Free Print Form 8962

Free Print Form 8962 - You need to complete form 8962 if you. Web moves section 3, reverification and rehire, to a standalone supplement that employers can print if or when rehire occurs or reverification is required; Next, go to “part 1” of the form. You have to include form 8962 with your tax return if: You’ll use this form to “reconcile” — to find out if you used more or less premium tax credit than you qualify for. Web you’ll enter the number of exemptions and the modified adjusted gross income (magi) from your 1040 or 1040nr. Web open the downloaded pdf and navigate to your form 8962 to print it. Use the cross or check marks in the top toolbar to select your answers in the list boxes. Download the form and open it using pdfelement and start filling it. Form 8962, premium tax credit;

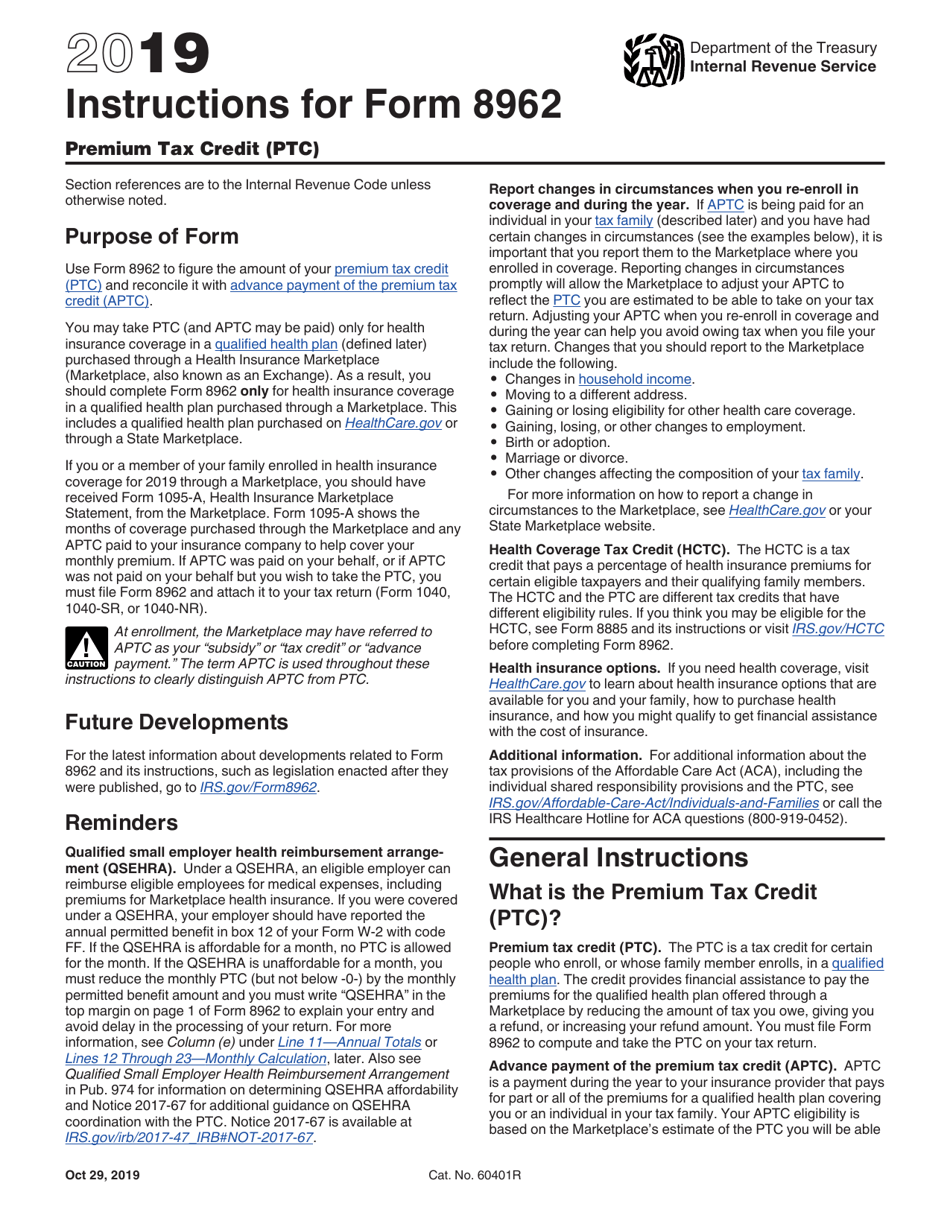

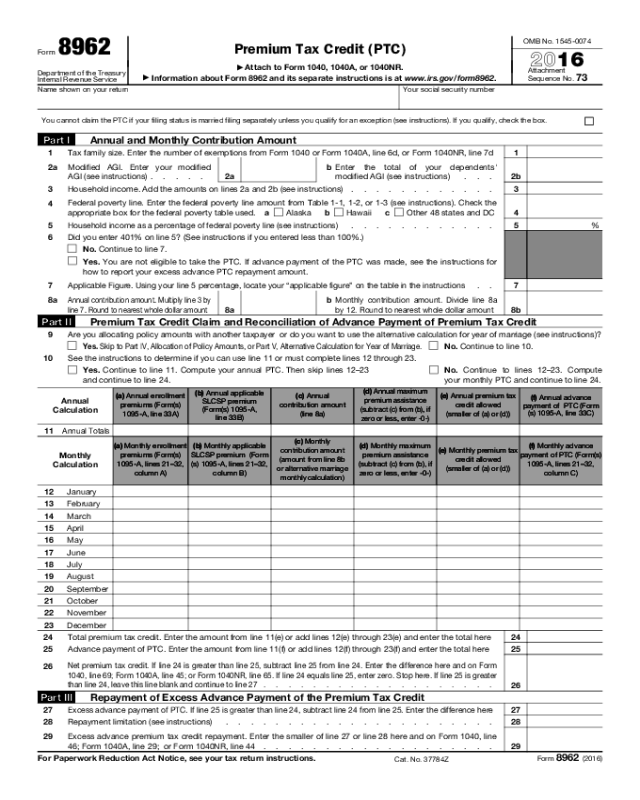

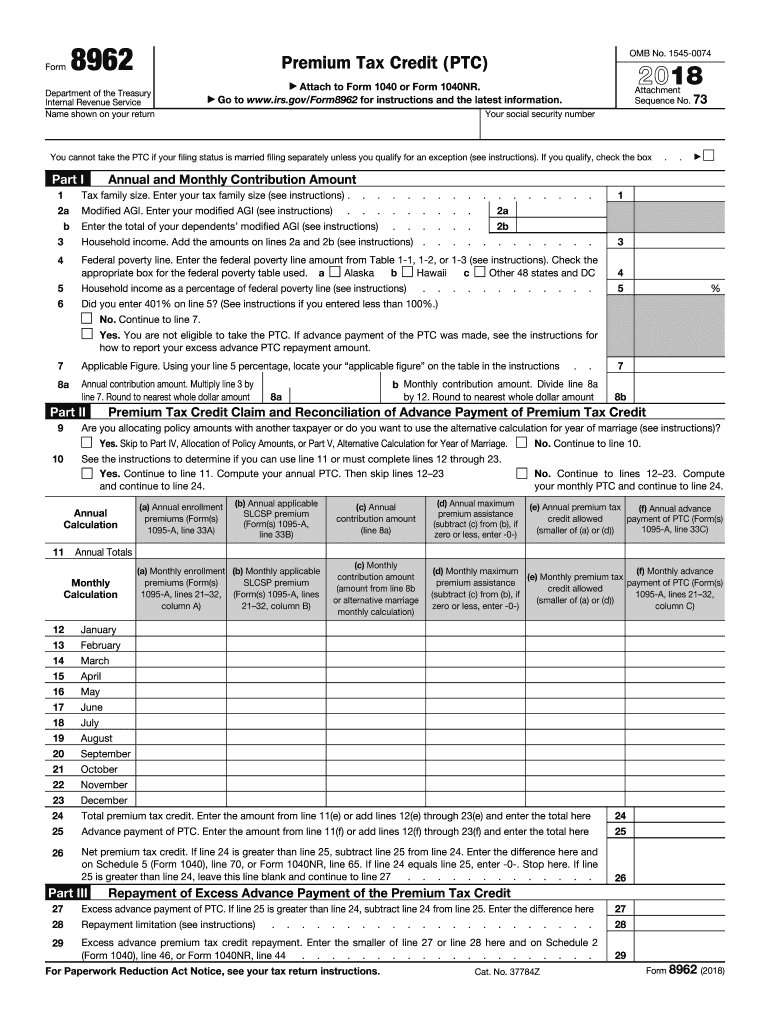

You can print other federal tax forms here. Web quick steps to complete and design printable 8962 form 2019 online: You’ll use this form to “reconcile” — to find out if you used more or less premium tax credit than you qualify for. Protect yourself from tax scams; 73 name shown on your return your social security number a. Web form 8962, premium tax credit. Must be removed before printing. You’ll also enter your household income as a percentage of the federal poverty line. Web your electronic return was rejected because irs records show that advance payments of the premium tax credit (aptc) were paid to your marketplace health insurance company on behalf of a member of your family in 2021, and you are required to complete form 8962 and attach it to your return to reconcile the aptc with the premium tax credit. Go to www.irs.gov/form8962 for instructions and the latest information.

Web we last updated the premium tax credit in december 2022, so this is the latest version of form 8962, fully updated for tax year 2022. You or someone on your tax return received advance payments of the premium tax credit. Web form 8962 at the end of these instructions. You qualified for the premium tax credit in 2022. Web form 8962 department of the treasury internal revenue service premium tax credit (ptc) attach to form 1040, 1040a, or 1040nr. Consult the table in the. Must be removed before printing. Find out where to get free volunteer tax help; • aptc was paid for an individual you told the marketplace Find a tax software program to help you prepare your taxes;

Form 8962 Edit, Fill, Sign Online Handypdf

You may take the ptc (and aptc may be paid) only for health insurance coverage in a qualified health plan (defined later) purchased through a health insurance marketplace (marketplace, also known as an. Form 8962 is used either (1) to reconcile a premium tax credit advanced payment toward the cost of a health insurance. 2021 instructions for form 8962 premium.

8962 Form App for iPhone Free Download 8962 Form for iPhone & iPad at

Web form 8962 is a form you must file with your federal income tax return for a year if you received an advanced premium tax credit through the marketplace during that year. Before doing anything, you may wish to save a backup copy of the original pdf and tax data file of your return as originally filed, just in case.

Fillable Tax Form 8962 Universal Network

Web moves section 3, reverification and rehire, to a standalone supplement that employers can print if or when rehire occurs or reverification is required; Web open the downloaded pdf and navigate to your form 8962 to print it. Form 8962 is used either (1) to reconcile a premium tax credit advanced payment toward the cost of a health insurance. A.

Form 8962 Fill Out and Sign Printable PDF Template signNow

You’ll use this form to “reconcile” — to find out if you used more or less premium tax credit than you qualify for. Web 13 hours agoa federal grand jury has indicted former president donald trump in special counsel jack smith’s investigation into efforts to overturn the 2020 election leading up to the january 6, 2021, attack. Learn about the.

Irs form 8962 Aca Irs form 8962 for ‘premium Tax Credits’ Successfully

2021 instructions for form 8962 premium tax credit (ptc) department of the treasury internal revenue service section references are to the internal revenue code unless otherwise noted. You’ll also enter your household income as a percentage of the federal poverty line. A copy of the irs letter that you received Web use form 8962 to figure the amount of your.

IRS Form 8962 Understanding Your Form 8962

A member of your family received advance. You have to include form 8962 with your tax return if: Protect yourself from tax scams; Find a tax software program to help you prepare your taxes; Download the form and open it using pdfelement and start filling it.

Instructions 8962 2018 2019 Blank Sample to Fill out Online in PDF

You have to include form 8962 with your tax return if: Web 13 hours agoa federal grand jury has indicted former president donald trump in special counsel jack smith’s investigation into efforts to overturn the 2020 election leading up to the january 6, 2021, attack. Go to www.irs.gov/form8962 for instructions and the latest information. Consult the table in the. Web.

Health Insurance 1095A Subsidy Flow Through IRS Tax Return

Web form 8962 is used to estimate the amount of premium tax credit for which you’re eligible if you’re insured through the health insurance marketplace. Web how it works open form follow the instructions easily sign the form with your finger send filled & signed form or save 8962 form 2021 rating ★ ★ ★ ★ ★ ★ ★ ★.

Download Instructions for IRS Form 8962 Premium Tax Credit (Ptc) PDF

You can get the irs form 8962 from the website of department of the treasury, internal revenue service or you can simply download irs form 8962 here. 73 name shown on your return your social security number a. Web open the downloaded pdf and navigate to your form 8962 to print it. To do so, simply add the numbers from.

2017 Form IRS Instructions 8962 Fill Online, Printable, Fillable, Blank

Irs 8962 is the form that was made for taxpayers who want to find out the premium tax credit amount and to reconcile this figure. • you are taking the ptc. You’ll use this form to “reconcile” — to find out if you used more or less premium tax credit than you qualify for. Send the following to the irs.

A Copy Of The Irs Letter That You Received

Web form 8962 is used to estimate the amount of premium tax credit for which you’re eligible if you’re insured through the health insurance marketplace. Find out where to get free volunteer tax help; Next, you should enter the amounts relating to the updated agi on lines 2a and 2b. Must be removed before printing.

• Aptc Was Paid For An Individual You Told The Marketplace

Next, you must add the household income to line 3; You or someone on your tax return received advance payments of the premium tax credit. You need to complete form 8962 if you. Learn about the irs free file and related services;

You Can Get The Irs Form 8962 From The Website Of Department Of The Treasury, Internal Revenue Service Or You Can Simply Download Irs Form 8962 Here.

• aptc was paid for you or another individual in your tax family. Web information about form 8962, premium tax credit, including recent updates, related forms and instructions on how to file. Web your electronic return was rejected because irs records show that advance payments of the premium tax credit (aptc) were paid to your marketplace health insurance company on behalf of a member of your family in 2021, and you are required to complete form 8962 and attach it to your return to reconcile the aptc with the premium tax credit. You can free download irs form 8962 to fill, edit, print and sign.

Web We Last Updated The Premium Tax Credit In December 2022, So This Is The Latest Version Of Form 8962, Fully Updated For Tax Year 2022.

Web form 8962, premium tax credit. Use the cross or check marks in the top toolbar to select your answers in the list boxes. You qualified for the premium tax credit in 2022. Protect yourself from tax scams;

:max_bytes(150000):strip_icc()/irs-form-8962.resized-4c525af04e6347f296d912d00785f2f2.png)