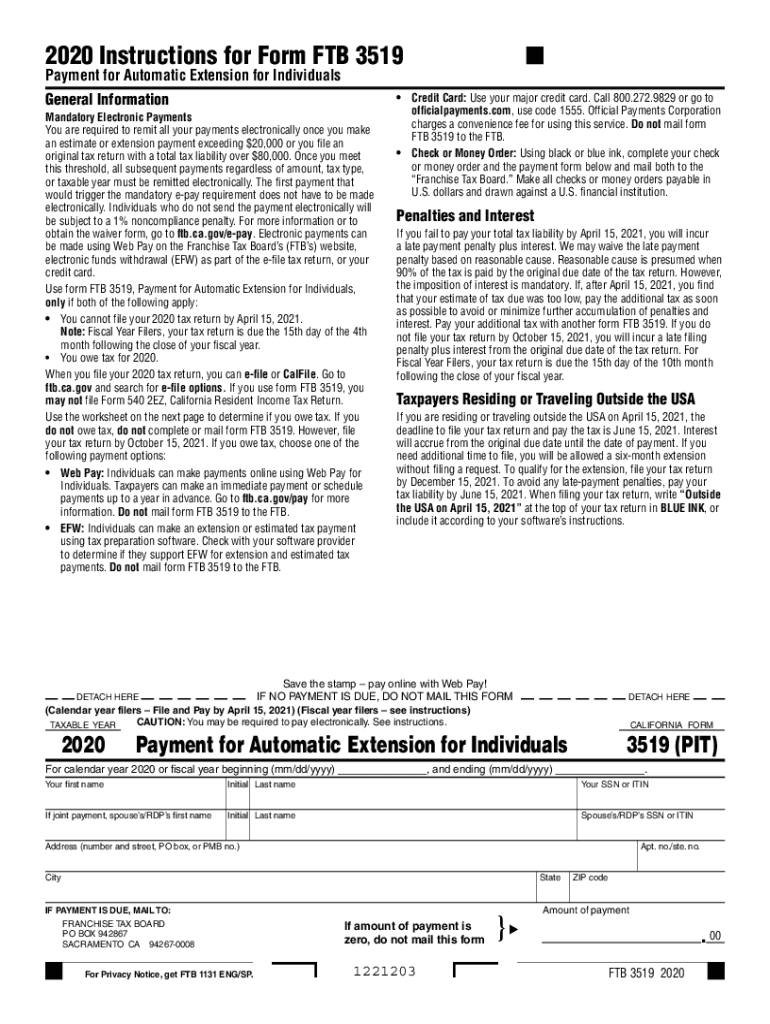

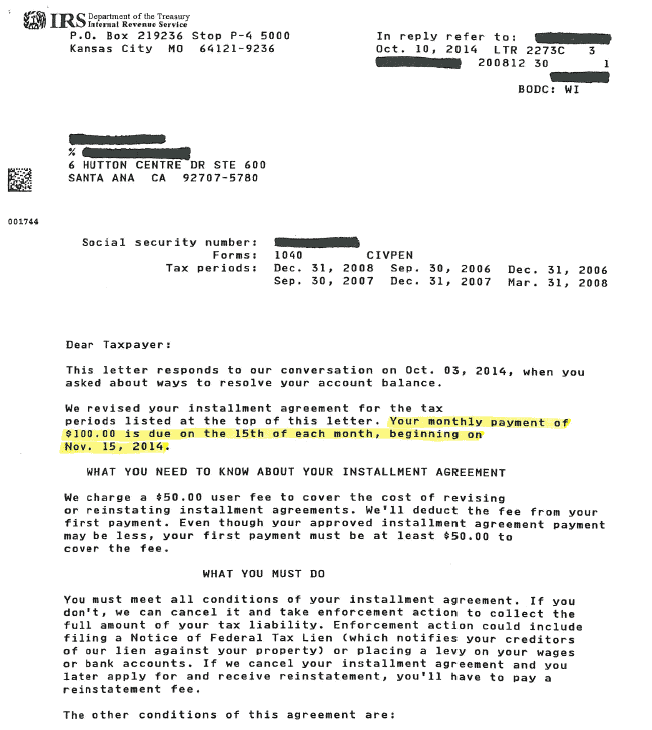

Form Ftb 3519

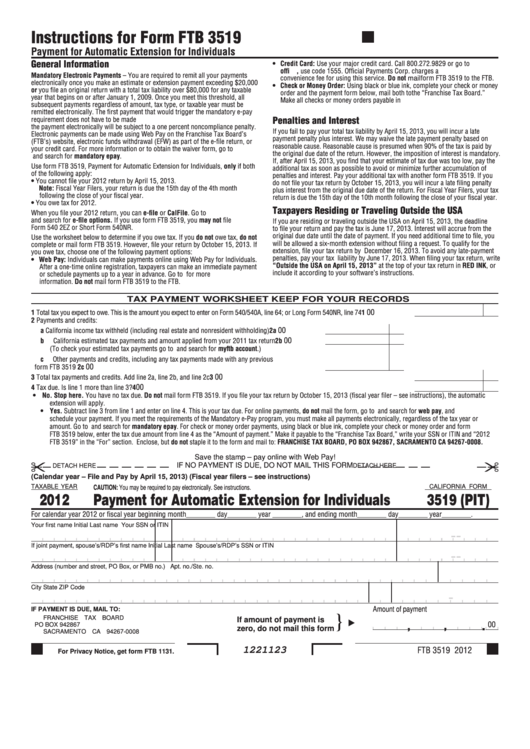

Form Ftb 3519 - You cannot file your 2020 tax return by april 15, 2021. Use the worksheet on the next page to determine if you owe tax. Edit your ftb 3519 online type text, add images, blackout confidential details, add comments, highlights and more. This form is for income earned in tax year 2022, with tax returns due in april. File form 540 2ez or short form 540nr. Web follow the simple instructions below: Sign it in a few clicks draw your signature, type it,. Web send form 3519 ftb via email, link, or fax. You cannot file your 2020 tax return by april 15, 2021. Web use form ftb 3519, payment for automatic extension for individuals, only if both of the following apply:

Web get forms, instructions, and publications. You cannot file your 2018 tax return by april 15, 2019. Type text, add images, blackout confidential details, add. File form 540 2ez or short form 540nr. Successfully filing the 3519 (pit). Use the worksheet on the next page to determine if you owe tax. You cannot file your 2020 tax return by april 15, 2021. Web use form ftb 3519, payment for automatic extension for individuals, only if both of the following apply: Web we last updated california form 3519 in january 2023 from the california franchise tax board. You can also download it, export it or print it out.

File form 540 2ez or short form 540nr. Sign it in a few clicks draw your signature, type it,. Web the 3519 (pit) form is used for california residents who seek an extension of the filing deadline for their state income tax returns. Web get forms, instructions, and publications. Web use form ftb 3519, payment for automatic extension for individuals, only if both of the following apply: Use the worksheet on the next page to determine if you owe tax. Instructions), the automatic extension will apply. Web we last updated california form 3519 in january 2023 from the california franchise tax board. If payment is due, mail to: Edit your ftb 3519 online type text, add images, blackout confidential details, add comments, highlights and more.

CA FTB 3519 2020 Fill out Tax Template Online US Legal Forms

Web use payment for automatic extension for individuals (ftb 3519) to make a payment by mail if both of the following apply: Sign it in a few clicks draw your signature, type it,. Instructions), the automatic extension will apply. You cannot file your 2018 tax return by april 15, 2019. However, with our preconfigured online templates, things get simpler.

Schedule Ca 540Nr Fill Out and Sign Printable PDF Template signNow

Instructions), the automatic extension will apply. Type text, add images, blackout confidential details, add. If payment is due, mail to: You can also download it, export it or print it out. Web use form ftb 3519, payment for automatic extension for individuals, only if both of the following apply:

