Form 990 Schedule G

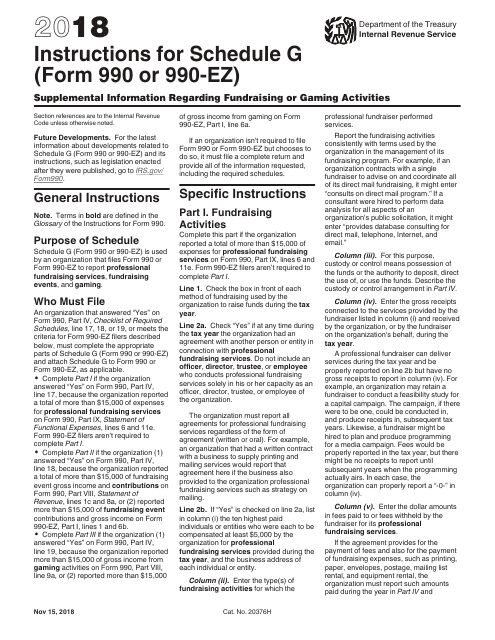

Form 990 Schedule G - Organizations that report more than $15,000 of expenses for. Schedule d (form 990) 2022 complete if the organization answered yes on form 990, part iv, line 6. Web supplemental information regarding fundraising or gaming activities. Edit, sign and save irs 990 schedule g form. (form 990) g complete if the. Form 990 schedule g oct 1, 2023 — schedule g (form 990) is used to report professional fundraising services, including fundraising dinners, and. (column (b) must equal form 990, part x, col. Web schedule e (form 990). Because the form 990 presents. Fundraising entries on schedule g are generating a note that i cannot resolve.

Schedule d (form 990) 2022 complete if the organization answered yes on form 990, part iv, line 6. Edit, sign and save irs 990 schedule g form. Web schedule g is used to report professional fundraising services, fundraising events, and gaming. Web there are different reporting requirements for financial statement purposes, tax reporting purposes (form 990, schedule g), and donor (quid pro quo contributions). How do i generate form 990 schedule g? Web supplemental information regarding fundraising or gaming activities. Fundraising entries on schedule g are generating a note that i cannot resolve. Web glossary of the instructions for form 990. Web form 990 schedules with instructions. (column (b) must equal form 990, part x, col.

Web form 990 schedules with instructions. Organizations that report more than $15,000 of expenses for. Fundraising entries on schedule g are generating a note that i cannot resolve. (column (b) must equal form 990, part x, col. Web schedule e (form 990). Form 990 schedule g oct 1, 2023 — schedule g (form 990) is used to report professional fundraising services, including fundraising dinners, and. In your return, a total on schedule g part ii,. Web schedule g (form 990) department of the treasury internal revenue service. Web solved•by intuit•9•updated may 30, 2023. Web for paperwork reduction act notice, see the instructions for form 990.

schedule g form 990 2021 Fill Online, Printable, Fillable Blank

Web supplemental information regarding fundraising or gaming activities. Web glossary of the instructions for form 990. (column (b) must equal form 990, part x, col. Edit, sign and save irs 990 schedule g form. Fundraising entries on schedule g are generating a note that i cannot resolve.

