Ga Form 700 Instructions 2021

Ga Form 700 Instructions 2021 - 08/02/21) partnership tax return page 1. Web to the form 700 which provides the details of the income reported for the partners and the total income should be entered on line 1 of schedule 1. Web up to $40 cash back fill ga form 700 instructions 2021, edit online. How do i enter these on the georgia state tax return? (approved web version) georgia department of revenue 2021 beginning income tax return ending. The bill also provides for. Web georgia form 700 ( rev. This form is for income earned in tax year 2022, with tax returns due in april. 06/20/20) page 1 partnership tax return (approved web version) georgia department of revenue 2020 beginning income tax return ending original. You are required to file a georgia income tax return form 700 if your business is required to file a federal income tax form 1065 and your business:

If the partnership makes this election, a schedule should be attached to the form 700 which provides the details of the income reported for the partners. Web page 1 of form 700. Save or instantly send your ready documents. Web georgia form 700 ( rev. 07/20/22)page 1 partnership tax return georgia department of revenue 2022 income tax returnbeginning ending a.federal employer id no. Easily fill out pdf blank, edit, and sign them. Attach additional pages if needed. Total income for georgia, form 700, schedule. Web georgia form 700 ( rev. Web to the form 700 which provides the details of the income reported for the partners and the total income should be entered on line 1 of schedule 1.

If the partnership makes this election, a schedule should be attached to the form 700 which provides the details of the income reported for the partners. Read the application carefully & answer each question accurately. Web georgia form 700 ( rev. Web general instructions and information for filing georgia partnerships tax returns. Visit the georgia ethics commission website or search for georgia. Save or instantly send your ready documents. A copy of the federal return is attached to file with the georgia return. Web georgia department of revenue save form. Feel all the benefits of completing and submitting forms on the internet. Easily fill out pdf blank, edit, and sign them.

