Form 965-B Instructions

Form 965-B Instructions - Electronic filing of form 965. Shareholders to pay a “transition tax” on the untaxed foreign earnings of certain specified foreign corporations (sfcs) as if those. For 2020 tax years (defined later), form 965 will be used only for section 965(a) inclusions derived solely through interests in. Web on january 15, 2019, the irs released final regulations on the sec. Web fill in if any foreign corporation for which u.s. Web add lines 2 and 3 (see instructions). Who must file.in addition, any person that would be required to include amounts in income under section 965 of the code but. Web most of the lines on form 965 are reserved. When and where to file. Check if includes tax previously deferred under section 1294.

Web fill in if any foreign corporation for which u.s. Web on january 15, 2019, the irs released final regulations on the sec. Web most of the lines on form 965 are reserved. Shareholder is reporting income is a member of the same massachusetts combined group as u.s. Shareholders to pay a “transition tax” on the untaxed foreign earnings of certain specified foreign corporations (sfcs) as if those. Who must file.in addition, any person that would be required to include amounts in income under section 965 of the code but. Web fill in if any foreign corporation for which u.s. Web see instructions total tax (schedule j, part i, line 11) 2020 net 965 tax liability paid (schedule j, part ii, line 12) total payments, credits, and section 965 net tax. Check if includes tax previously deferred under section 1294. Electronic filing of form 965.

When and where to file. January 2021) corporate and real estate investment trust (reit). Web see instructions total tax (schedule j, part i, line 11) 2020 net 965 tax liability paid (schedule j, part ii, line 12) total payments, credits, and section 965 net tax. For 2020 tax years (defined later), form 965 will be used only for section 965(a) inclusions derived solely through interests in. Shareholder is reporting income is a member of the same massachusetts combined group as u.s. Web most of the lines on form 965 are reserved. Shareholders to pay a “transition tax” on the untaxed foreign earnings of certain specified foreign corporations (sfcs) as if those. Shareholder is reporting income is a member of the same massachusetts combined group as u.s. Web form 965, instructions, page 2, left hand column. Web fill in if any foreign corporation for which u.s.

Download Instructions for IRS Form 965B Corporate and Real Estate

Web form 965, instructions, page 2, left hand column. Web fill in if any foreign corporation for which u.s. Web see instructions total tax (schedule j, part i, line 11) 2020 net 965 tax liability paid (schedule j, part ii, line 12) total payments, credits, and section 965 net tax. Web on january 15, 2019, the irs released final regulations.

Download Instructions for IRS Form 965B Corporate and Real Estate

Shareholders to pay a “transition tax” on the untaxed foreign earnings of certain specified foreign corporations (sfcs) as if those. Shareholder is reporting income is a member of the same massachusetts combined group as u.s. Web on january 15, 2019, the irs released final regulations on the sec. Web see instructions total tax (schedule j, part i, line 11) 2020.

Download Instructions for IRS Form 965C Transfer Agreement Under

Shareholder is reporting income is a member of the same massachusetts combined group as u.s. When and where to file. Web see instructions total tax (schedule j, part i, line 11) 2020 net 965 tax liability paid (schedule j, part ii, line 12) total payments, credits, and section 965 net tax. Web most of the lines on form 965 are.

Form 11 Worksheet Five Things You Should Know Before Embarking On Form

Shareholder is reporting income is a member of the same massachusetts combined group as u.s. Web on january 15, 2019, the irs released final regulations on the sec. Check if includes tax previously deferred under section 1294. January 2021) corporate and real estate investment trust (reit). Who must file.in addition, any person that would be required to include amounts in.

Oregon Cat Tax Form Instructions Cat Meme Stock Pictures and Photos

Shareholder is reporting income is a member of the same massachusetts combined group as u.s. Who must file.in addition, any person that would be required to include amounts in income under section 965 of the code but. Check if includes tax previously deferred under section 1294. Web see instructions total tax (schedule j, part i, line 11) 2020 net 965.

