Form 990 Ez Extension

Form 990 Ez Extension - Our system does not support these forms:. Short form return of organization exempt from income tax. The extension only provided you the time to file the information return and not to. Take advantage of our package pricing and file form 8868 for free when you pay in advance for a 990 return. To be valid, the extension must be filed with the irs,. Department of the treasury internal revenue service. Short form return of organization exempt from income tax. Thus, for a calendar year. Ad download or email irs 990ez & more fillable forms, register and subscribe now! To help exempt organizations comply with their filing.

For organizations on a calendar year, the form 990 is due. Department of the treasury internal revenue service. Take advantage of our package pricing and file form 8868 for free when you pay in advance for a 990 return. Our system does not support these forms:. The extension only provided you the time to file the information return and not to. To help exempt organizations comply with their filing. Department of the treasury internal revenue service. To be valid, the extension must be filed with the irs,. Short form return of organization exempt from income tax. Web form 990 is due on the 15th day of the 5th month following the end of the organization's taxable year.

Take advantage of our package pricing and file form 8868 for free when you pay in advance for a 990 return. This initial extension was requested. Ad download or email irs 990ez & more fillable forms, register and subscribe now! For organizations on a calendar year, the form 990 is due. Thus, for a calendar year. Web form 990 is due on the 15th day of the 5th month following the end of the organization's taxable year. Department of the treasury internal revenue service. Short form return of organization exempt from income tax. Department of the treasury internal revenue service. The extension only provided you the time to file the information return and not to.

What is Form 990EZ and Who Qualifies for it? Foundation Group, Inc.

To help exempt organizations comply with their filing. Short form return of organization exempt from income tax. The extension only provided you the time to file the information return and not to. Web form 990 is due on the 15th day of the 5th month following the end of the organization's taxable year. Short form return of organization exempt from.

How Do I Avoid Form 990EZ Penalties?

Department of the treasury internal revenue service. Department of the treasury internal revenue service. To help exempt organizations comply with their filing. The extension only provided you the time to file the information return and not to. This initial extension was requested.

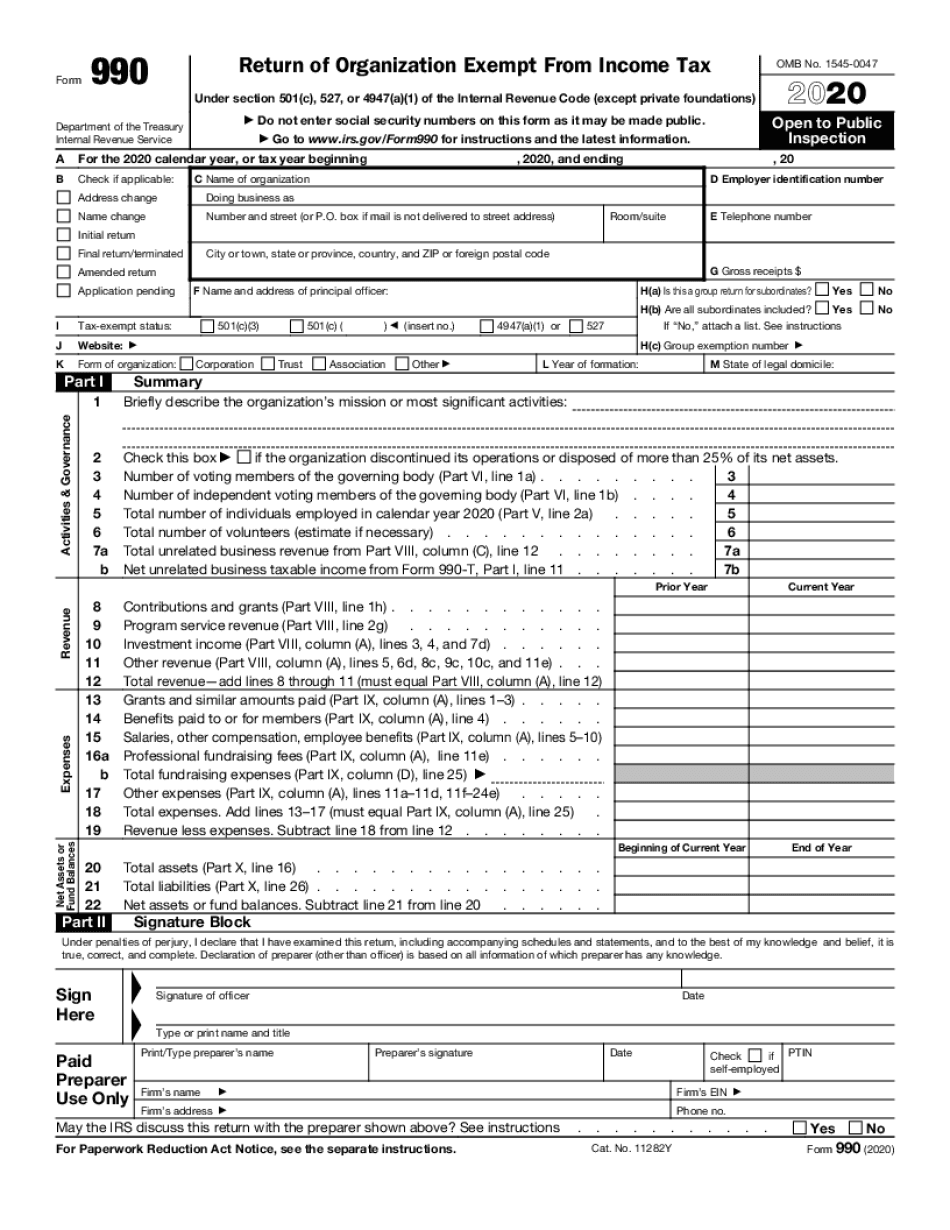

990 ez form Fill Online, Printable, Fillable Blank

To help exempt organizations comply with their filing. This initial extension was requested. Department of the treasury internal revenue service. For organizations on a calendar year, the form 990 is due. Thus, for a calendar year.

