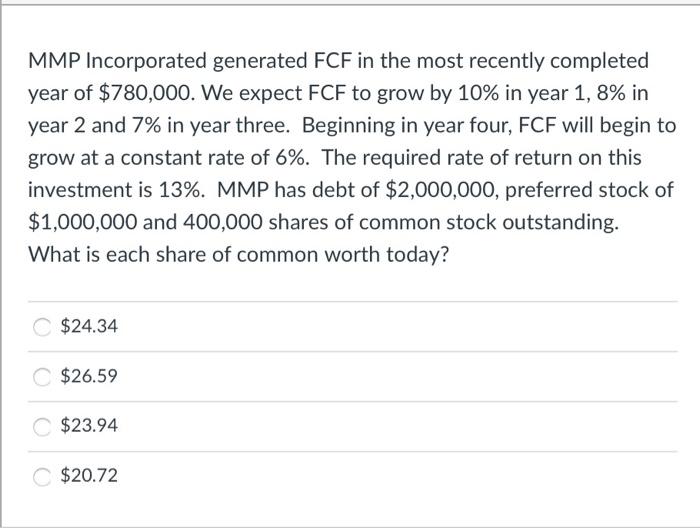

Generated Fcf In The Most Recently Completed Year

Generated Fcf In The Most Recently Completed Year - Mmp incorporated generated fcf in the most recently completed year of $700,000. We expect fcf to grow by 10% in year 1, 8% in year 2 and. Mmp incorporated generated fcf in the most recently completed year of $700,000. In this section, we will delve into the topic of calculating free cash flow (fcf) and explore various methods and formulas used in the. We expect fcf to grow by 10% in year 1, 8% in year 2 and 7% in year three. 2 pts question 14 mmp incorporated generated fcf in the most recently completed year of $700,000. Beginning in year four, fcf will begin to grow at. We expect fcf to grow by 10% in year 1, 8% in year 2 and. We expect fcf to grow by 10% in.

We expect fcf to grow by 10% in year 1, 8% in year 2 and. In this section, we will delve into the topic of calculating free cash flow (fcf) and explore various methods and formulas used in the. We expect fcf to grow by 10% in year 1, 8% in year 2 and 7% in year three. 2 pts question 14 mmp incorporated generated fcf in the most recently completed year of $700,000. Beginning in year four, fcf will begin to grow at. Mmp incorporated generated fcf in the most recently completed year of $700,000. Mmp incorporated generated fcf in the most recently completed year of $700,000. We expect fcf to grow by 10% in year 1, 8% in year 2 and. We expect fcf to grow by 10% in.

Mmp incorporated generated fcf in the most recently completed year of $700,000. We expect fcf to grow by 10% in year 1, 8% in year 2 and 7% in year three. 2 pts question 14 mmp incorporated generated fcf in the most recently completed year of $700,000. We expect fcf to grow by 10% in year 1, 8% in year 2 and. In this section, we will delve into the topic of calculating free cash flow (fcf) and explore various methods and formulas used in the. Beginning in year four, fcf will begin to grow at. We expect fcf to grow by 10% in year 1, 8% in year 2 and. Mmp incorporated generated fcf in the most recently completed year of $700,000. We expect fcf to grow by 10% in.

