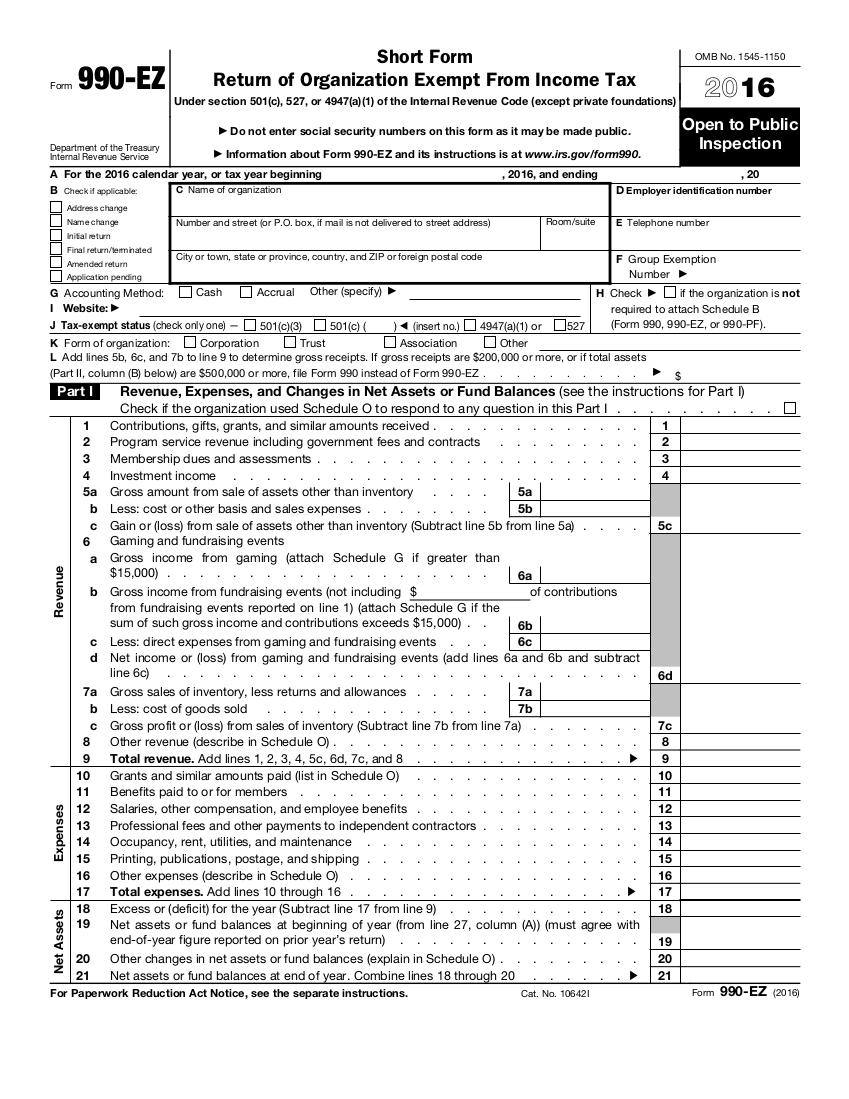

Form 990 Ez For 2016

Form 990 Ez For 2016 - Thus, for a calendar year. On this page you may download the 990 series filings on record from 2016. Ad get ready for tax season deadlines by completing any required tax forms today. 2015 (d) 2016 (e) 2017 (complete only if you checked the box on line 5, 7, or 8 of part i or if the organization failed to qualify under. Web federal state local governments. Complete, edit or print tax forms instantly. An organization that has terminated its operations and has no. Web a section 501(d) religious and apostolic organization files form 1065. A supporting organization described in section 509 (a) (3) is required to file form 990 (or.

On this page you may download the 990 series filings on record from 2016. An organization that has terminated its operations and has no. Complete, edit or print tax forms instantly. 2015 (d) 2016 (e) 2017 (complete only if you checked the box on line 5, 7, or 8 of part i or if the organization failed to qualify under. Web a section 501(d) religious and apostolic organization files form 1065. Ad get ready for tax season deadlines by completing any required tax forms today. Thus, for a calendar year. Web federal state local governments. A supporting organization described in section 509 (a) (3) is required to file form 990 (or.

