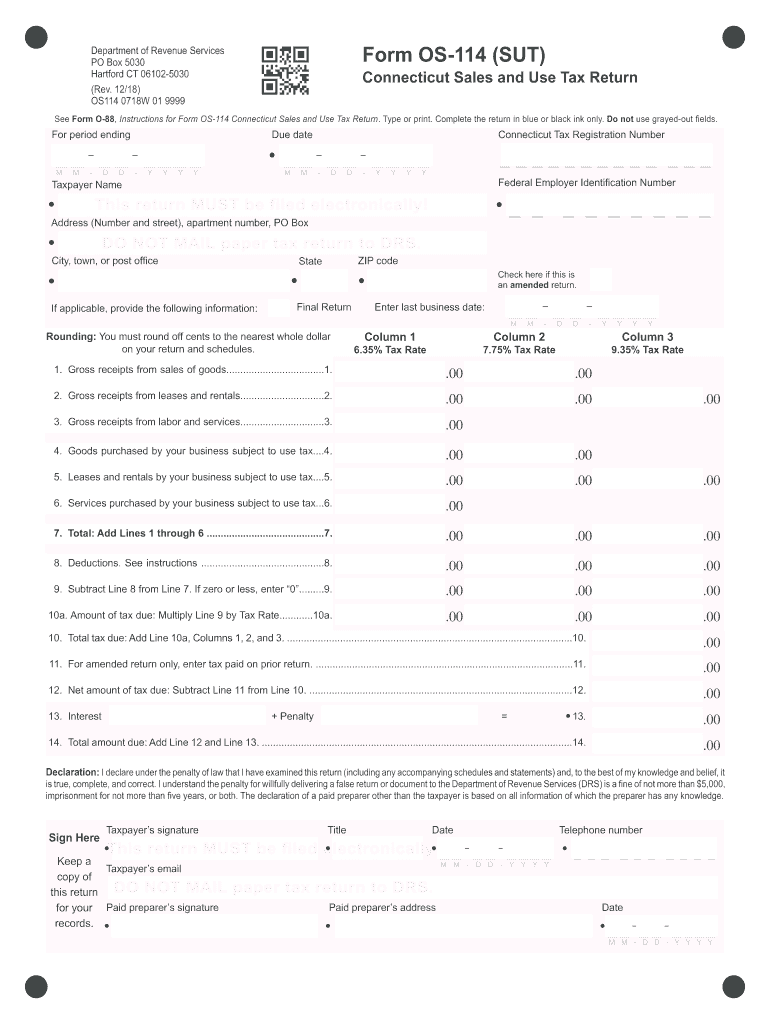

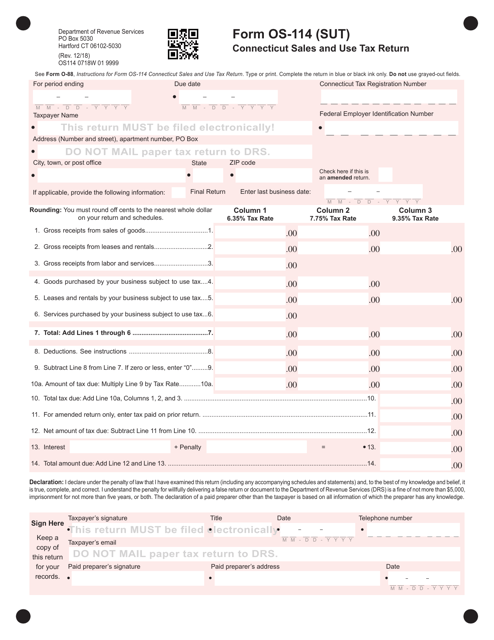

Form Os 114

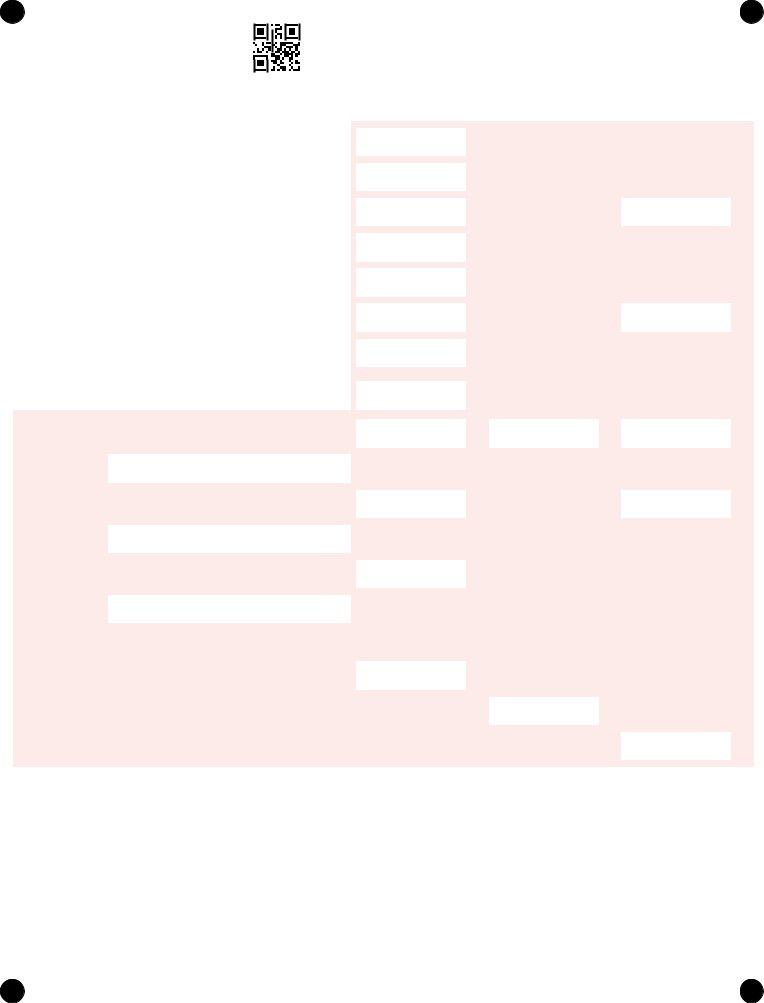

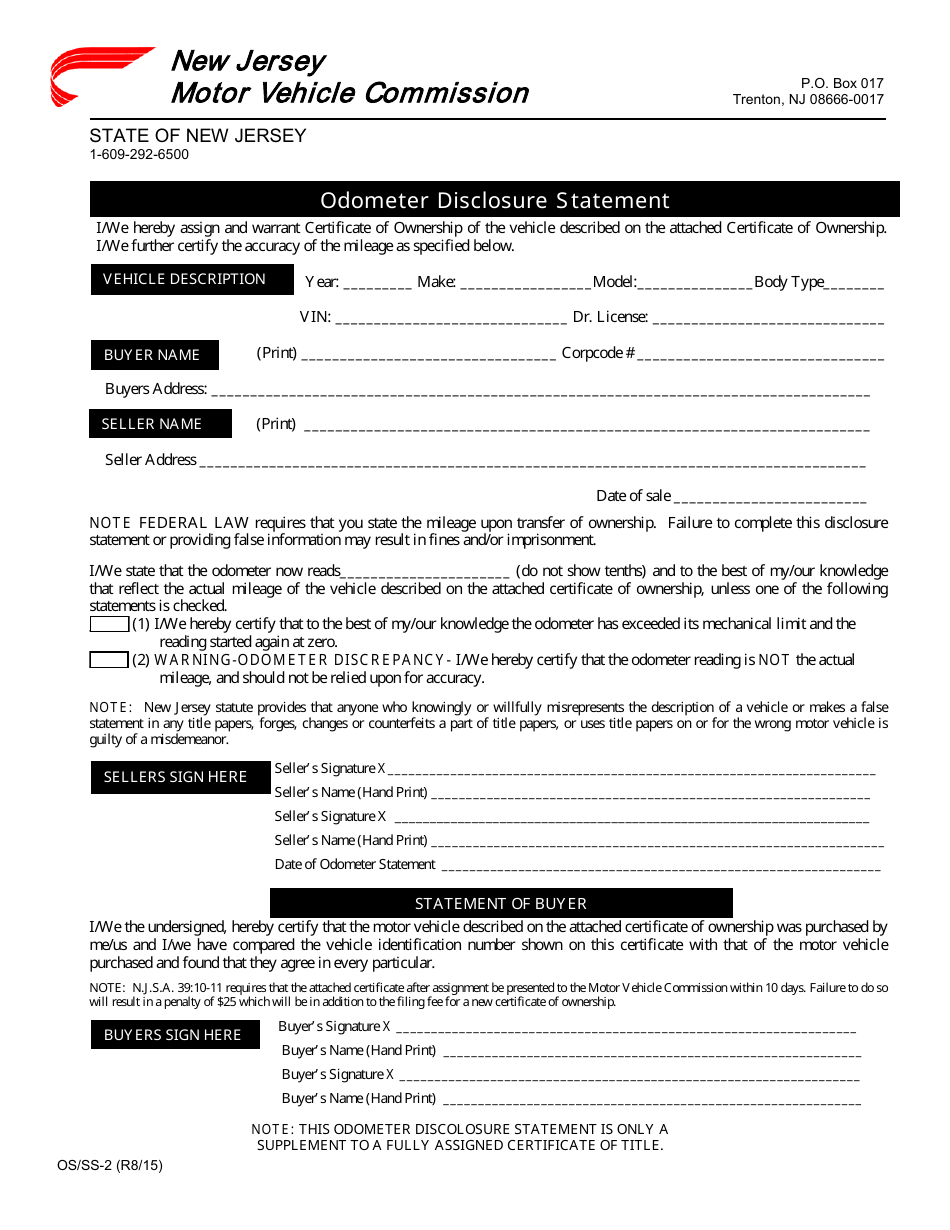

Form Os 114 - You must file a return even if no tax is due or no sales were made. Easily fill out pdf blank, edit, and sign them. Save or instantly send your ready documents. If you are fi ling an amended return, check the box on the. Annual filers are required to electronically. 07/11) for period ending connecticut tax. Save or instantly send your ready documents. This information is for state of connecticut. Web all connecticut businesses must regularly file a sales and use tax return even if they have no tax due. Use get form or simply click on the template preview to open it in the editor.

