Garage Liability Coverage Form

Garage Liability Coverage Form - The garage coverage form is a standard form commonly used by insurers that can provide several types of coverage for automotive businesses. Salvage pools and wreckers garage liability policy or commercial auto policy is acceptable. Business auto liability (including physical. It provides them with liability protection in the event that a. Garage liability insurance is helpful to car dealerships who are looking to cover all autos on their lots, including cars. Garage keeper’s insurance has three options offered: Web this insurance does not apply, under the garage liability coverages: This insurance provides coverage for: The goal of garage liability is twofold: Web what is the garage coverage form?

The insurance will pay for repairs, medical. This is called the legal liability (or standard) coverage option. For example, the standard iso electronic data liability coverage form, cg 00 65 04 13, and its. On this page additional information The goal of garage liability is twofold: (a) to liability assumed by the insured under any contract or agreement except an incidental contract; To provide peace of mind and protection for your business when the vehicles in your care inflict bodily injury or property damage to customers, visitors, and third parties both. This insurance is added to the business liability coverage of car dealerships and parking lot or parking garage operators. Web the standard garage form applies to garage operations and liability arising out of the ownership, maintenance or use of covered autos. Web insurance services office (iso) recently introduced several changes to its auto dealer coverage form (ca 00 25) with a november 2020 edition date and a proposed effective date of december 1, 2020.

The insurance will pay for repairs, medical. The cgl form does offer certain limited coverage. Garage liability insurance is one of the types of insurance that is available on the garage coverage form. This is 3rd party protection only. Web a good garage liability insurance policy with ample coverage will include both general liability and auto liability exposures. Web garage liability insurance is a policy that covers property damage or bodily injury caused by an incident out of garage operations. This is called the legal liability (or standard) coverage option. (a) to liability assumed by the insured under any contract or agreement except an incidental contract; Web this type of coverage is needed due to an exclusion in the garage liability form for damage to a customer’s auto while in the “care, custody or control” of the garage. Web what is the garage coverage form?

Garage Liability H&H Risk Partners

Web hirurg | getty images garage keepers insurance falls under a garage policy held by auto dealers, body shops, and repair shops. Is a policy that covers bodily injury or property damage caused by an incident out of garage operations. Liability claims like discrimination and employee dishonesty. A direct coverage option allows coverage to be triggered without regard to liability,.

InStar v9.6 Release Notes

Liability claims like discrimination and employee dishonesty. Garage liability insurance is one of the types of insurance that is available on the garage coverage form. This is called the legal liability (or standard) coverage option. Garage liability insurance is helpful to car dealerships who are looking to cover all autos on their lots, including cars. On this page additional information

Garage Liability Insurance Cost, Coverage & Providers

The cgl form does offer certain limited coverage. Web a good garage liability insurance policy with ample coverage will include both general liability and auto liability exposures. This insurance provides coverage for: Web garage liability insurance is a policy that covers property damage or bodily injury caused by an incident out of garage operations. Meaning it protects other people and.

Garage Liability Insurance ASCO Insurance

Garage liability insurance is one of the types of insurance that is available on the garage coverage form. Liability claims like discrimination and employee dishonesty. This is called the legal liability (or standard) coverage option. Web this insurance does not apply, under the garage liability coverages: Web a good garage liability insurance policy with ample coverage will include both general.

Garage Liability Insurance Cost and Coverage EINSURANCE

Web this type of coverage is needed due to an exclusion in the garage liability form for damage to a customer’s auto while in the “care, custody or control” of the garage. Web coverage under garage liability insurance garage liability insurance combines a business auto policy with general liability insurance. The insurance will pay for repairs, medical. Garage keeper’s insurance.

Dissecting the Garage Liability Policy Dealer Risk Services

(b) to bodily injury or property damage arising out of the ownership, maintenance, operation, use, loading or unloading of any escalator at premises owned, rented or controlle. To provide peace of mind and protection for your business when the vehicles in your care inflict bodily injury or property damage to customers, visitors, and third parties both. Personal injury and advertising.

