Form 8990 Instructions 2021

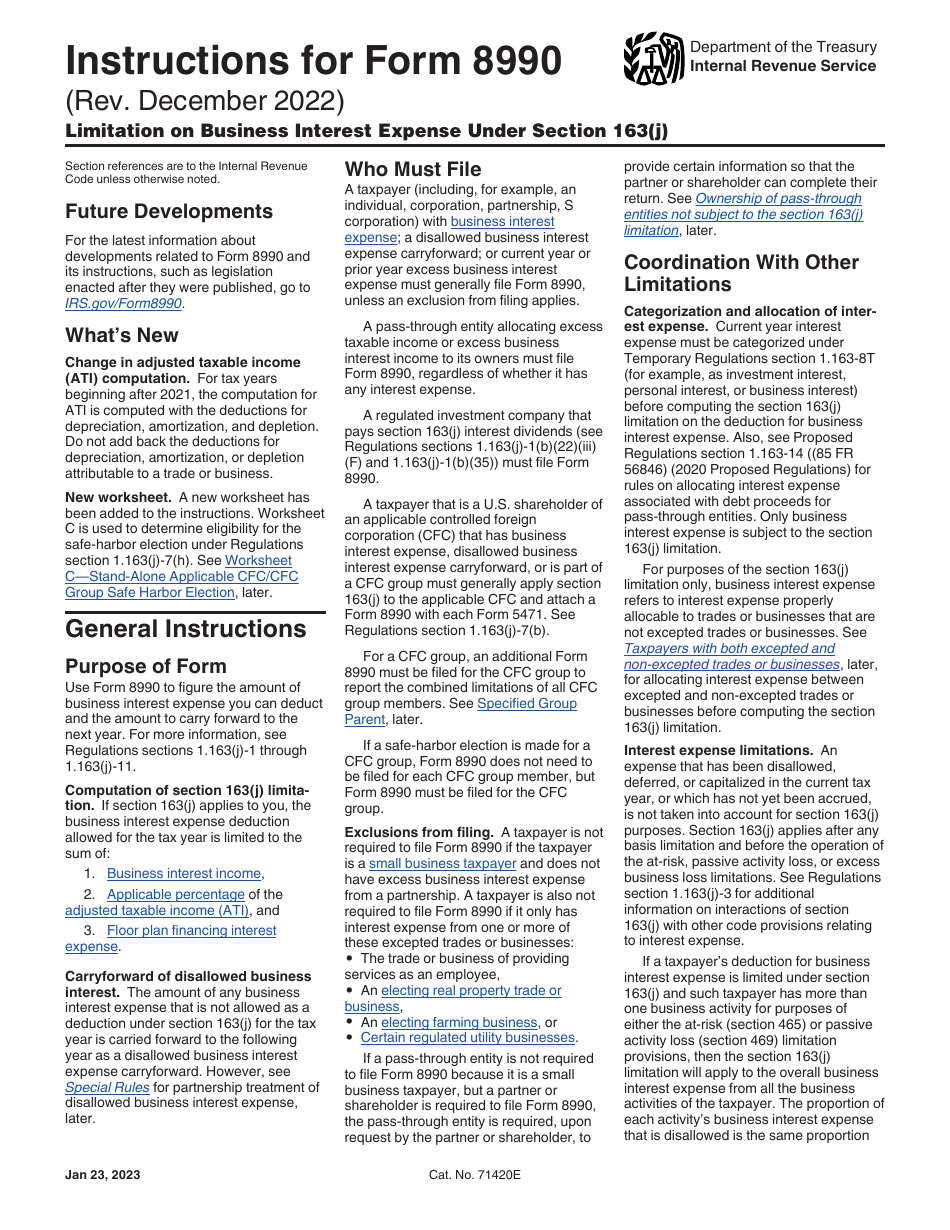

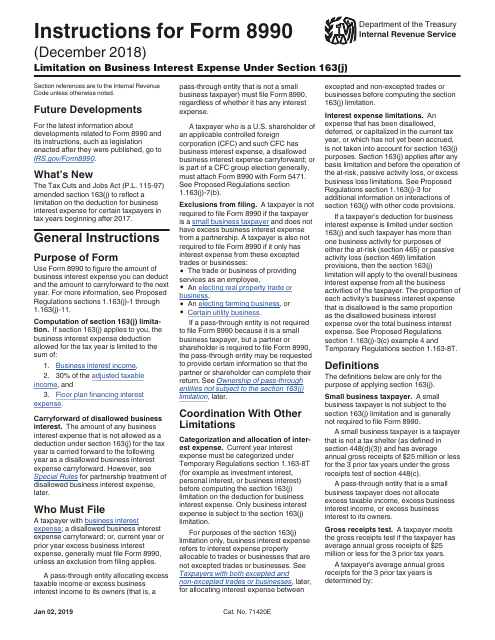

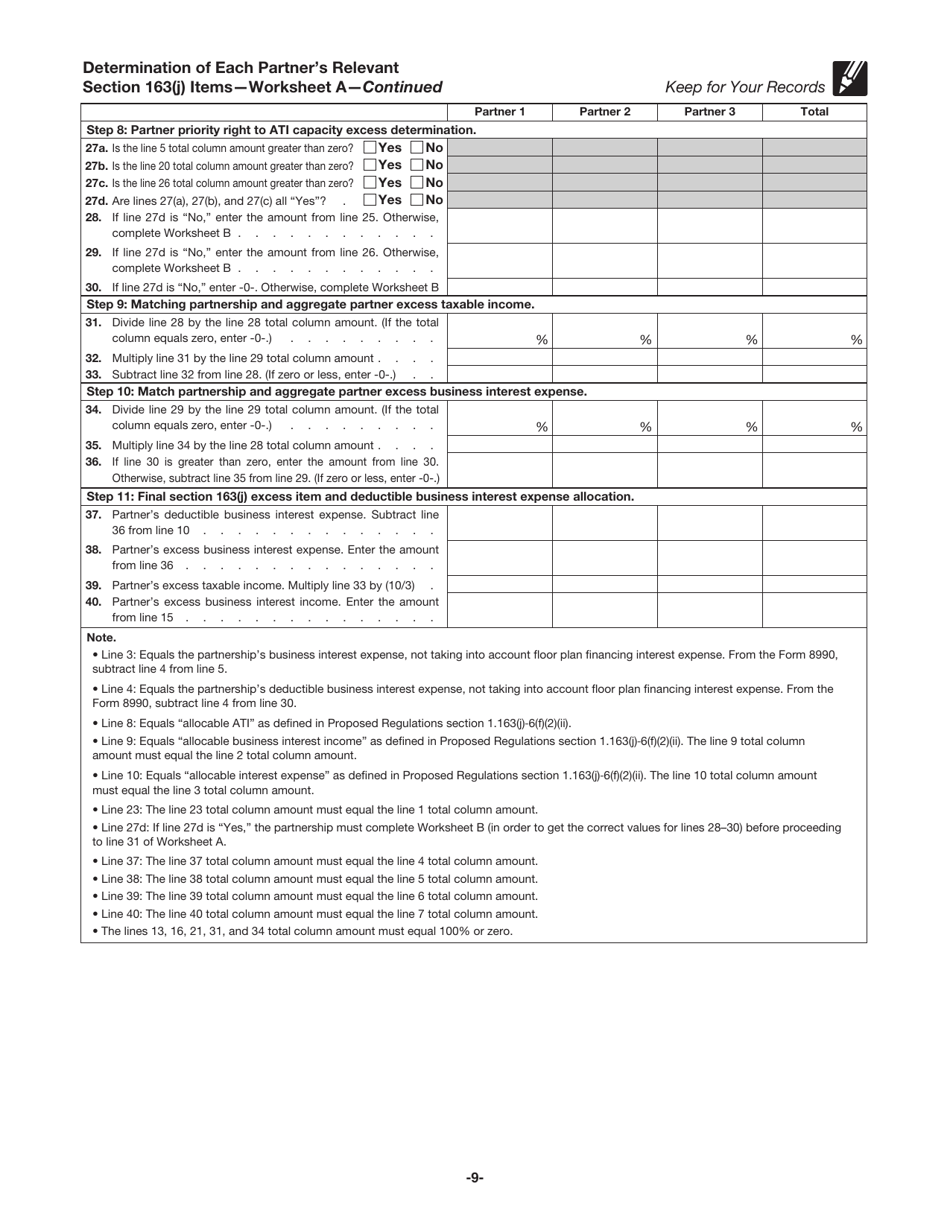

Form 8990 Instructions 2021 - Table of contents how do i complete irs form 8990? What’s new change in adjusted taxable income (ati) computation. For more information on the filing requirements and calculations, see the form 8990 instructions. Web information about form 8990, limitation on business interest expense under section 163(j), including recent updates, related forms and instructions on how to file. A taxpayer may generally apply the 2020 final regulations for taxable years beginning after december 31, 2017, so long as the taxpayer and its related parties consistently apply all of the rules of the 2020 final regulations. December 2022) department of the treasury internal revenue service limitation on business interest expense under section 163(j) attach to your tax return. Sign in products lacerte proconnect proseries easyacct quickbooks online accountant. Computation of allowable business interest expense part ii: For tax years beginning after 2021, the computation for ati is computed with the deductions for depreciation, amortization, and depletion. Web developments related to form 8990 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8990.

