Form 990 Extension

Form 990 Extension - Taxable trusts and private foundations that are required to file a form 990pf are also included. Only submit original (no copies needed). Web extension of time to file exempt organization returns. File by the due date for filing your Web nonprofit explorer has organizations claiming tax exemption in each of the 27 subsections of the 501(c) section of the tax code, and which have filed a form 990, form 990ez or form 990pf. No action was required to obtain the new filing date. As a result, the extensions generally now apply to all taxpayers that have a filing or payment deadline falling on or after april 1, 2020, and before july 15, 2020. Web information about form 8868, application for extension of time to file an exempt organization return, including recent updates, related forms, and instructions on how to file. Web with expresstaxexempt, you have everything you need to file an extension and meet your form 990 deadline on time. These organizations need only eight items of basic information to complete the submission, which must be electronically filed.

Web information about form 8868, application for extension of time to file an exempt organization return, including recent updates, related forms, and instructions on how to file. No action was required to obtain the new filing date. As a result, the extensions generally now apply to all taxpayers that have a filing or payment deadline falling on or after april 1, 2020, and before july 15, 2020. These organizations need only eight items of basic information to complete the submission, which must be electronically filed. Web with expresstaxexempt, you have everything you need to file an extension and meet your form 990 deadline on time. Form 990, return of organization exempt from income tax pdf. Taxable trusts and private foundations that are required to file a form 990pf are also included. Web nonprofit explorer has organizations claiming tax exemption in each of the 27 subsections of the 501(c) section of the tax code, and which have filed a form 990, form 990ez or form 990pf. Web extension of time to file exempt organization returns. From within your taxact return ( online or desktop), click.

Taxable trusts and private foundations that are required to file a form 990pf are also included. These organizations need only eight items of basic information to complete the submission, which must be electronically filed. From within your taxact return ( online or desktop), click. As a result, the extensions generally now apply to all taxpayers that have a filing or payment deadline falling on or after april 1, 2020, and before july 15, 2020. Web with expresstaxexempt, you have everything you need to file an extension and meet your form 990 deadline on time. Web information about form 8868, application for extension of time to file an exempt organization return, including recent updates, related forms, and instructions on how to file. File by the due date for filing your Web extension of time to file exempt organization returns. Only submit original (no copies needed). No action was required to obtain the new filing date.

Irs Fillable Extension Form Printable Forms Free Online

As a result, the extensions generally now apply to all taxpayers that have a filing or payment deadline falling on or after april 1, 2020, and before july 15, 2020. From within your taxact return ( online or desktop), click. These organizations need only eight items of basic information to complete the submission, which must be electronically filed. Form 990,.

Time Is Running Out File A Tax Extension Form 8868 Today

Only submit original (no copies needed). Web extension of time to file exempt organization returns. File by the due date for filing your Form 990, return of organization exempt from income tax pdf. Web with expresstaxexempt, you have everything you need to file an extension and meet your form 990 deadline on time.

Form 990 Filing Extension Form Resume Examples GEOG2LE5Vr

As a result, the extensions generally now apply to all taxpayers that have a filing or payment deadline falling on or after april 1, 2020, and before july 15, 2020. Web with expresstaxexempt, you have everything you need to file an extension and meet your form 990 deadline on time. Web extension of time to file exempt organization returns. These.

