Form 940 For 2020

Form 940 For 2020 - If the amount of federal unemployment tax due for the year has been paid, the form 940 due date is february 10 to file. Web form 940 (2020) employer's annual federal unemployment (futa) tax return. Futa stands for federal unemployment tax act. Use schedule a (form 940) to figure the credit For employers who withhold taxes from employee's paychecks or who must pay the employer's portion of social security or medicare tax. 23 by the internal revenue service. If you paid any wages that are subject to the unemployment compensation laws of the usvi, your credit against federal unemployment tax will be reduced based on the credit reduction rate for the usvi. Use form 940 to report your annual federal unemployment tax act (futa) tax. Virgin islands (usvi) is the only credit reduction state. Web form 940 is due on jan.

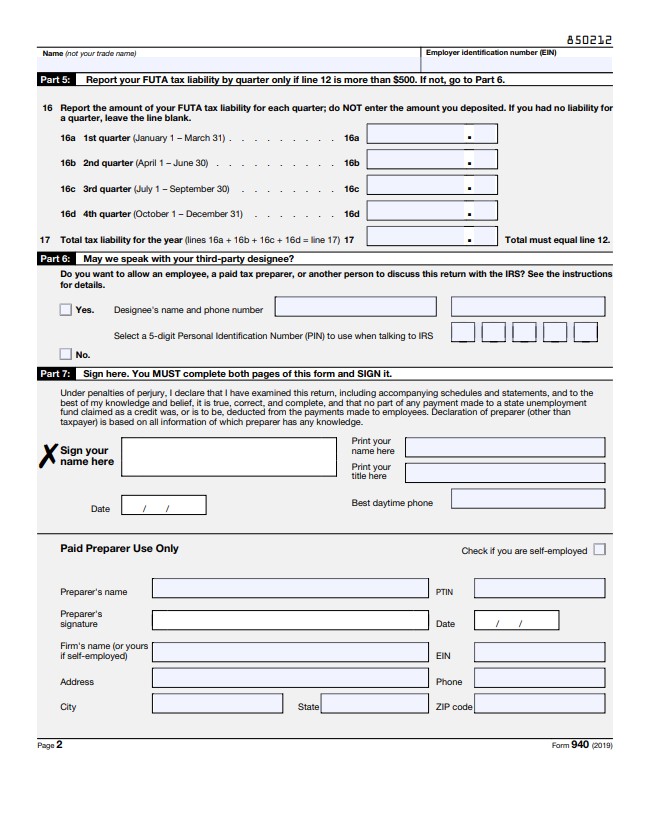

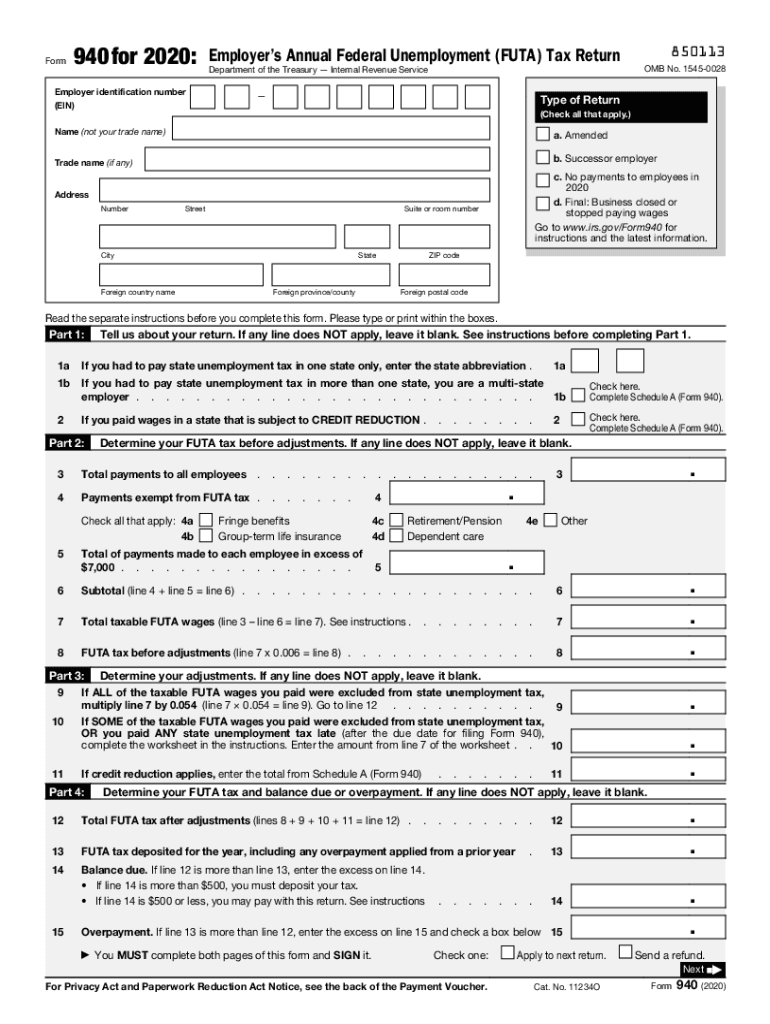

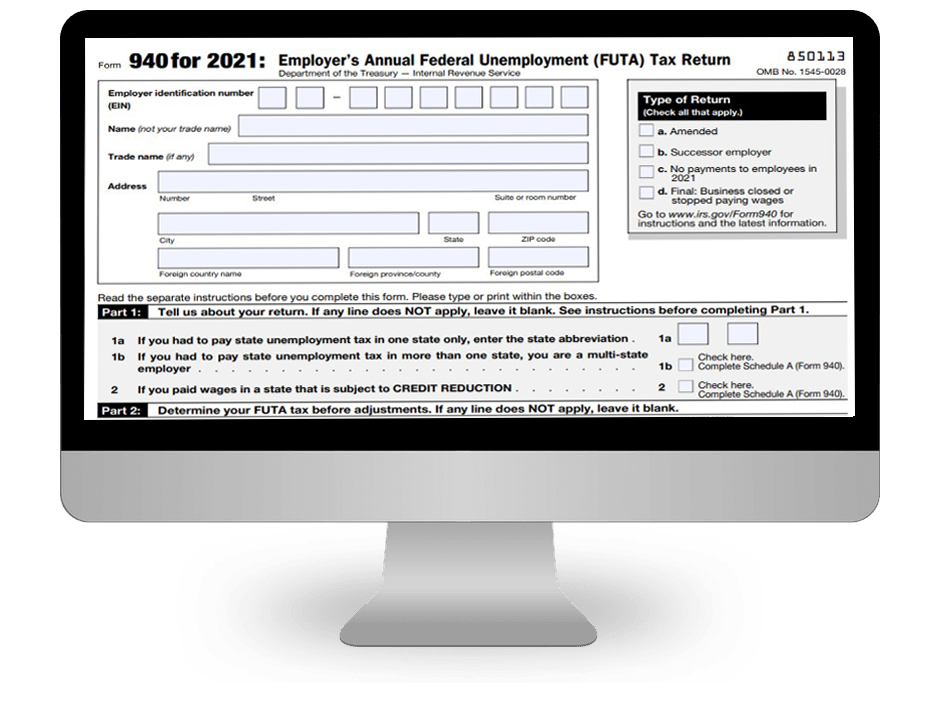

Web form 940 (2020) employer's annual federal unemployment (futa) tax return. Employer’s annual federal unemployment (futa) tax return department of the treasury — internal revenue service employer identification number (ein) — name (not your trade name) trade name (if any) address number street suite or room number city state foreign country name foreign province/county zip code. File this schedule with form 940. Together with state unemployment tax systems, the futa tax provides funds for paying unemployment compensation to workers who have. Virgin islands (usvi) is the only credit reduction state. If the amount of federal unemployment tax due for the year has been paid, the form 940 due date is february 10 to file. Use form 940 to report your annual federal unemployment tax act (futa) tax. Futa stands for federal unemployment tax act. 31 each year for the previous year. Web the 2020 form 940, employer’s annual federal unemployment (futa) tax return, was released nov.

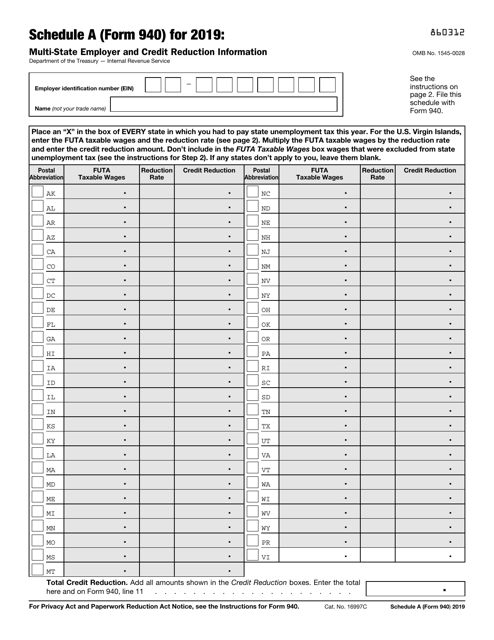

23 by the internal revenue service. For employers who withhold taxes from employee's paychecks or who must pay the employer's portion of social security or medicare tax. If the amount of federal unemployment tax due for the year has been paid, the form 940 due date is february 10 to file. 31 each year for the previous year. Virgin islands (usvi) is the only credit reduction state. Web form 940, employer’s annual federal unemployment tax return, is an irs form that employers use to report any futa tax payments they’ve made over the course of the calendar year, as well as any outstanding futa payments they have yet to make. Web irs form 940 reports an employer’s unemployment tax payments and calculations to the irs. Employer’s annual federal unemployment (futa) tax return department of the treasury — internal revenue service employer identification number (ein) — name (not your trade name) trade name (if any) address number street suite or room number city state foreign country name foreign province/county zip code. Web schedule a (form 940) for 2020: Form 941 is used by employers who withhold income taxes from wages or who must pay social security or medicare tax.

2020 form 940 Fill Online, Printable, Fillable Blank

If you paid any wages that are subject to the unemployment compensation laws of the usvi, your credit against federal unemployment tax will be reduced based on the credit reduction rate for the usvi. Web schedule a (form 940) for 2020: Web form 940 (2020) employer's annual federal unemployment (futa) tax return. Instructions for form 940 (2020) pdf. Use schedule.

940 Form 2021 IRS Forms

Instructions for form 940 (2020) pdf. If the amount of federal unemployment tax due for the year has been paid, the form 940 due date is february 10 to file. Web form 940 (2020) employer's annual federal unemployment (futa) tax return. Virgin islands (usvi) is the only credit reduction state. Web schedule a (form 940) for 2020:

Payroll Tax Forms and Reports in ezPaycheck Software

Web form 940, employer’s annual federal unemployment tax return, is an irs form that employers use to report any futa tax payments they’ve made over the course of the calendar year, as well as any outstanding futa payments they have yet to make. Instructions for form 940 (2020) pdf. 23 by the internal revenue service. Futa stands for federal unemployment.

FUTA Taxes & Form 940 Instructions

Web form 940 (2020) employer's annual federal unemployment (futa) tax return. If the amount of federal unemployment tax due for the year has been paid, the form 940 due date is february 10 to file. Form 941 is used by employers who withhold income taxes from wages or who must pay social security or medicare tax. Web form 940, employer’s.

How to calculate Line 10 on Form 940 (FUTA TAX RETURN)?

Web when filing its form 940. Use form 940 to report your annual federal unemployment tax act (futa) tax. Form 941 is used by employers who withhold income taxes from wages or who must pay social security or medicare tax. Web form 940 is due on jan. File this schedule with form 940.

USA 940 Form Template Templates, Pdf templates, How to apply

For employers who withhold taxes from employee's paychecks or who must pay the employer's portion of social security or medicare tax. Web the 2020 form 940, employer’s annual federal unemployment (futa) tax return, was released nov. Use form 940 to report your annual federal unemployment tax act (futa) tax. Instructions for form 940 (2020) pdf. Futa stands for federal unemployment.

2020 Form IRS 940 Fill Online, Printable, Fillable, Blank pdfFiller

Virgin islands (usvi) is the only credit reduction state. If you paid any wages that are subject to the unemployment compensation laws of the usvi, your credit against federal unemployment tax will be reduced based on the credit reduction rate for the usvi. For employers who withhold taxes from employee's paychecks or who must pay the employer's portion of social.

