Form An Llc In Delaware Advantages

Form An Llc In Delaware Advantages - Because of how flexible llcs are, choosing to structure as business as a limited liability company has become an extremely popular choice among local business owners. No tax on intangible income, like. Benefits of incorporating in delaware tax benefits Delaware has one of the most straightforward processes in forming an llc. The filing fee is $90. Web advantages of forming an llc in delaware 1) strong legal framework: Delaware has a specialized court, the court of chancery, which handles corporate matters, providing predictability and expertise in resolving business. Web formation service delaware llc business owners all over the world choose to form or register their business as a delaware llc to take advantage of the legal benefits provided by the state’s predictable business friendly laws. Form llc in delaware benefits refers to the unique benefits your business will receive if it is formed as a limited liability company in the state of delaware. Web what are the advantages of forming an llc in delaware?

Delaware has one of the most straightforward processes in forming an llc. As in most states, delaware law requires you to. Simple and secure of all the llcs in the known universe, the delaware llc is by far the simplest to form. Web major delaware llc advantages. It's important to understand the benefits of an llc to determine if this is the right business structure for your company. Create your llc in delaware. The court of chancery in delaware hears all cases involving delaware. The delaware division of corporations doesn’t require a lot of information in terms of the llc’s formation documents. Benefits of incorporating in delaware tax benefits Gain privacy, asset protection, and tax savings advantages.

Web what are the advantages of forming an llc in delaware? Web $249 + state filing fees i need all the essentials to help me operate in a compliant way form my llc includes basic package, plus: Web with minimal startup requirements, simple maintenance and the ability for members to establish their own company structures and rules, there are many advantages to forming a delaware llc. On top of that, a delaware llc will be more costly when it comes to your ongoing tax obligations. Web the key benefits to incorporating in delaware are tax benefits, privacy, expediency, simplified structure and the corporation court. No income tax if the llc doesn’t do business in delaware, though llcs must pay $300 annually for the delaware llc. Benefits of incorporating in delaware tax benefits Gain privacy, asset protection, and tax savings advantages. Web 12 benefits of forming a delaware llc: You can form a series llc, an anonymous llc, and benefit from delaware's court of chancery.

Delaware LLC How to Start an LLC in Delaware TRUiC

Web forming an llc in delaware has several benefits, including privacy protection, strong protection from creditors, the potential of forming a series llc, state tax advantages, and a special court, the court of chancery, for business matters. Custom rules and business structure in delaware, llcs have freedom of contract, which means that the llc’s structure and governing rules can be.

Delaware Limited Liability Company / Form a Delaware LLC

Web $249 + state filing fees i need all the essentials to help me operate in a compliant way form my llc includes basic package, plus: Operate anywhere delaware llcs can operate in any state or country. Benefits of incorporating in delaware tax benefits Simple and secure of all the llcs in the known universe, the delaware llc is by.

How to form a Delaware INC or LLC in 4 Steps

No income tax if the llc doesn’t do business in delaware, though llcs must pay $300 annually for the delaware llc. The first step to starting an llc in delaware is choosing a name. No sales tax if the llc doesn’t do business in the state. One of the delaware llc advantages is taxation. You can elect to be taxed.

Form Llc In Nevada Or Delaware Universal Network

Web forming an llc in delaware has several benefits, including privacy protection, strong protection from creditors, the potential of forming a series llc, state tax advantages, and a special court, the court of chancery, for business matters. A delaware llc is not required to pay state income taxes if it. Web the delaware court of chancery's recent decision in new.

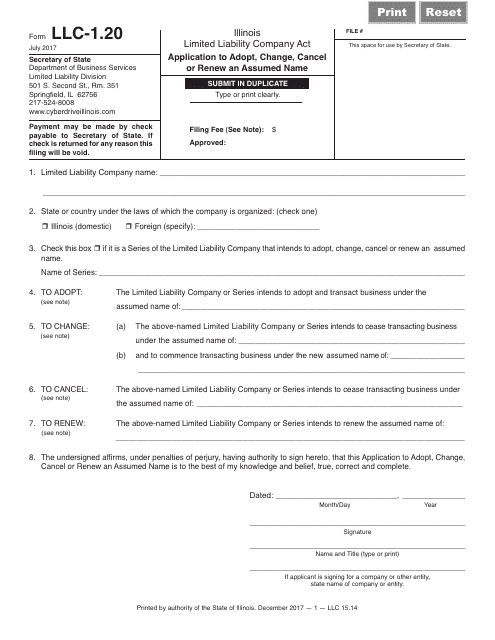

Form LLC1.20 Download Fillable PDF or Fill Online Application to Adopt

An operating agreement, which helps you set entity guidelines and settle disputes an ein, which is used to. Web forming an llc in delaware has several benefits, including privacy protection, strong protection from creditors, the potential of forming a series llc, state tax advantages, and a special court, the court of chancery, for business matters. Delaware has a specialized court,.

