Form R 10614

Form R 10614 - To enter information for the. You can also download it, export it or print it out. Web send form r 10614 via email, link, or fax. (1) each form must be on paper measuring. Use get form or simply click on the template preview to open it in the editor. As amended through may 12, 2023. Local forms must comply with the following: Find out when all state tax returns are due. You can also download it, export it or print it out. Type text, add images, blackout confidential details,.

As amended through may 12, 2023. File returns and make payments. This option is no longer available because the credit had a december 31, 2019 sunset date. You can also download it, export it or print it out. Online applications to register a business. Texas health and human services subject: Web amount of foreign tax credit claimed on their federal form. Web access your account online. Edit your blank r 1064 form online. The sale or transfer of tax credits may have income tax consequences for the transferor.

To qualify for this credit, the taxpayer must. The sale or transfer of tax credits may have income tax consequences for the transferor. Start completing the fillable fields and. Type text, add images, blackout confidential details,. As amended through may 12, 2023. Web amount of foreign tax credit claimed on their federal form. 47:6104 provides a school readiness credit in addition to the credit for child care expenses as provided under r.s. Texas health and human services subject: Web access your account online. Web taxpayers who claim the school readiness child care expense credit must obtain a louisiana school readiness tax credit, child care expense credit certificate, form r.

Solved It says a form cannot be efiled on my tax return, Form School

Web taxpayers who claim the school readiness child care expense credit must obtain a louisiana school readiness tax credit, child care expense credit certificate, form r. Web amount of foreign tax credit claimed on their federal form. The childcare expense tax credit with a quality star school? Web send form r 10614 via email, link, or fax. To qualify for.