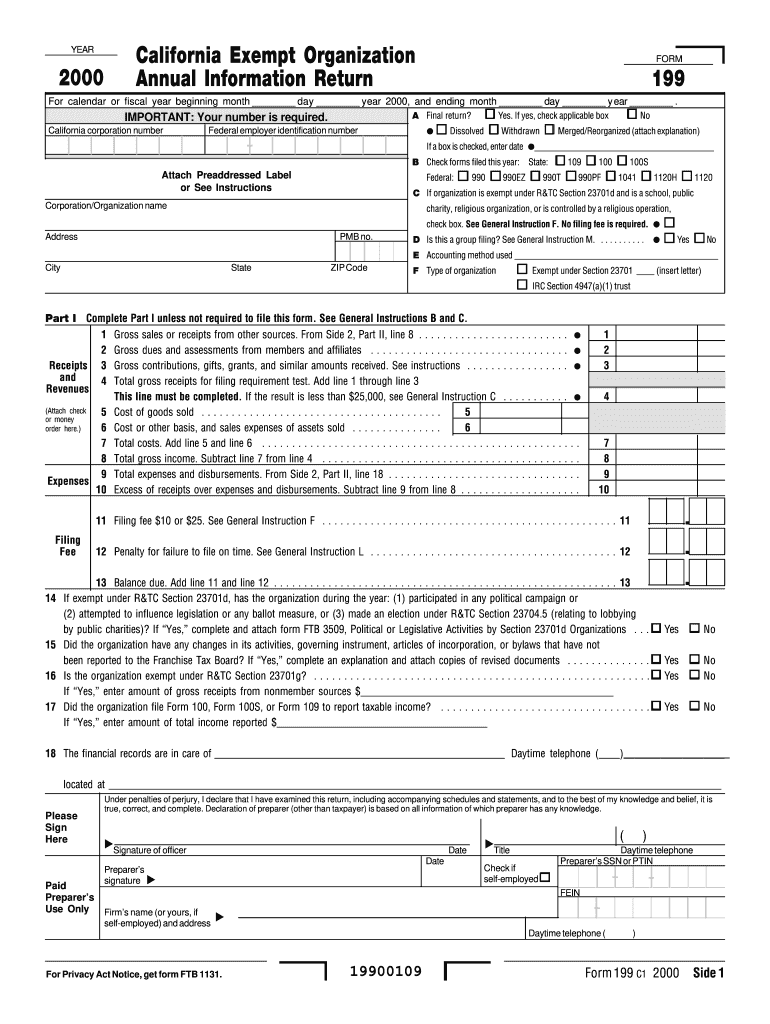

CA FTB 199 2000 Fill out Tax Template Online US Legal Forms

This form is for income earned in tax year 2022, with tax returns due in april. Web use form ftb 3519, payment for automatic extension for individuals, only if both of the following apply: Web use payment for automatic extension for individuals (ftb 3519) to make a payment by mail if both of the following apply: You cannot file your.

