Form 926 Threshold

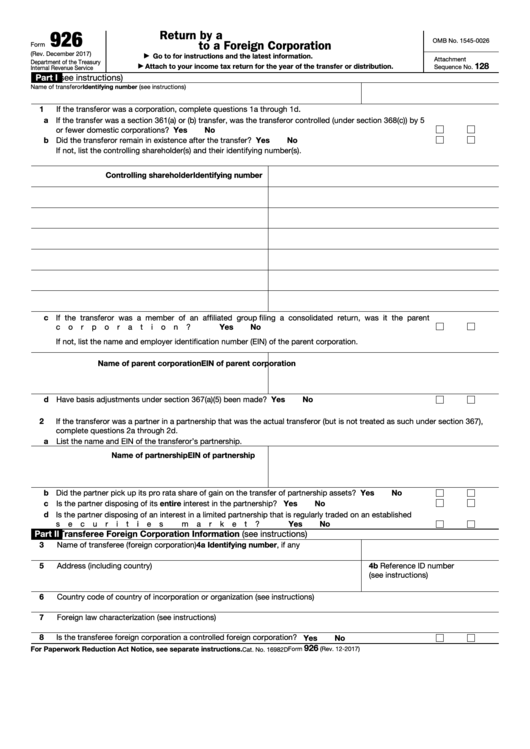

Form 926 Threshold - The partnership does not need to file form 926. Spouses can file a single form if they file a joint tax return. Web information about form 926, return by a u.s. The experts at h&r block have your expat tax needs covered return by a u.s. Transferor of property to a foreign corporation, to report any exchanges or transfers of property described in section 6038b(a)(1)(a) to a foreign corporation. Persons, domestic corporations or domestic estates or trusts must file form 926, return by a u.s. Citizen or resident, a domestic corporation, or a domestic estate or trust must complete and file form 926 to report certain transfers of property to a foreign corporation that are described in section 6038b (a) (1) (a), 367 (d), or 367 (e). **say thanks by clicking the thumb icon in a post Expats at a glance learn more about irs form 926 and if you’re required to file for exchanging property to a foreign company. Web october 25, 2022 resource center forms form 926 for u.s.