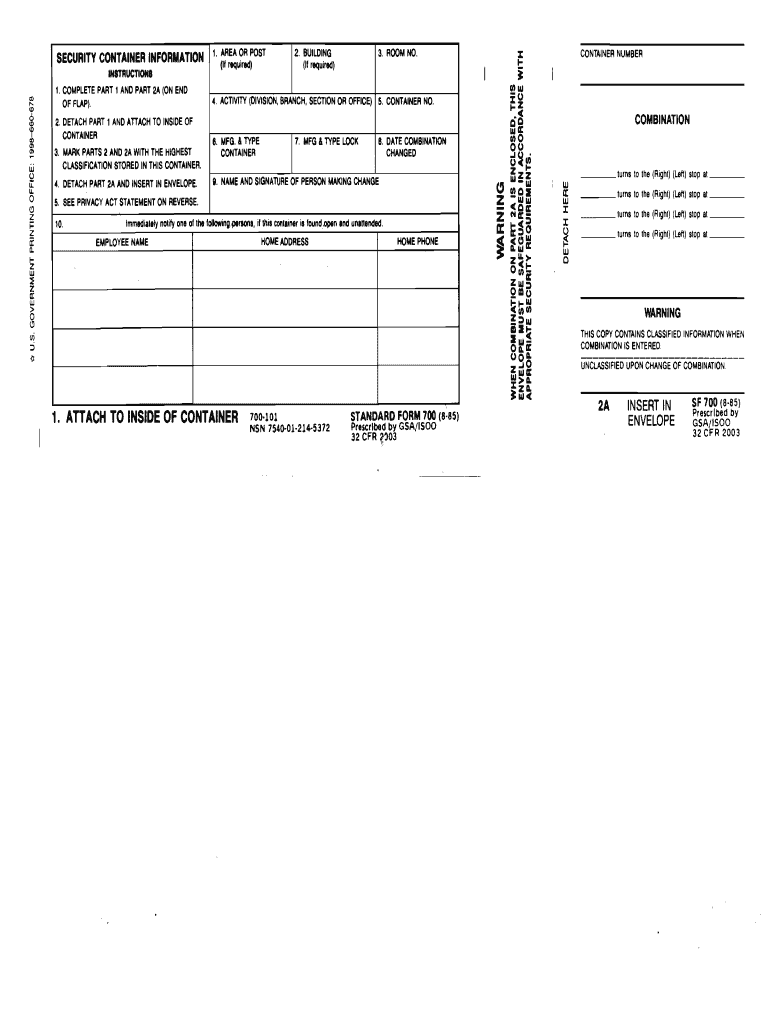

Sf 700 Fill Out and Sign Printable PDF Template signNow

Web georgia form 700 ( rev. If the partnership makes this election, a schedule should be attached to the form 700 which provides the details of the income reported for the partners. Save or instantly send your ready documents. Web georgia department of revenue save form. Web we last updated georgia form 700 in january 2023 from the georgia department.

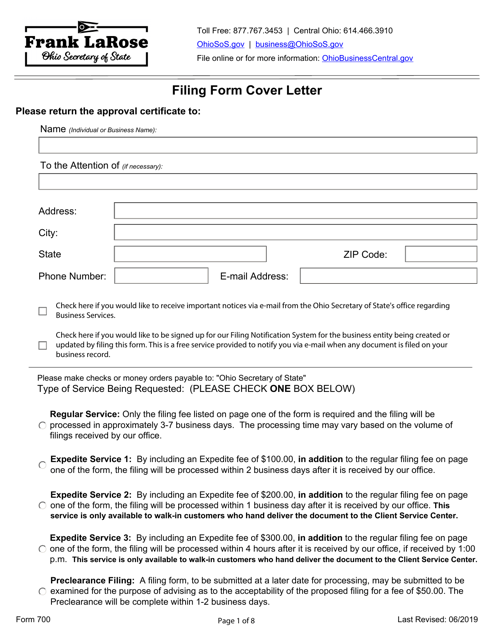

Form 700 Download Fillable PDF or Fill Online Certificate for

Easily fill out pdf blank, edit, and sign them. Web georgia form 700 ( rev. If the partnership makes this election, a schedule should be attached to the form 700 which provides the details of the income reported for the partners. Web complete georgia form 700 instructions online with us legal forms. Feel all the benefits of completing and submitting.

