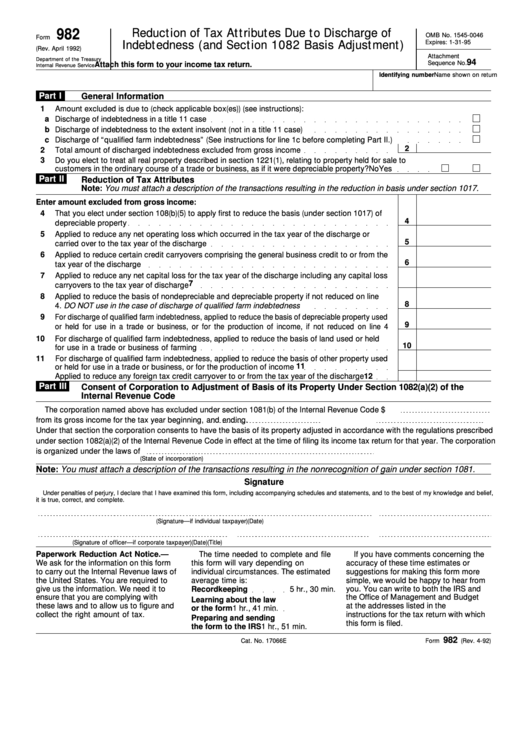

Form 982 Turbotax

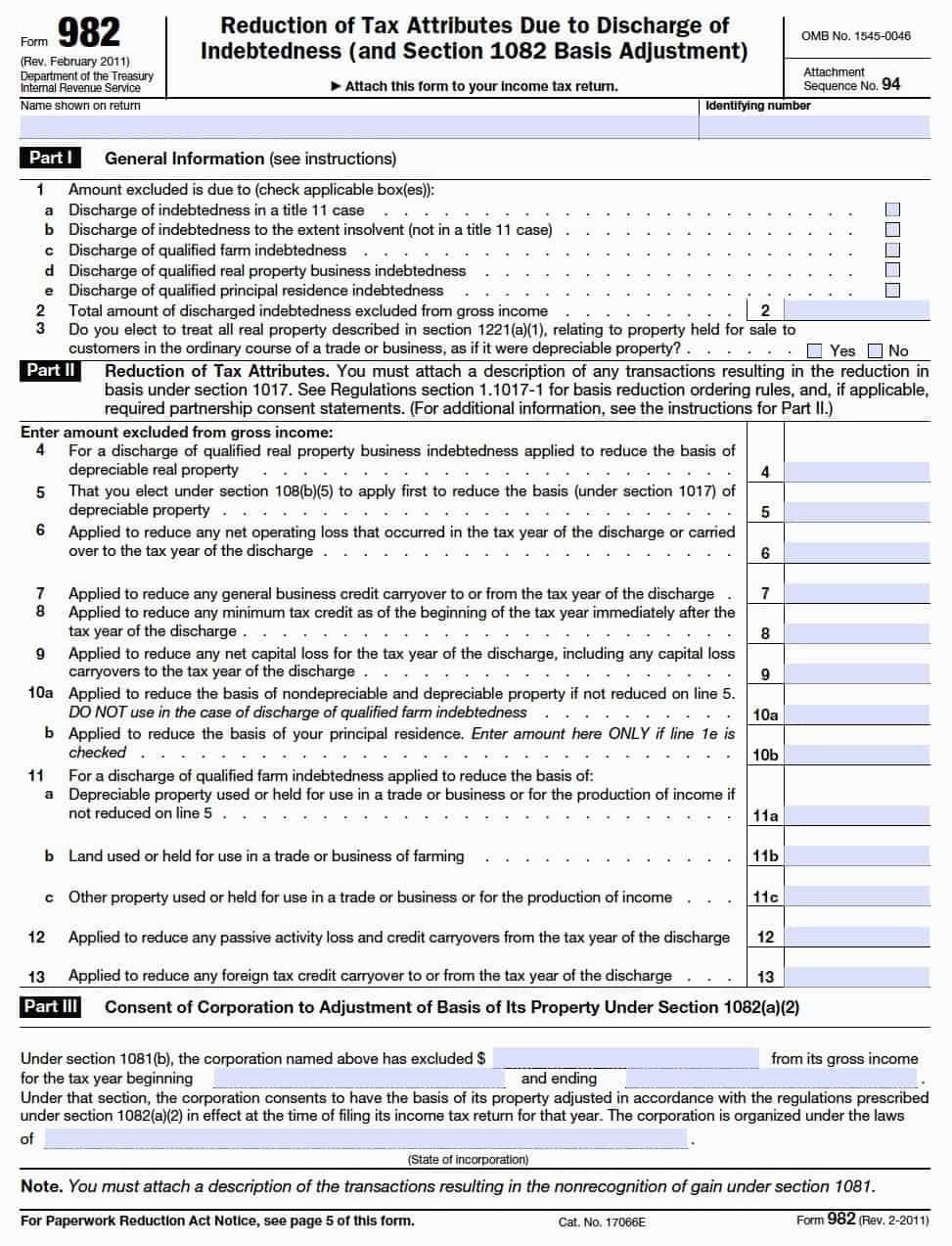

Form 982 Turbotax - I will be receiving a 1099 c this year and i want to claim insolvency. Web we last updated the reduction of tax attributes due to discharge of indebtedness (and section 1082 basis adjustment) in february 2023, so this is the latest version of form. Web in turbotax online there is no way to complete form 982 for insolvency. Web you were insolvent if your liabilities (the total amount of all debts) were more than the fair market value (fmv) of all of your assets immediately before the discharge. However, when using an exception and it relates to property that. Reach out to learn how we can help you! Try it for free now! Web form 982 (reduction of tax attributes due to discharge of indebtedness) reports the amount of cancelled debt to excluded from taxable income. Include the amount of canceled qualified real property business debt (but. Web form 982 federal — reduction of tax attributes due to discharge of indebtedness (and section 1082 basis adjustment) download this form print this form it appears you.

Web in turbotax online there is no way to complete form 982 for insolvency. Ad sovos combines tax automation with a human touch. Try it for free now! Web 1 best answer. March 2018) department of the treasury internal revenue service. United states (english) united states. Web form 982 (reduction of tax attributes due to discharge of indebtedness) reports the amount of cancelled debt to excluded from taxable income. Web attach form 982 to your federal income tax return for 2022 and check the box on line 1d. Web you can find the detailed description and irs guidance within irs publication 4681, canceled debts, foreclosures, repossessions, and abandonments. Upload, modify or create forms.

Web form 982 (reduction of tax attributes due to discharge of indebtedness) reports the amount of cancelled debt to excluded from taxable income. I will be receiving a 1099 c this year and i want to claim insolvency. Web if you qualify for an exception or exclusion, you don’t report your canceled debt on your tax return. Reduction of tax attributes due to discharge of indebtedness (and section 1082 basis. Upload, modify or create forms. Turbotax does not have an interview for form 982 and it is also not possible to import this form. June 5, 2019 3:37 pm. Web form 982 (reduction of tax attributes due to discharge of indebtedness) reports the amount of cancelled debt to excluded from taxable income. Include the amount of canceled qualified real property business debt (but. Web attach form 982 to your federal income tax return for 2022 and check the box on line 1d.