To request a waiver from the electronic filing. This information is for state of connecticut. Start completing the fillable fields. 07/11) for period ending connecticut tax. 1 gross receipts from sales of goods 1 2 gross receipts from leases and rentals 2 3 gross receipts from. You must file a return even if no tax is due or no sales were made. Both taxable and nontaxable sales must be. Use get form or simply click on the template preview to open it in the editor. If you are fi ling an amended return, check the box on the. Web businesses must complete and file form os‑114 to report all sales activity in connecticut, even if no sales were made or no tax is due.

Web all connecticut businesses must regularly file a sales and use tax return even if they have no tax due. Annual filers are required to electronically. This information is for state of connecticut. Sales and use tax return:. 1 gross receipts from sales of goods 1 2 gross receipts from leases and rentals 2 3 gross receipts from. Web businesses must complete and file form os‑114 to report all sales activity in connecticut, even if no sales were made or no tax is due. 07/11) for period ending connecticut tax. Save or instantly send your ready documents. Start completing the fillable fields. You must file a return even if no tax is due or no sales were made.

Ct Form Os 114 ≡ Fill Out Printable PDF Forms Online

Easily fill out pdf blank, edit, and sign them. You must file a return even if no tax is due or no sales were made. Use get form or simply click on the template preview to open it in the editor. Save or instantly send your ready documents. Visit portal.ct.gov/tsc to file your return electronically using the tsc.

