Form 8962 Free File

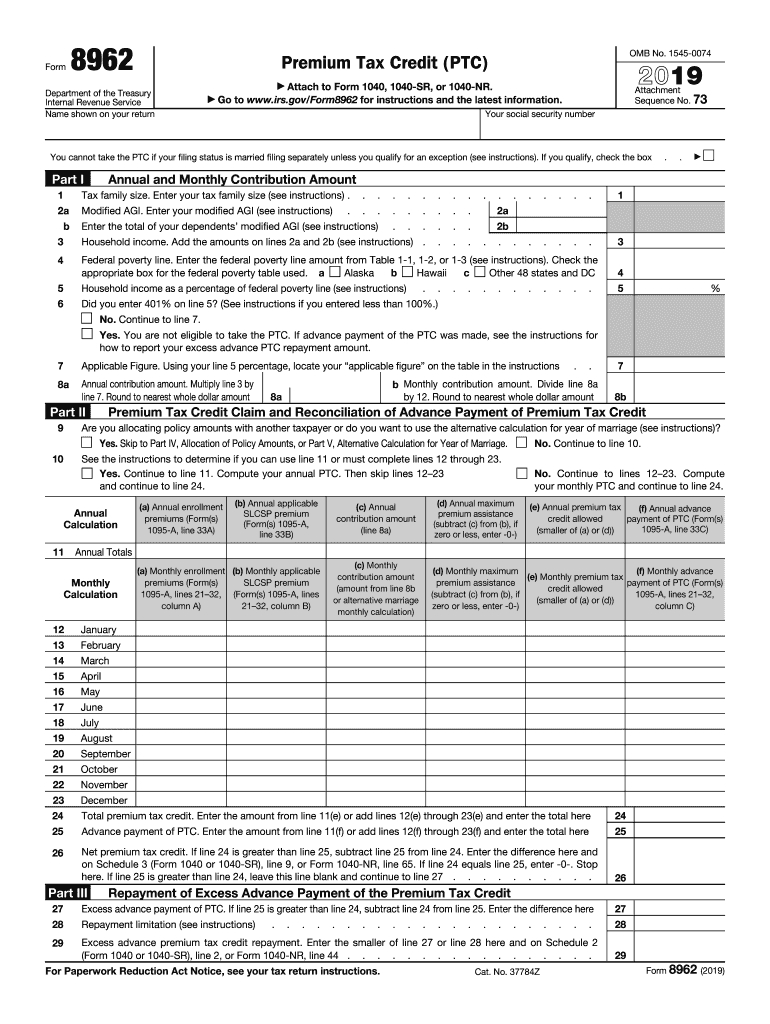

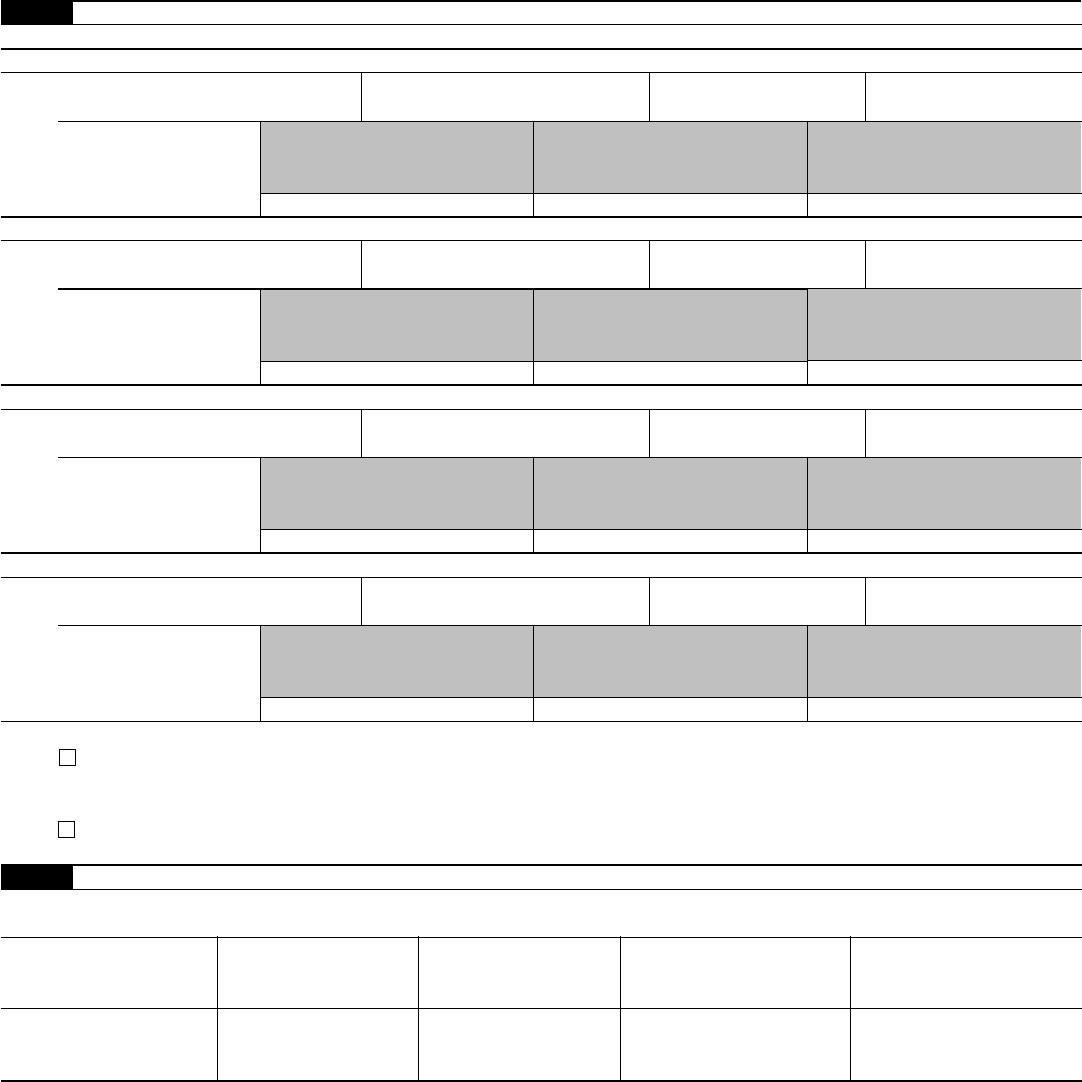

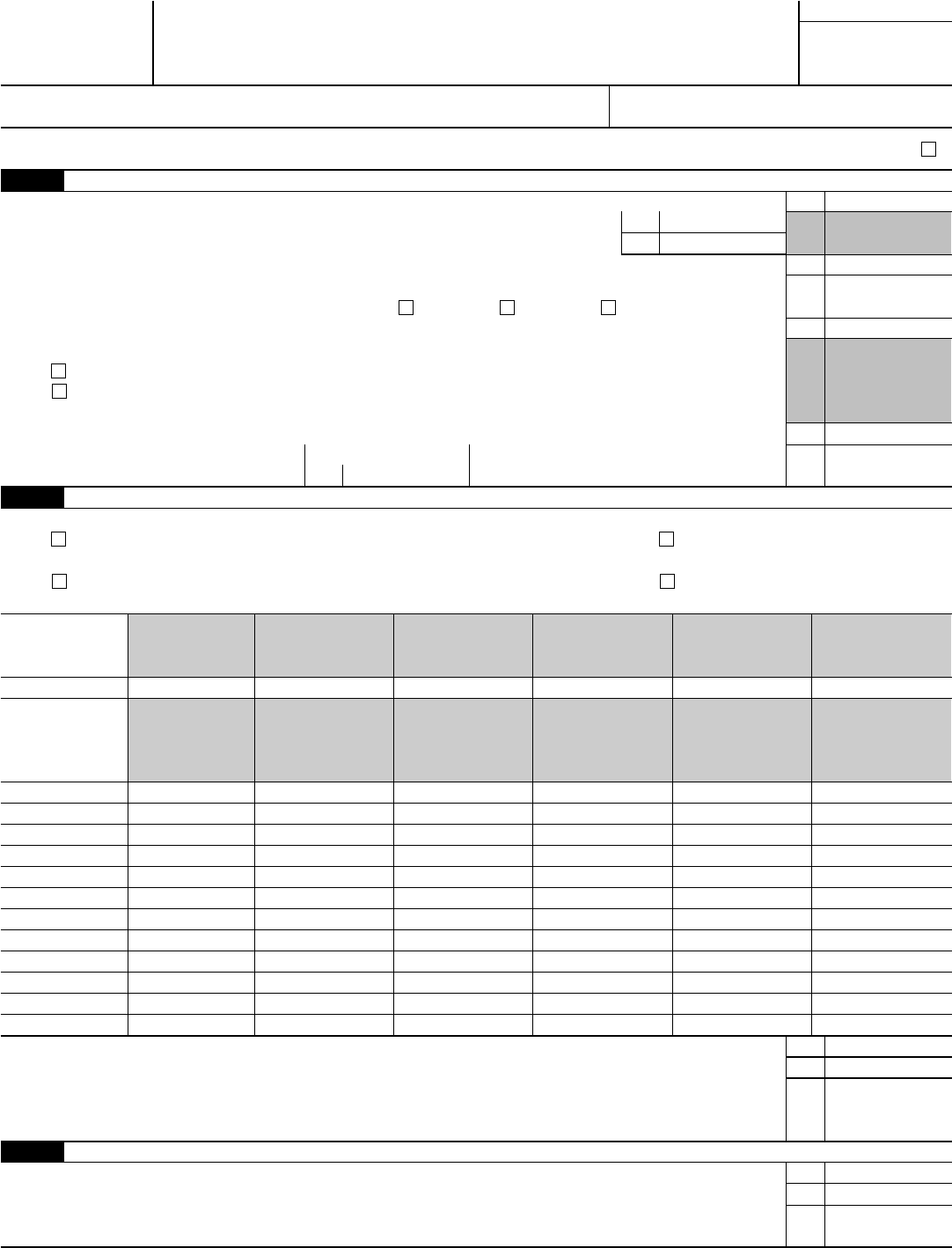

Form 8962 Free File - Over 12m americans filed 100% free with turbotax® last year. Web for tax years other than 2020, if you or someone in your family received advance payments of the premium tax credit through the health insurance marketplace, you must complete. You have to include form 8962 with your tax return if: This form is for income. We last updated federal form 8862 in december 2022 from the federal internal revenue service. A complaint filed july 27 in the u.s. Web irs.gov shows that form 8962 is included in the available free file forms but when i complete the form turbotax assigns a $40 fee and says i need the next filing. Web up to $40 cash back easily complete a printable irs 8962 form 2022 online. Web form 8962 is a form you must file with your federal income tax return for a year if you received an advanced premium tax credit through the marketplace during that year. Get ready for this year's tax season quickly and safely with pdffiller!

You have to include form 8962 with your tax return if: Web 20 hours agothe law was struck down by the u.s. Over 12m americans filed 100% free with turbotax® last year. Web if you downloaded the 2022 instructions for form 8962, premium tax credit, please be advised that there is an update to the 2nd bullet under exception 1—certain. Ad get ready for tax season deadlines by completing any required tax forms today. This form is for income. Web the irs form 8962 is used when you need to figure out your amount of the premium tax credit (also known as ptc). Form 8962 is used either (1) to reconcile a premium tax. Web form 8962, premium tax credit if you had marketplace insurance and used premium tax credits to lower your monthly payment, you must file this health insurance tax form with. Get ready for this year's tax season quickly and safely with pdffiller!

Web more about the federal form 8862 tax credit. You have to include form 8962 with your tax return if: The thomas more society is now suing over the illinois law. Web 20 hours agothe law was struck down by the u.s. This form is for income. A complaint filed july 27 in the u.s. Web for tax years other than 2020, if you or someone in your family received advance payments of the premium tax credit through the health insurance marketplace, you must complete. Web form 8962 is a form you must file with your federal income tax return for a year if you received an advanced premium tax credit through the marketplace during that year. You can download or print current or past. Form 8962 is used either (1) to reconcile a premium tax.

form 8962 2014 Diy Menu Cards, Menu Card Template, Wedding Menu

See if you qualify today. Web information about form 8962, premium tax credit, including recent updates, related forms and instructions on how to file. Taxpayers should figure their premium. A complaint filed july 27 in the u.s. You can download or print current or past.

2017 Form IRS Instructions 8962 Fill Online, Printable, Fillable, Blank

Create a blank & editable 8962 form,. You have to include form 8962 with your tax return if: Web irs.gov shows that form 8962 is included in the available free file forms but when i complete the form turbotax assigns a $40 fee and says i need the next filing. Taxpayers should figure their premium. Web information about form 8962,.