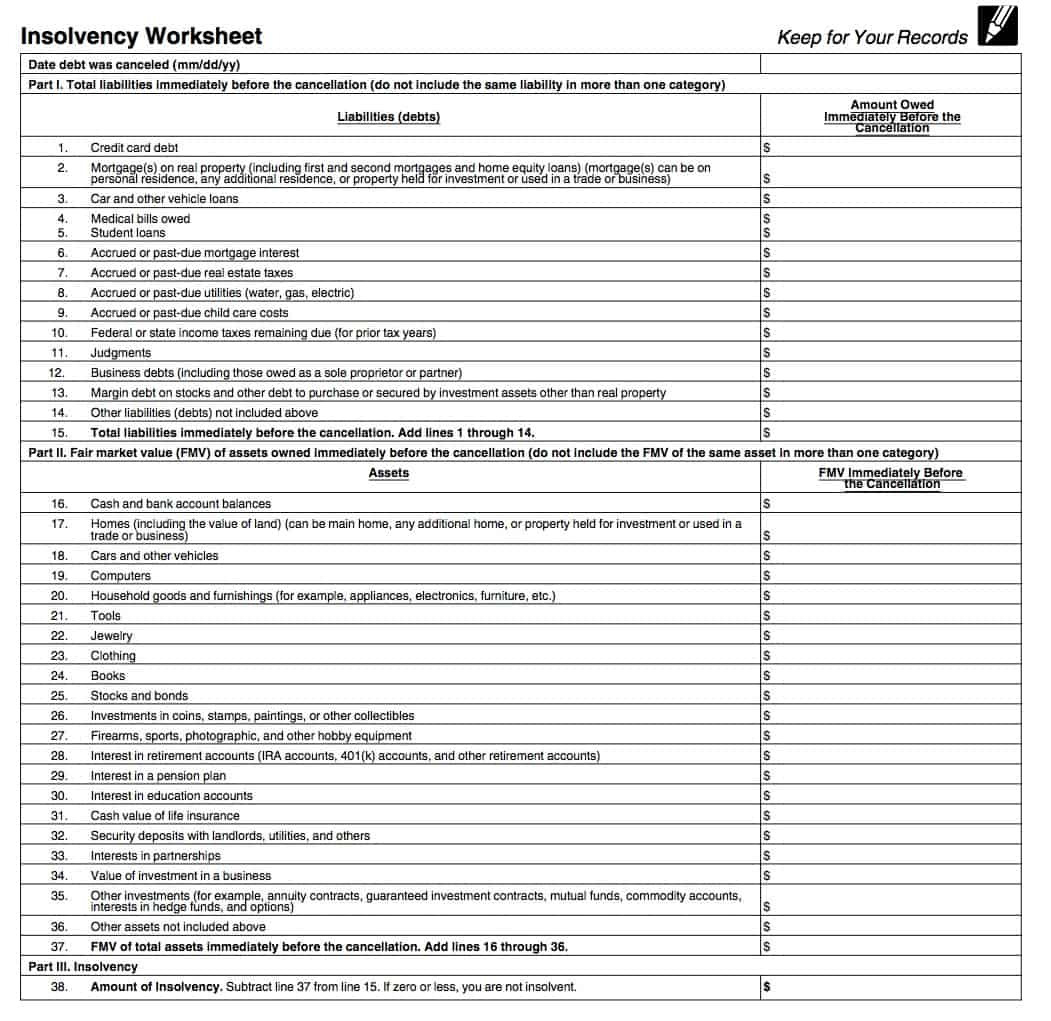

Form 982 Insolvency Worksheet —

Web form 982 is used to find the discharged indebtedness amount that can be excluded from gross income. Web you must file form 982 to report the exclusion and the reduction of certain tax attributes either dollar for dollar or 331/3 cents per dollar (as explained later). Web does turbo tax support filing form 982 for insolvency? But if you.

Form 982 turbotax home and business lanthgolfsi

Web form 982 (reduction of tax attributes due to discharge of indebtedness) reports the amount of cancelled debt to excluded from taxable income. Web form 982 (reduction of tax attributes due to discharge of indebtedness) reports the amount of cancelled debt to excluded from taxable income. Web form 982 federal — reduction of tax attributes due to discharge of indebtedness.

Form 982 Instructions Reasons Why 9 Is Grad Amended Return —

But if you used turbotax deluxe or higher to file. Form 982 is used to determine, under certain. Ad sovos combines tax automation with a human touch. Web you can find the detailed description and irs guidance within irs publication 4681, canceled debts, foreclosures, repossessions, and abandonments. Web attach form 982 to your federal income tax return for 2022 and.

Form 982 Edit, Fill, Sign Online Handypdf

Upload, modify or create forms. Web form 982 (reduction of tax attributes due to discharge of indebtedness) reports the amount of cancelled debt to excluded from taxable income. Web attach form 982 to your federal income tax return for 2022 and check the box on line 1d. Reach out to learn how we can help you! Include the amount of.