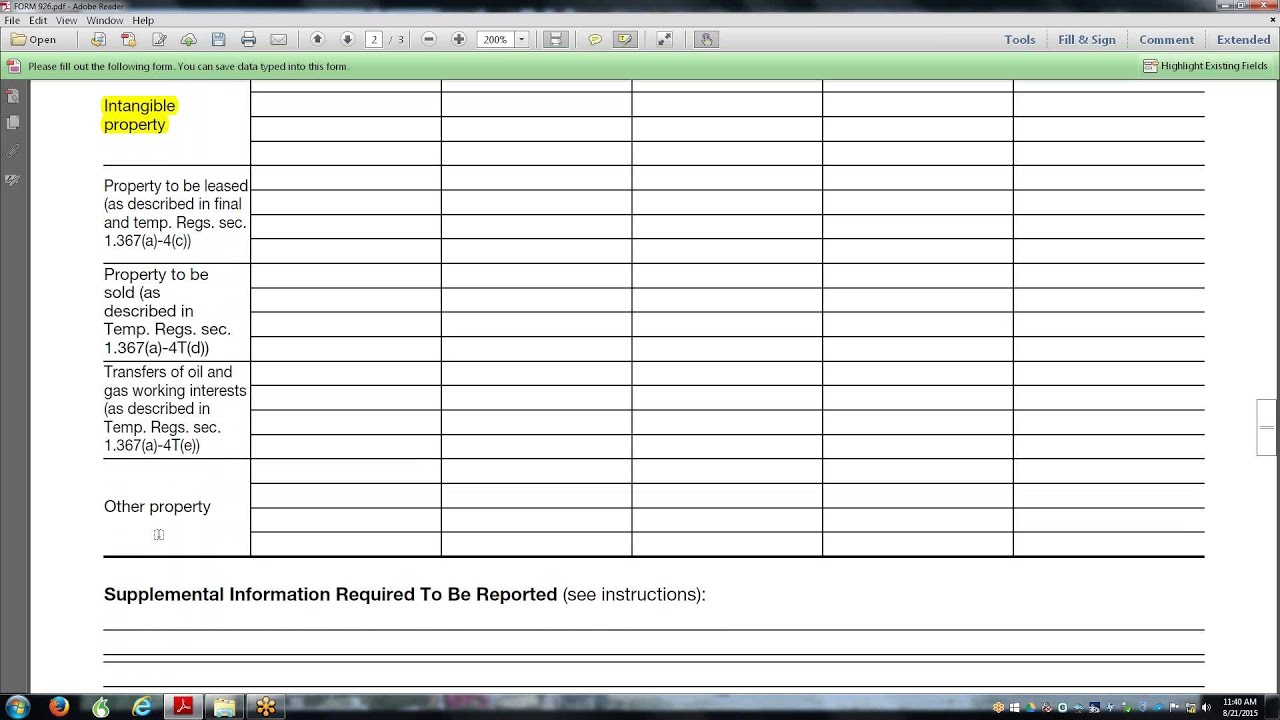

Form 926 is used to report certain transfers of property to a foreign corporation. Web october 25, 2022 resource center forms form 926 for u.s. The form 926 is used to report certain transfers to foreign corporation. Transferor of property to a foreign corporation was filed by the partnership and sent to you for information. Expats at a glance learn more about irs form 926 and if you’re required to file for exchanging property to a foreign company. Persons, domestic corporations or domestic estates or trusts must file form 926, return by a u.s. Transferor of property to a foreign corporation for paperwork reduction act notice, see separate instructions. As provided by the irs: Form 926 is not limited to individuals. If a partnership makes the transfer, each domestic partner must file form 926 and report their proportional share of the partnership’s property.

Web october 25, 2022 resource center forms form 926 for u.s. Expats at a glance learn more about irs form 926 and if you’re required to file for exchanging property to a foreign company. You do not need to report this form 926 on your tax return. Web new form 926 filing requirements the irs and the treasury department have expanded the reporting requirements associated with form 926, return by a u.s. The experts at h&r block have your expat tax needs covered return by a u.s. The form 926 is used to report certain transfers to foreign corporation. Form 926 is not limited to individuals. “use form 926 to report certain transfers of tangible or intangible property to a foreign corporation, as required by section 6038b.” Transferor of property to a foreign corporation Web return by a u.s.

Sample Form 2

Web what is form 926 used for. Transferor of property to a foreign corporation. Transferor of property to a foreign corporation, to report any exchanges or transfers of property described in section 6038b(a)(1)(a) to a foreign corporation. Web information about form 926, return by a u.s. **say thanks by clicking the thumb icon in a post

Form 926 Return by a U.S. Transferor of Property to a Foreign

If a partnership makes the transfer, each domestic partner must file form 926 and report their proportional share of the partnership’s property. Web return by a u.s. Persons, domestic corporations or domestic estates or trusts must file form 926, return by a u.s. The form 926 is used to report certain transfers to foreign corporation. You do not need to.

AVOIDING TAX OFFSHORE WITH FORM 926 YouTube

And, unless an exception, exclusion, or limitation applies, irs form 926 must be filed by any of the following that meet the reporting threshold requirements: Web return by a u.s. **say thanks by clicking the thumb icon in a post Web october 25, 2022 resource center forms form 926 for u.s. Web new form 926 filing requirements the irs and.

American Breast Care Weighted First Form 926 ladygracenew

Citizen or resident, a domestic corporation, or a domestic estate or trust must complete and file form 926 to report certain transfers of property to a foreign corporation that are described in section 6038b (a) (1) (a), 367 (d), or 367 (e). You do not need to report this form 926 on your tax return. Transferor of property to a.

Fillable Form 926 Return By A U.s. Transferor Of Property To A

Web return by a u.s. Transferor of property to a foreign corporation for paperwork reduction act notice, see separate instructions. **say thanks by clicking the thumb icon in a post Transferor of property to a foreign corporation, including recent updates, related forms, and instructions on how to file. Expats at a glance learn more about irs form 926 and if.

