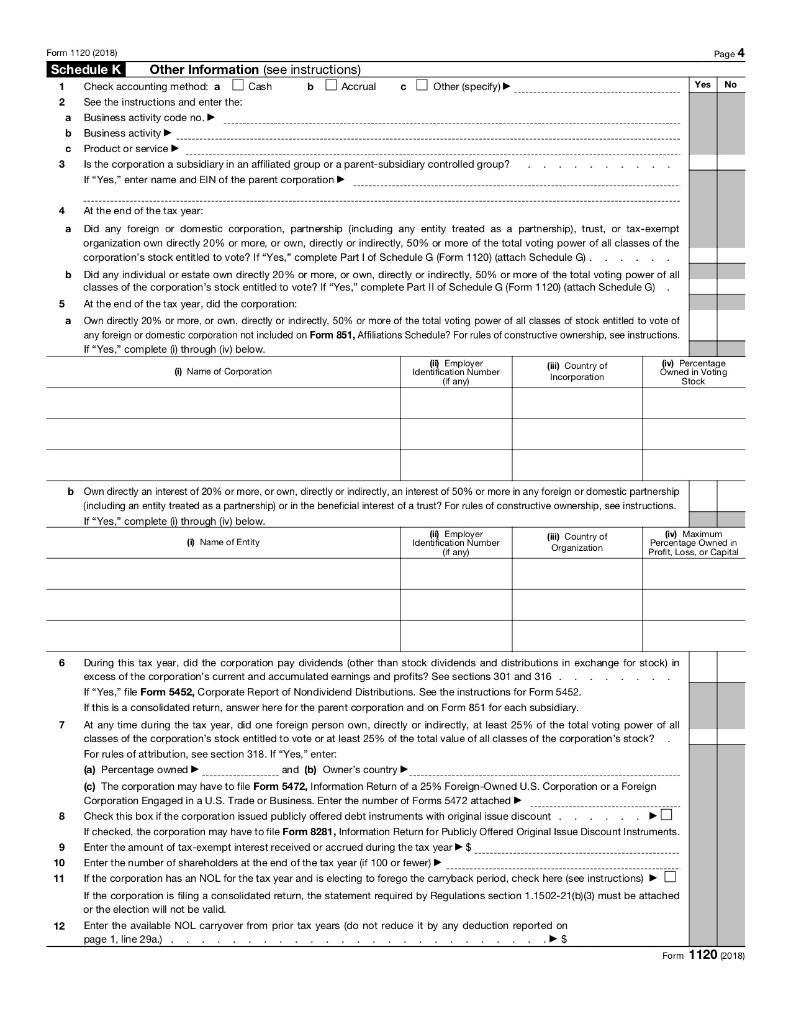

Form 8992 Schedule A

Form 8992 Schedule A - December 2022) department of the treasury internal revenue service. Shareholder is not a member of a u.s. Complete form 8992 as follows. Form 8892 consists of parts i and ii. Name of person filing this return. For instructions and the latest information. Name of person filing this return. Web use form 8992 to compute the u.s. January 2020) department of the treasury internal revenue service. Web notably, when computing form 8992, schedule a, if a cfc is owned by two or more members of the consolidated group, each ownership interest should be reported on separate lines.

When and where to file attach form 8992 and schedule a to your income tax return (including, if applicable, Web notably, when computing form 8992, schedule a, if a cfc is owned by two or more members of the consolidated group, each ownership interest should be reported on separate lines. Complete form 8992 as follows. Web form 8992 and include in schedule a its tested income cfcs as well as any cfc from which it is allocated a portion of the consolidated tested loss, consolidated qbai, or consolidated specified interest expense. January 2020) department of the treasury internal revenue service. December 2022) department of the treasury internal revenue service. For instructions and the latest information. Consolidated group who are u.s. December 2022) department of the treasury internal revenue service. Shareholder that owns, within the meaning of section 958 (a), stock in one or more cfcs must attach a form 8892 to a form 5471.