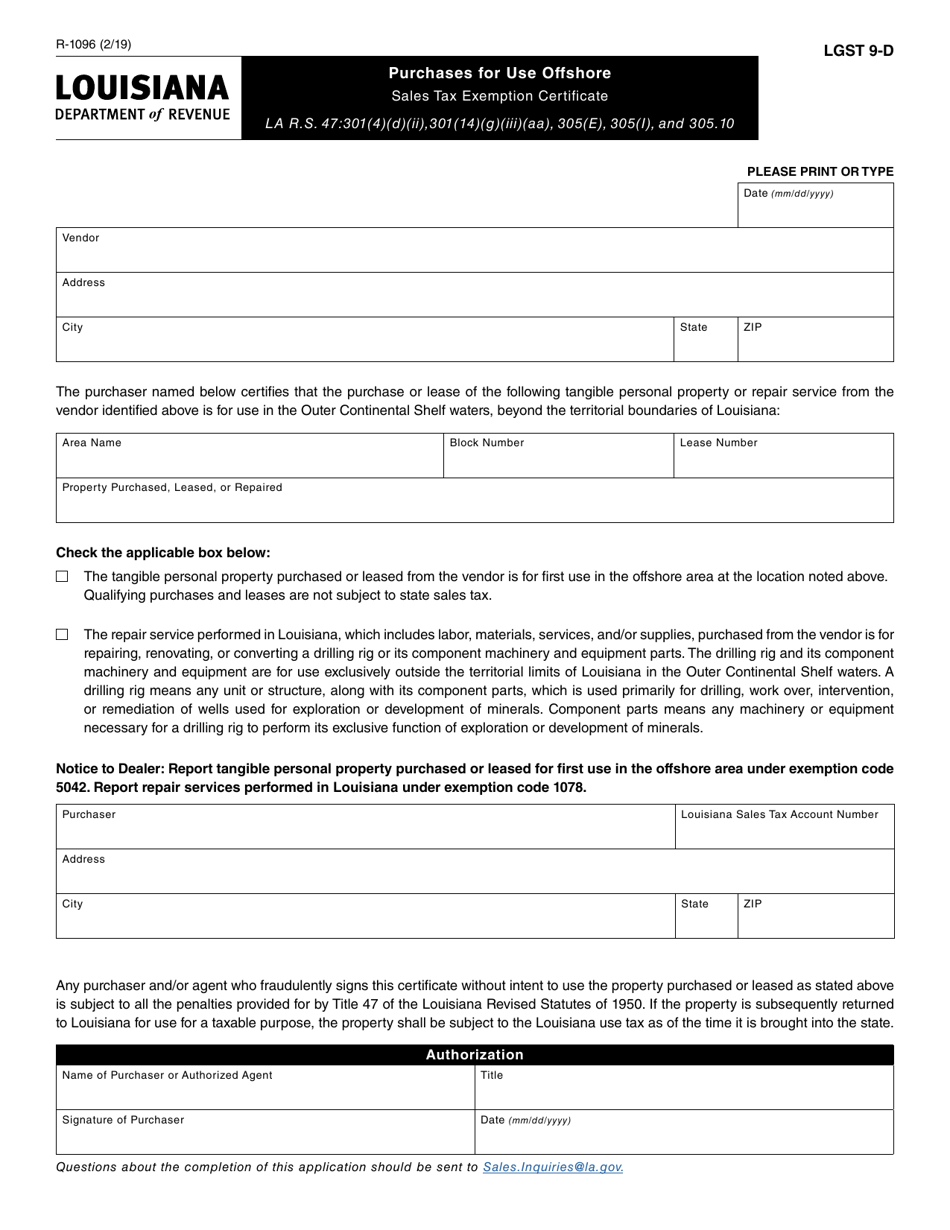

Form R1096 Download Fillable PDF or Fill Online Purchases for Use

Web access your account online. Texas health and human services subject: File returns and make payments. To qualify for this credit, the taxpayer must. The childcare expense tax credit with a quality star school?

Resident Tax Return Louisiana Free Download

Start completing the fillable fields and. To enter information for the. Web taxpayers who claim the school readiness child care expense credit must obtain a louisiana school readiness tax credit, child care expense credit certificate, form r. Web amount of foreign tax credit claimed on their federal form. The sale or transfer of tax credits may have income tax consequences.

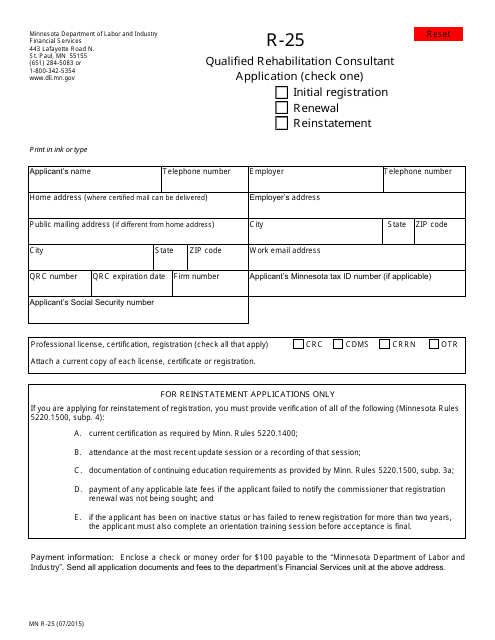

Form R25 Download Fillable PDF or Fill Online Qualified Rehabilitation

As amended through may 12, 2023. (1) each form must be on paper measuring. File returns and make payments. The sale or transfer of tax credits may have income tax consequences for the transferor. To enter information for the.

2014 NJ ELEC Form R3 Fill Online, Printable, Fillable, Blank pdfFiller

Web access your account online. 47:6104 provides a school readiness credit in addition to the credit for child care expenses as provided under r.s. Web taxpayers who claim the school readiness child care expense credit must obtain a louisiana school readiness tax credit, child care expense credit certificate, form r. Web amount of foreign tax credit claimed on their federal.

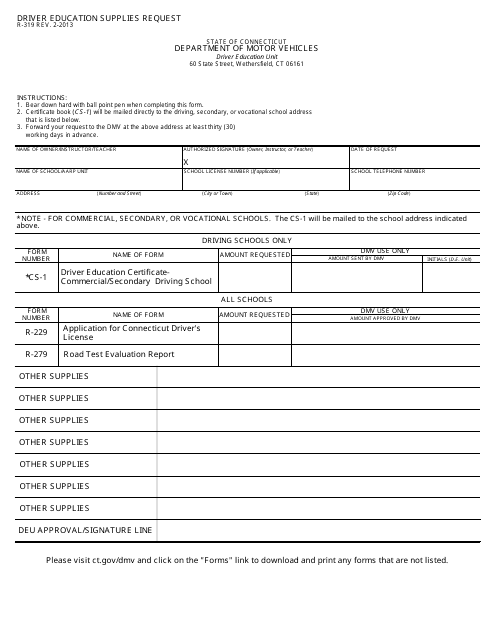

Form R319 Download Fillable PDF or Fill Online Driver Education

Web send form r 10614 via email, link, or fax. Edit your blank r 1064 form online. Local forms must comply with the following: To enter information for the. This option is no longer available because the credit had a december 31, 2019 sunset date.

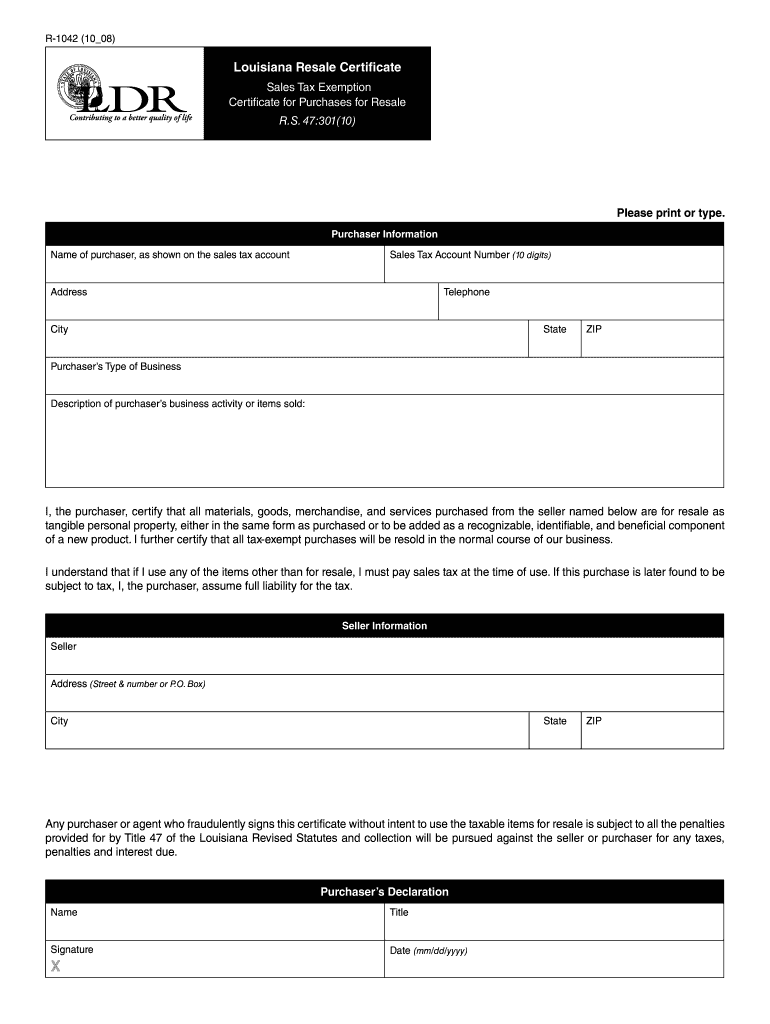

Louisiana Resale Certificate Pdf Fill Online, Printable, Fillable

This option is no longer available because the credit had a december 31, 2019 sunset date. As amended through may 12, 2023. To enter information for the. Type text, add images, blackout confidential details,. Texas health and human services subject:

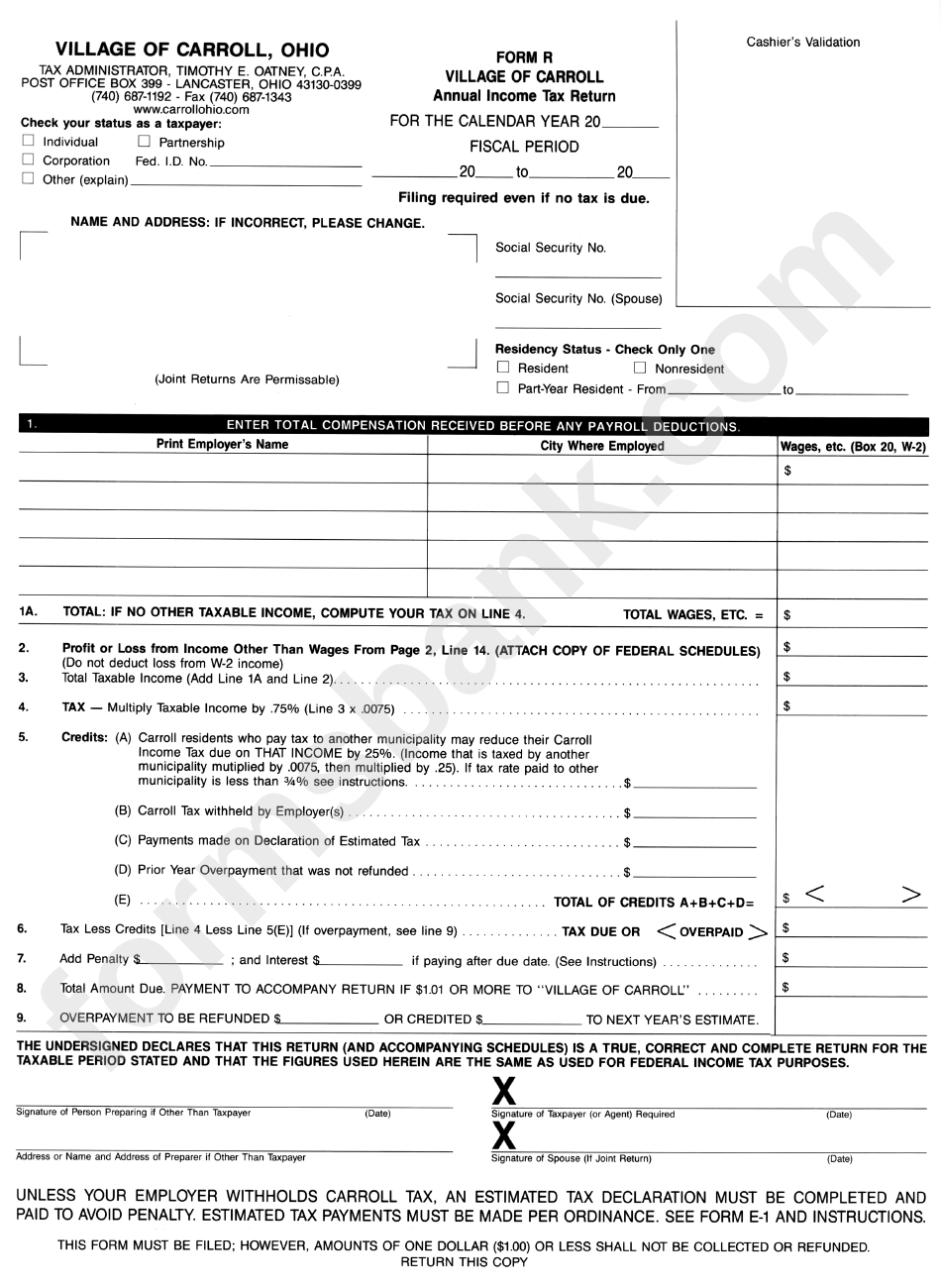

Form R Annual Tax Return printable pdf download

47:6104 provides a school readiness credit in addition to the credit for child care expenses as provided under r.s. Online applications to register a business. Edit your blank r 1064 form online. File returns and make payments. Use get form or simply click on the template preview to open it in the editor.