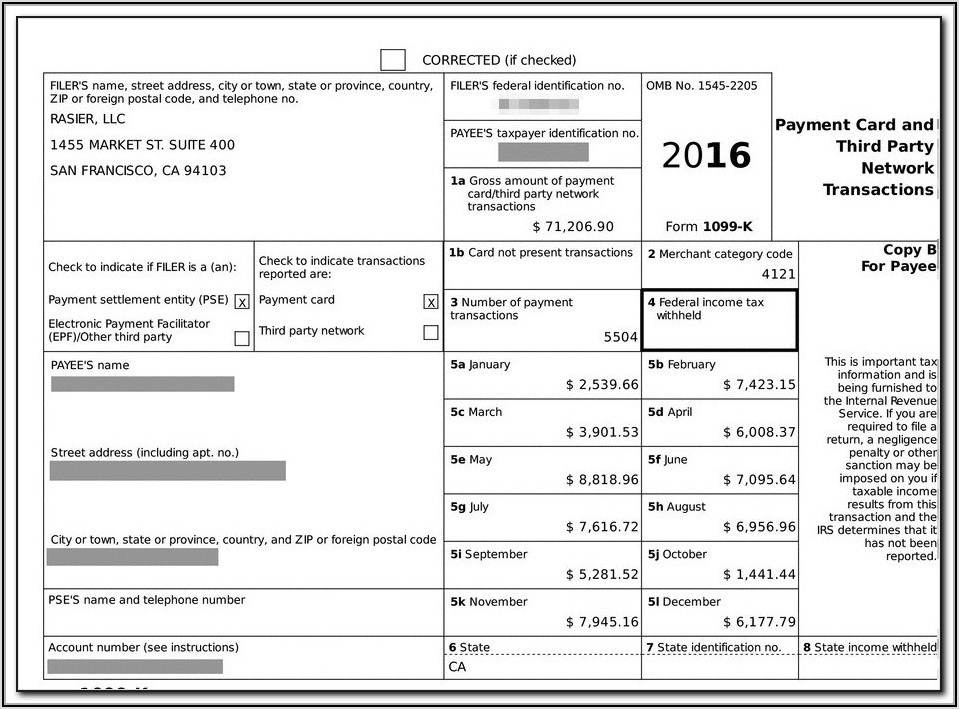

Turbotax 1099 Quick Employer Forms Form Resume Examples 3q9JaRZ2Ar

Web form 982 (reduction of tax attributes due to discharge of indebtedness) reports the amount of cancelled debt to excluded from taxable income. Web 1 best answer. Web does turbo tax support filing form 982 for insolvency? Web you were insolvent if your liabilities (the total amount of all debts) were more than the fair market value (fmv) of all.

Form 982 Edit, Fill, Sign Online Handypdf

Web does turbo tax support filing form 982 for insolvency? United states (english) united states. Web we last updated the reduction of tax attributes due to discharge of indebtedness (and section 1082 basis adjustment) in february 2023, so this is the latest version of form. Web attach form 982 to your federal income tax return for 2022 and check the.

IRS Form 982 Reduction of Attributes Due to Discharge of Indebtedness

Web in turbotax online there is no way to complete form 982 for insolvency. Web form 982 (reduction of tax attributes due to discharge of indebtedness) reports the amount of cancelled debt to excluded from taxable income. Web instructions for form 982 (12/2021) reduction of tax attributes due to discharge of indebtedness (and section 1082 basis adjustment) (for use with.

Form 982 Reduction Of Tax Attributes Due To Discharge Of Indebtedness

March 2018) department of the treasury internal revenue service. Web form 982 (reduction of tax attributes due to discharge of indebtedness) reports the amount of cancelled debt to excluded from taxable income. Web form 982 is used to find the discharged indebtedness amount that can be excluded from gross income. June 5, 2019 3:37 pm. Web you can find the.

CONVERTING TURBOTAX FILES TO PDF

Web instructions for form 982 (12/2021) reduction of tax attributes due to discharge of indebtedness (and section 1082 basis adjustment) (for use with form 982 (rev. Web form 982 (reduction of tax attributes due to discharge of indebtedness) reports the amount of cancelled debt to excluded from taxable income. Web in turbotax online there is no way to complete form.

Form 982 Edit, Fill, Sign Online Handypdf

Complete, edit or print tax forms instantly. March 2018) department of the treasury internal revenue service. Turbotax does not have an interview for form 982 and it is also not possible to import this form. Form 982 is used to determine, under certain. But if you used turbotax deluxe or higher to file.

Web You Can Find The Detailed Description And Irs Guidance Within Irs Publication 4681, Canceled Debts, Foreclosures, Repossessions, And Abandonments.

I will be receiving a 1099 c this year and i want to claim insolvency. Web attach form 982 to your federal income tax return for 2022 and check the box on line 1d. Try it for free now! Web you must file form 982 to report the exclusion and the reduction of certain tax attributes either dollar for dollar or 331/3 cents per dollar (as explained later).

Reduction Of Tax Attributes Due To Discharge Of Indebtedness (And Section 1082 Basis.

Web form 982 (reduction of tax attributes due to discharge of indebtedness) reports the amount of cancelled debt to excluded from taxable income. Complete, edit or print tax forms instantly. Web does turbo tax support filing form 982 for insolvency? March 2018) department of the treasury internal revenue service.

Web In Turbotax Online There Is No Way To Complete Form 982 For Insolvency.

Web you were insolvent if your liabilities (the total amount of all debts) were more than the fair market value (fmv) of all of your assets immediately before the discharge. June 5, 2019 3:37 pm. Ad sovos combines tax automation with a human touch. Include the amount of canceled qualified real property business debt (but.

Web Form 982 Is Used To Find The Discharged Indebtedness Amount That Can Be Excluded From Gross Income.

Web form 982 (reduction of tax attributes due to discharge of indebtedness) reports the amount of cancelled debt to excluded from taxable income. Reach out to learn how we can help you! However, when using an exception and it relates to property that. Upload, modify or create forms.