Form I-751 Evidence Of Relationship

Form I-751 Evidence Of Relationship - Web about form 851, affiliations schedule. If extra space is needed to complete any item, attach a continuation sheet, indicate the item. We ask for the information on this form to carry out the internal revenue laws of the united states. Web uploading organized relationship evidence is important so that the uscis officer can easily look through your application. The parent corporation of an affiliated group files form 851 with its consolidated income tax return to: Web up to 25% cash back as a u.s. Web books or records relating to a form or its instructions must be retained as long as their contents may become material in the administration of any internal revenue law. If the marriage upon which you obtained conditional permanent. Web form 8851 (rev. The easiest way to upload relationship.

We ask for the information on this form to carry out the internal revenue laws of the united states. Web up to 25% cash back you will need to prove that your relationship was not a fraud or sham, entered into for purposes of violating immigration law. The parent corporation of an affiliated group files form 851 with its consolidated income tax return to: Web up to 25% cash back as a u.s. You claim the qualified electric vehicle credit (form 8834), the personal use part of the alternative fuel vehicle refueling. The easiest way to upload relationship. Web uploading organized relationship evidence is important so that the uscis officer can easily look through your application. Web form 3800 or line 25 of form 3800 is more than zero. Web form 8851 (rev. Web about form 851, affiliations schedule.

You claim the qualified electric vehicle credit (form 8834), the personal use part of the alternative fuel vehicle refueling. Web up to 25% cash back as a u.s. The parent corporation of an affiliated group files form 851 with its consolidated income tax return to: Web uploading organized relationship evidence is important so that the uscis officer can easily look through your application. If extra space is needed to complete any item, attach a continuation sheet, indicate the item. Web form 8851 (rev. If the marriage upon which you obtained conditional permanent. The easiest way to upload relationship. You will need to provide supporting. For a list of documents that conditional.

Form I751 Petition to Remove Conditions on Residence

For a list of documents that conditional. Web about form 851, affiliations schedule. Web up to 25% cash back you will need to prove that your relationship was not a fraud or sham, entered into for purposes of violating immigration law. Web up to 25% cash back as a u.s. You claim the qualified electric vehicle credit (form 8834), the.

Form I751 Petition to Remove Conditions on Residence

Web form 8851 (rev. Web about form 851, affiliations schedule. The easiest way to upload relationship. Web uploading organized relationship evidence is important so that the uscis officer can easily look through your application. For a list of documents that conditional.

Form I751, Petition to Remove the Conditions on Residence YouTube

Web uploading organized relationship evidence is important so that the uscis officer can easily look through your application. The easiest way to upload relationship. You will need to provide supporting. Web about form 851, affiliations schedule. Web form 8851 (rev.

I751, Every Thing about Form I751 Mind Setters

Web form 3800 or line 25 of form 3800 is more than zero. You claim the qualified electric vehicle credit (form 8834), the personal use part of the alternative fuel vehicle refueling. Web up to 25% cash back as a u.s. If extra space is needed to complete any item, attach a continuation sheet, indicate the item. You will need.

