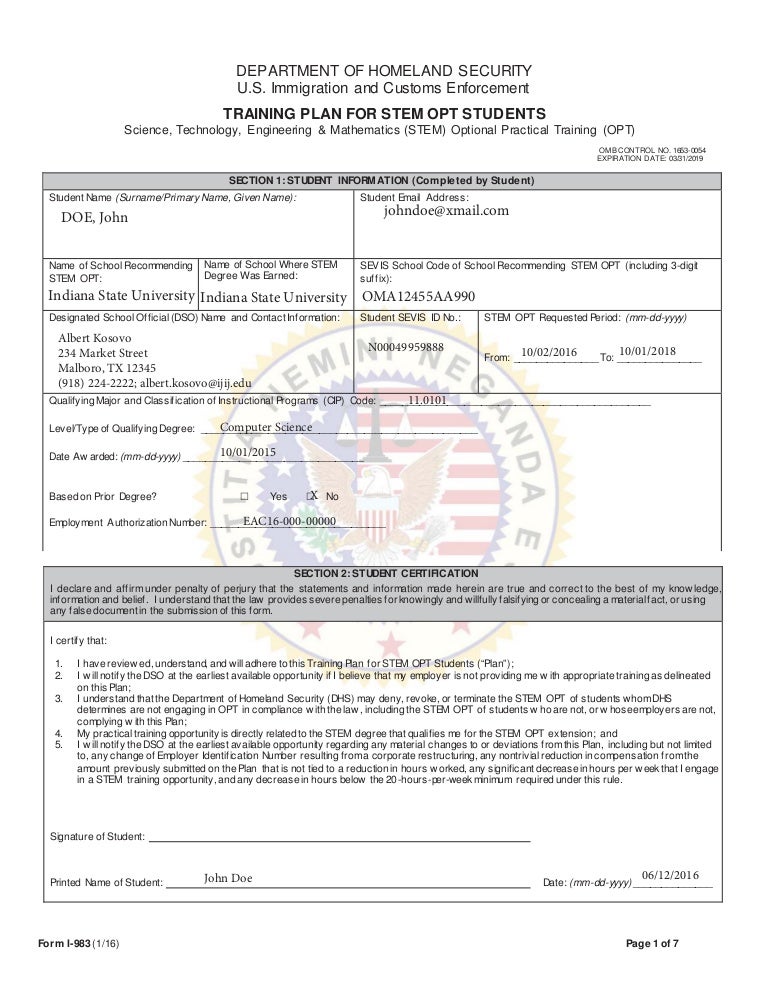

Form I-983 Sample Answers

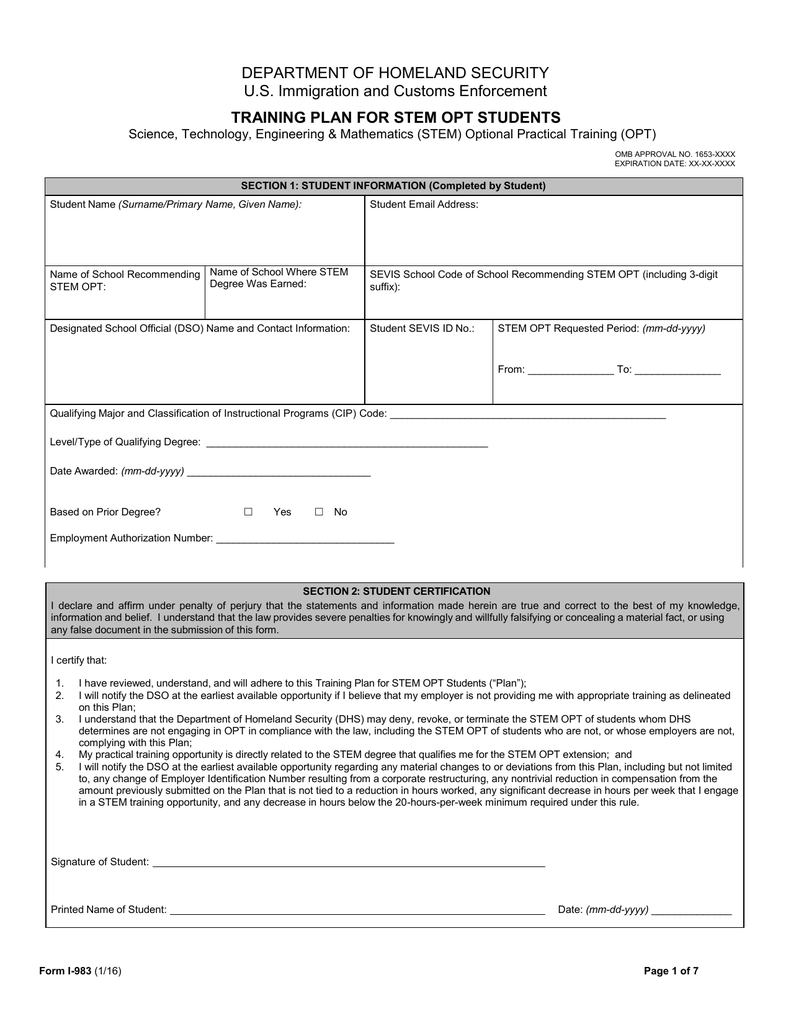

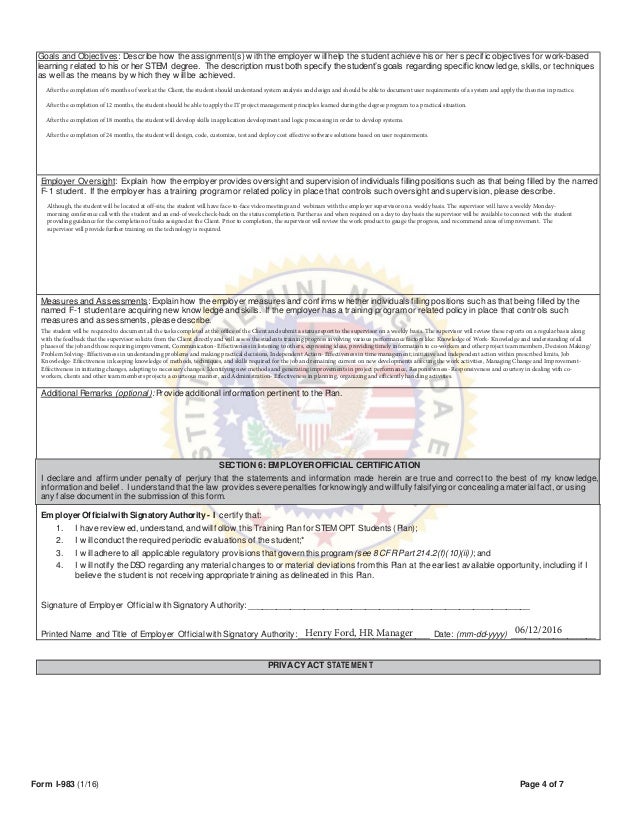

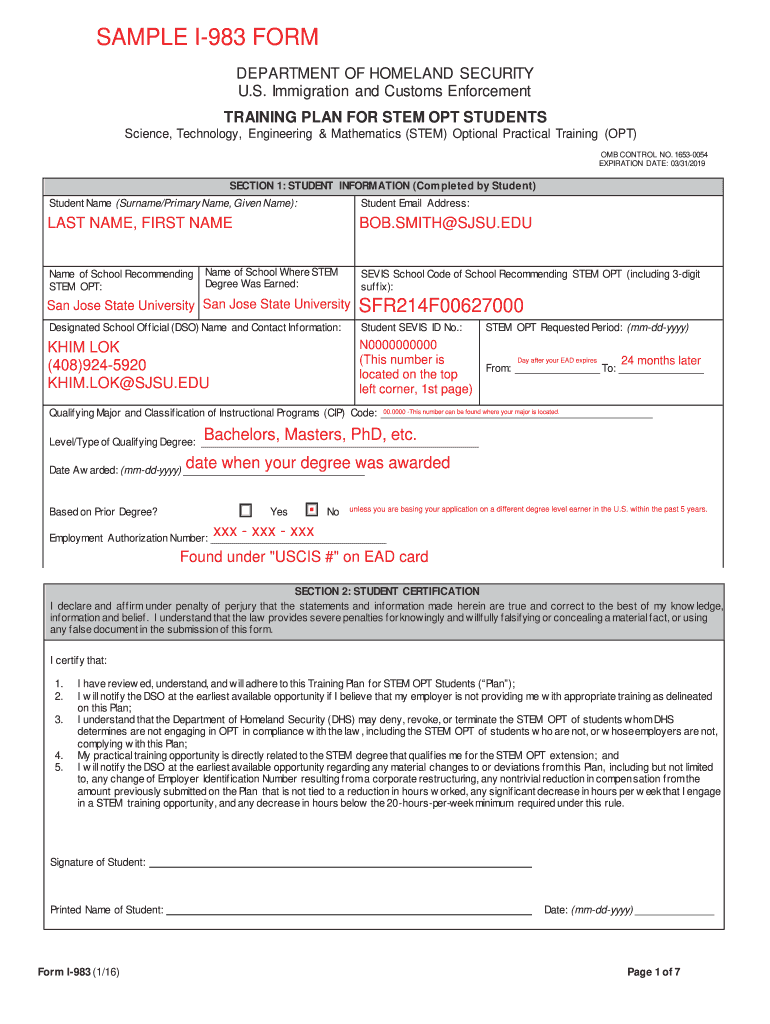

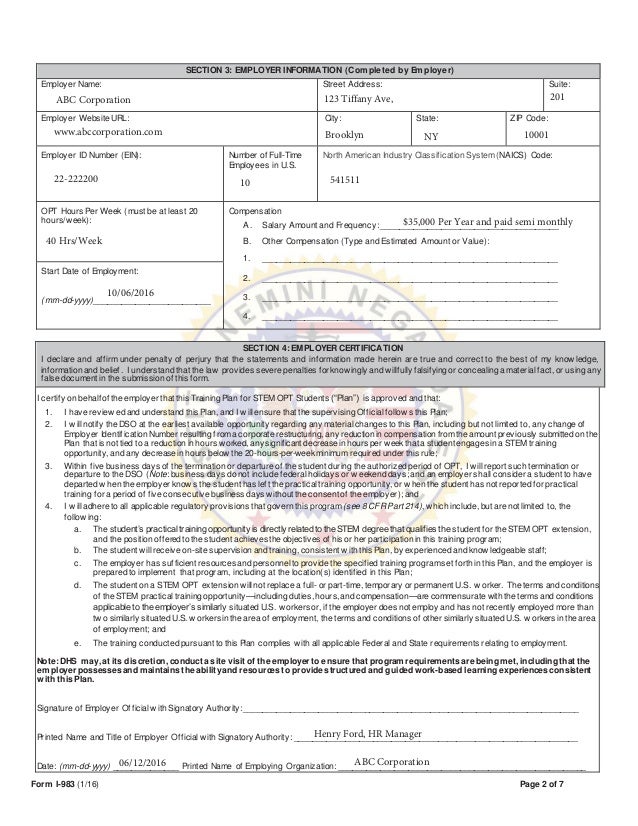

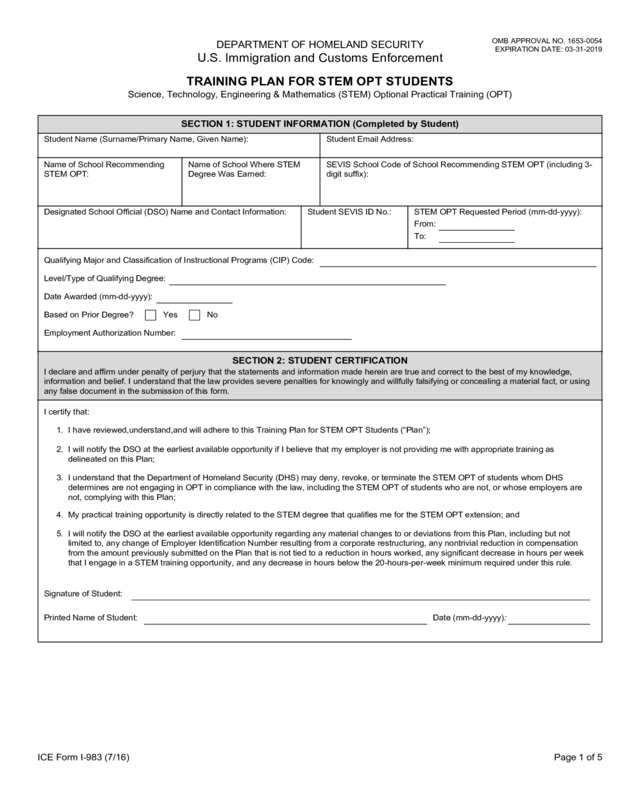

Form I-983 Sample Answers - Name of other party to the transaction. Section 1 requires information about both stem opt. The employer who signs the training plan must be the same entity that. Web make changes to claims made on schedule c (form 720), except for the section 4051(d) tire credit and section 6426 fuel credits. Student information (completed by student): Enter your full name (surname/primary name, given name) exactly as it appears on your sevis (student. Part ii other party’s identifying information. Specific student cases may vary, therefore the student is responsible for reading and following ice form instructions:. See your tax return instructions. Web partnerships and s corporations.

Web for general use only. Naturally, you'll also need to. Properly completing this form will. Web the european union says etias approval will stay valid for three years or until the passport you used in your application expires. Isss comments are in the color boxes. Specific student cases may vary, therefore the student is responsible for reading and following ice form instructions:. Student information (completed by student): A partnership or s corporation that claims a deduction for noncash gifts of more than $500 must file form 8283 (section a or section. Web was a valid and timely form 8023 filed? • use form 730, monthly tax return for.

Properly completing this form will. Federal tax law allows you to claim a deduction for the value of all property you donate to a qualified charity during the year provided you. Isss comments are in the color boxes. Enter your full name (surname/primary name, given name) exactly as it appears on your sevis (student. Web make changes to claims made on schedule c (form 720), except for the section 4051(d) tire credit and section 6426 fuel credits. • use form 730, monthly tax return for. Section 1 requires information about both stem opt. Web when to use form 8283. See your tax return instructions. Web was a valid and timely form 8023 filed?

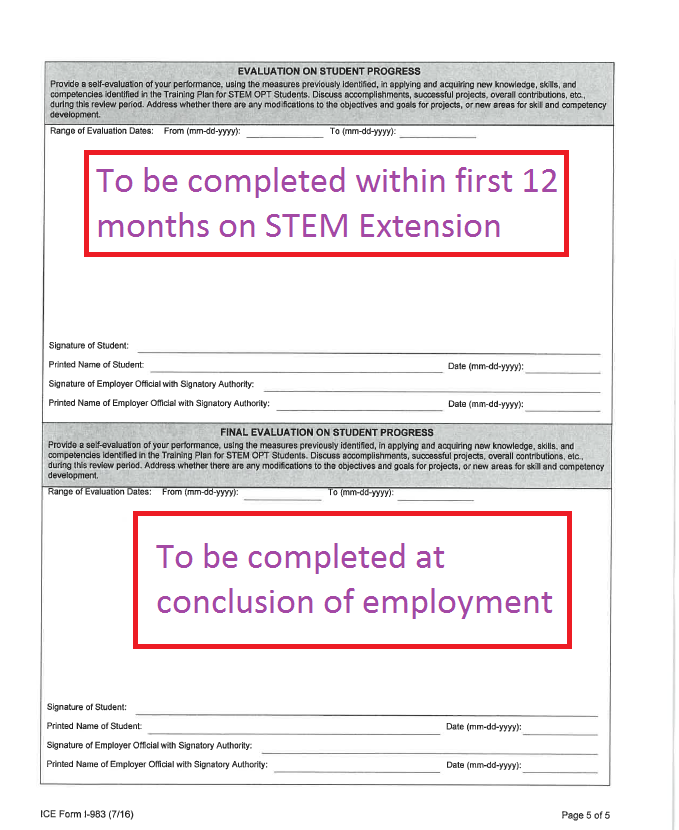

I983 Evaluation Final Evaluation On Student Progress I 983 Sample

Web the european union says etias approval will stay valid for three years or until the passport you used in your application expires. Isss comments are in the color boxes. Web for general use only. Donated property of $5,000 or less and publicly traded. Web partnerships and s corporations.