Thus, for a calendar year. Web a section 501(d) religious and apostolic organization files form 1065. Ad get ready for tax season deadlines by completing any required tax forms today. On this page you may download the 990 series filings on record from 2016. 2015 (d) 2016 (e) 2017 (complete only if you checked the box on line 5, 7, or 8 of part i or if the organization failed to qualify under. Complete, edit or print tax forms instantly. Web federal state local governments. A supporting organization described in section 509 (a) (3) is required to file form 990 (or. An organization that has terminated its operations and has no.

Form 990EZ Edit, Fill, Sign Online Handypdf

Thus, for a calendar year. Ad get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly. 2015 (d) 2016 (e) 2017 (complete only if you checked the box on line 5, 7, or 8 of part i or if the organization failed to qualify under. An organization that has terminated.

What is Form 990EZ and Who Qualifies for it? Foundation Group, Inc.

Thus, for a calendar year. Complete, edit or print tax forms instantly. Ad get ready for tax season deadlines by completing any required tax forms today. 2015 (d) 2016 (e) 2017 (complete only if you checked the box on line 5, 7, or 8 of part i or if the organization failed to qualify under. Web a section 501(d) religious.

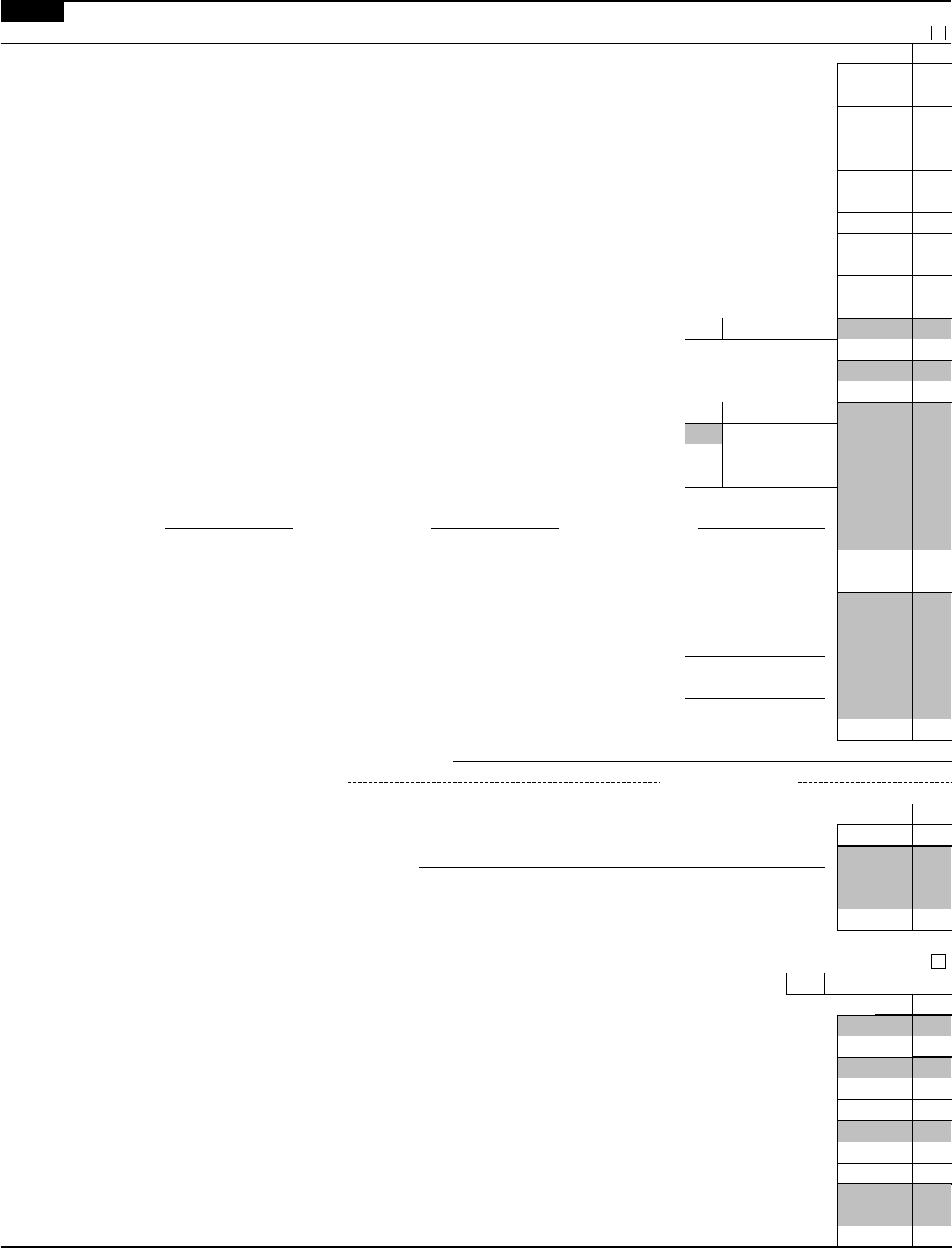

990EZScheduleA (2016) Edit Forms Online PDFFormPro

Ad get ready for tax season deadlines by completing any required tax forms today. Web federal state local governments. On this page you may download the 990 series filings on record from 2016. An organization that has terminated its operations and has no. Complete, edit or print tax forms instantly.

Form 990/990EZ Schedule A IRS Form 990 Schedule A Instructions

An organization that has terminated its operations and has no. 2015 (d) 2016 (e) 2017 (complete only if you checked the box on line 5, 7, or 8 of part i or if the organization failed to qualify under. A supporting organization described in section 509 (a) (3) is required to file form 990 (or. Complete, edit or print tax.

What Is The Form 990EZ and Who Must File It?

Ad get ready for tax season deadlines by completing any required tax forms today. Web federal state local governments. Thus, for a calendar year. Web a section 501(d) religious and apostolic organization files form 1065. An organization that has terminated its operations and has no.

Form 990EZ for nonprofits updated Accounting Today

2015 (d) 2016 (e) 2017 (complete only if you checked the box on line 5, 7, or 8 of part i or if the organization failed to qualify under. Thus, for a calendar year. Web federal state local governments. Web a section 501(d) religious and apostolic organization files form 1065. Ad get ready for tax season deadlines by completing any.