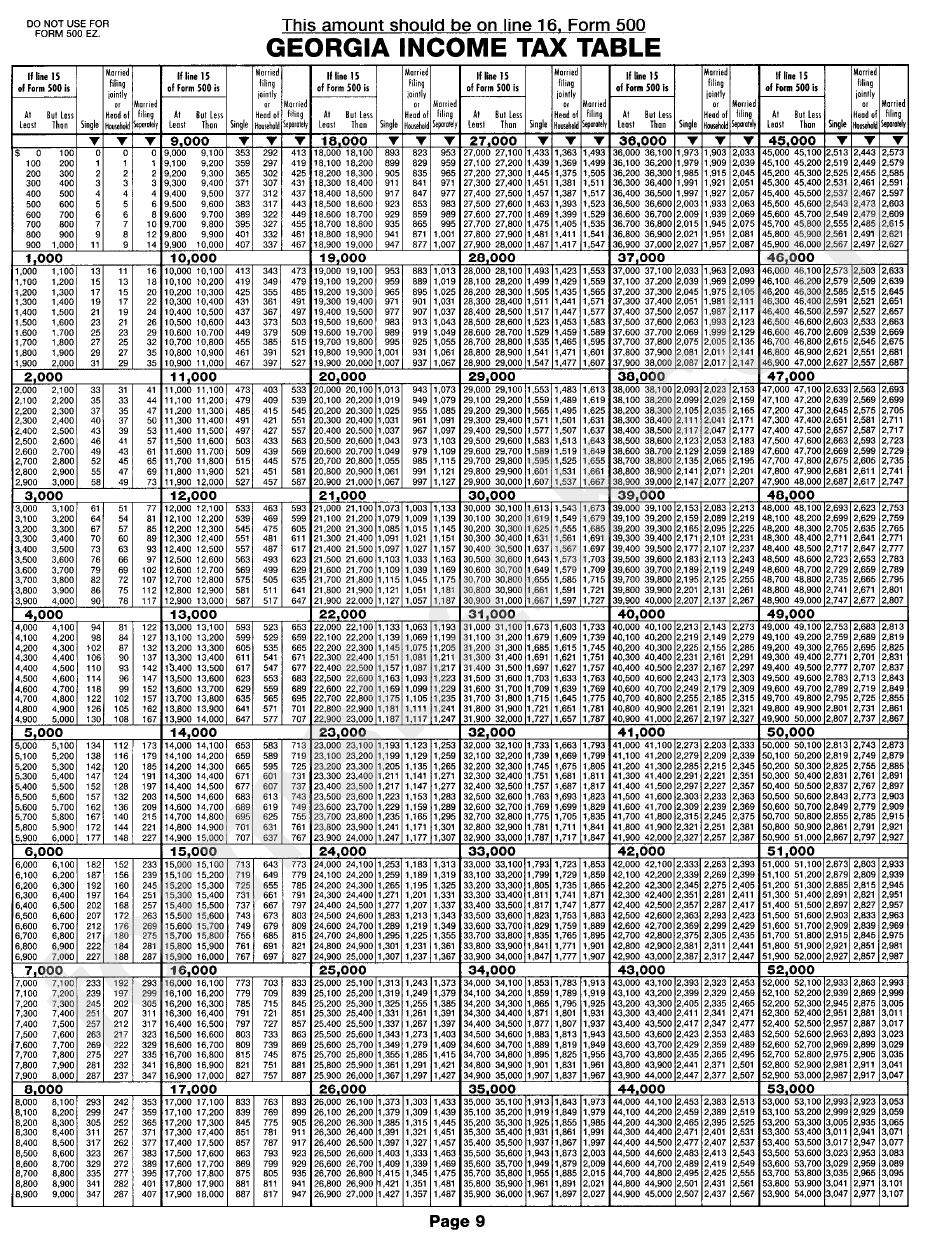

Form 500 Tax Table printable pdf download

Easily fill out pdf blank, edit, and sign them. This form is for income earned in tax year 2022, with tax returns due in april. 07/20/22)page 1 partnership tax return georgia department of revenue 2022 income tax returnbeginning ending a.federal employer id no. Feel all the benefits of completing and submitting forms on the internet. Save or instantly send your.