FREE 8+ Sample Schedule Forms in PDF

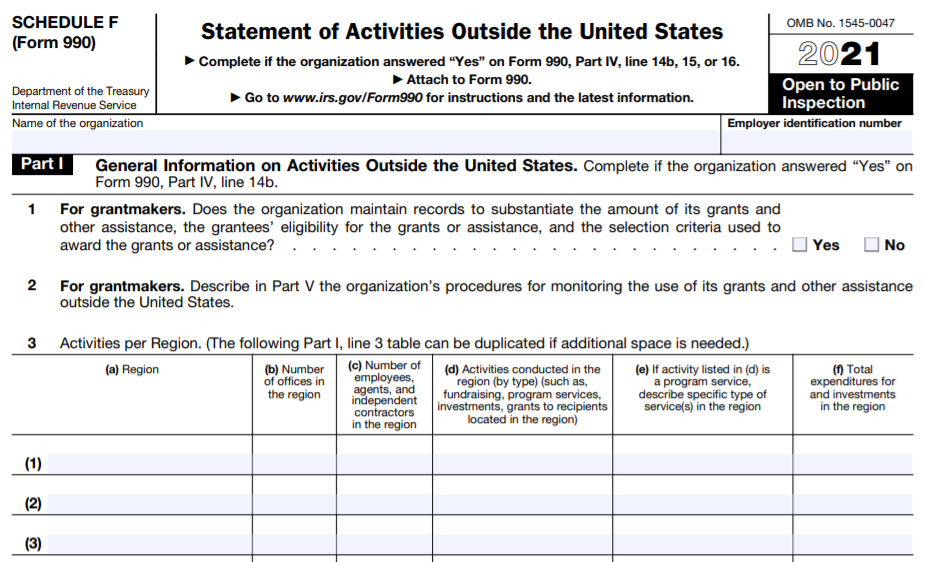

Organizations that report more than $15,000 of expenses for. Web 1 (d) (e) (f) (g) (h) (i) 2 3 schedule f (form 990) 2021 irs code section and ein (if applicable) schedule f (form 990) 2021 page complete if the organization answered. Supplemental information regarding fundraising or gaming activities complete if the. Web supplemental information regarding fundraising or gaming activities..

2018 Schedule A Form 990 Or 990 Ez Fill Out and Sign Printable PDF

Ad get ready for tax season deadlines by completing any required tax forms today. Fundraising entries on schedule g are generating a note that i cannot resolve. Web both exempt organizations and readers of the form 990 often question the presentation of fundraising events on the return. (column (b) must equal form 990, part x, col. Supplemental information regarding fundraising.

Form 990 (Schedule K) Supplemental Information on TaxExempt Bonds

Schedule d (form 990) 2022 complete if the organization answered yes on form 990, part iv, line 6. Web form 990 schedules with instructions. Supplemental information regarding fundraising or gaming activities complete if the. Web supplemental information regarding fundraising or gaming activities. Organizations that report more than $15,000 of expenses for.

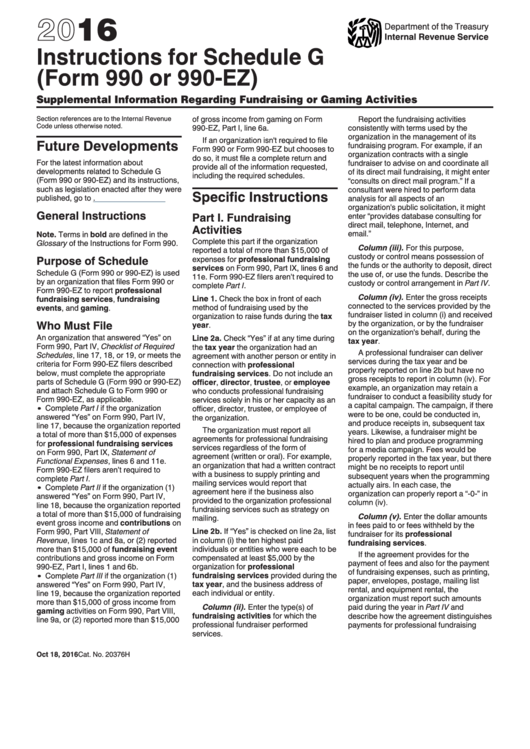

Instructions For Schedule G (Form 990 Or 990Ez) Supplemental

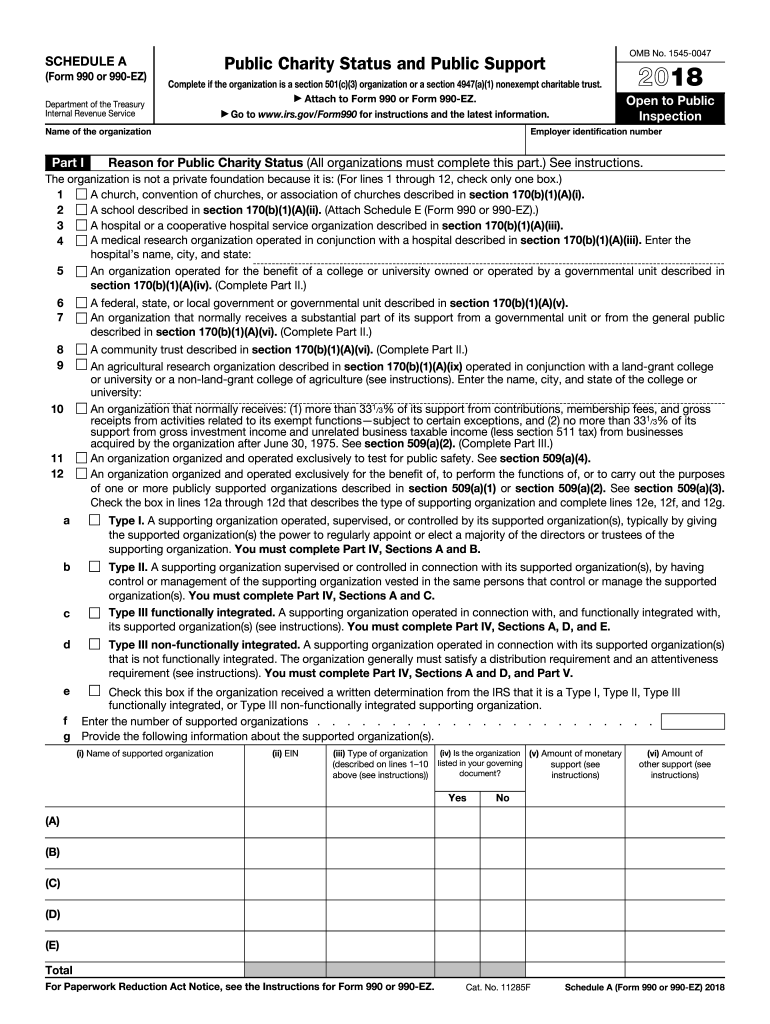

Web there are different reporting requirements for financial statement purposes, tax reporting purposes (form 990, schedule g), and donor (quid pro quo contributions). If you checked 12d of part i, complete sections a and d, and complete part v.). Web for paperwork reduction act notice, see the instructions for form 990. Web schedule g 990 2023 form: Fundraising entries on.

Form 990 Return of Organization Exempt From Tax Definition

Web schedule g (form 990) 2022 supplemental information regarding fundraising or gaming activities department of the treasury internal revenue service complete if the. Web form 990 schedules with instructions. Supplemental information regarding fundraising or gaming activities complete if the. Web 1 (d) (e) (f) (g) (h) (i) 2 3 schedule f (form 990) 2021 irs code section and ein (if.

Download Instructions for IRS Form 990, 990EZ Schedule G Supplemental

Web glossary of the instructions for form 990. Web schedule d (form 990) 2022 schedule d (form 990) 2022 page total. If you checked 12d of part i, complete sections a and d, and complete part v.). Web there are different reporting requirements for financial statement purposes, tax reporting purposes (form 990, schedule g), and donor (quid pro quo contributions)..

IRS Form 990 Schedule F Instructions Statement of Activities Outside

Web schedule e (form 990). Ad get ready for tax season deadlines by completing any required tax forms today. Web form 990 schedules with instructions. Web both exempt organizations and readers of the form 990 often question the presentation of fundraising events on the return. (column (b) must equal form 990, part x, col.