Form 8892 consists of parts i and ii. Name of person filing this return. For instructions and the latest information. Shareholder is not a member of a u.s. Name of person filing this return. January 2020) department of the treasury internal revenue service. December 2022) department of the treasury internal revenue service. Consolidated group who are u.s. Shareholder that owns, within the meaning of section 958 (a), stock in one or more cfcs must attach a form 8892 to a form 5471. For instructions and the latest information.

Form 12 Schedule A Instructions Five Brilliant Ways To Advertise Form

When and where to file attach form 8992 and schedule a to your income tax return (including, if applicable, Name of person filing this return. Web form 8992 and include in schedule a its tested income cfcs as well as any cfc from which it is allocated a portion of the consolidated tested loss, consolidated qbai, or consolidated specified interest.

Form 12 Pdf 12 Secrets About Form 12 Pdf That Has Never Been Revealed

Web attach form 8992 and schedule a to your income tax return (including, if applicable, partnership or exempt organization return) and file both by the due date (including extensions) for that return. December 2022) department of the treasury internal revenue service. Complete form 8992 as follows. Form 8892 consists of parts i and ii. Name of person filing this return.

Form 8992 Fill Out and Sign Printable PDF Template signNow

December 2022) department of the treasury internal revenue service. Web use form 8992 to compute the u.s. Form 8892 consists of parts i and ii. Web notably, when computing form 8992, schedule a, if a cfc is owned by two or more members of the consolidated group, each ownership interest should be reported on separate lines. Name of person filing.

Form 16 Tested 16 Doubts You Should Clarify About Form 16 Tested

Shareholder that owns, within the meaning of section 958 (a), stock in one or more cfcs must attach a form 8892 to a form 5471. Complete form 8992 as follows. Consolidated group, use schedule a (form 8992), to determine the amounts to enter on form 8992, part l. January 2020) department of the treasury internal revenue service. Web form 8992.

IRS Form 8992 San Francisco Tax Attorney SF Tax Counsel

Complete form 8992 as follows. December 2022) department of the treasury internal revenue service. Consolidated group, use schedule a (form 8992), to determine the amounts to enter on form 8992, part l. When and where to file attach form 8992 and schedule a to your income tax return (including, if applicable, Form 8892 consists of parts i and ii.

Form 12 Schedule A Instructions Five Brilliant Ways To Advertise Form

Name of person filing this return. December 2022) department of the treasury internal revenue service. Form 8892 consists of parts i and ii. Shareholder is not a member of a u.s. December 2022) department of the treasury internal revenue service.