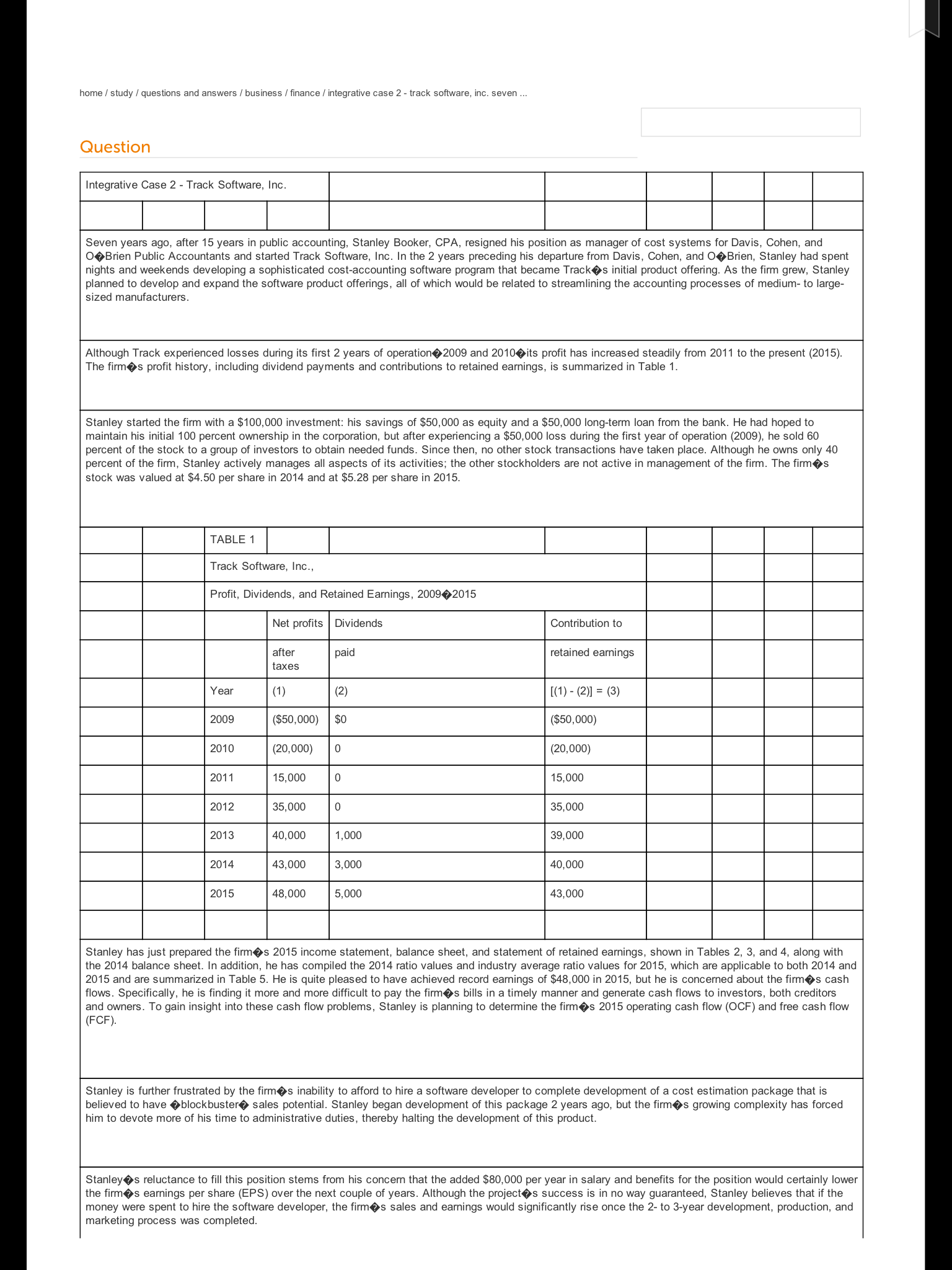

Solved Suppose that you believed that the FCF generated by

We expect fcf to grow by 10% in. Beginning in year four, fcf will begin to grow at. We expect fcf to grow by 10% in year 1, 8% in year 2 and 7% in year three. We expect fcf to grow by 10% in year 1, 8% in year 2 and. In this section, we will delve into the.

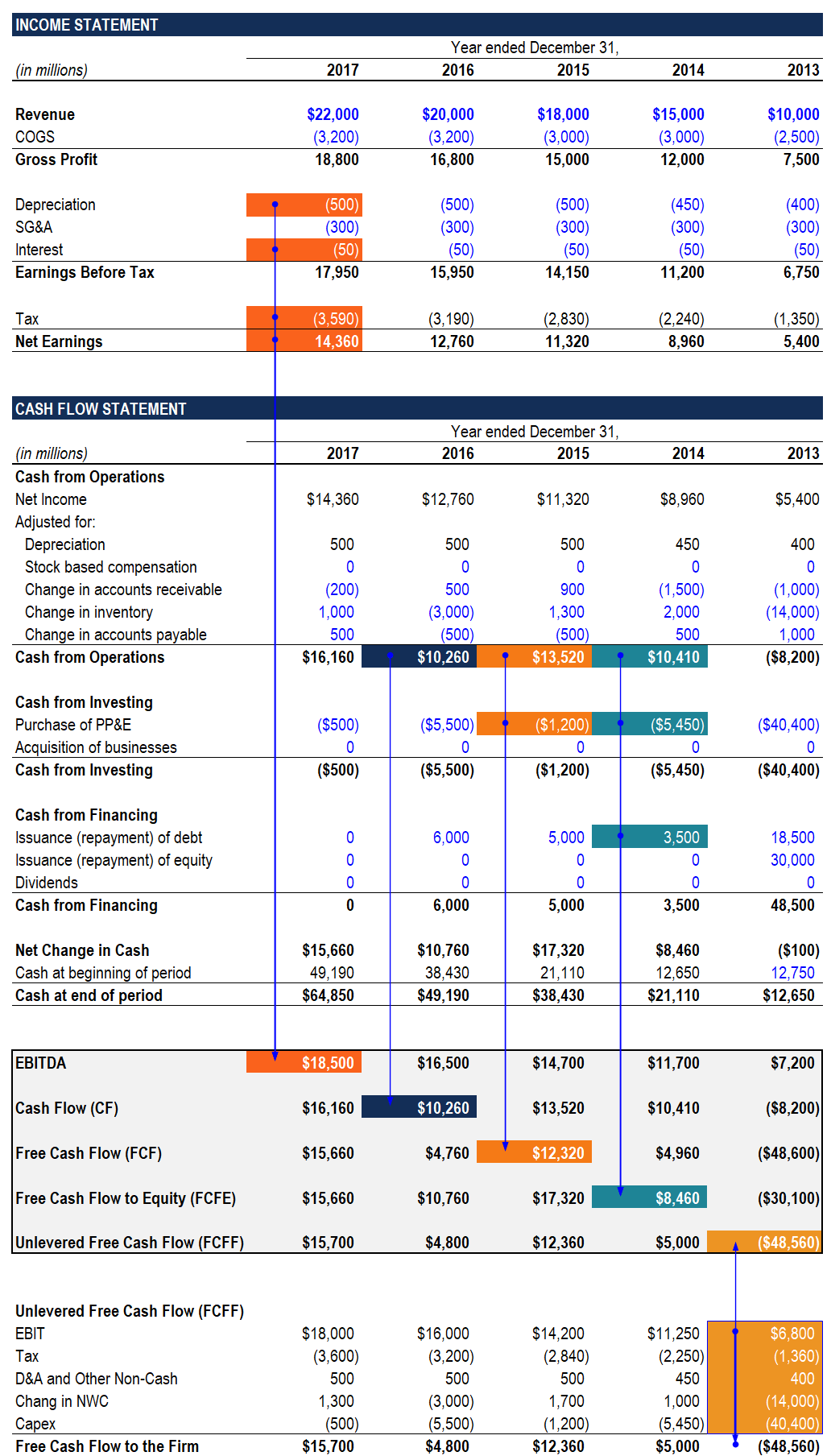

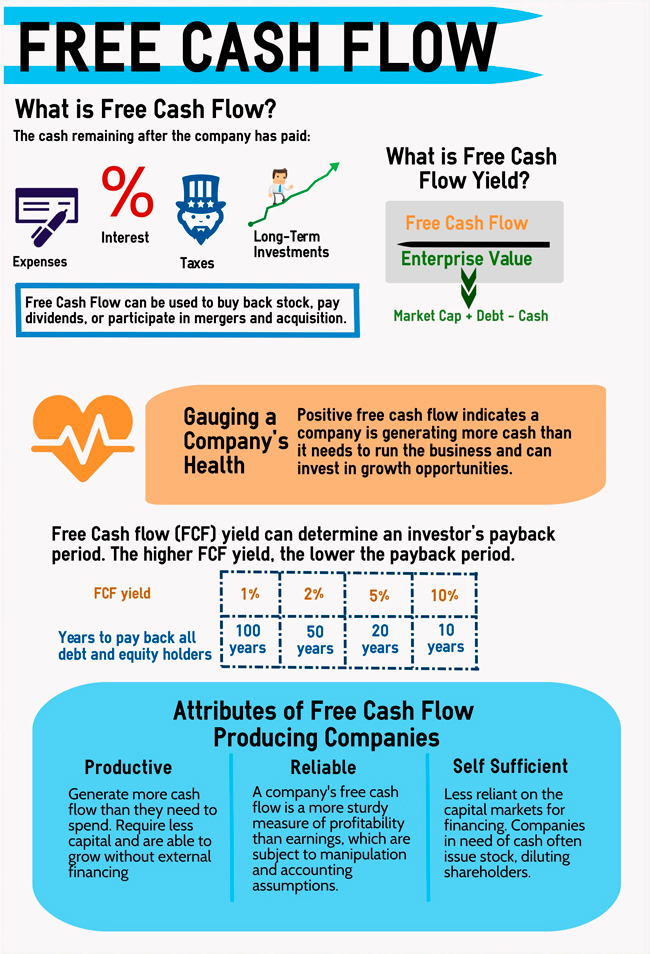

Free Cash Flow (FCF) Agicap

2 pts question 14 mmp incorporated generated fcf in the most recently completed year of $700,000. We expect fcf to grow by 10% in. We expect fcf to grow by 10% in year 1, 8% in year 2 and 7% in year three. Mmp incorporated generated fcf in the most recently completed year of $700,000. We expect fcf to grow.