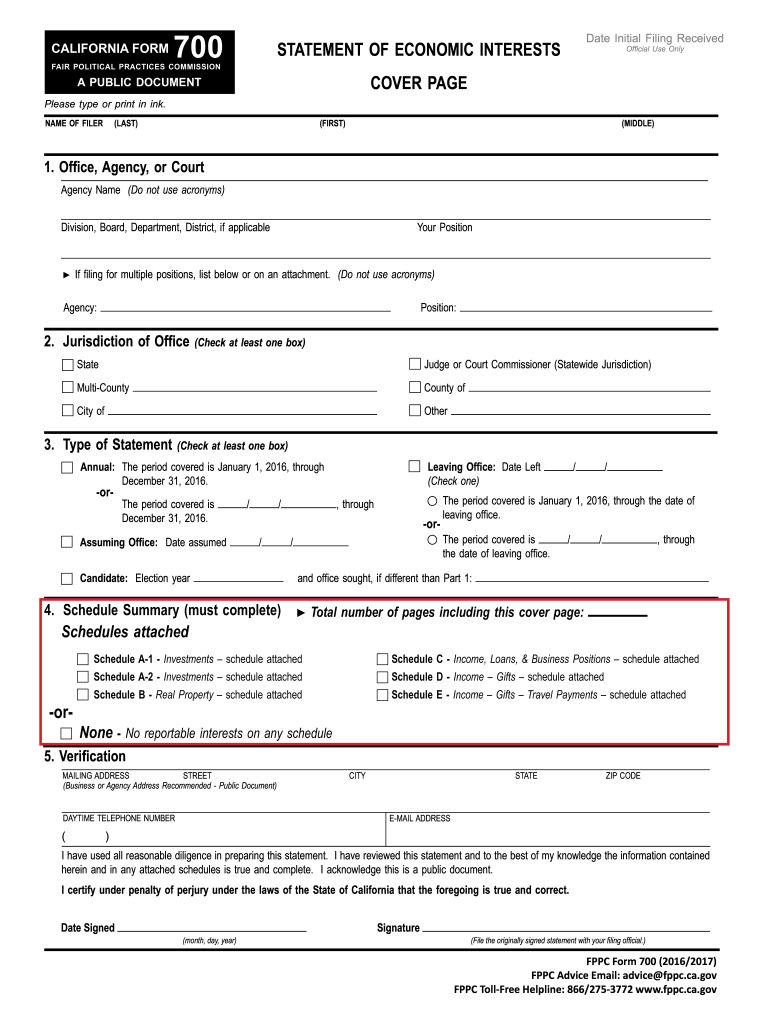

Form 700 Fill Out and Sign Printable PDF Template signNow

You can download or print current or past. Web georgia form 700 ( rev. (approved web version) georgia department of revenue 2021 beginning income tax return ending. Web up to $40 cash back fill ga form 700 instructions 2021, edit online. Web georgia form 700 ( rev.

500 Form Fill Out and Sign Printable PDF Template signNow

Web follow the simple instructions below: Web georgia form 700 ( rev. A copy of the federal return is attached to file with the georgia return. Read the application carefully & answer each question accurately. If the partnership makes this election, a schedule should be attached to the form 700 which provides the details of the income reported for the.

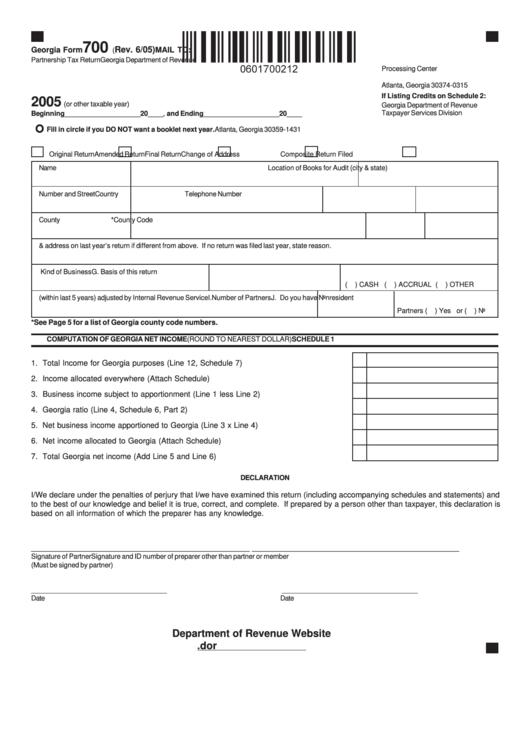

Fillable Form 700 Partnership Tax Return 2005 printable pdf

Web complete georgia form 700 instructions online with us legal forms. If the partnership makes this election, a schedule should be attached to the form 700 which provides the details of the income reported for the partners. This form is for income earned in tax year 2022, with tax returns due in april. 08/02/21) partnership tax return page 1. Web.