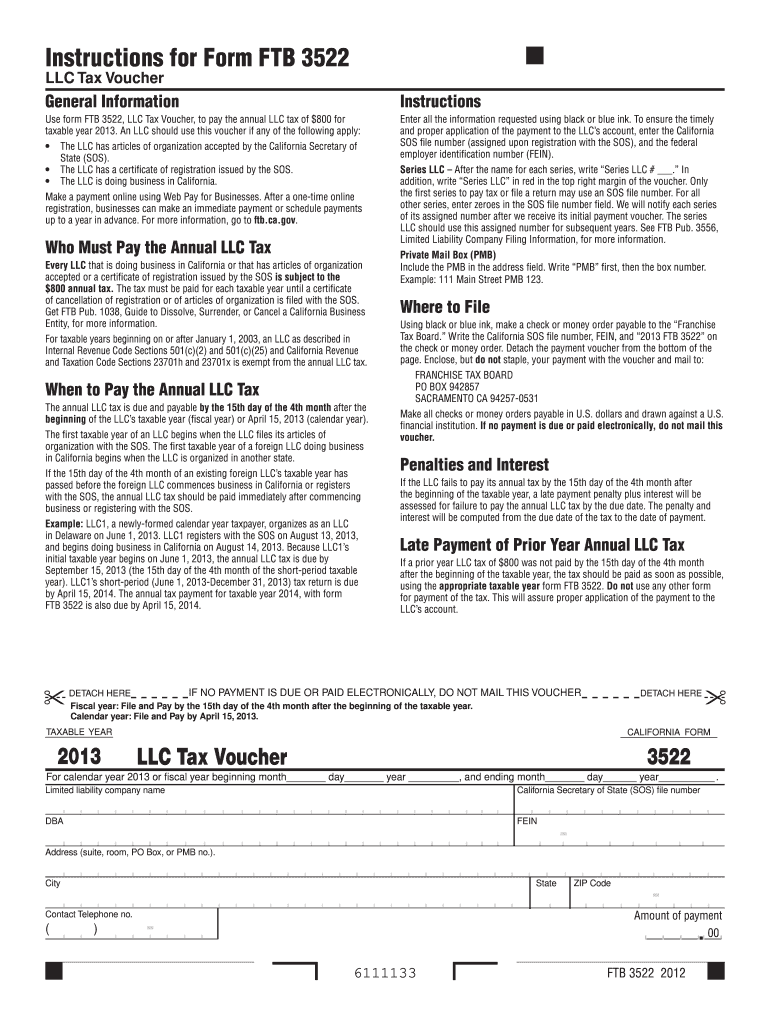

Instructions for Form FTB 3522 California Franchise Tax Board Fill

Web use form ftb 3519, payment for automatic extension for individuals, only if both of the following apply: Web use form ftb 3519, payment for automatic extension for individuals, only if both of the following apply: Web use form ftb 3519, payment for automatic extension for individuals, only if both of the following apply: Type text, add images, blackout confidential.

Where To Mail Federal Tax Return California 2021

You can also download it, export it or print it out. Web follow the simple instructions below: Use the worksheet on the next page to determine if you owe tax. Web send form 3519 ftb via email, link, or fax. You cannot file your 2020 tax return by april 15, 2021.

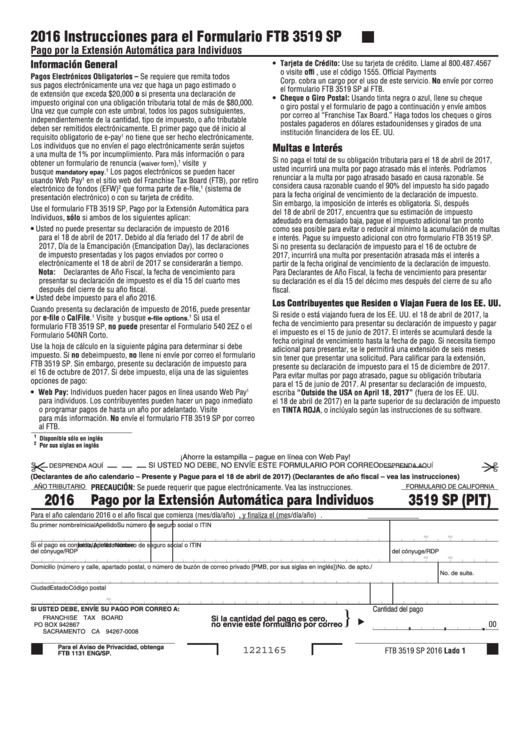

Fillable Form 3519 Pago Por La Extension Automatica Para Individuos

You cannot file your 2022 tax return, form 540 or form 540nr, by april. You cannot file your 2018 tax return by april 15, 2019. Web if you use form ftb 3519, you. Web use payment for automatic extension for individuals (ftb 3519) to make a payment by mail if both of the following apply: Edit your ftb 3519 online.

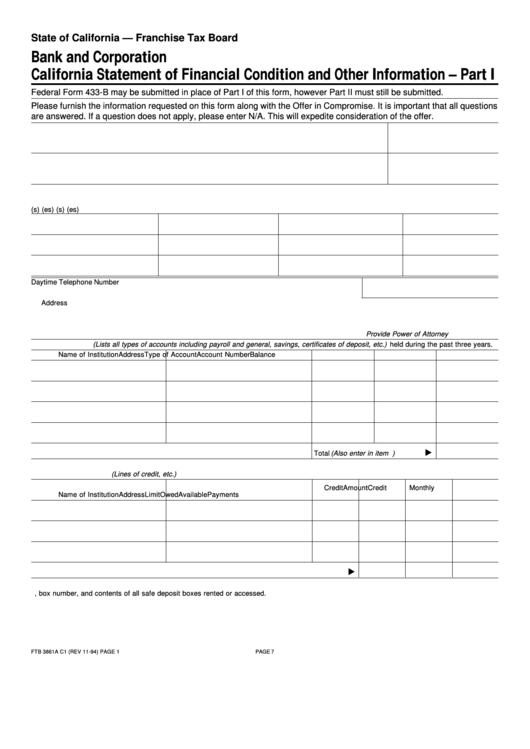

Form Ftb 3861a C1 Bank And Corporation Statement Of Financial

Web use form ftb 3519, payment for automatic extension for individuals, only if both of the following apply: You cannot file your 2020 tax return by april 15, 2021. This form is for income earned in tax year 2022, with tax returns due in april. Edit your ftb 3519 online. Instructions), the automatic extension will apply.