I983 Evaluation Final Evaluation On Student Progress I 983 Sample

Web figure the amount of your contribution deduction before completing this form. Federal tax law allows you to claim a deduction for the value of all property you donate to a qualified charity during the year provided you. Specific student cases may vary, therefore the student is responsible for reading and following ice form instructions:. Enter the employer's site name.

I983 fillable form no download needed Fill out & sign online DocHub

See your tax return instructions. Web for general use only. Enter your full name (surname/primary name, given name) exactly as it appears on your sevis (student. • use form 730, monthly tax return for. Web partnerships and s corporations.

STEM OPT I983培训计划样本答案30个 SEVIS SAVVY

A partnership or s corporation that claims a deduction for noncash gifts of more than $500 must file form 8283 (section a or section. Specific student cases may vary, therefore the student is responsible for reading and following ice form instructions:. Name of other party to the transaction. Training plan for stem opt. No if yes, enter the date filed.

I983

Specific student cases may vary, therefore the student is responsible for reading and following ice form instructions:. Naturally, you'll also need to. Web make changes to claims made on schedule c (form 720), except for the section 4051(d) tire credit and section 6426 fuel credits. A partnership or s corporation that claims a deduction for noncash gifts of more than.

I983 Evaluation Final Evaluation On Student Progress I 983 Sample

Specific student cases may vary, therefore the student is responsible for reading and following ice form instructions:. No if yes, enter the date filed. A partnership or s corporation that claims a deduction for noncash gifts of more than $500 must file form 8283 (section a or section. Web partnerships and s corporations. • use form 730, monthly tax return.

STEM OPT I983 Training Plan 30 sample answers SEVIS SAVVY

Donated property of $5,000 or less and publicly traded. Web partnerships and s corporations. Web figure the amount of your contribution deduction before completing this form. If the application is based on a prior degree, answer “yes”. Training plan for stem opt.

I983

The employer who signs the training plan must be the same entity that. Isss comments are in the color boxes. Specific student cases may vary, therefore the student is responsible for reading and following ice form instructions:. Enter the employer's site name which may be the same as employer name in section 3. Web the european union says etias approval.

I983 Evaluation Final Evaluation On Student Progress I 983 Sample

Web the european union says etias approval will stay valid for three years or until the passport you used in your application expires. Web for general use only. Web when to use form 8283. Isss comments are in the color boxes. Section 1 requires information about both stem opt.

Web Was A Valid And Timely Form 8023 Filed?

Web partnerships and s corporations. Web when to use form 8283. Student information (completed by student): A partnership or s corporation that claims a deduction for noncash gifts of more than $500 must file form 8283 (section a or section.

Web Figure The Amount Of Your Contribution Deduction Before Completing This Form.

Part ii other party’s identifying information. Specific student cases may vary, therefore the student is responsible for reading and following ice form instructions:. See your tax return instructions. Naturally, you'll also need to.

Web The European Union Says Etias Approval Will Stay Valid For Three Years Or Until The Passport You Used In Your Application Expires.

Section 1 requires information about both stem opt. Web make changes to claims made on schedule c (form 720), except for the section 4051(d) tire credit and section 6426 fuel credits. Federal tax law allows you to claim a deduction for the value of all property you donate to a qualified charity during the year provided you. Training plan for stem opt.

Donated Property Of $5,000 Or Less And Publicly Traded.

If the application is based on a prior degree, answer “yes”. Web for general use only. Properly completing this form will. The employer who signs the training plan must be the same entity that.