For tax years beginning after 2021, the computation for ati is computed with the deductions for depreciation, amortization, and depletion. Computation of allowable business interest expense part ii: Web taxpayers must calculate their business interest expense deductions on irs form 8990 to comply with the business interest limitation requirements outlined in internal revenue code section 163 (j). Table of contents how do i complete irs form 8990? What’s new change in adjusted taxable income (ati) computation. Use form 8990 to calculate the amount of business interest expense you can deduct and the amount to carry forward to the next year. Web information about form 8990, limitation on business interest expense under section 163(j), including recent updates, related forms and instructions on how to file. For more information on the filing requirements and calculations, see the form 8990 instructions. December 2022) department of the treasury internal revenue service limitation on business interest expense under section 163(j) attach to your tax return. Sign in products lacerte proconnect proseries easyacct quickbooks online accountant.

What’s new change in adjusted taxable income (ati) computation. For tax years beginning after 2021, the computation for ati is computed with the deductions for depreciation, amortization, and depletion. December 2022) department of the treasury internal revenue service limitation on business interest expense under section 163(j) attach to your tax return. Web form 8990 calculates the business interest expense deduction and carryover amounts.the form utilizes the section 163(j) limitation on business interest expenses in coordination with other limits. Sign in products lacerte proconnect proseries easyacct quickbooks online accountant. Web developments related to form 8990 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8990. Table of contents how do i complete irs form 8990? A taxpayer may generally apply the 2020 final regulations for taxable years beginning after december 31, 2017, so long as the taxpayer and its related parties consistently apply all of the rules of the 2020 final regulations. Web get your taxes done wstewart level 2 form 8990 for dummies looking for help from some of the more knowledgable members here, like @nexchap and others. For more information on the filing requirements and calculations, see the form 8990 instructions.

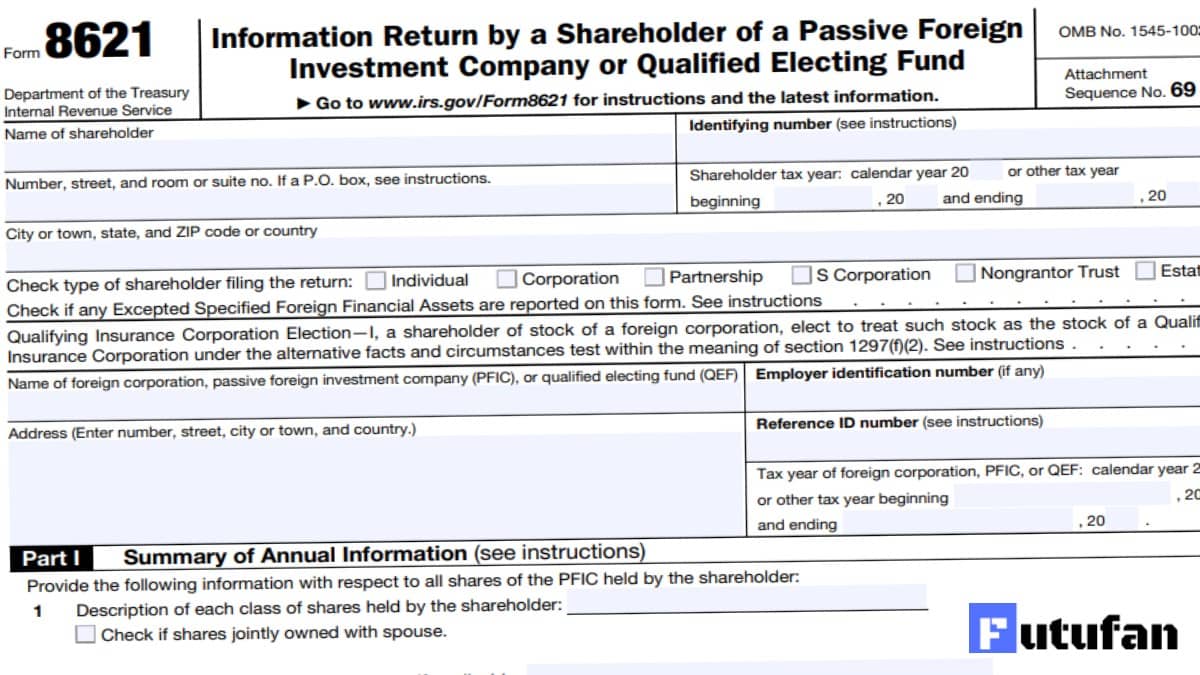

Form 8621 Instructions 2021 2022 IRS Forms

Use form 8990 to calculate the amount of business interest expense you can deduct and the amount to carry forward to the next year. Web developments related to form 8990 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8990. December 2022) department of the treasury internal revenue service limitation on business interest expense under section.