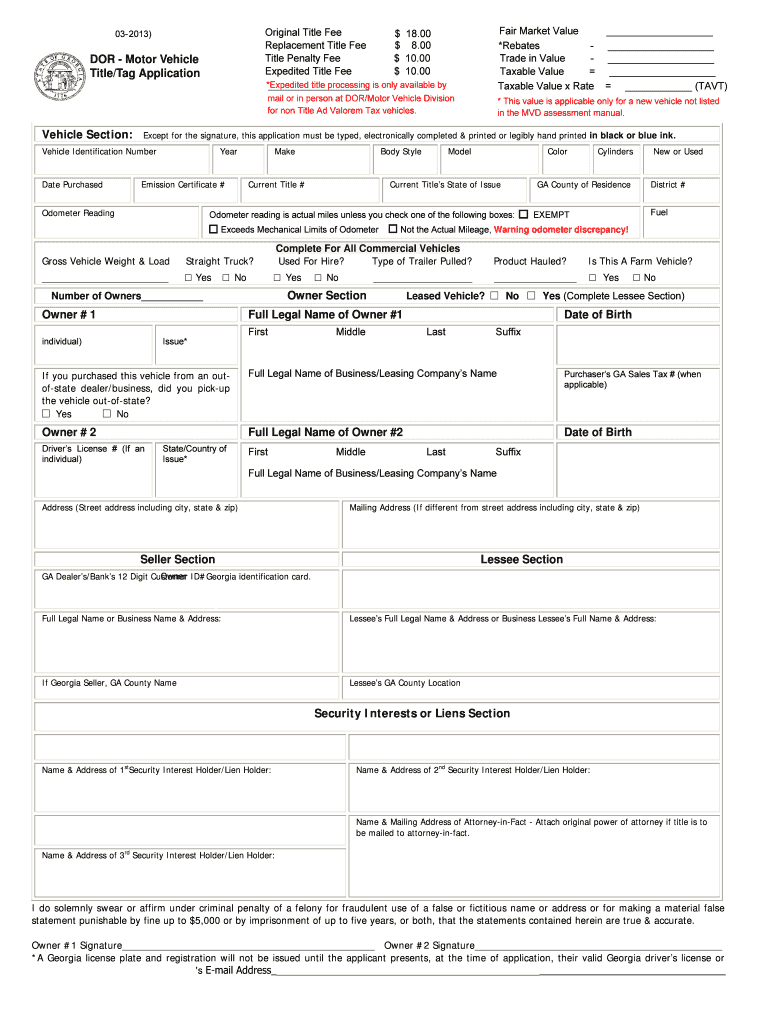

2006 Form GA MV1 Fill Online, Printable, Fillable, Blank PDFfiller

Attach additional pages if needed. 07/20/22)page 1 partnership tax return georgia department of revenue 2022 income tax returnbeginning ending a.federal employer id no. Web georgia form 700 ( rev. The bill also provides for. Web georgia form 700 ( rev.

GA Form NCC&M09 Complete Legal Document Online US Legal Forms

Total income for georgia, form 700, schedule. Sign and mail application to:. A copy of the federal return is attached to file with the georgia return. Web up to $40 cash back fill ga form 700 instructions 2021, edit online. Web up to $40 cash back to fill out georgia form 700, you will need to follow these instructions:

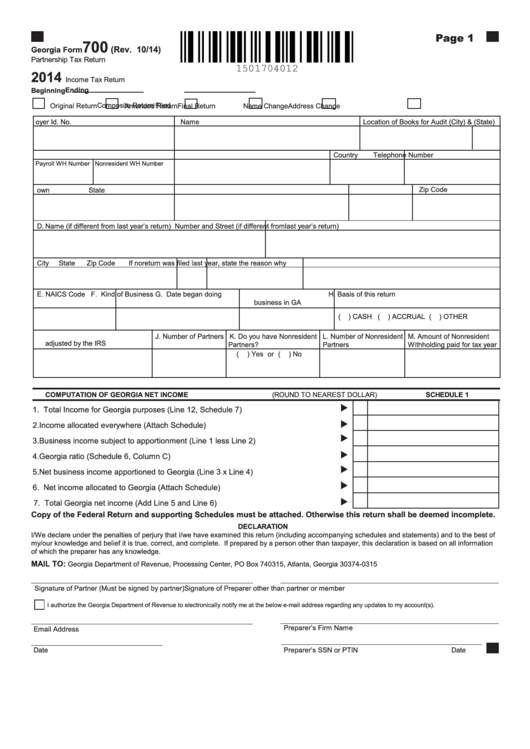

Fillable Form 700 Partnership Tax Return 2014 printable pdf

07/20/22)page 1 partnership tax return georgia department of revenue 2022 income tax returnbeginning ending a.federal employer id no. (approved web version) georgia department of revenue 2021 beginning income tax return ending. Uet, underpayment of estimated taxes ; If the partnership makes this election, a schedule should be attached to the form 700 which provides the details of the income reported.