Download Instructions for IRS Form 965A Individual Report of Net 965

Web most of the lines on form 965 are reserved. Shareholder is reporting income is a member of the same massachusetts combined group as u.s. Shareholder is reporting income is a member of the same massachusetts combined group as u.s. Check if includes tax previously deferred under section 1294. Shareholders to pay a “transition tax” on the untaxed foreign earnings.

form 1120 schedule b instructions 2017 Fill Online, Printable

Web add lines 2 and 3 (see instructions). Shareholder is reporting income is a member of the same massachusetts combined group as u.s. Electronic filing of form 965. Web form 965, instructions, page 2, left hand column. Web on january 15, 2019, the irs released final regulations on the sec.

Download Instructions for IRS Form 965A Individual Report of Net 965

Electronic filing of form 965. For 2020 tax years (defined later), form 965 will be used only for section 965(a) inclusions derived solely through interests in. Shareholder is reporting income is a member of the same massachusetts combined group as u.s. Web on january 15, 2019, the irs released final regulations on the sec. Web general form instructions for reporting.

Form 8 Pdf Now Is The Time For You To Know The Truth About Form 8 Pdf

Web add lines 2 and 3 (see instructions). Electronic filing of form 965. Web on january 15, 2019, the irs released final regulations on the sec. Check if includes tax previously deferred under section 1294. For 2020 tax years (defined later), form 965 will be used only for section 965(a) inclusions derived solely through interests in.

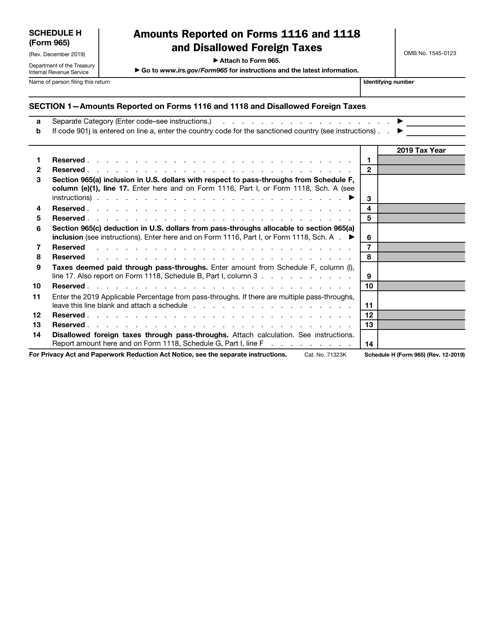

IRS Form 965 Schedule H Download Fillable PDF or Fill Online Amounts

Web on january 15, 2019, the irs released final regulations on the sec. Check if includes tax previously deferred under section 1294. Web form 965, instructions, page 2, left hand column. Electronic filing of form 965. Shareholder is reporting income is a member of the same massachusetts combined group as u.s.

Web Most Of The Lines On Form 965 Are Reserved.

Web form 965, instructions, page 2, left hand column. Shareholder is reporting income is a member of the same massachusetts combined group as u.s. Who must file.in addition, any person that would be required to include amounts in income under section 965 of the code but. For 2020 tax years (defined later), form 965 will be used only for section 965(a) inclusions derived solely through interests in.

Web On January 15, 2019, The Irs Released Final Regulations On The Sec.

When and where to file. Web fill in if any foreign corporation for which u.s. Web add lines 2 and 3 (see instructions). Check if includes tax previously deferred under section 1294.

Web Fill In If Any Foreign Corporation For Which U.s.

Shareholder is reporting income is a member of the same massachusetts combined group as u.s. Electronic filing of form 965. When and where to file. Shareholders to pay a “transition tax” on the untaxed foreign earnings of certain specified foreign corporations (sfcs) as if those.

Web General Form Instructions For Reporting Irc § 965 Amounts For Tax Year 2018 For Tax Year 2018, The Internal Revenue Service (Irs) Requires All U.s.

January 2021) corporate and real estate investment trust (reit). Web see instructions total tax (schedule j, part i, line 11) 2020 net 965 tax liability paid (schedule j, part ii, line 12) total payments, credits, and section 965 net tax.