AU Threshold Regular Reimbursement Claim Form 20142021 Fill and Sign

Web what is form 926 used for. If a partnership makes the transfer, each domestic partner must file form 926 and report their proportional share of the partnership’s property. The form 926 is used to report certain transfers to foreign corporation. Persons, domestic corporations or domestic estates or trusts must file form 926, return by a u.s. Expats at a.

CrossBorder Transfers and on IRS Form 926 SF Tax Counsel

Web october 25, 2022 resource center forms form 926 for u.s. And, unless an exception, exclusion, or limitation applies, irs form 926 must be filed by any of the following that meet the reporting threshold requirements: Form 926 is used to report certain transfers of property to a foreign corporation. Transferor of property to a foreign corporation. Citizen or resident,.

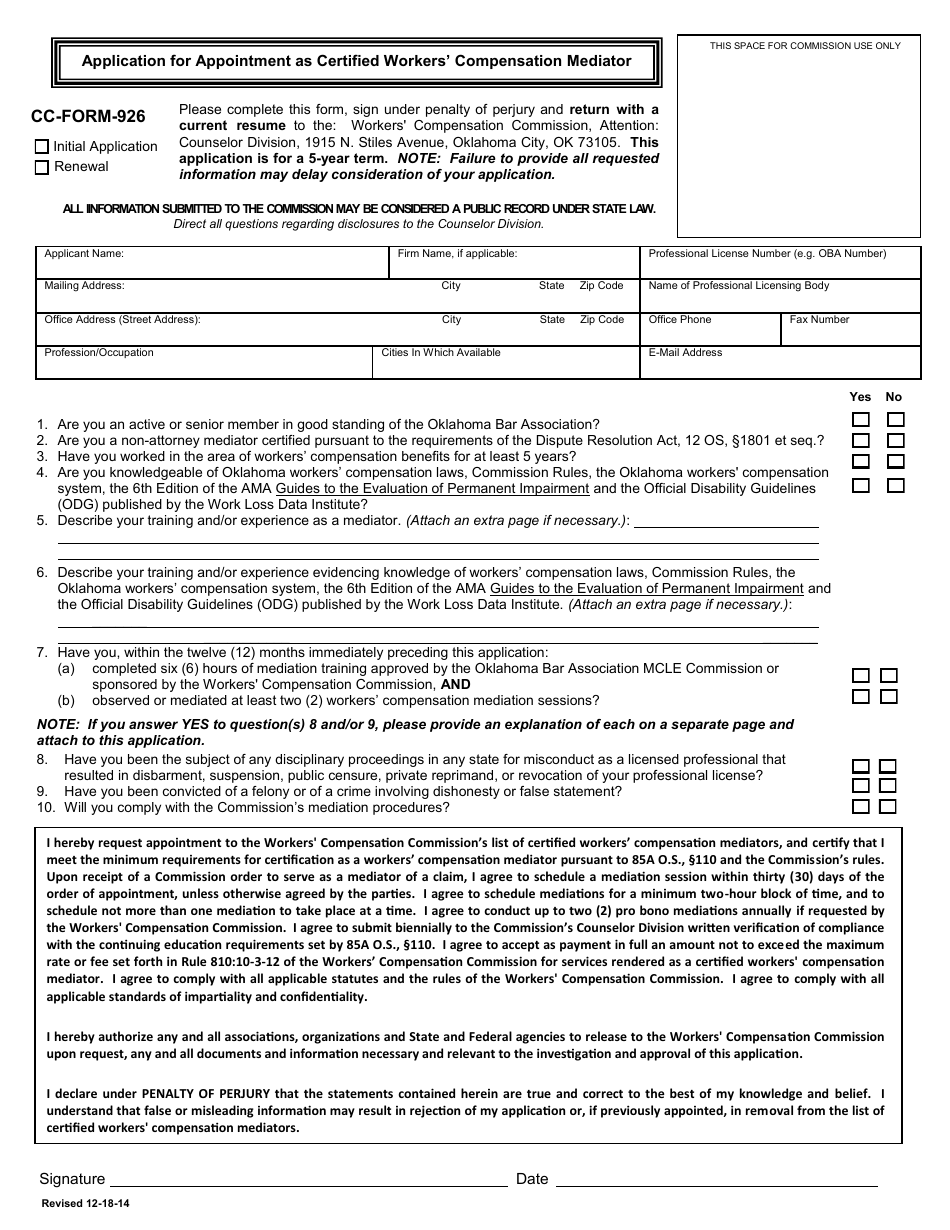

CC Form 926 Download Fillable PDF or Fill Online Application for

Transferor of property to a foreign corporation for paperwork reduction act notice, see separate instructions. Transferor of property to a foreign corporation, including recent updates, related forms, and instructions on how to file. The partnership does not need to file form 926. The experts at h&r block have your expat tax needs covered return by a u.s. And, unless an.