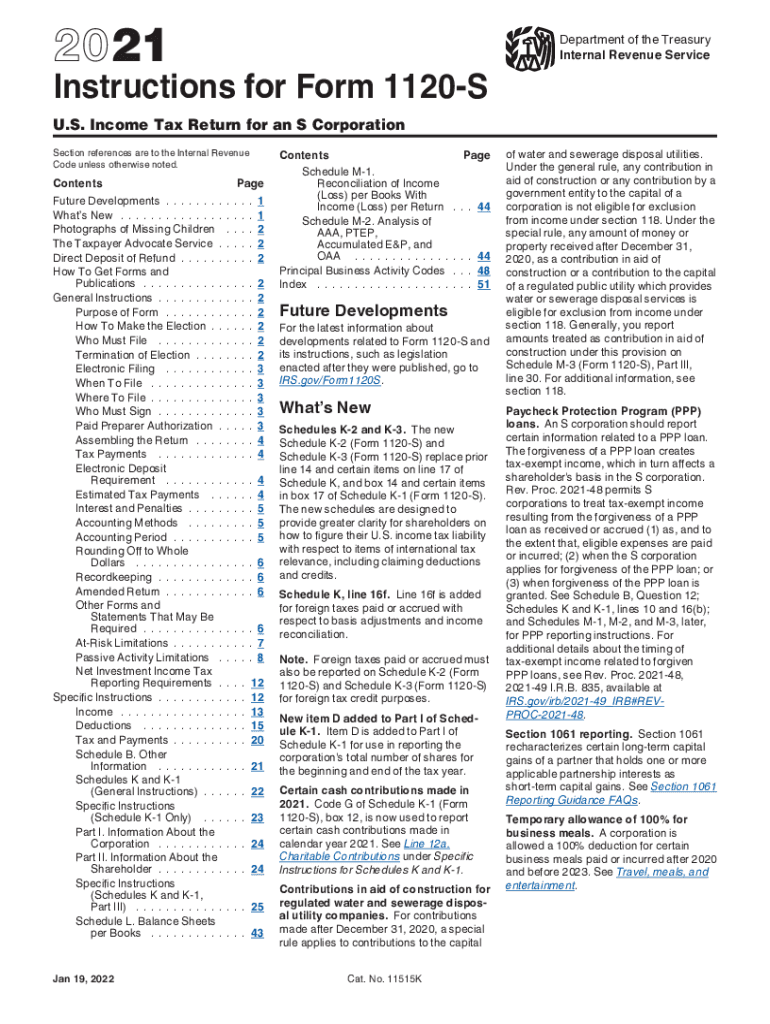

2021 Form IRS Instructions 1120S Fill Online, Printable, Fillable

Attach additional pages if needed. Web up to $40 cash back fill ga form 700 instructions 2021, edit online. Sign, fax and printable from pc, ipad, tablet or mobile with pdffiller instantly. Web up to $40 cash back to fill out georgia form 700, you will need to follow these instructions: You can download or print current or past.

Easily Fill Out Pdf Blank, Edit, And Sign Them.

Attach additional pages if needed. Visit the georgia ethics commission website or search for georgia. How do i enter these on the georgia state tax return? A copy of the federal return is attached to file with the georgia return.

Web Up To $40 Cash Back Fill Ga Form 700 Instructions 2021, Edit Online.

Web complete georgia form 700 instructions online with us legal forms. Save or instantly send your ready documents. Total income for georgia, form 700, schedule. Uet, underpayment of estimated taxes ;

Feel All The Benefits Of Completing And Submitting Forms On The Internet.

Web general instructions and information for filing georgia partnerships tax returns. This form is for income earned in tax year 2022, with tax returns due in april. Sign and mail application to:. (approved web version) georgia department of revenue 2021 beginning income tax return ending.

08/02/21) Partnership Tax Return Page 1.

Web page 1 of form 700. Web georgia form 700 ( rev. 07/20/22)page 1 partnership tax return georgia department of revenue 2022 income tax returnbeginning ending a.federal employer id no. You are required to file a georgia income tax return form 700 if your business is required to file a federal income tax form 1065 and your business: