Form 990 N Filing Requirements

Form 990 N Filing Requirements - If a nonprofit has fluctuating income from year to year, it should file the e. Gross receipts of $200,000 or more, or total assets of $500,000 or more. Web 21 rows required filing (form 990 series) see the form 990 filing thresholds page to. A sponsoring organization of one. Web up to 10% cash back is at least three (3) years old and averaged $50,000 or less in gross receipts for the immediately preceding three (3) tax years (including the year for. Web open the electronic filing page: Web is at least 3 years old and averaged $50,000 or less in gross receipts for the immediately preceding 3 tax years (including the year for which calculations are being made). Web organizations that file form 990 use schedule d to provide required reporting for: Web an organization must file form 990, if it is: The irs will send you a reminder notice if you do not file your form.

Web open the electronic filing page: A sponsoring organization of one. Web an organization that normally has $50,000 or more in gross receipts and that is required to file an exempt organization information return must file either form 990, return of. Gross receipts of $200,000 or more, or total assets of $500,000 or more. Certain art and museum collections. Web 21 rows required filing (form 990 series) see the form 990 filing thresholds page to. Employer identification number (ein), also known as a. Web organizations that file form 990 use schedule d to provide required reporting for: If a nonprofit has fluctuating income from year to year, it should file the e. The irs will send you a reminder notice if you do not file your form.

Gross receipts of $200,000 or more, or total assets of $500,000 or more. Employer identification number (ein), also known as a. Web open the electronic filing page: Web 21 rows required filing (form 990 series) see the form 990 filing thresholds page to. Web an organization must file form 990, if it is: A sponsoring organization of one. Web is at least 3 years old and averaged $50,000 or less in gross receipts for the immediately preceding 3 tax years (including the year for which calculations are being made). Certain art and museum collections. If a nonprofit has fluctuating income from year to year, it should file the e. The irs will send you a reminder notice if you do not file your form.

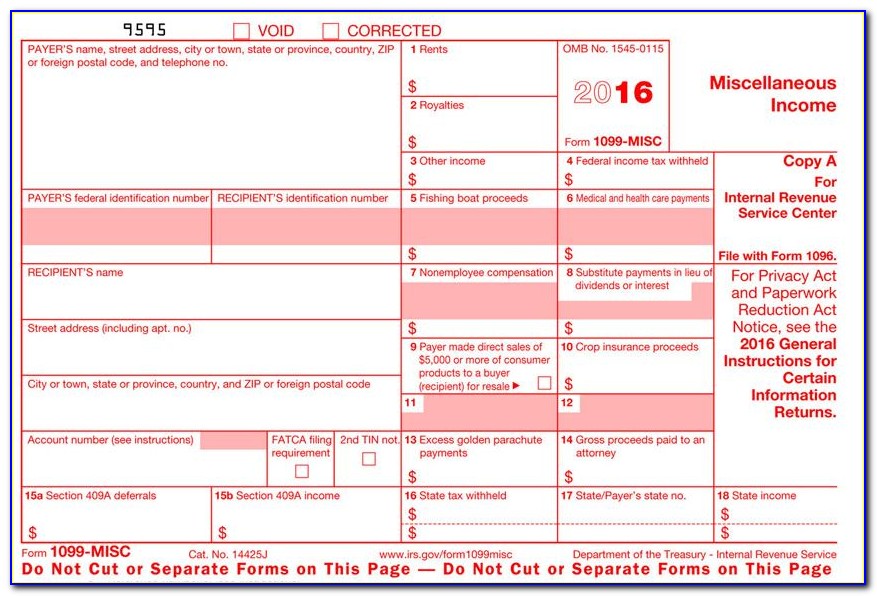

Irs Form 1099 Int Filing Requirements Form Resume Examples o85pxXq5ZJ

Web an organization must file form 990, if it is: Gross receipts of $200,000 or more, or total assets of $500,000 or more. Web up to 10% cash back is at least three (3) years old and averaged $50,000 or less in gross receipts for the immediately preceding three (3) tax years (including the year for. If a nonprofit has.

A concrete proposal for a Twin Cities Drupal User Group nonprofit

Web up to 10% cash back is at least three (3) years old and averaged $50,000 or less in gross receipts for the immediately preceding three (3) tax years (including the year for. Employer identification number (ein), also known as a. Web 21 rows required filing (form 990 series) see the form 990 filing thresholds page to. Web an organization.

Form 990 N E Filing Receipt Irs Status Accepted Forms NjkxMQ

If a nonprofit has fluctuating income from year to year, it should file the e. Web organizations that file form 990 use schedule d to provide required reporting for: Web open the electronic filing page: The irs will send you a reminder notice if you do not file your form. Web 21 rows required filing (form 990 series) see the.

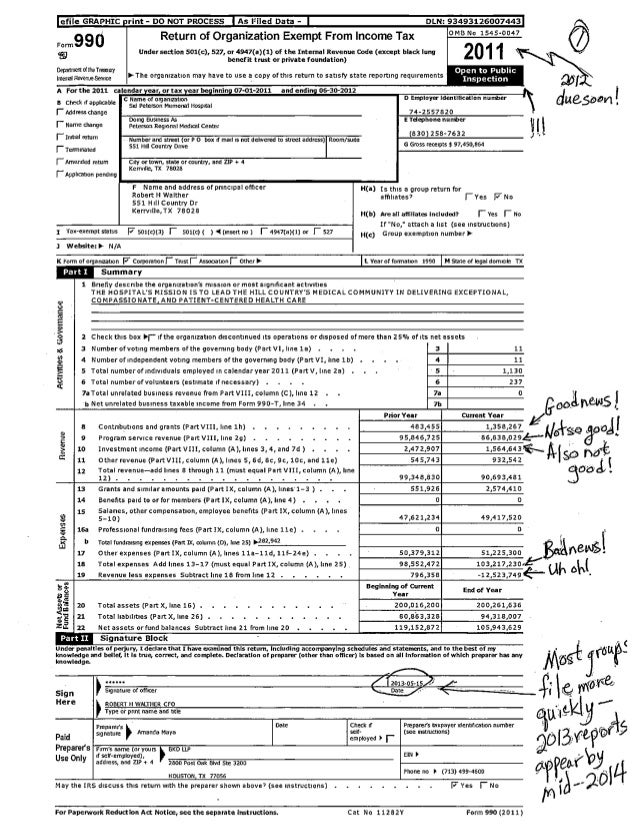

Form 990N Filing Requirement for Small Exempt Organizations YouTube

Certain art and museum collections. Web up to 10% cash back is at least three (3) years old and averaged $50,000 or less in gross receipts for the immediately preceding three (3) tax years (including the year for. Web 21 rows required filing (form 990 series) see the form 990 filing thresholds page to. Employer identification number (ein), also known.

Irs Form 990 N Filing Postcard Form Resume Examples GwkQ8AWOWV

Gross receipts of $200,000 or more, or total assets of $500,000 or more. Web 21 rows required filing (form 990 series) see the form 990 filing thresholds page to. Web up to 10% cash back is at least three (3) years old and averaged $50,000 or less in gross receipts for the immediately preceding three (3) tax years (including the.

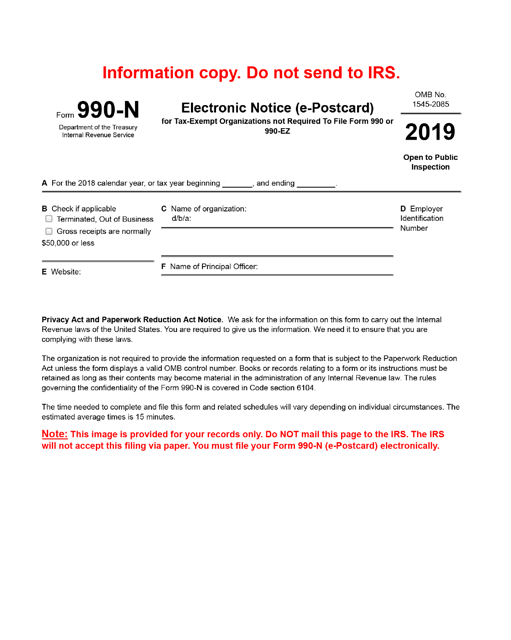

IRS Form 990N Download Printable PDF or Fill Online Electronic Notice

Web an organization must file form 990, if it is: The irs will send you a reminder notice if you do not file your form. Gross receipts of $200,000 or more, or total assets of $500,000 or more. Employer identification number (ein), also known as a. Web up to 10% cash back is at least three (3) years old and.

Failure To File Form 990N free download programs ealetitbit

Web an organization must file form 990, if it is: Web organizations that file form 990 use schedule d to provide required reporting for: A sponsoring organization of one. Web an organization that normally has $50,000 or more in gross receipts and that is required to file an exempt organization information return must file either form 990, return of. Web.

Form 990EZ for nonprofits updated Accounting Today

Gross receipts of $200,000 or more, or total assets of $500,000 or more. Employer identification number (ein), also known as a. Web organizations that file form 990 use schedule d to provide required reporting for: Web up to 10% cash back is at least three (3) years old and averaged $50,000 or less in gross receipts for the immediately preceding.

How to Complete Form 990N in 3 Simple Steps

Gross receipts of $200,000 or more, or total assets of $500,000 or more. Web organizations that file form 990 use schedule d to provide required reporting for: If a nonprofit has fluctuating income from year to year, it should file the e. Web an organization that normally has $50,000 or more in gross receipts and that is required to file.

Form 990 Electronic Filing Requirements Atlanta Audit Firm

Web 21 rows required filing (form 990 series) see the form 990 filing thresholds page to. Gross receipts of $200,000 or more, or total assets of $500,000 or more. Certain art and museum collections. Web open the electronic filing page: If a nonprofit has fluctuating income from year to year, it should file the e.

Web An Organization Must File Form 990, If It Is:

Web an organization that normally has $50,000 or more in gross receipts and that is required to file an exempt organization information return must file either form 990, return of. If a nonprofit has fluctuating income from year to year, it should file the e. The irs will send you a reminder notice if you do not file your form. Web organizations that file form 990 use schedule d to provide required reporting for:

Certain Art And Museum Collections.

Web 21 rows required filing (form 990 series) see the form 990 filing thresholds page to. A sponsoring organization of one. Web is at least 3 years old and averaged $50,000 or less in gross receipts for the immediately preceding 3 tax years (including the year for which calculations are being made). Web open the electronic filing page:

Gross Receipts Of $200,000 Or More, Or Total Assets Of $500,000 Or More.

Web up to 10% cash back is at least three (3) years old and averaged $50,000 or less in gross receipts for the immediately preceding three (3) tax years (including the year for. Employer identification number (ein), also known as a.