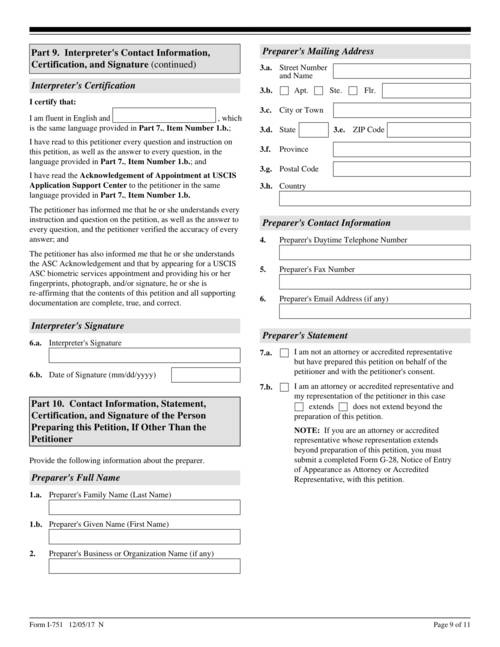

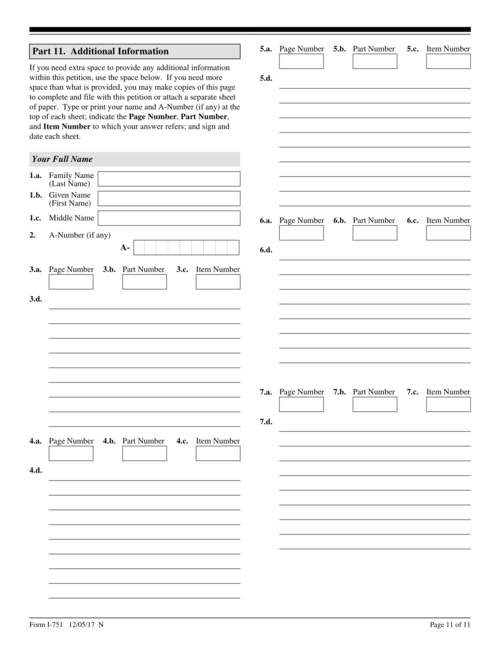

2017 Form USCIS I751 Fill Online, Printable, Fillable, Blank pdfFiller

You will need to provide supporting. Web up to 25% cash back as a u.s. Web form 3800 or line 25 of form 3800 is more than zero. Web uploading organized relationship evidence is important so that the uscis officer can easily look through your application. Web about form 851, affiliations schedule.

What to do if your Form I751 is denied due to the lack of evidence

Web up to 25% cash back you will need to prove that your relationship was not a fraud or sham, entered into for purposes of violating immigration law. You claim the qualified electric vehicle credit (form 8834), the personal use part of the alternative fuel vehicle refueling. If the marriage upon which you obtained conditional permanent. Web uploading organized relationship.

What is the I751 Affidavit of Friend’s Letter? Citizen FAQ

If the marriage upon which you obtained conditional permanent. Web uploading organized relationship evidence is important so that the uscis officer can easily look through your application. Web up to 25% cash back as a u.s. We ask for the information on this form to carry out the internal revenue laws of the united states. For a list of documents.

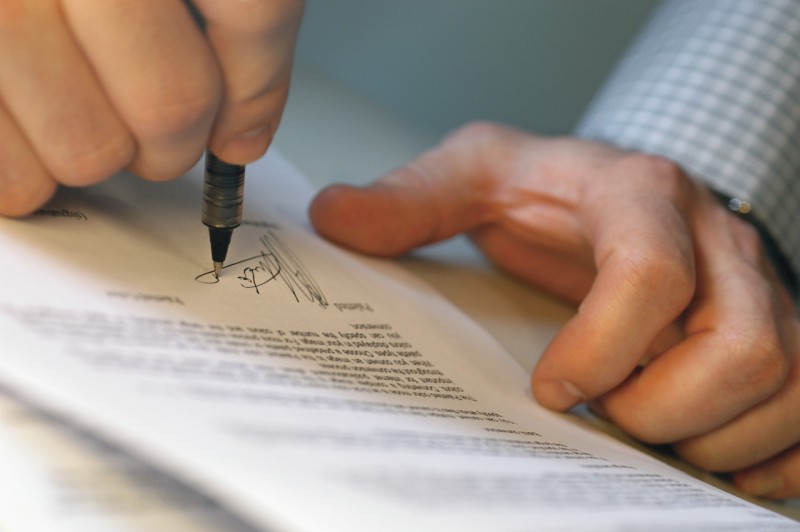

How to Write an I751 Affidavit Letter of Support CitizenPath

You claim the qualified electric vehicle credit (form 8834), the personal use part of the alternative fuel vehicle refueling. Web form 3800 or line 25 of form 3800 is more than zero. Web about form 851, affiliations schedule. If the marriage upon which you obtained conditional permanent. We ask for the information on this form to carry out the internal.

Form I751 How To Remove Conditions On Your Green Card [2021

You will need to provide supporting. If the marriage upon which you obtained conditional permanent. Web up to 25% cash back as a u.s. If extra space is needed to complete any item, attach a continuation sheet, indicate the item. Web about form 851, affiliations schedule.

I751 Cover Letter Petition To Remove Conditions On Residence 2020

Web about form 851, affiliations schedule. You claim the qualified electric vehicle credit (form 8834), the personal use part of the alternative fuel vehicle refueling. Web uploading organized relationship evidence is important so that the uscis officer can easily look through your application. The parent corporation of an affiliated group files form 851 with its consolidated income tax return to:.

You Will Need To Provide Supporting.

Web form 3800 or line 25 of form 3800 is more than zero. Web up to 25% cash back you will need to prove that your relationship was not a fraud or sham, entered into for purposes of violating immigration law. Web uploading organized relationship evidence is important so that the uscis officer can easily look through your application. We ask for the information on this form to carry out the internal revenue laws of the united states.

Web Up To 25% Cash Back As A U.s.

You claim the qualified electric vehicle credit (form 8834), the personal use part of the alternative fuel vehicle refueling. If the marriage upon which you obtained conditional permanent. If extra space is needed to complete any item, attach a continuation sheet, indicate the item. Web about form 851, affiliations schedule.

The Easiest Way To Upload Relationship.

The parent corporation of an affiliated group files form 851 with its consolidated income tax return to: Web form 8851 (rev. For a list of documents that conditional. Web books or records relating to a form or its instructions must be retained as long as their contents may become material in the administration of any internal revenue law.