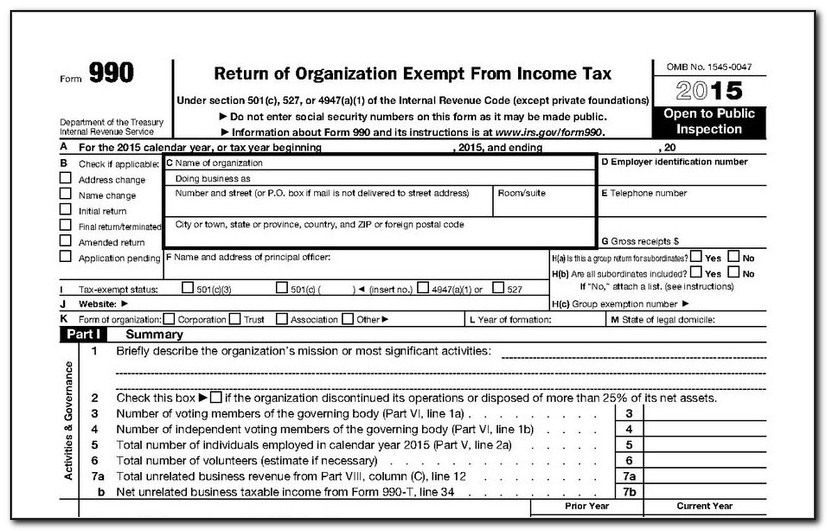

990 Form For Non Profits Irs Universal Network

From within your taxact return ( online or desktop), click. Web nonprofit explorer has organizations claiming tax exemption in each of the 27 subsections of the 501(c) section of the tax code, and which have filed a form 990, form 990ez or form 990pf. No action was required to obtain the new filing date. Web extension of time to file.

How to Keep Your TaxExempt Status by Filing IRS Form 990

Only submit original (no copies needed). Web nonprofit explorer has organizations claiming tax exemption in each of the 27 subsections of the 501(c) section of the tax code, and which have filed a form 990, form 990ez or form 990pf. Web with expresstaxexempt, you have everything you need to file an extension and meet your form 990 deadline on time..

Instructions to file your Form 990PF A Complete Guide

Only submit original (no copies needed). Form 990, return of organization exempt from income tax pdf. Web information about form 8868, application for extension of time to file an exempt organization return, including recent updates, related forms, and instructions on how to file. As a result, the extensions generally now apply to all taxpayers that have a filing or payment.

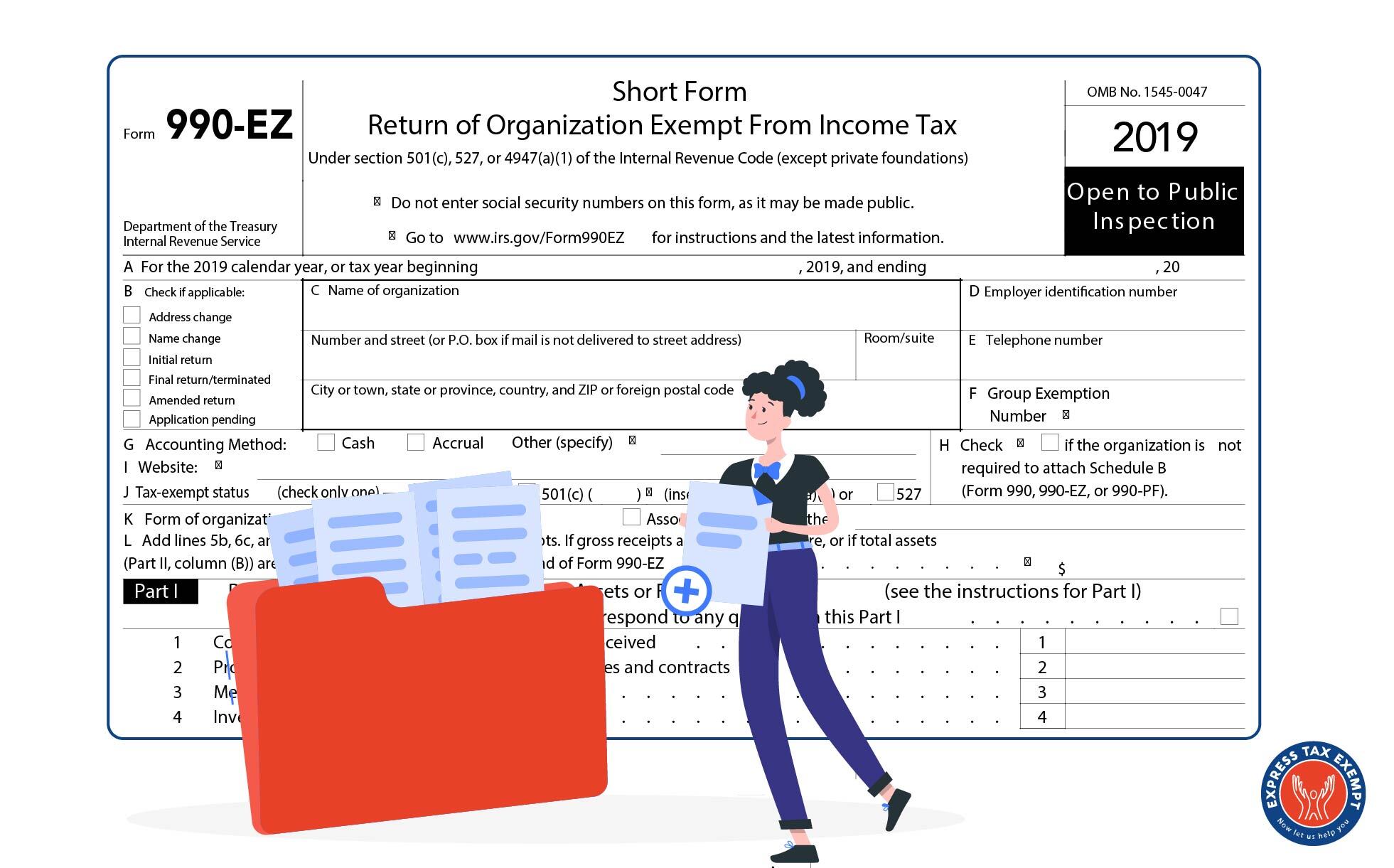

What Is The Form 990EZ and Who Must File It?

As a result, the extensions generally now apply to all taxpayers that have a filing or payment deadline falling on or after april 1, 2020, and before july 15, 2020. File by the due date for filing your Web extension of time to file exempt organization returns. These organizations need only eight items of basic information to complete the submission,.

How to File A LastMinute 990 Extension With Form 8868

Web nonprofit explorer has organizations claiming tax exemption in each of the 27 subsections of the 501(c) section of the tax code, and which have filed a form 990, form 990ez or form 990pf. File by the due date for filing your Web extension of time to file exempt organization returns. No action was required to obtain the new filing.

form 990 extension due date 2020 Fill Online, Printable, Fillable

From within your taxact return ( online or desktop), click. Web information about form 8868, application for extension of time to file an exempt organization return, including recent updates, related forms, and instructions on how to file. Web nonprofit explorer has organizations claiming tax exemption in each of the 27 subsections of the 501(c) section of the tax code, and.

How To Never Mistake IRS Form 990 and Form 990N Again

No action was required to obtain the new filing date. Web nonprofit explorer has organizations claiming tax exemption in each of the 27 subsections of the 501(c) section of the tax code, and which have filed a form 990, form 990ez or form 990pf. Web with expresstaxexempt, you have everything you need to file an extension and meet your form.

Web Extension Of Time To File Exempt Organization Returns.

Form 990, return of organization exempt from income tax pdf. Web with expresstaxexempt, you have everything you need to file an extension and meet your form 990 deadline on time. Web nonprofit explorer has organizations claiming tax exemption in each of the 27 subsections of the 501(c) section of the tax code, and which have filed a form 990, form 990ez or form 990pf. As a result, the extensions generally now apply to all taxpayers that have a filing or payment deadline falling on or after april 1, 2020, and before july 15, 2020.

Web Information About Form 8868, Application For Extension Of Time To File An Exempt Organization Return, Including Recent Updates, Related Forms, And Instructions On How To File.

No action was required to obtain the new filing date. These organizations need only eight items of basic information to complete the submission, which must be electronically filed. From within your taxact return ( online or desktop), click. File by the due date for filing your

Only Submit Original (No Copies Needed).

Taxable trusts and private foundations that are required to file a form 990pf are also included.