IRS Form 990EZ 2018 2019 Printable & Fillable Sample in PDF

Short form return of organization exempt from income tax. Web form 990 is due on the 15th day of the 5th month following the end of the organization's taxable year. Our system does not support these forms:. Thus, for a calendar year. To help exempt organizations comply with their filing.

Where Should I Mail My Form 990EZ?

For organizations on a calendar year, the form 990 is due. Take advantage of our package pricing and file form 8868 for free when you pay in advance for a 990 return. Short form return of organization exempt from income tax. To help exempt organizations comply with their filing. Short form return of organization exempt from income tax.

File 990EZ Online Efile 990 Short Form 990EZ Filing Deadline

Ad download or email irs 990ez & more fillable forms, register and subscribe now! Short form return of organization exempt from income tax. For organizations on a calendar year, the form 990 is due. To be valid, the extension must be filed with the irs,. Department of the treasury internal revenue service.

Form 990EZ Short Form Return of Organization Exempt from Tax

Our system does not support these forms:. To be valid, the extension must be filed with the irs,. Thus, for a calendar year. To help exempt organizations comply with their filing. Short form return of organization exempt from income tax.

990 Ez Form Fill Out and Sign Printable PDF Template signNow

To be valid, the extension must be filed with the irs,. The extension only provided you the time to file the information return and not to. Thus, for a calendar year. Our system does not support these forms:. Short form return of organization exempt from income tax.

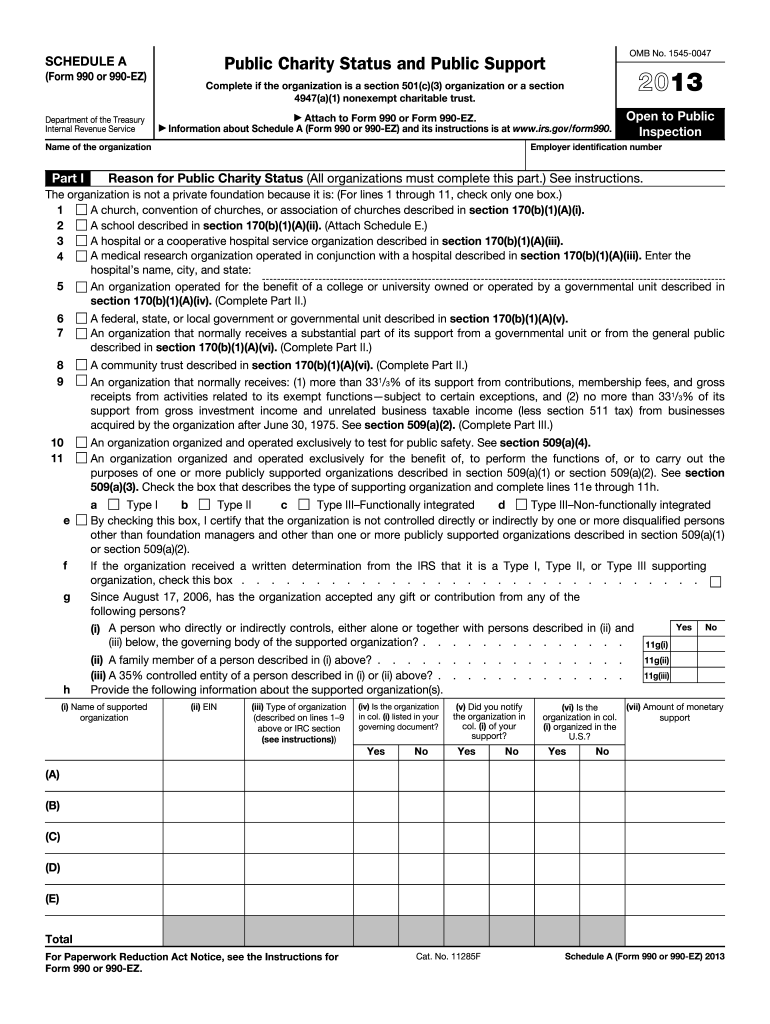

Form 990/990EZ Schedule A IRS Form 990 Schedule A Instructions

To be valid, the extension must be filed with the irs,. Ad download or email irs 990ez & more fillable forms, register and subscribe now! The extension only provided you the time to file the information return and not to. Our system does not support these forms:. Thus, for a calendar year.

What Is The Form 990EZ and Who Must File It?

To help exempt organizations comply with their filing. For organizations on a calendar year, the form 990 is due. Thus, for a calendar year. Take advantage of our package pricing and file form 8868 for free when you pay in advance for a 990 return. Department of the treasury internal revenue service.

Ad Download Or Email Irs 990Ez & More Fillable Forms, Register And Subscribe Now!

Short form return of organization exempt from income tax. For organizations on a calendar year, the form 990 is due. To help exempt organizations comply with their filing. Department of the treasury internal revenue service.

This Initial Extension Was Requested.

Thus, for a calendar year. Department of the treasury internal revenue service. The extension only provided you the time to file the information return and not to. To be valid, the extension must be filed with the irs,.

Web Form 990 Is Due On The 15Th Day Of The 5Th Month Following The End Of The Organization's Taxable Year.

Our system does not support these forms:. Short form return of organization exempt from income tax. Take advantage of our package pricing and file form 8868 for free when you pay in advance for a 990 return.