Cost Of Forming A Delaware Llc Form Resume Examples BpV5mz5V1Z

Operate anywhere delaware llcs can operate in any state or country. No income tax if the llc doesn’t do business in delaware, though llcs must pay $300 annually for the delaware llc. Create your llc in delaware. Delaware has a specialized court, the court of chancery, which handles corporate matters, providing predictability and expertise in resolving business. Rich, underscores and.

Form Llc In Nevada Or Delaware Universal Network

A delaware llc is not required to pay state income taxes if it. It's important to understand the benefits of an llc to determine if this is the right business structure for your company. Gain privacy, asset protection, and tax savings advantages. Their courts are efficient & knowledgeable. Web 12 benefits of forming a delaware llc:

Forming A Delaware Series Llc Universal Network

You can form a series llc, an anonymous llc, and benefit from delaware's court of chancery. Choose a name for your llc. As in most states, delaware law requires you to. Web 12 benefits of forming a delaware llc: Creating an llc is simple and straightforward.

How To Register An LLC In Delaware (In Only 5 Steps)

One of the delaware llc advantages is taxation. Web 12 benefits of forming a delaware llc: As in most states, delaware law requires you to. Delaware has one of the most straightforward processes in forming an llc. Accessibility almost anyone (other than individuals from restricted countries) can form a delaware llc without having to live in or visit delaware.

Delaware LLC Everything You Need to Know Business Formations

Web the benefits of forming an llc in delaware. Delaware has one of the most straightforward processes in forming an llc. Gain privacy, asset protection, and tax savings advantages. Rich, underscores and reinforces the superior benefits of delaware lps and llcs for private equity funds. On top of that, a delaware llc will be more costly when it comes to.

Delaware Has One Of The Most Straightforward Processes In Forming An Llc.

The filing fee is $90. Web advantages of forming an llc in delaware 1) strong legal framework: The delaware division of corporations requires only a minimal amount of information in an llc’s formation documents (called the certificate of formation). The first step to starting an llc in delaware is choosing a name.

The Delaware Division Of Corporations Doesn’t Require A Lot Of Information In Terms Of The Llc’s Formation Documents.

On top of that, a delaware llc will be more costly when it comes to your ongoing tax obligations. No sales tax if the llc doesn’t do business in the state. Forming a delaware llc is easy. Obtain a delaware business license.

You Can Elect To Be Taxed As A Partnership, S Corporation Or Sole Proprietorship.

Simple and secure of all the llcs in the known universe, the delaware llc is by far the simplest to form. Operate anywhere delaware llcs can operate in any state or country. Their courts are efficient & knowledgeable. Because of how flexible llcs are, choosing to structure as business as a limited liability company has become an extremely popular choice among local business owners.

Web The Key Benefits To Incorporating In Delaware Are Tax Benefits, Privacy, Expediency, Simplified Structure And The Corporation Court.

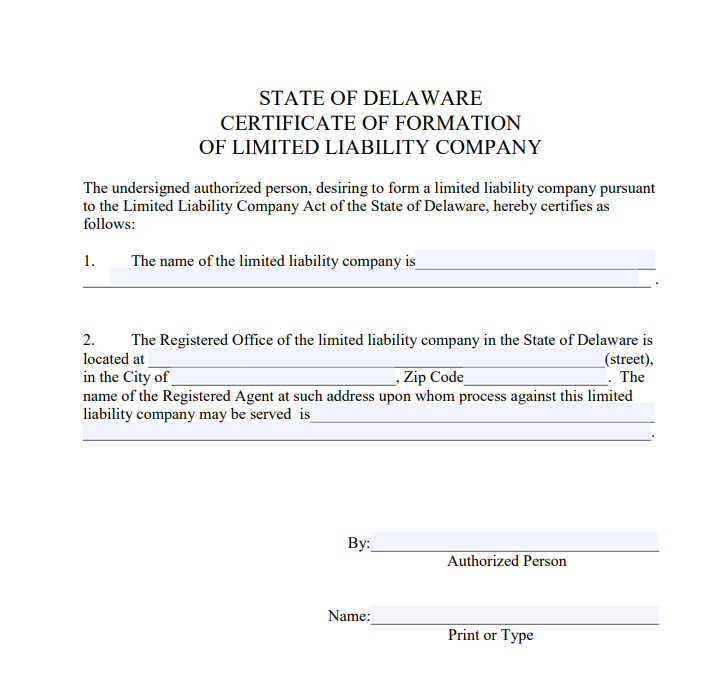

Web 12 benefits of forming a delaware llc: Visit our website to learn more. All you have to provide is your company name, your contact information and the names of the members of the llc. Web to form an llc in delaware, you must submit a certificate of formation to the delaware division of corporations.