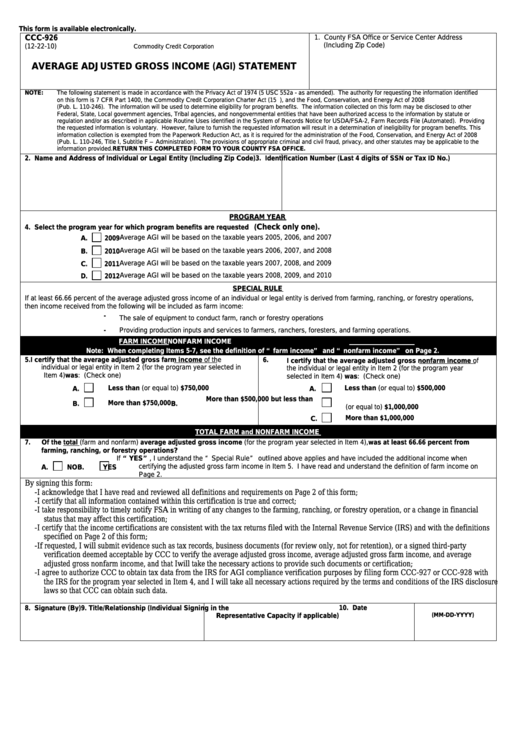

Fillable Form Ccc926 Aveerage Adjusted Gross (Agi) Statement

Citizen or resident, a domestic corporation, or a domestic estate or trust must complete and file form 926 to report certain transfers of property to a foreign corporation that are described in section 6038b (a) (1) (a), 367 (d), or 367 (e). Web what is form 926 used for. And, unless an exception, exclusion, or limitation applies, irs form 926.

Form 926Return by a U.S. Transferor of Property to a Foreign Corpora…

Transferor of property to a foreign corporation The partnership does not need to file form 926. Expats at a glance learn more about irs form 926 and if you’re required to file for exchanging property to a foreign company. And, unless an exception, exclusion, or limitation applies, irs form 926 must be filed by any of the following that meet.

Citizen Or Resident, A Domestic Corporation, Or A Domestic Estate Or Trust Must Complete And File Form 926 To Report Certain Transfers Of Property To A Foreign Corporation That Are Described In Section 6038B (A) (1) (A), 367 (D), Or 367 (E).

You do not need to report this form 926 on your tax return. Web october 25, 2022 resource center forms form 926 for u.s. Web new form 926 filing requirements the irs and the treasury department have expanded the reporting requirements associated with form 926, return by a u.s. Transferor of property to a foreign corporation for paperwork reduction act notice, see separate instructions.

Form 926 Is Used To Report Certain Transfers Of Property To A Foreign Corporation.

Transferor of property to a foreign corporation, to report any exchanges or transfers of property described in section 6038b(a)(1)(a) to a foreign corporation. **say thanks by clicking the thumb icon in a post Web what is form 926? Transferor of property to a foreign corporation, including recent updates, related forms, and instructions on how to file.

Transferor Of Property To A Foreign Corporation Was Filed By The Partnership And Sent To You For Information.

Transferor of property to a foreign corporation “use form 926 to report certain transfers of tangible or intangible property to a foreign corporation, as required by section 6038b.” Web all domestic corporations, estates, and trusts. Transferor of property to a foreign corporation.

The Partnership Does Not Need To File Form 926.

The experts at h&r block have your expat tax needs covered return by a u.s. If a partnership makes the transfer, each domestic partner must file form 926 and report their proportional share of the partnership’s property. And, unless an exception, exclusion, or limitation applies, irs form 926 must be filed by any of the following that meet the reporting threshold requirements: Web what is form 926 used for.