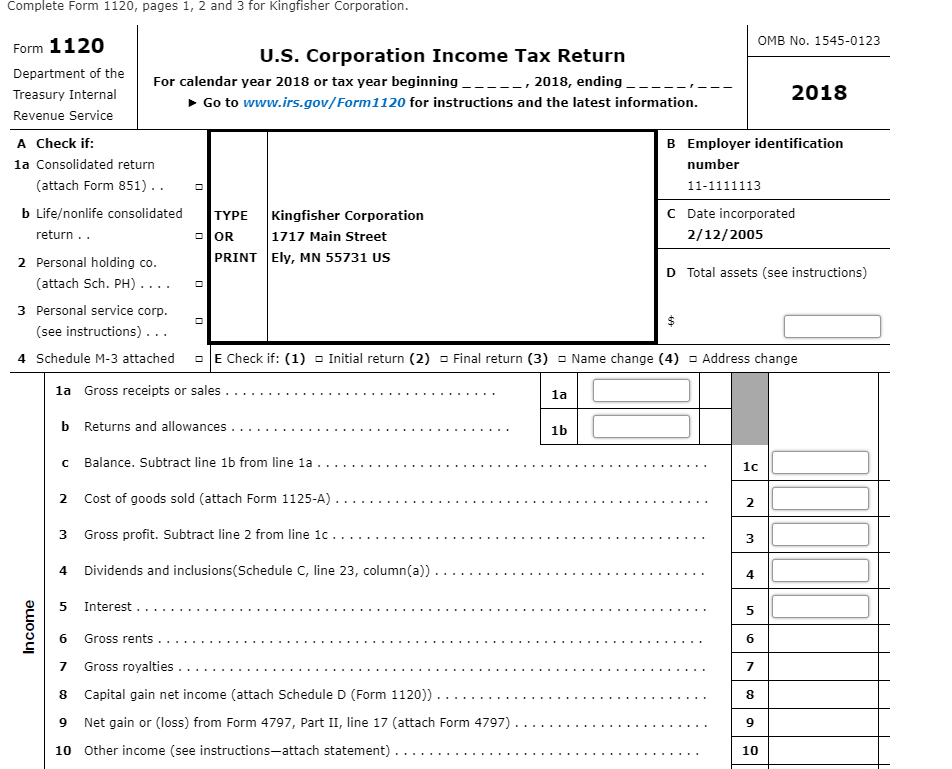

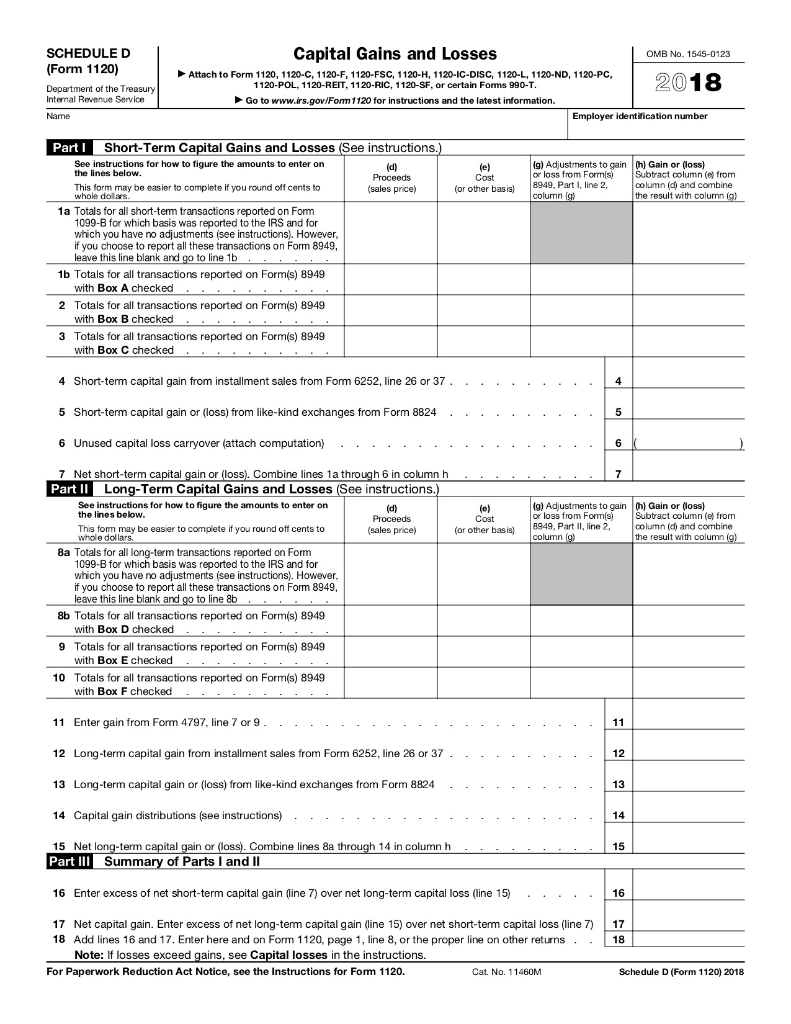

C16 Appendix C CORPORATE TAX RETURN PROBLEM 2

Web notably, when computing form 8992, schedule a, if a cfc is owned by two or more members of the consolidated group, each ownership interest should be reported on separate lines. For instructions and the latest information. For instructions and the latest information. Complete form 8992 as follows. Web use form 8992 to compute the u.s.