Fillable Form Ftb 3519 Payment For Automatic Extension For

However, with our preconfigured online templates, things get simpler. Web if you use form ftb 3519, you. You cannot file your 2022 tax return, form 540 or form 540nr, by april. You cannot file your 2018 tax return by april 15, 2019. Web if you use form ftb 3519, you may not file form 540 2ez, california resident income tax.

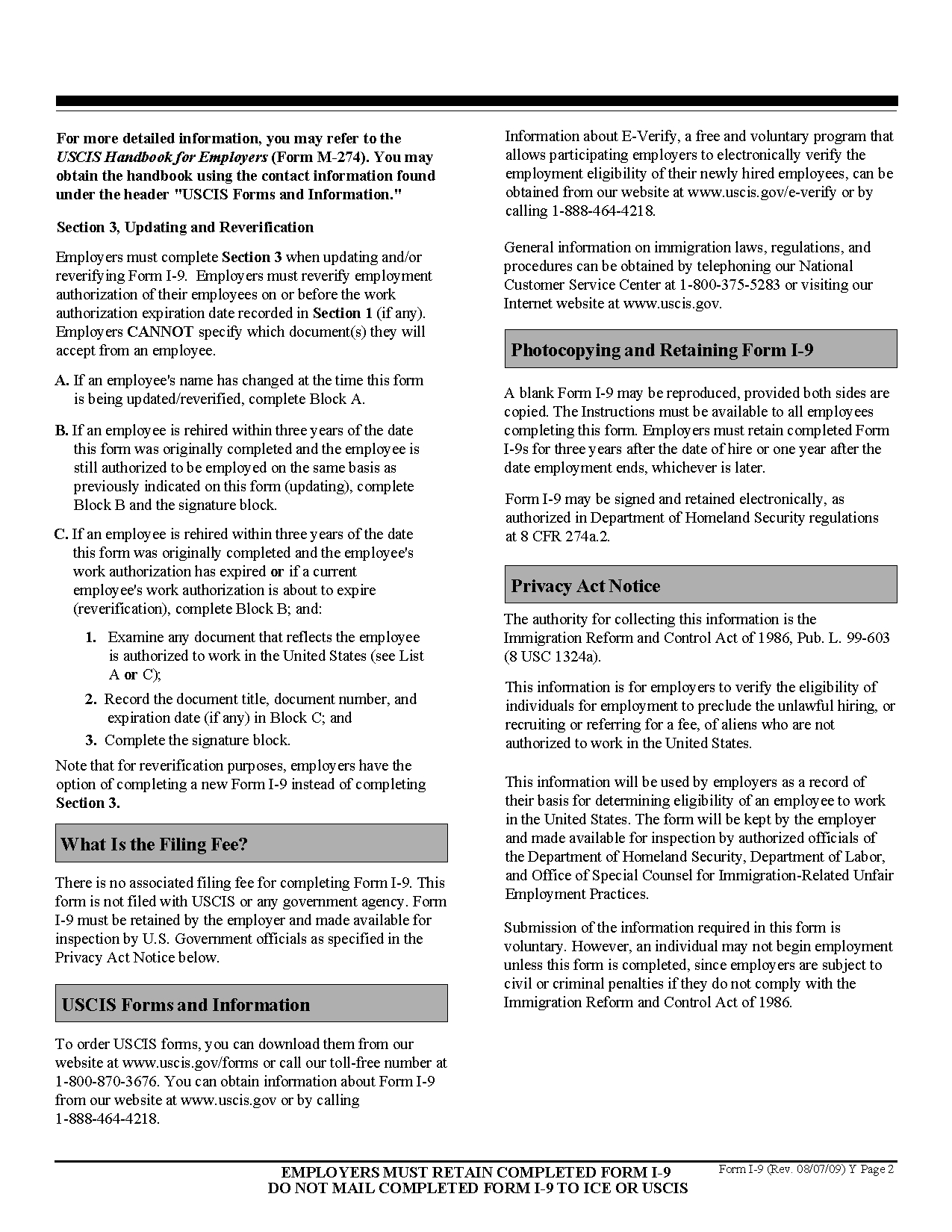

Free I 9 Form Printable Example Calendar Printable

You cannot file your 2020 tax return by april 15, 2021. Web if you use form ftb 3519, you. Edit your ftb 3519 online. Franchise tax board po box 942867 sacramento ca. Use the worksheet on the next page to determine if you owe tax.