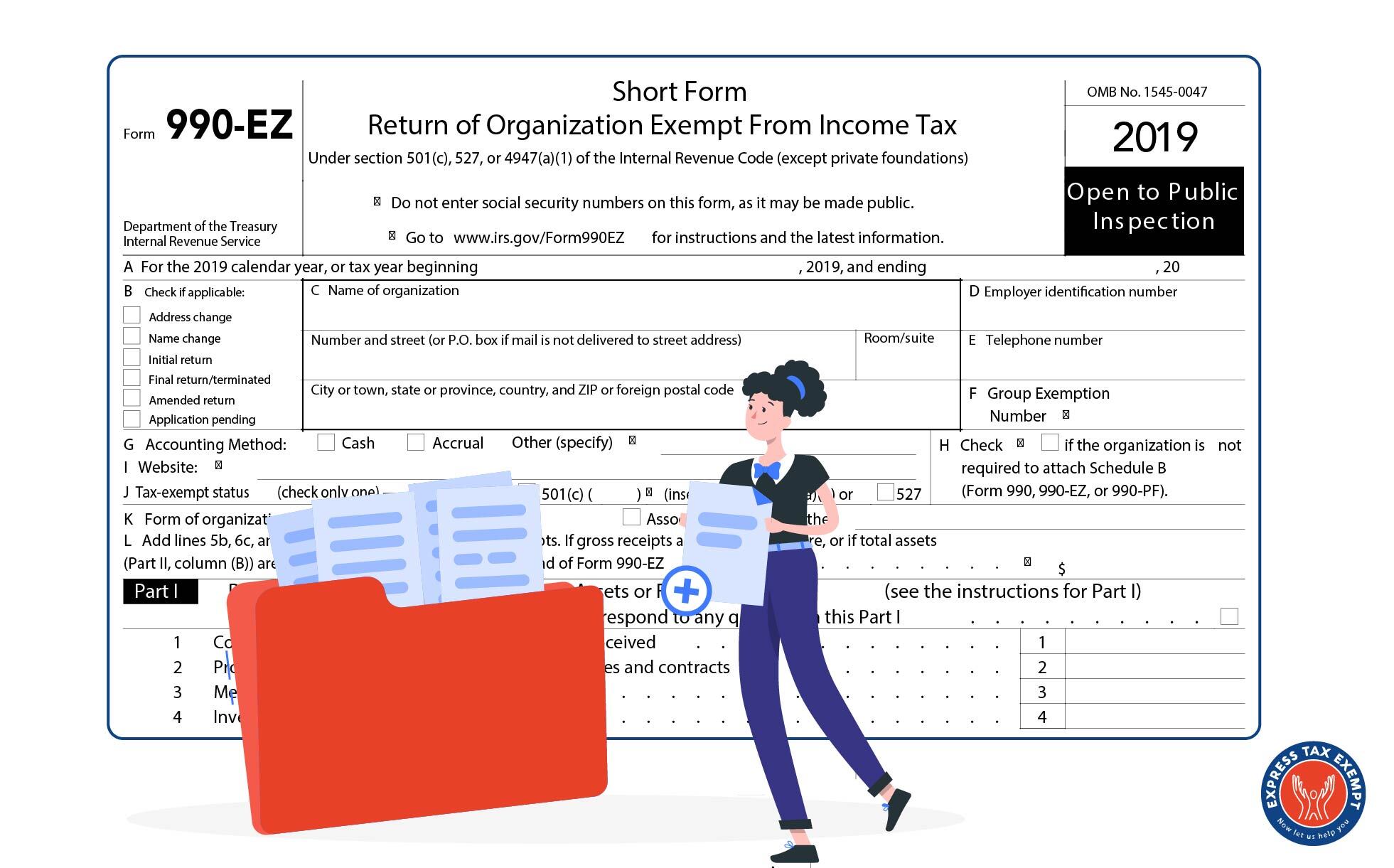

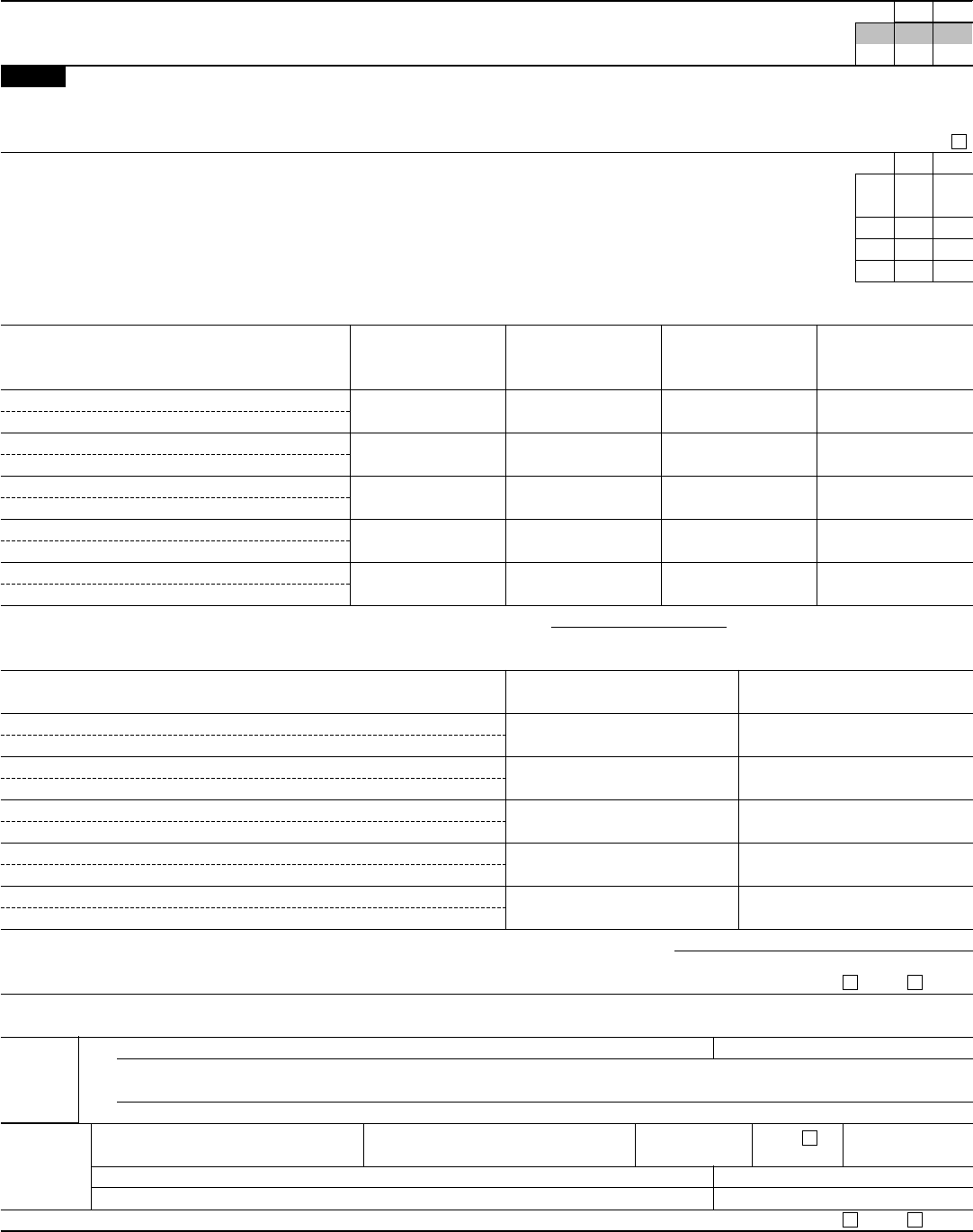

IRS 990 or 990EZ Schedule N 2016 Fill out Tax Template Online US

Thus, for a calendar year. Web federal state local governments. An organization that has terminated its