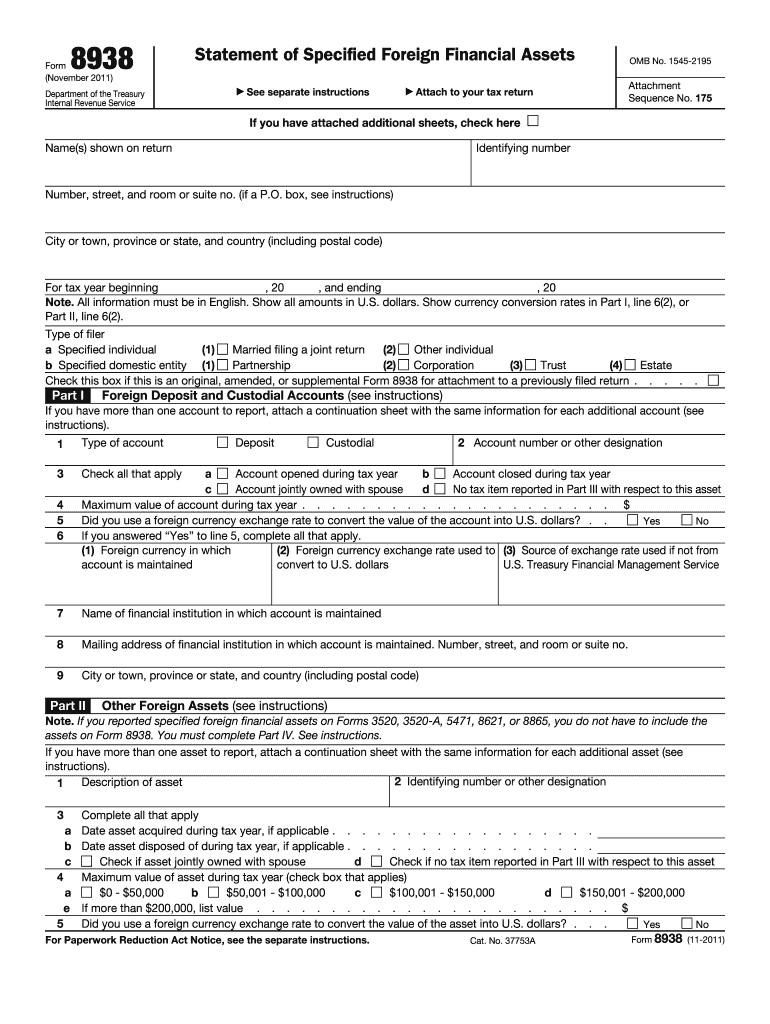

2011 Form IRS 8938 Fill Online, Printable, Fillable, Blank pdfFiller

Consolidated group, use schedule a (form 8992), to determine the amounts to enter on form 8992, part l. Web attach form 8992 and schedule a to your income tax return (including, if applicable, partnership or exempt organization return) and file both by the due date (including extensions) for that return. Form 8892 consists of parts i and ii. Web notably,.

Contact Us — Signature Builders Group Luxury New Home Builders in

Web attach form 8992 and schedule a to your income tax return (including, if applicable, partnership or exempt organization return) and file both by the due date (including extensions) for that return. January 2020) department of the treasury internal revenue service. Web form 8992 and include in schedule a its tested income cfcs as well as any cfc from which.