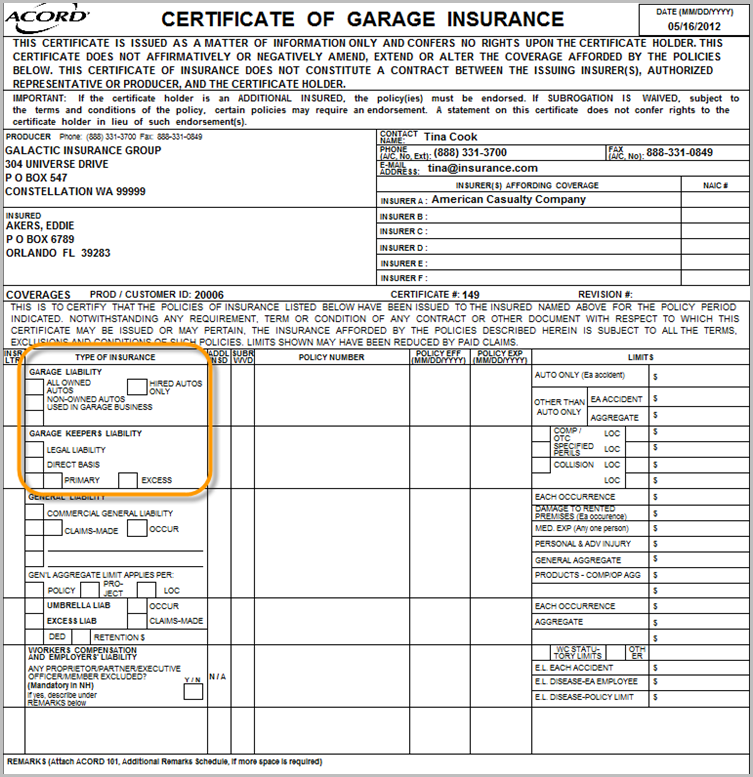

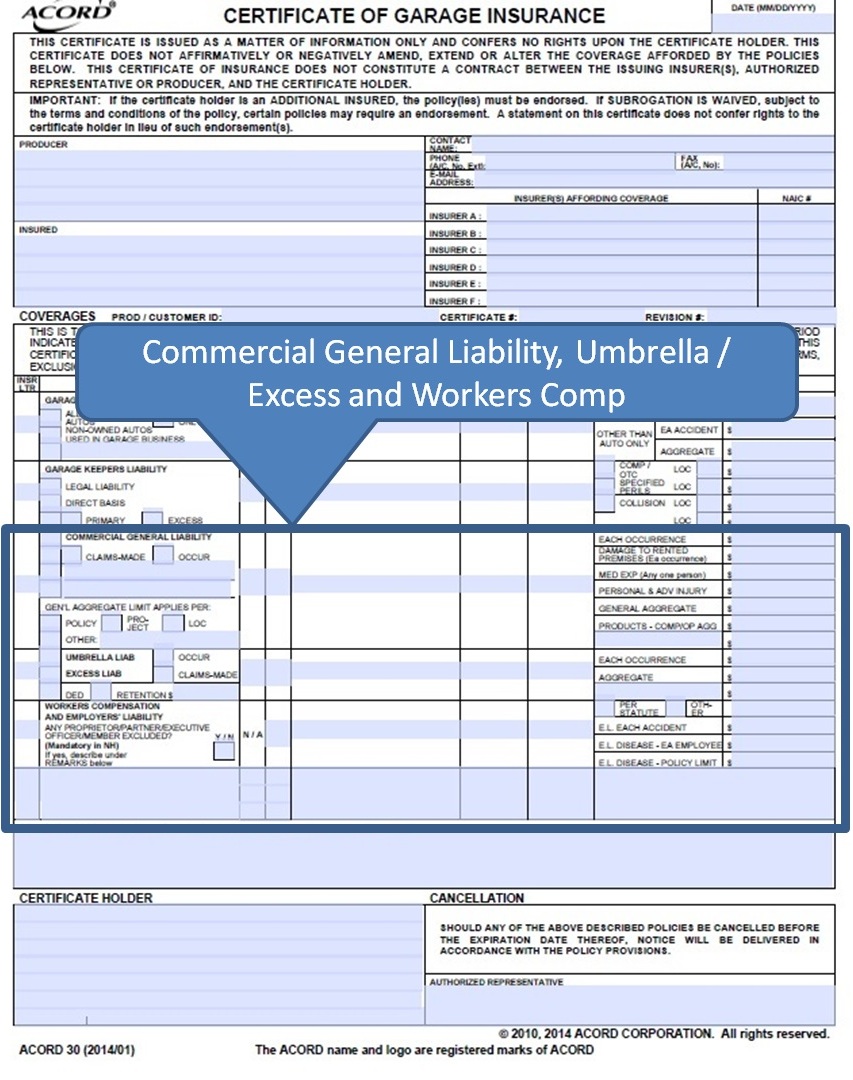

SimplyEasierACORDForms How to Complete the ACORD 30 Coverage

For example, the standard iso electronic data liability coverage form, cg 00 65 04 13, and its. Web garage liability coverage is typically purchased by automobile dealerships and repair shops, among other businesses. Web the standard garage form applies to garage operations and liability arising out of the ownership, maintenance or use of covered autos. (a) to liability assumed by.