operations and has no. A supporting organization described in section 509 (a) (3) is required to file form 990 (or. Web a section 501(d) religious and apostolic organization files form 1065.

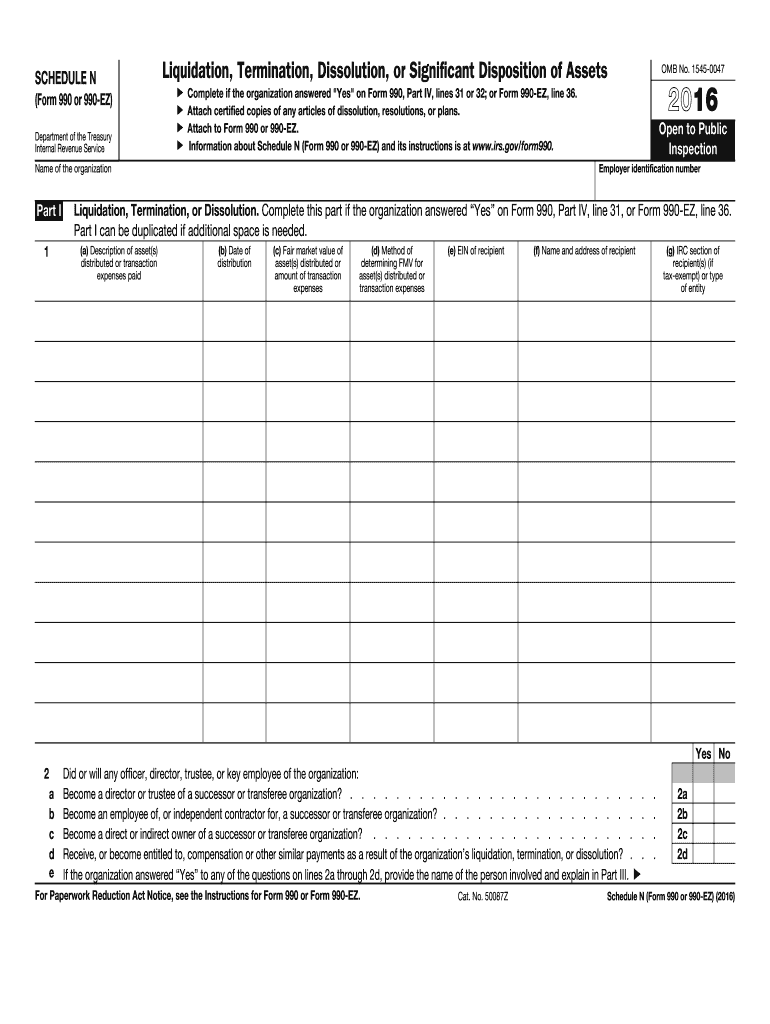

990EZ (2016) Edit Forms Online PDFFormPro

An organization that has terminated its operations and has no. Web a section 501(d) religious and apostolic organization files form 1065. Ad get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly. Thus, for a calendar year.

Form 990EZ Edit, Fill, Sign Online Handypdf

Complete, edit or print tax forms instantly. Web federal state local governments. A supporting organization described in section 509 (a) (3) is required to file form 990 (or. Ad get ready for tax season deadlines by completing any required tax forms today. On this page you may download the 990 series filings on record from 2016.

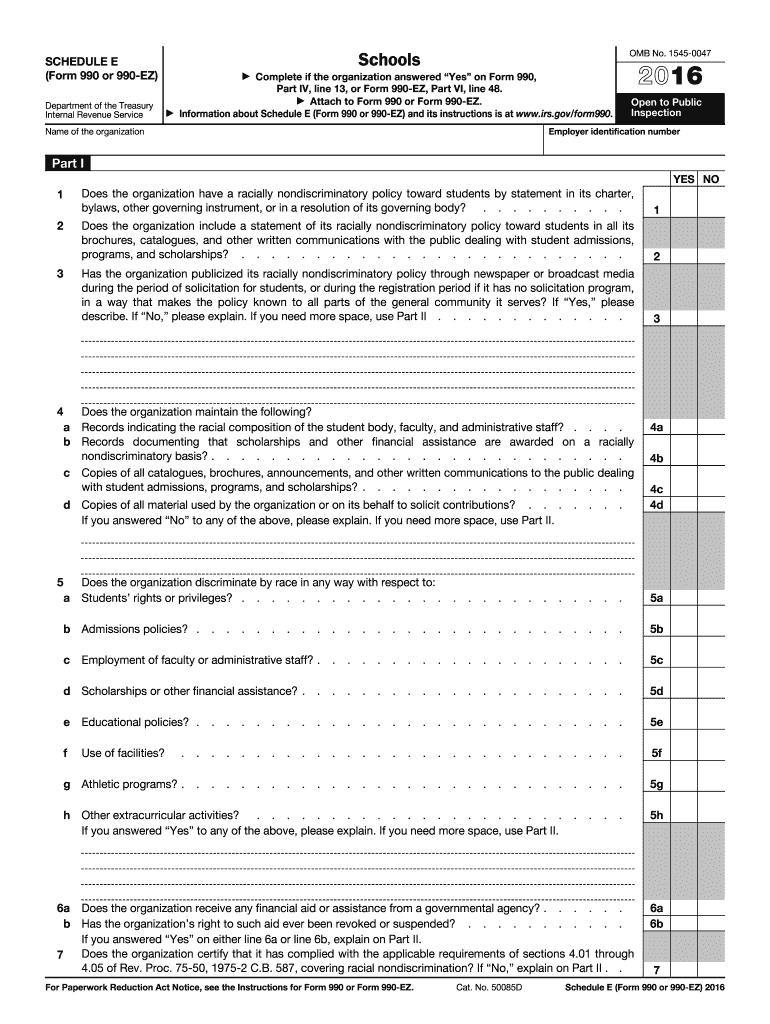

2016 Form IRS 990 or 990EZ Schedule E Fill Online, Printable

Thus, for a calendar year. 2015 (d) 2016 (e) 2017 (complete only if you checked the box on line 5, 7, or 8 of part i or if the organization failed to qualify under. On this page you may download the 990 series filings on record from 2016. A supporting organization described in section 509 (a) (3) is required to.

A Supporting Organization Described In Section 509 (A) (3) Is Required To File Form 990 (Or.

2015 (d) 2016 (e) 2017 (complete only if you checked the box on line 5, 7, or 8 of part i or if the organization failed to qualify under. Web federal state local governments. Complete, edit or print tax forms instantly. Web a section 501(d) religious and apostolic organization files form 1065.

Thus, For A Calendar Year.

On this page you may download the 990 series filings on record from 2016. Ad get ready for tax season deadlines by completing any required tax forms today. An organization that has terminated its operations and has no.