2009 Form LA LDR IT540Bi Fill Online, Printable, Fillable, Blank

Texas health and human services subject: Web send form r 10614 via email, link, or fax. The childcare expense tax credit with a quality star school? File returns and make payments. Web send form r 10614 via email, link, or fax.

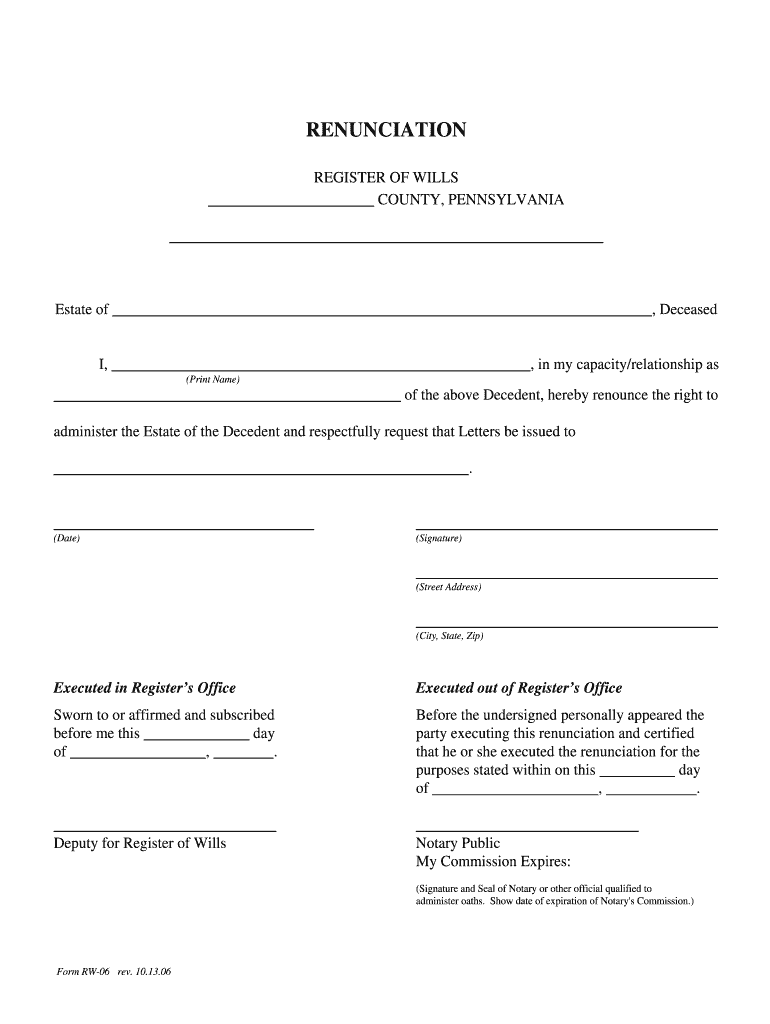

Form Rw 06 Instructions Fill Online, Printable, Fillable, Blank

File returns and make payments. 47:6104 provides a school readiness credit in addition to the credit for child care expenses as provided under r.s. 6c first name last name social security number relationship to you birth date. You can also download it, export it or print it out. To enter information for the.

Web Send Form R 10614 Via Email, Link, Or Fax.

To qualify for this credit, the taxpayer must. Use get form or simply click on the template preview to open it in the editor. You can also download it, export it or print it out. As amended through may 12, 2023.

To Enter Information For The.

Texas health and human services subject: 6c first name last name social security number relationship to you birth date. Web amount of foreign tax credit claimed on their federal form. Web access your account online.

File Returns And Make Payments.

Find out when all state tax returns are due. Online applications to register a business. 47:6104 provides a school readiness credit in addition to the credit for child care expenses as provided under r.s. (1) each form must be on paper measuring.

For Exempt Organizations, Use Form Ft.

Local forms must comply with the following: The sale or transfer of tax credits may have income tax consequences for the transferor. This option is no longer available because the credit had a december 31, 2019 sunset date. Web send form r 10614 via email, link, or fax.