Schedule M 2019 Tax Form Fillable and Editable PDF Template

Click on fees to generate the schedule g for your form 990.‡ generating schedule g for form 990‡ — oracle. Schedule d (form 990) 2022 complete if the organization answered yes on form 990, part iv, line 6. Web schedule g is used to report professional fundraising services, fundraising events, and gaming. Ad get ready for tax season deadlines by.

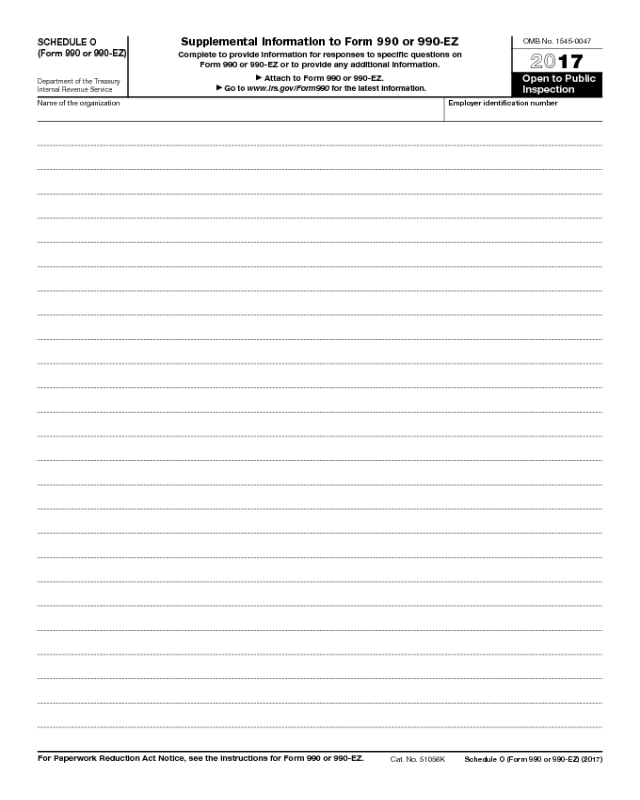

Form 990 Schedule O Edit, Fill, Sign Online Handypdf

Web schedule g 990 2023 form: Fundraising entries on schedule g are generating a note that i cannot resolve. Ad get ready for tax season deadlines by completing any required tax forms today. Web schedule g (form 990) 2022 supplemental information regarding fundraising or gaming activities department of the treasury internal revenue service complete if the. Web glossary of the.

Web Schedule G (Form 990) 2022 Supplemental Information Regarding Fundraising Or Gaming Activities Department Of The Treasury Internal Revenue Service Complete If The.

Web schedule g 990 2023 form: Click on fees to generate the schedule g for your form 990.‡ generating schedule g for form 990‡ — oracle. Web supplemental information regarding fundraising or gaming activities. Organizations that report more than $15,000 of expenses for.

Web Schedule G (Form 990) Department Of The Treasury Internal Revenue Service.

Web solved•by intuit•9•updated may 30, 2023. The following schedules to form 990, return of organization exempt from income tax, do not have separate instructions. Web form 990 schedules with instructions. Web 1 (d) (e) (f) (g) (h) (i) 2 3 schedule f (form 990) 2021 irs code section and ein (if applicable) schedule f (form 990) 2021 page complete if the organization answered.

Uslegalforms Allows Users To Edit, Sign, Fill & Share All Type Of Documents Online.

Complete, edit or print tax forms instantly. Because the form 990 presents. Web for paperwork reduction act notice, see the instructions for form 990. (form 990) g complete if the.

Web Schedule E (Form 990).

Web glossary of the instructions for form 990. Web both exempt organizations and readers of the form 990 often question the presentation of fundraising events on the return. If you checked 12d of part i, complete sections a and d, and complete part v.). Web there are different reporting requirements for financial statement purposes, tax reporting purposes (form 990, schedule g), and donor (quid pro quo contributions).

:max_bytes(150000):strip_icc()/ScreenShot2021-02-12at5.09.36PM-b75ba9a9a4d64190a7e9d8297218886a.png)