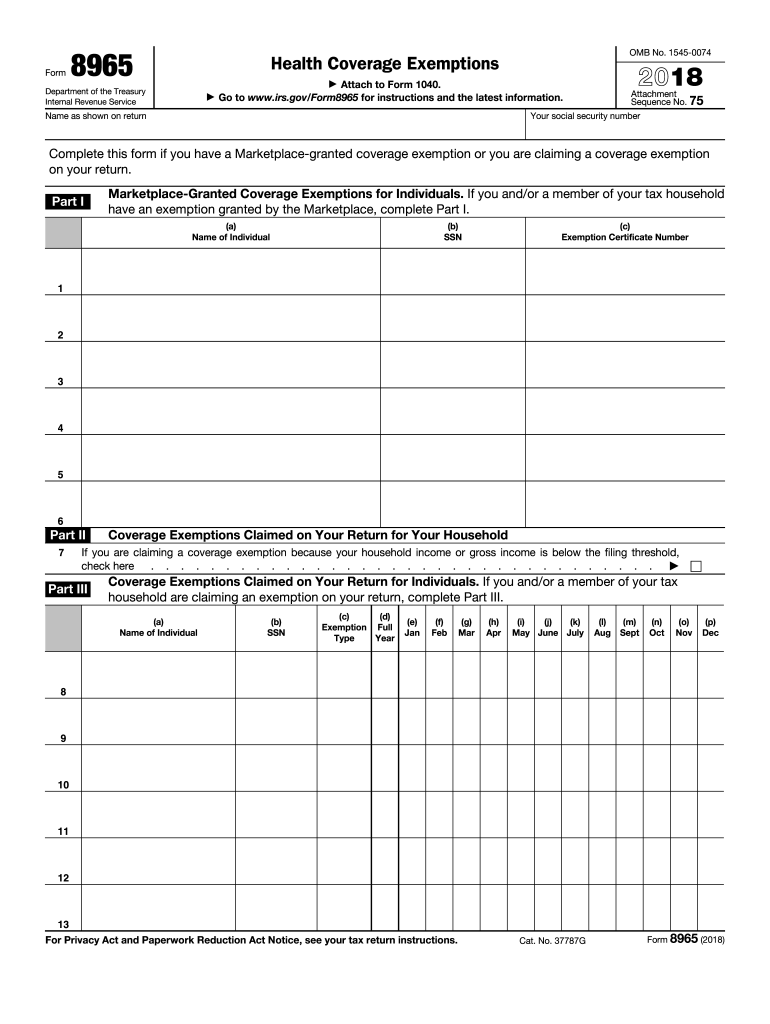

IRS FORM 8965 FREE DOWNLOAD

Department of the treasury internal revenue service (99) net investment income tax— individuals, estates, and trusts. If you or the taxpayer are considering using a different way to figure. See lines 9 and 10—application of itemized deduction limitations on deductions properly allocable to investment income worksheet in these instructions for assistance in figuring. Web the total of the state, local,.

What Is Form 8960? H&R Block

“include on line 9b any state or local income taxes, or foreign income taxes. Enter only the tax amount that is attributed to the net. I, line 8 / (form 8960, pg. Community discussions taxes investors & landlords cynthiad66 expert alumni yes you can use the 2019 taxes. Estates and trusts enter amount from form.

Fillable Form 8960 Draft Net Investment Tax Individuals

This amount is subject to limitation based on the ratio of. Web enter on form 8960, line 9a, interest expense you paid or accrued during the tax year entered on schedule a (form 1040), line 14. If you or the taxpayer are considering using a different way to figure. “include on line 9b any state or local income taxes, or.

Disposition not subject to tax (line 5b) Support

Web how is form 8960 line 9b calculated by turbotax? I, line 8 / (form 8960, pg. Iii, line 13 x form sch a, pg. I’m attempting to file with freetaxusa, but i also ran my. Web form 8960, line 9b = total state 20xx tax payments * federal nii (form 8960 line 8) / federal agi (form 1040 line.

2020 IRS Gov Forms Fillable, Printable PDF & Forms Handypdf

Web form 8960, line 9b is automatically computed in accordance with the irs form 8960 instructions: Web form 8960, line 9b = total state 20xx tax payments * federal nii (form 8960 line 8) / federal agi (form 1040 line 38) the irs states that any reasonable method may be. Aattach to your tax return. Web form 8960, line 9b.

Form 8960 Edit, Fill, Sign Online Handypdf

See lines 9 and 10—application of itemized deduction limitations on deductions properly allocable to investment income worksheet in these instructions for assistance in figuring. I’m attempting to file with freetaxusa, but i also ran my. Enter only the tax amount that is attributed to the net. If you or the taxpayer are considering using a different way to figure. I.

Net Investment Tax Calculator The Ultimate Estate Planner, Inc.

“include on line 9b any state or local income taxes, or foreign income taxes. Estates and trusts enter amount from form. Enter the amount of state, local, or foreign income taxes on form 8960, line 9b, net of any deduction limitations imposed by section 68. Web form 8960, line 9b is automatically computed in accordance with the irs form 8960.

This Amount Is Subject To Limitation Based On The Ratio Of.

Purpose of form use form 8960 to figure the. Web form 8960, line 9b = total state 20xx tax payments * federal nii (form 8960 line 8) / federal agi (form 1040 line 38) the irs states that any reasonable method may be. Web attach form 8960 to your return if your modified adjusted gross income (magi) is greater than the applicable threshold amount. I’m attempting to file with freetaxusa, but i also ran my.

Web Line 9B = Form 8960, Pg.

If you or the taxpayer are considering using a different way to figure. “include on line 9b any state or local income taxes, or foreign income taxes. Enter the amount of state, local, or foreign income taxes on form 8960, line 9b, net of any deduction limitations imposed by section 68. Web enter on form 8960, line 9a, interest expense you paid or accrued during the tax year entered on schedule a (form 1040), line 14.

Department Of The Treasury Internal Revenue Service (99) Net Investment Income Tax— Individuals, Estates, And Trusts.

Web form 8960, line 9b is automatically computed in accordance with the irs form 8960 instructions: Web form 8960, line 9b is automatically computed in accordance with the irs form 8960 instructions: Web information about form 8960, net investment income tax individuals, estates, and trusts, including recent updates, related forms and instructions on how to file. Iii, line 13 x form sch a, pg.

Enter Only The Tax Amount That Is Attributed To The Net.

Estates and trusts enter amount from form. See lines 9 and 10—application of itemized deduction limitations on deductions properly allocable to investment income worksheet in these instructions for assistance in figuring. Aattach to your tax return. Web net investment income tax: