Form 941 For 2020 3Rd Quarter

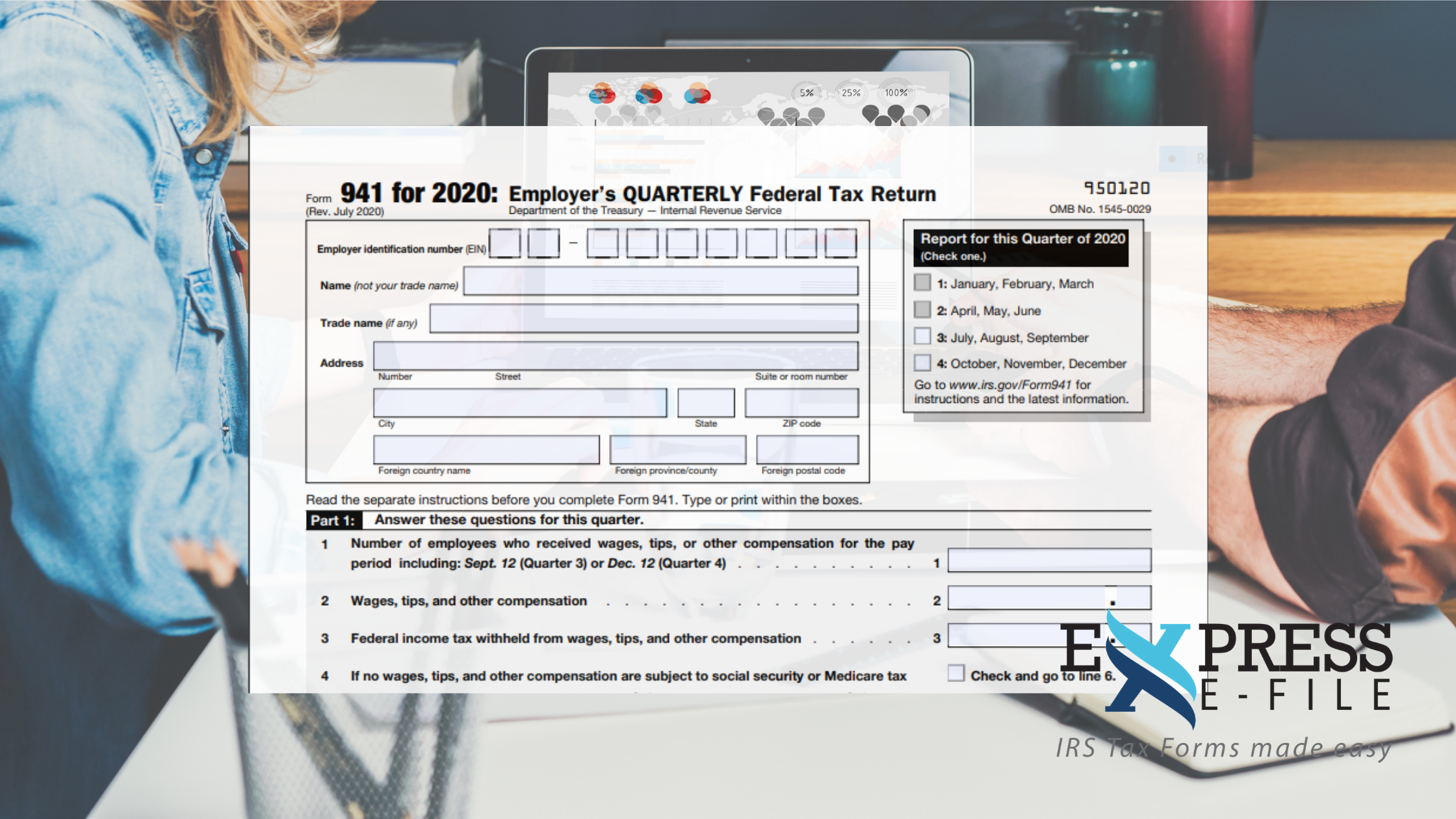

Form 941 For 2020 3Rd Quarter - Web “2nd quarter 2023,” “3rd quarter 2023,” or “4th quarter 2023”) on your check or money order. Web employer’s quarterly federal tax return form 941 for 2023: You must complete all four pages. Web ein, “form 941,” and the tax period (“1st quarter 2020,” “2nd quarter 2020,” “3rd quarter 2020,” or “4th quarter 2020”) on your check or money order. July 2020) employer’s quarterly federal tax return 950120 omb no. Web tax liability for month 3. June 2022) employer’s quarterly federal tax return department of the treasury — internal. Real gdp grew for the fourth consecutive quarter, picking up. Web 1 day agointroduction the u.s. Paycheck protection program (ppp) under cares act;

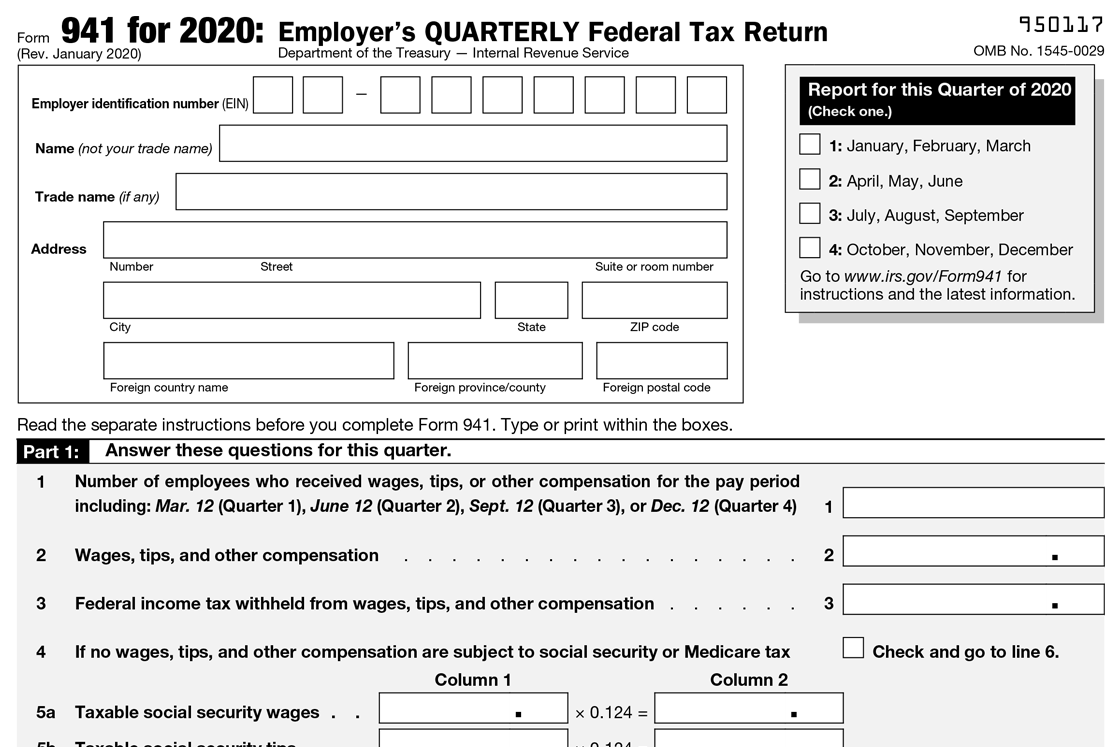

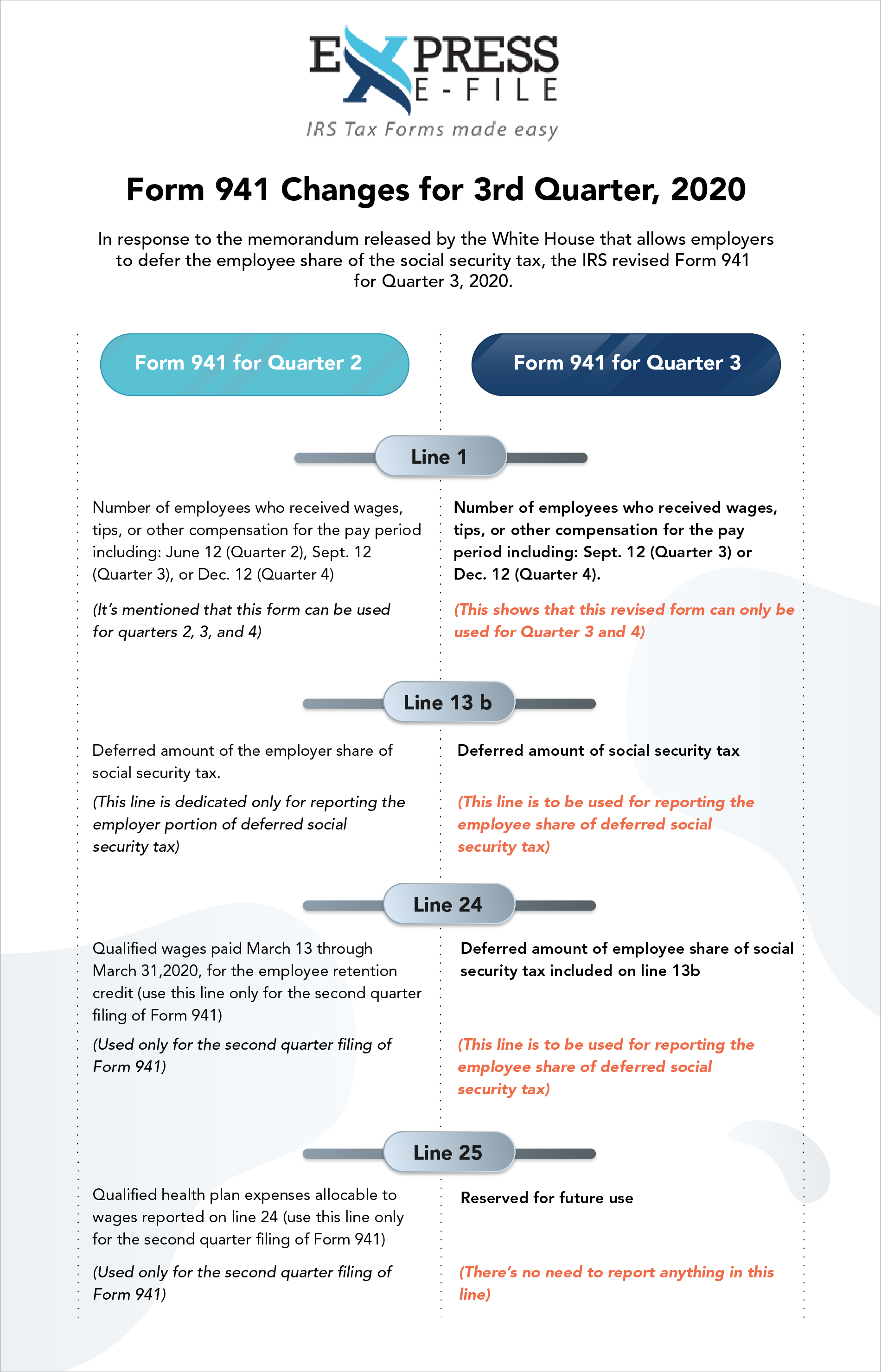

Report income taxes, social security tax, or medicare tax withheld from employee's paychecks. Web revised form 941 for 3rd quarter, 2020. Web employer’s quarterly federal tax return form 941 for 2022: Those returns are processed in. March 2021) employer’s quarterly federal tax return department of the treasury — internal. Answer these questions for this quarter. Economy continued to show resilience and strength in the second quarter of 2023. Web “2nd quarter 2023,” “3rd quarter 2023,” or “4th quarter 2023”) on your check or money order. Web click download latest update. Use the march 2021 revision of form 941 only to report taxes for the quarter ending march 31, 2021.

Web in the 3rd quarter: Web employer’s quarterly federal tax return form 941 for 2021: June 2022) employer’s quarterly federal tax return department of the treasury — internal. As of july 13, 2023, the irs had 266,000 unprocessed forms 941, employer's quarterly federal tax return. The june 2021 revision of form 941 should be used for the. Answer these questions for this quarter. Web ein, “form 941,” and the tax period (“1st quarter 2020,” “2nd quarter 2020,” “3rd quarter 2020,” or “4th quarter 2020”) on your check or money order. June 12 (quarter 2), sept. Use the march 2021 revision of form 941 only to report taxes for the quarter ending march 31, 2021. April, may, june read the separate instructions before completing this form.

You Will Probably See These Changes on the Revised Form 941… Blog

Type or print within the boxes. Ad irs 941 inst & more fillable forms, register and subscribe now! Web about form 941, employer's quarterly federal tax return. Now, you can try generating your q3 941 form again. Web 1 day agointroduction the u.s.

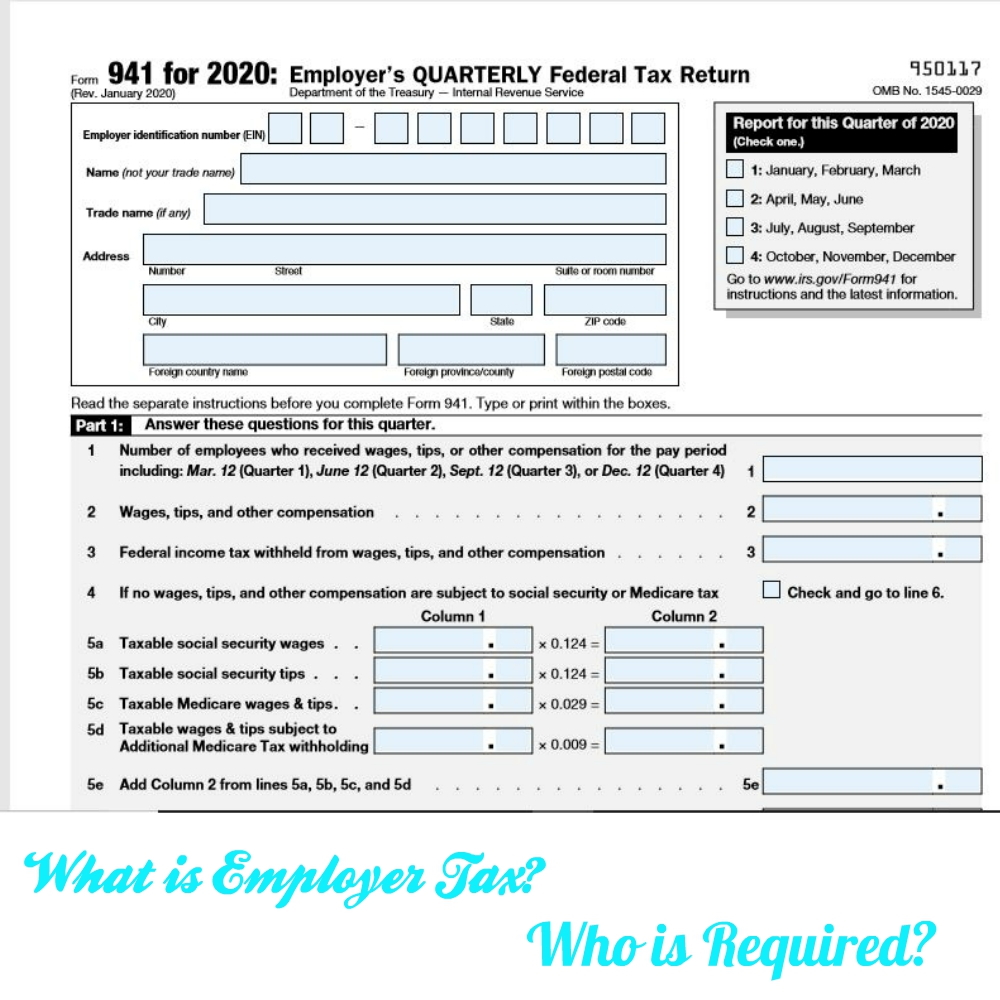

What is the IRS Form 941? Form 941 Instructions and Information

March 2021) employer’s quarterly federal tax return department of the treasury — internal. Web about form 941, employer's quarterly federal tax return. Real gdp grew for the fourth consecutive quarter, picking up. Web revised form 941 for 3rd quarter, 2020. As of july 13, 2023, the irs had 266,000 unprocessed forms 941, employer's quarterly federal tax return.

What You Need to Know About 3rd Quarter IRS Form 941 Changes 2020

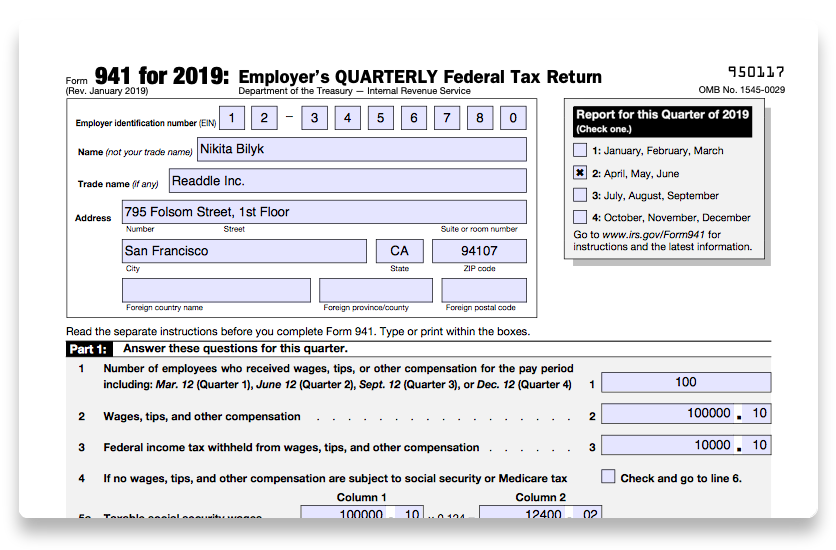

June 12 (quarter 2), sept. Report income taxes, social security tax, or medicare tax withheld from employee's paychecks. Web employer’s quarterly federal tax return form 941 for 2022: Number of employees who received wages, tips, or other compensation for the pay period including: Now, you can try generating your q3 941 form again.

2020 Form IRS 941SS Fill Online, Printable, Fillable, Blank pdfFiller

June 2022) employer’s quarterly federal tax return department of the treasury — internal. Web in the 3rd quarter: Web employer’s quarterly federal tax return form 941 for 2021: The lines 13b, 24, and 25 are not. Number of employees who received wages, tips, or other compensation for the pay period including:

2020 Form 941 Employer’s Quarterly Federal Tax Return What is

Web revised form 941 for 3rd quarter, 2020. Web tax liability for month 3. Ad irs 941 inst & more fillable forms, register and subscribe now! March 2021) employer’s quarterly federal tax return department of the treasury — internal. The june 2021 revision of form 941 should be used for the.

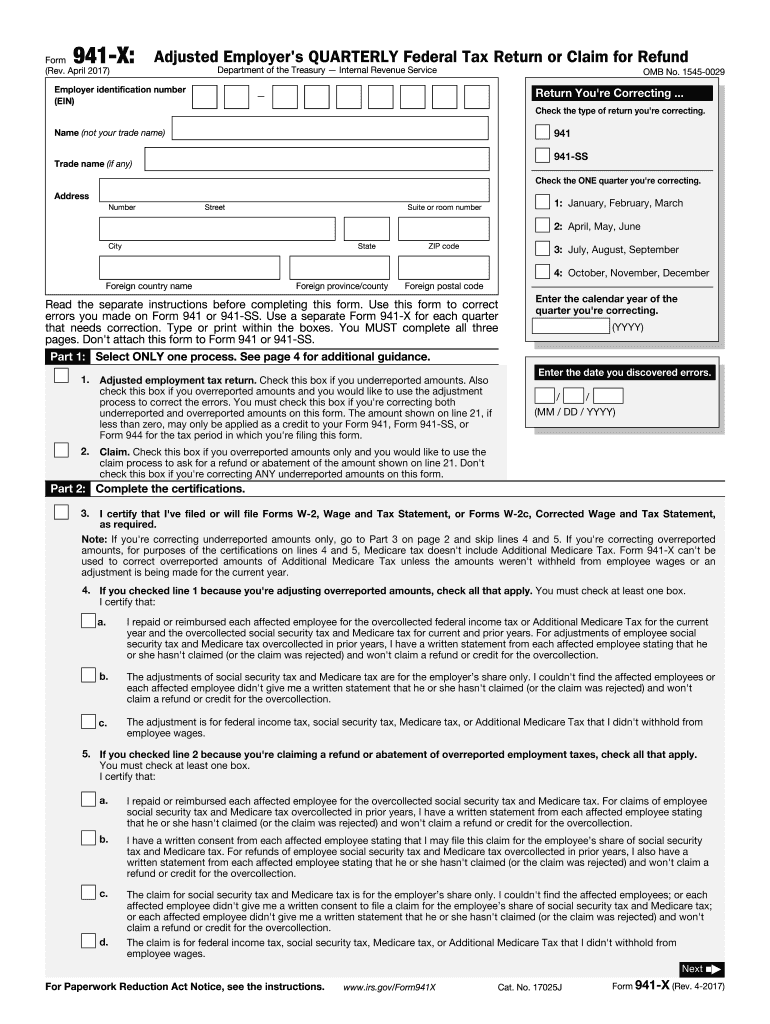

941 Form Fill Out and Sign Printable PDF Template signNow

Web instructions for form 941 (03/2023) employer's quarterly federal tax return section references are to the internal revenue code unless otherwise noted. Economy continued to show resilience and strength in the second quarter of 2023. Paycheck protection program (ppp) under cares act; In this article we will cover the following: You must complete all four pages.

File 941 Online How to File 2023 Form 941 electronically

The lines 13b, 24, and 25 are not. Web instructions for form 941 (03/2023) employer's quarterly federal tax return section references are to the internal revenue code unless otherwise noted. The june 2021 revision of form 941 should be used for the. Paycheck protection program (ppp) under cares act; Economy continued to show resilience and strength in the second quarter.

How to fill out IRS Form 941 2019 PDF Expert

Ad download or email irs 941 & more fillable forms, register and subscribe now! Web employer’s quarterly federal tax return form 941 for 2022: Now, you can try generating your q3 941 form again. Web “2nd quarter 2023,” “3rd quarter 2023,” or “4th quarter 2023”) on your check or money order. Under these facts, you would qualify for the second.

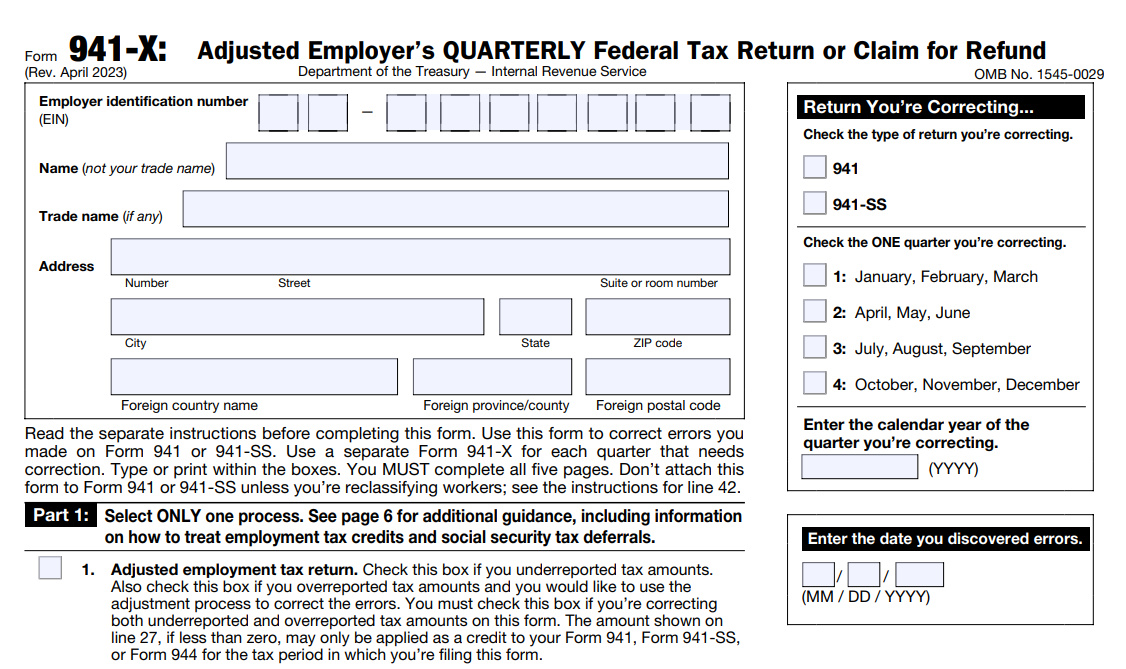

Update Form 941 Changes Regulatory Compliance

Type or print within the boxes. A window appears when the download is complete. The lines 13b, 24, and 25 are not. Web ein, “form 941,” and the tax period (“1st quarter 2020,” “2nd quarter 2020,” “3rd quarter 2020,” or “4th quarter 2020”) on your check or money order. Web they were $45 in the second quarter of 2020, $85.

Web Employer’s Quarterly Federal Tax Return Form 941 For 2022:

Web 1 day agointroduction the u.s. In this article we will cover the following: July 2020) employer’s quarterly federal tax return 950120 omb no. Real gdp grew for the fourth consecutive quarter, picking up.

Number Of Employees Who Received Wages, Tips, Or Other Compensation For The Pay Period Including:

Web instructions for form 941 (03/2023) employer's quarterly federal tax return section references are to the internal revenue code unless otherwise noted. Report income taxes, social security tax, or medicare tax withheld from employee's paychecks. June 2022) employer’s quarterly federal tax return department of the treasury — internal. June 12 (quarter 2), sept.

Web Payroll Tax Returns.

Now, you can try generating your q3 941 form again. Web revised form 941 for 3rd quarter, 2020. Ad download or email irs 941 & more fillable forms, register and subscribe now! Web about form 941, employer's quarterly federal tax return.

Web Employer’s Quarterly Federal Tax Return Form 941 For 2021:

Web they were $45 in the second quarter of 2020, $85 in the third quarter and $75 in the fourth quarter. Use the march 2021 revision of form 941 only to report taxes for the quarter ending march 31, 2021. The lines 13b, 24, and 25 are not. Under these facts, you would qualify for the second and third.