2016 Form 8962 Edit, Fill, Sign Online Handypdf

Max refund is guaranteed and 100% accurate. Web for tax years other than 2020, if you or someone in your family received advance payments of the premium tax credit through the health insurance marketplace, you must complete. Upload, modify or create forms. The ptc is intended to assist taxpayers in. Web form 8962, premium tax credit if you had marketplace.

How To Calculate Form 8962 Printable Form, Templates and Letter

Ad free for simple tax returns only with turbotax® free edition. Web if you downloaded the 2022 instructions for form 8962, premium tax credit, please be advised that there is an update to the 2nd bullet under exception 1—certain. Web form 8962, premium tax credit if you had marketplace insurance and used premium tax credits to lower your monthly payment,.

Blank Irs Forms To Print Calendar Template Printable

Web irs.gov shows that form 8962 is included in the available free file forms but when i complete the form turbotax assigns a $40 fee and says i need the next filing. Taxpayers should figure their premium. This form is for income. Web we last updated the premium tax credit in december 2022, so this is the latest version of.

How To Fill Out Tax Form 8962 amulette

A complaint filed july 27 in the u.s. Web irs.gov shows that form 8962 is included in the available free file forms but when i complete the form turbotax assigns a $40 fee and says i need the next filing. You can download or print current or past. Max refund is guaranteed and 100% accurate. Complete, edit or print tax.

IRS 8962 2014 Fill and Sign Printable Template Online US Legal Forms

Ptc can be claimed by families and other eligible persons. Web at efile.com, we cover all the healthcare tax forms in the following pages: Form 8962 is used either (1) to reconcile a premium tax. Web taxpayers should file irs form 8962 with their federal income tax return to claim the premium tax credit (ptc). You can download or print.

Example Of Form 8962 Filled Out fasrportland

Over 12m americans filed 100% free with turbotax® last year. Web instructions on how to correct an electronically filed return that was rejected for a missing form 8962. Web form 8962 is a form you must file with your federal income tax return for a year if you received an advanced premium tax credit through the marketplace during that year..

Form 8962 Fill Out and Sign Printable PDF Template signNow

The ptc is intended to assist taxpayers in. Over 12m americans filed 100% free with turbotax® last year. Upload, modify or create forms. Web instructions for form 8962 premium tax credit (ptc) department of the treasury internal revenue service section references are to the internal revenue code unless otherwise. Complete, edit or print tax forms instantly.

Form 8962 Edit, Fill, Sign Online Handypdf

Try it for free now! Taxpayers should figure their premium. Web 20 hours agothe law was struck down by the u.s. Web taxpayers should file irs form 8962 with their federal income tax return to claim the premium tax credit (ptc). The thomas more society is now suing over the illinois law.

The Ptc Is Intended To Assist Taxpayers In.

Web up to $40 cash back easily complete a printable irs 8962 form 2022 online. Web instructions for form 8962 premium tax credit (ptc) department of the treasury internal revenue service section references are to the internal revenue code unless otherwise. Try it for free now! Web at efile.com, we cover all the healthcare tax forms in the following pages:

Web Irs.gov Shows That Form 8962 Is Included In The Available Free File Forms But When I Complete The Form Turbotax Assigns A $40 Fee And Says I Need The Next Filing.

Taxpayers should figure their premium. Web instructions on how to correct an electronically filed return that was rejected for a missing form 8962. Web form 8962 is a form you must file with your federal income tax return for a year if you received an advanced premium tax credit through the marketplace during that year. Web more about the federal form 8862 tax credit.

Ptc Can Be Claimed By Families And Other Eligible Persons.

Web the irs form 8962 is used when you need to figure out your amount of the premium tax credit (also known as ptc). Get ready for this year's tax season quickly and safely with pdffiller! Web taxpayers should file irs form 8962 with their federal income tax return to claim the premium tax credit (ptc). Form 8962 is used either (1) to reconcile a premium tax.

Web 20 Hours Agothe Law Was Struck Down By The U.s.

We last updated federal form 8862 in december 2022 from the federal internal revenue service. Over 12m americans filed 100% free with turbotax® last year. Upload, modify or create forms. Web if you downloaded the 2022 instructions for form 8962, premium tax credit, please be advised that there is an update to the 2nd bullet under exception 1—certain.

/ScreenShot2021-02-08at3.59.40PM-9f028cea3cb545d19e4c64e10ca68a06.png)