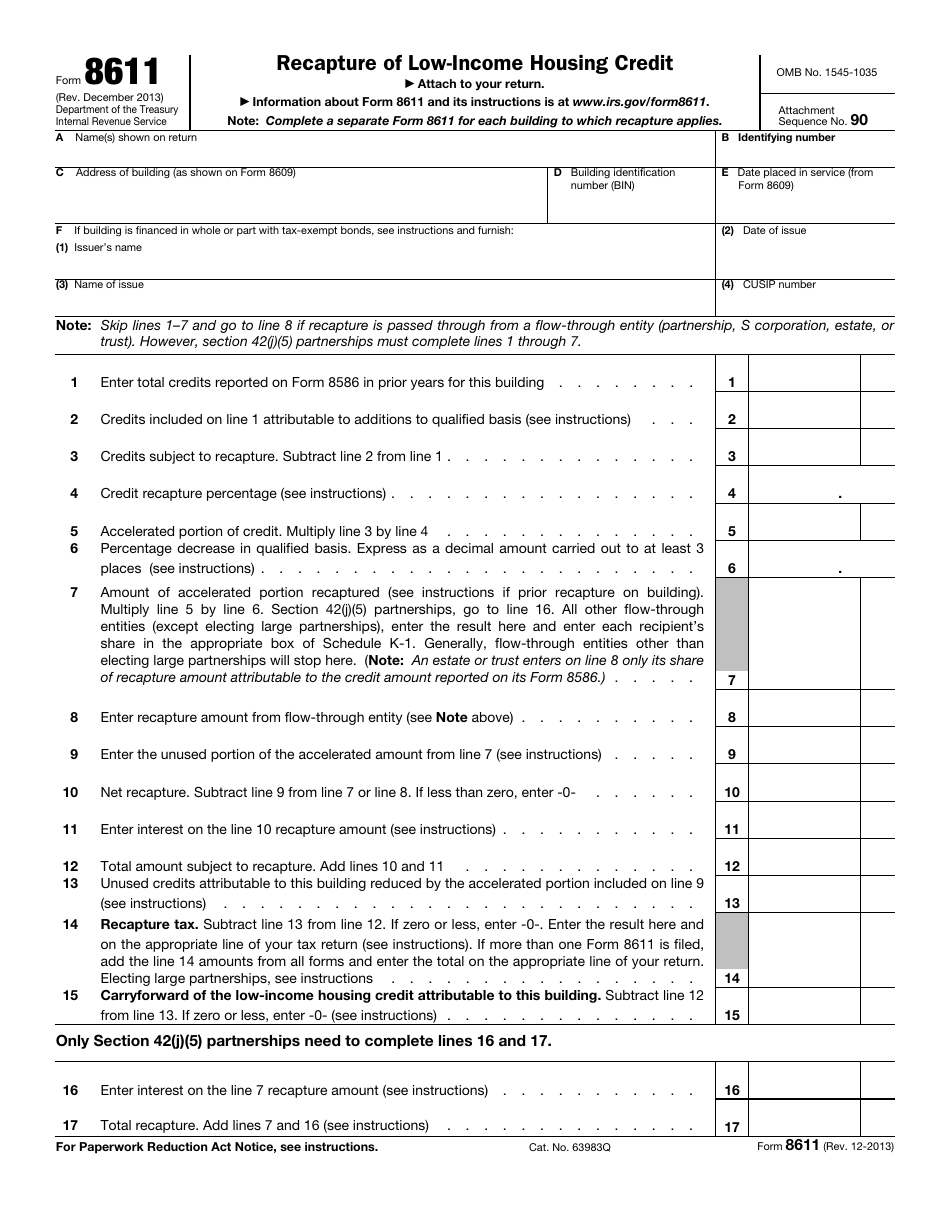

IRS Form 8611 Download Fillable PDF or Fill Online Recapture of Low

Consolidated group, use schedule a (form 8992), to determine the amounts to enter on form 8992, part l. January 2020) department of the treasury internal revenue service. Shareholder is not a member of a u.s. Name of person filing this return. Consolidated group who are u.s.

Name Of Person Filing This Return.

January 2020) department of the treasury internal revenue service. Shareholder is not a member of a u.s. Web schedule a (form 8992) (rev. For instructions and the latest information.

Complete Form 8992 As Follows.

Form 8892 consists of parts i and ii. December 2022) department of the treasury internal revenue service. Web notably, when computing form 8992, schedule a, if a cfc is owned by two or more members of the consolidated group, each ownership interest should be reported on separate lines. For instructions and the latest information.

Consolidated Group, Use Schedule A (Form 8992), To Determine The Amounts To Enter On Form 8992, Part L.

December 2022) department of the treasury internal revenue service. Web form 8992 and include in schedule a its tested income cfcs as well as any cfc from which it is allocated a portion of the consolidated tested loss, consolidated qbai, or consolidated specified interest expense. When and where to file attach form 8992 and schedule a to your income tax return (including, if applicable, Web attach form 8992 and schedule a to your income tax return (including, if applicable, partnership or exempt organization return) and file both by the due date (including extensions) for that return.

Web Schedule B (Form 8992) (Rev.

December 2022) department of the treasury internal revenue service. For instructions and the latest information. Consolidated group who are u.s. Name of person filing this return.