8990 Fill out & sign online DocHub

For tax years beginning after 2021, the computation for ati is computed with the deductions for depreciation, amortization, and depletion. Taxpayer name(s) shown on tax return identification number yes no yes no yes no Use form 8990 to calculate the amount of business interest expense you can deduct and the amount to carry forward to the next year. Carryforward of.

Fill Free fillable form 8990 limitation on business interest expense

Carryforward of disallowed business interest. Web information about form 8990, limitation on business interest expense under section 163(j), including recent updates, related forms and instructions on how to file. Change in adjusted taxable income (ati) computation. For more information on the filing requirements and calculations, see the form 8990 instructions. Web taxpayers must calculate their business interest expense deductions on.

Download Instructions for IRS Form 8990 Limitation on Business Interest

Table of contents how do i complete irs form 8990? Use form 8990 to calculate the amount of business interest expense you can deduct and the amount to carry forward to the next year. Computation of allowable business interest expense part ii: Web form 8990 calculates the business interest expense deduction and carryover amounts.the form utilizes the section 163(j) limitation.

Download Instructions for IRS Form 8990 Limitation on Business Interest

Web developments related to form 8990 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8990. Web form 8990 calculates the business interest expense deduction and carryover amounts.the form utilizes the section 163(j) limitation on business interest expenses in coordination with other limits. Change in adjusted taxable income (ati) computation. Taxpayer name(s) shown on tax return.

How to find form 1125 E Compensation of officers online YouTube

Carryforward of disallowed business interest. Computation of section 163(j) limitation. For more information on the filing requirements and calculations, see the form 8990 instructions. Use form 8990 to calculate the amount of business interest expense you can deduct and the amount to carry forward to the next year. Web on january 19, 2021, the irs published additional final regulations (t.d.

Download Instructions for IRS Form 8990 Limitation on Business Interest

Computation of allowable business interest expense part ii: Web developments related to form 8990 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8990. December 2022) department of the treasury internal revenue service limitation on business interest expense under section 163(j) attach to your tax return. Change in adjusted taxable income (ati) computation. For tax years.

Download Instructions for IRS Form 8990 Limitation on Business Interest

For more information on the filing requirements and calculations, see the form 8990 instructions. Computation of section 163(j) limitation. Web form 8990 calculates the business interest expense deduction and carryover amounts.the form utilizes the section 163(j) limitation on business interest expenses in coordination with other limits. Taxpayer name(s) shown on tax return identification number yes no yes no yes no.

K1 Excess Business Interest Expense ubisenss

Table of contents how do i complete irs form 8990? Web taxpayers must calculate their business interest expense deductions on irs form 8990 to comply with the business interest limitation requirements outlined in internal revenue code section 163 (j). Web developments related to form 8990 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8990. Web.

1040NJ Data entry guidelines for a New Jersey partnership K1

For tax years beginning after 2021, the computation for ati is computed with the deductions for depreciation, amortization, and depletion. Use form 8990 to calculate the amount of business interest expense you can deduct and the amount to carry forward to the next year. Web on january 19, 2021, the irs published additional final regulations (t.d. Computation of allowable business.

Change In Adjusted Taxable Income (Ati) Computation.

Web on january 19, 2021, the irs published additional final regulations (t.d. December 2022) department of the treasury internal revenue service limitation on business interest expense under section 163(j) attach to your tax return. A taxpayer may generally apply the 2020 final regulations for taxable years beginning after december 31, 2017, so long as the taxpayer and its related parties consistently apply all of the rules of the 2020 final regulations. Web get your taxes done wstewart level 2 form 8990 for dummies looking for help from some of the more knowledgable members here, like @nexchap and others.

Table Of Contents How Do I Complete Irs Form 8990?

Web developments related to form 8990 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8990. Carryforward of disallowed business interest. Computation of section 163(j) limitation. Web information about form 8990, limitation on business interest expense under section 163(j), including recent updates, related forms and instructions on how to file.

Use Form 8990 To Calculate The Amount Of Business Interest Expense You Can Deduct And The Amount To Carry Forward To The Next Year.

Sign in products lacerte proconnect proseries easyacct quickbooks online accountant. Web form 8990 calculates the business interest expense deduction and carryover amounts.the form utilizes the section 163(j) limitation on business interest expenses in coordination with other limits. Computation of allowable business interest expense part ii: What’s new change in adjusted taxable income (ati) computation.

For More Information On The Filing Requirements And Calculations, See The Form 8990 Instructions.

For tax years beginning after 2021, the computation for ati is computed with the deductions for depreciation, amortization, and depletion. Taxpayer name(s) shown on tax return identification number yes no yes no yes no Web taxpayers must calculate their business interest expense deductions on irs form 8990 to comply with the business interest limitation requirements outlined in internal revenue code section 163 (j).