InStar v9.6 Release Notes

The cgl form does offer certain limited coverage. Required by the state of fl you must maintain a minimum of $25,000 combined single limit. Garage liability insurance is helpful to car dealerships who are looking to cover all autos on their lots, including cars. Garage liability insurance is one of the types of insurance that is available on the garage.

Garage Keepers Liability Acord Form Dandk Organizer

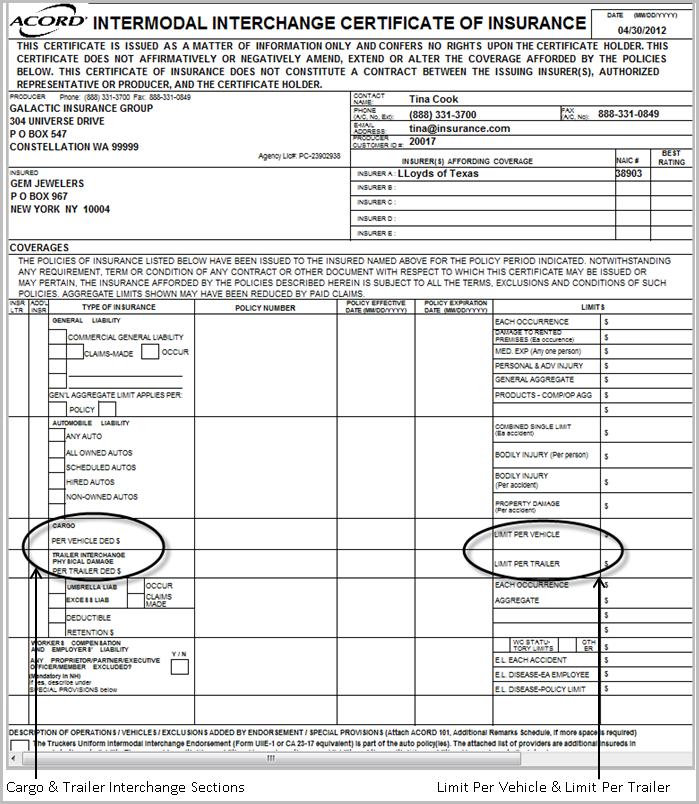

A direct coverage option allows coverage to be triggered without regard to liability, addition premium due and listed as active on the declarations page. Property damage caused by equipment owned by the business. The garage coverage form is a standard form commonly used by insurers that can provide several types of coverage for automotive businesses. Web the garage form liability.

SimplyEasierACORDForms Instructions ACORD 30 General Liability

Web garage liability insurance is a policy that covers property damage or bodily injury caused by an incident out of garage operations. Insurance is required only when the licensee. For example, the standard iso electronic data liability coverage form, cg 00 65 04 13, and its. The policy refers to the ownership, maintenance or use of locations for garage business.

The Policy Refers To The Ownership, Maintenance Or Use Of Locations For Garage Business Operations.

Garage liability insurance is one of the types of insurance that is available on the garage coverage form. Is a policy that covers bodily injury or property damage caused by an incident out of garage operations. Web coverage under garage liability insurance garage liability insurance combines a business auto policy with general liability insurance. Web insurance services office (iso) recently introduced several changes to its auto dealer coverage form (ca 00 25) with a november 2020 edition date and a proposed effective date of december 1, 2020.

This Insurance Provides Coverage For:

Web hirurg | getty images garage keepers insurance falls under a garage policy held by auto dealers, body shops, and repair shops. Garage keeper’s insurance has three options offered: Web garage liability coverage is typically purchased by automobile dealerships and repair shops, among other businesses. This insurance will add a layer of.

It Provides Them With Liability Protection In The Event That A.

Insurance is required only when the licensee. These changes are in response to changes in the business auto program, the general liability program and the dissolution of the. Garage liability insurance is helpful to car dealerships who are looking to cover all autos on their lots, including cars. The garage coverage form is a standard form commonly used by insurers that can provide several types of coverage for automotive businesses.

To Provide Peace Of Mind And Protection For Your Business When The Vehicles In Your Care Inflict Bodily Injury Or Property Damage To Customers, Visitors, And Third Parties Both.

On this page additional information This insurance is added to the business liability coverage of car dealerships and parking lot or parking garage operators. This is 3rd party protection only. (b) to bodily injury or property damage arising out of the ownership, maintenance, operation, use, loading or unloading of any escalator at premises owned, rented or controlle.