Form OS114 (SUT) Fill Out, Sign Online and Download Printable PDF

Visit portal.ct.gov/tsc to file your return electronically using the tsc. 1 gross receipts from sales of goods 1 2 gross receipts from leases and rentals 2 3 gross receipts from. Easily fill out pdf blank, edit, and sign them. Annual filers are required to electronically. This information is for state of connecticut.

Printable Ny State Tax Form It 201 Form Resume Examples Xk87wz28ZW

Web businesses must complete and file form os‑114 to report all sales activity in connecticut, even if no sales were made or no tax is due. Easily fill out pdf blank, edit, and sign them. Visit portal.ct.gov/tsc to file your return electronically using the tsc. Web all connecticut businesses must regularly file a sales and use tax return even if.

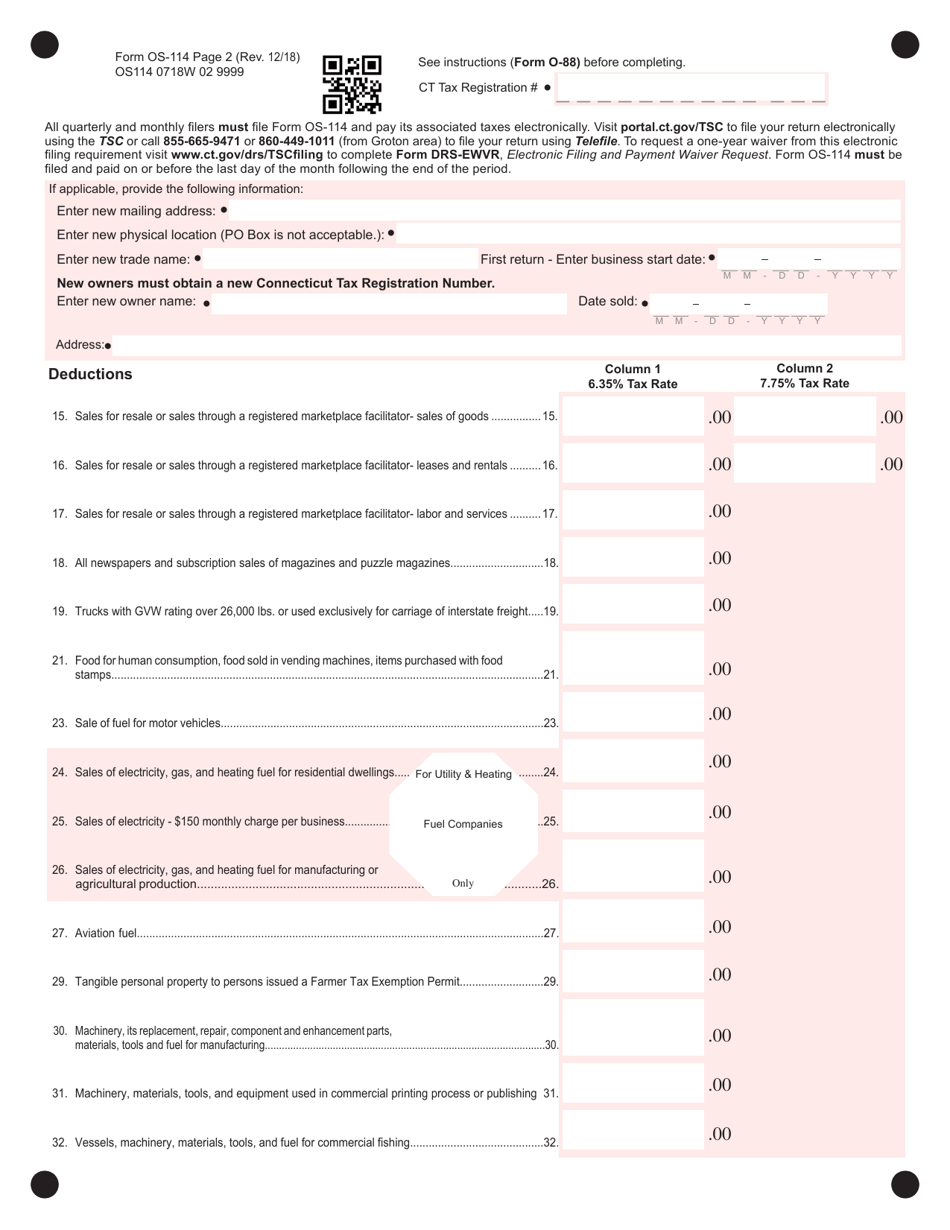

Form OS/SS2 Download Fillable PDF or Fill Online Odometer Disclosure

Both taxable and nontaxable sales must be. 1 gross receipts from sales of goods 1 2 gross receipts from leases and rentals 2 3 gross receipts from. Easily fill out pdf blank, edit, and sign them. If you are fi ling an amended return, check the box on the. Web businesses must complete and file form os‑114 to report all.

Form Os 114 20202022 Fill and Sign Printable Template Online US

Annual filers are required to electronically. Start completing the fillable fields. Web all connecticut businesses must regularly file a sales and use tax return even if they have no tax due. Save or instantly send your ready documents. Web businesses must complete and file form os‑114 to report all sales activity in connecticut, even if no sales were made or.

Where To Mail Tax Return In Texas

Save or instantly send your ready documents. Web all connecticut businesses must regularly file a sales and use tax return even if they have no tax due. Start completing the fillable fields. Save or instantly send your ready documents. Both taxable and nontaxable sales must be.

Grey2K Lies March 2012

Save or instantly send your ready documents. Annual filers are required to electronically. 1 gross receipts from sales of goods 1 2 gross receipts from leases and rentals 2 3 gross receipts from. Both taxable and nontaxable sales must be. Sales and use tax return:.

Form Os 114 Fill Out and Sign Printable PDF Template signNow

Start completing the fillable fields. 07/11) for period ending connecticut tax. Web businesses must complete and file form os‑114 to report all sales activity in connecticut, even if no sales were made or no tax is due. You must file a return even if no tax is due or no sales were made. Visit portal.ct.gov/tsc to file your return electronically.

Form OS114 (SUT) Fill Out, Sign Online and Download Printable PDF

07/11) for period ending connecticut tax. Save or instantly send your ready documents. Use get form or simply click on the template preview to open it in the editor. This information is for state of connecticut. Both taxable and nontaxable sales must be.

Ct Os 114 Mail Paper 2015 Fill Online, Printable, Fillable, Blank

Use get form or simply click on the template preview to open it in the editor. Annual filers are required to electronically. Easily fill out pdf blank, edit, and sign them. If you are fi ling an amended return, check the box on the. Save or instantly send your ready documents.

Both Taxable And Nontaxable Sales Must Be.

Sales and use tax return:. 1 gross receipts from sales of goods 1 2 gross receipts from leases and rentals 2 3 gross receipts from. Annual filers are required to electronically. If you are fi ling an amended return, check the box on the.

07/11) For Period Ending Connecticut Tax.

Easily fill out pdf blank, edit, and sign them. Visit portal.ct.gov/tsc to file your return electronically using the tsc. You must file a return even if no tax is due or no sales were made. Save or instantly send your ready documents.

Easily Fill Out Pdf Blank, Edit, And Sign Them.

Use get form or simply click on the template preview to open it in the editor. Save or instantly send your ready documents. Web all connecticut businesses must regularly file a sales and use tax return even if they have no tax due. Start completing the fillable fields.

To Request A Waiver From The Electronic Filing.

Web businesses must complete and file form os‑114 to report all sales activity in connecticut, even if no sales were made or no tax is due. This information is for state of connecticut.