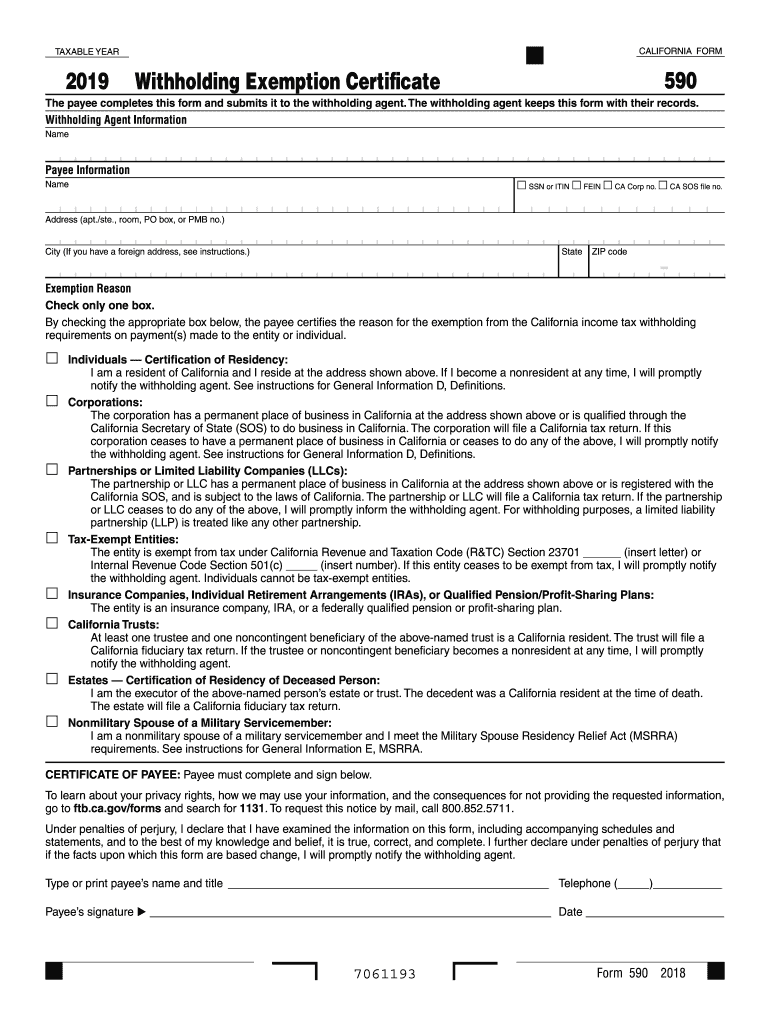

Ca590 Fill Out and Sign Printable PDF Template signNow

You cannot file your 2020 tax return by april 15, 2021. Successfully filing the 3519 (pit). This form is for income earned in tax year 2022, with tax returns due in april. Edit your ftb 3519 online. Franchise tax board po box 942867 sacramento ca.

Instructions), The Automatic Extension Will Apply.

You cannot file your 2022 tax return, form 540 or form 540nr, by april. Web if you use form ftb 3519, you may not file form 540 2ez, california resident income tax return. Web use payment for automatic extension for individuals (ftb 3519) to make a payment by mail if both of the following apply: You cannot file your 2018 tax return by april 15, 2019.

You Cannot File Your 2020 Tax Return By April 15, 2021.

You cannot file your 2022 tax return by april 18, 2023 you. This form is for income earned in tax year 2022, with tax returns due in april. Use the worksheet on the next page to determine if you owe tax. Web send form 3519 ftb via email, link, or fax.

Type Text, Add Images, Blackout Confidential Details, Add.

Use the worksheet on the next page to determine if you owe tax. Sign it in a few clicks draw your signature, type it,. Web the 3519 (pit) form is used for california residents who seek an extension of the filing deadline for their state income tax returns. Successfully filing the 3519 (pit).

However, With Our Preconfigured Online Templates, Things Get Simpler.

Web use form ftb 3519, payment for automatic extension for individuals, only if both of the following apply: Web follow the simple instructions below: Edit your ftb 3519 online type text, add images, blackout confidential details, add comments, highlights and more. Edit your ftb 3519 online.