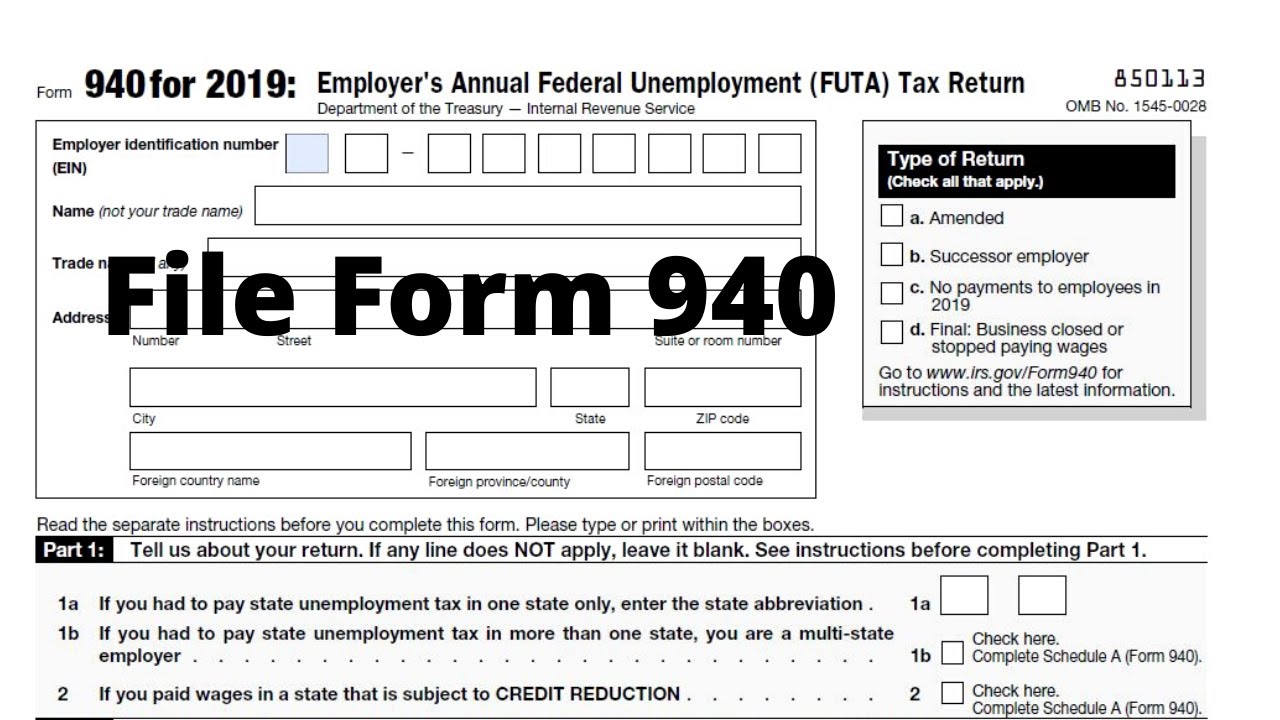

How to File Form 940 FUTA Employer’s Annual federal Unemployment Tax

Futa stands for federal unemployment tax act. File this schedule with form 940. Use form 940 to report your annual federal unemployment tax act (futa) tax. The form is required if you paid wages of $1,500 or more to employees in a calendar quarter, or if you had one or more employees for part of a day in any 20.

IRS Form 940 Schedule A Download Fillable PDF or Fill Online Multi

Together with state unemployment tax systems, the futa tax provides funds for paying unemployment compensation to workers who have. Use form 940 to report your annual federal unemployment tax act (futa) tax. If either of these dates is a holiday or weekend, you have until the next business day to file. Web schedule a (form 940) for 2020: Futa stands.

EFile Form 940 for 2021 tax year File Form 940 Online

Web the 2020 form 940, employer’s annual federal unemployment (futa) tax return, was released nov. Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. If either of these dates is a holiday or weekend, you have until the next business day to file. Instructions for form 940 (2020).

For Employers Who Withhold Taxes From Employee's Paychecks Or Who Must Pay The Employer's Portion Of Social Security Or Medicare Tax.

Together with state unemployment tax systems, the futa tax provides funds for paying unemployment compensation to workers who have. Instructions for form 940 (2020) pdf. Use schedule a (form 940) to figure the credit Web form 940, employer’s annual federal unemployment tax return, is an irs form that employers use to report any futa tax payments they’ve made over the course of the calendar year, as well as any outstanding futa payments they have yet to make.

Web Irs Form 940 Reports An Employer’s Unemployment Tax Payments And Calculations To The Irs.

Web form 940 is due on jan. Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. Use form 940 to report your annual federal unemployment tax act (futa) tax. Form 941 is used by employers who withhold income taxes from wages or who must pay social security or medicare tax.

If Either Of These Dates Is A Holiday Or Weekend, You Have Until The Next Business Day To File.

23 by the internal revenue service. File this schedule with form 940. Web when filing its form 940. Employer’s annual federal unemployment (futa) tax return department of the treasury — internal revenue service employer identification number (ein) — name (not your trade name) trade name (if any) address number street suite or room number city state foreign country name foreign province/county zip code.

If The Amount Of Federal Unemployment Tax Due For The Year Has Been Paid, The Form 940 Due Date Is February 10 To File.

Web form 940 (2020) employer's annual federal unemployment (futa) tax return. Web the 2020 form 940, employer’s annual federal unemployment (futa) tax return, was released nov. Web schedule a (form 940) for 2020: If you paid any wages that are subject to the unemployment compensation laws of the usvi, your credit against federal unemployment tax will be reduced based on the credit reduction rate for the usvi.