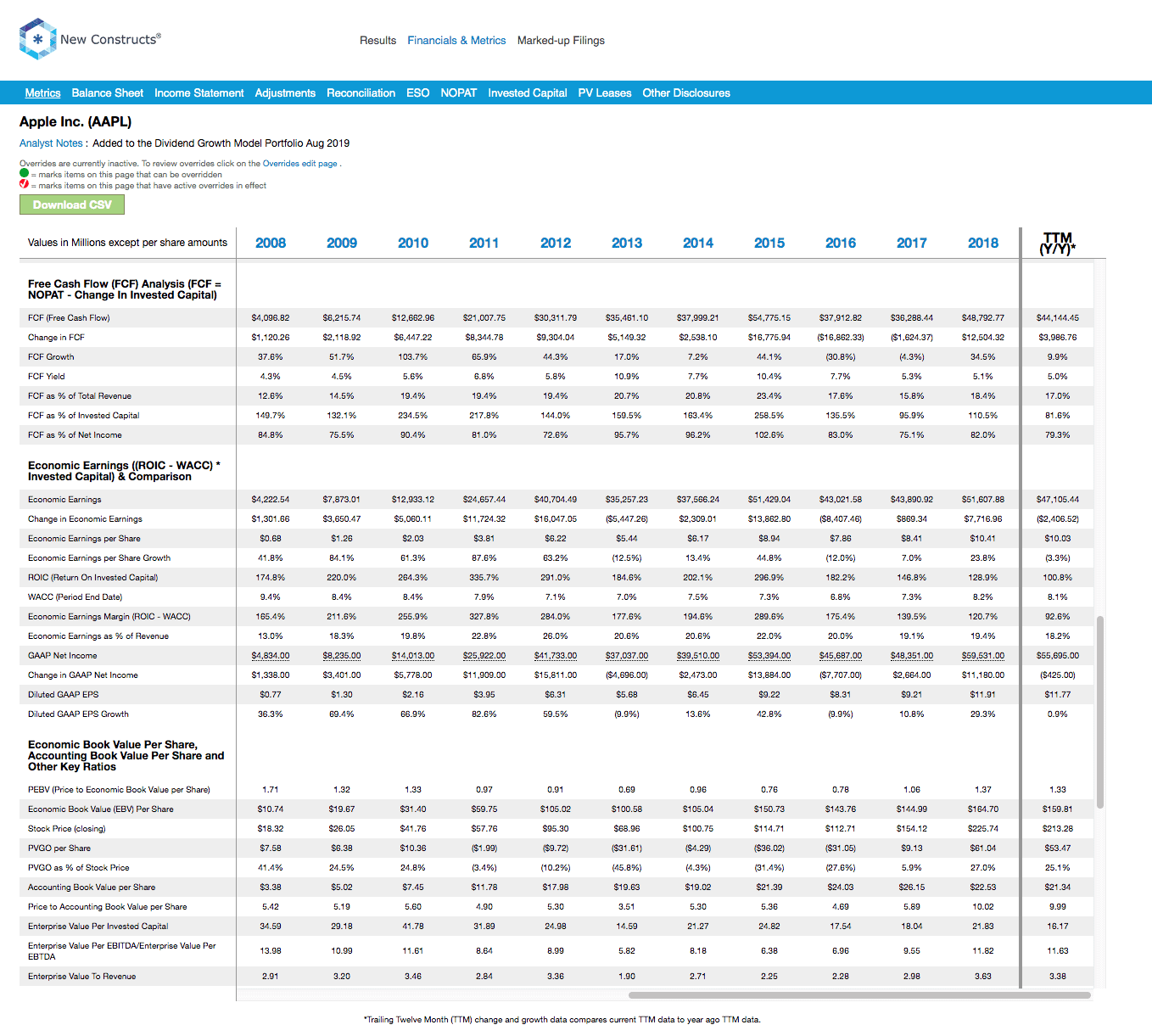

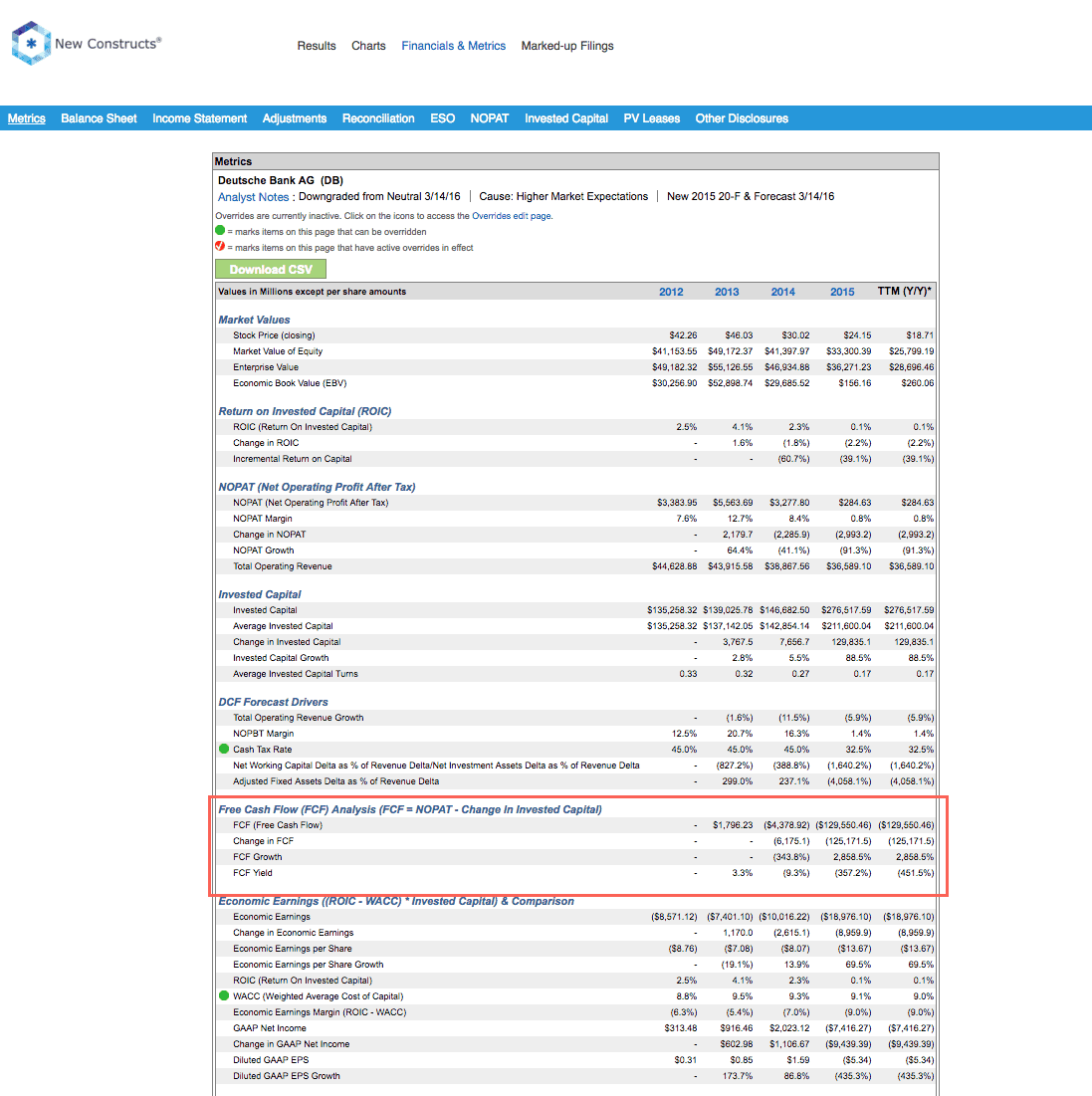

Free Cash Flow and FCF Yield

We expect fcf to grow by 10% in. In this section, we will delve into the topic of calculating free cash flow (fcf) and explore various methods and formulas used in the. Mmp incorporated generated fcf in the most recently completed year of $700,000. We expect fcf to grow by 10% in year 1, 8% in year 2 and. We.

Free Cash Flow (FCF) Most Important Metric in Finance & Valuation

2 pts question 14 mmp incorporated generated fcf in the most recently completed year of $700,000. Beginning in year four, fcf will begin to grow at. We expect fcf to grow by 10% in year 1, 8% in year 2 and 7% in year three. We expect fcf to grow by 10% in year 1, 8% in year 2 and..

Solved MMP Incorporated generated FCF in the most recently

We expect fcf to grow by 10% in. In this section, we will delve into the topic of calculating free cash flow (fcf) and explore various methods and formulas used in the. We expect fcf to grow by 10% in year 1, 8% in year 2 and 7% in year three. Mmp incorporated generated fcf in the most recently completed.

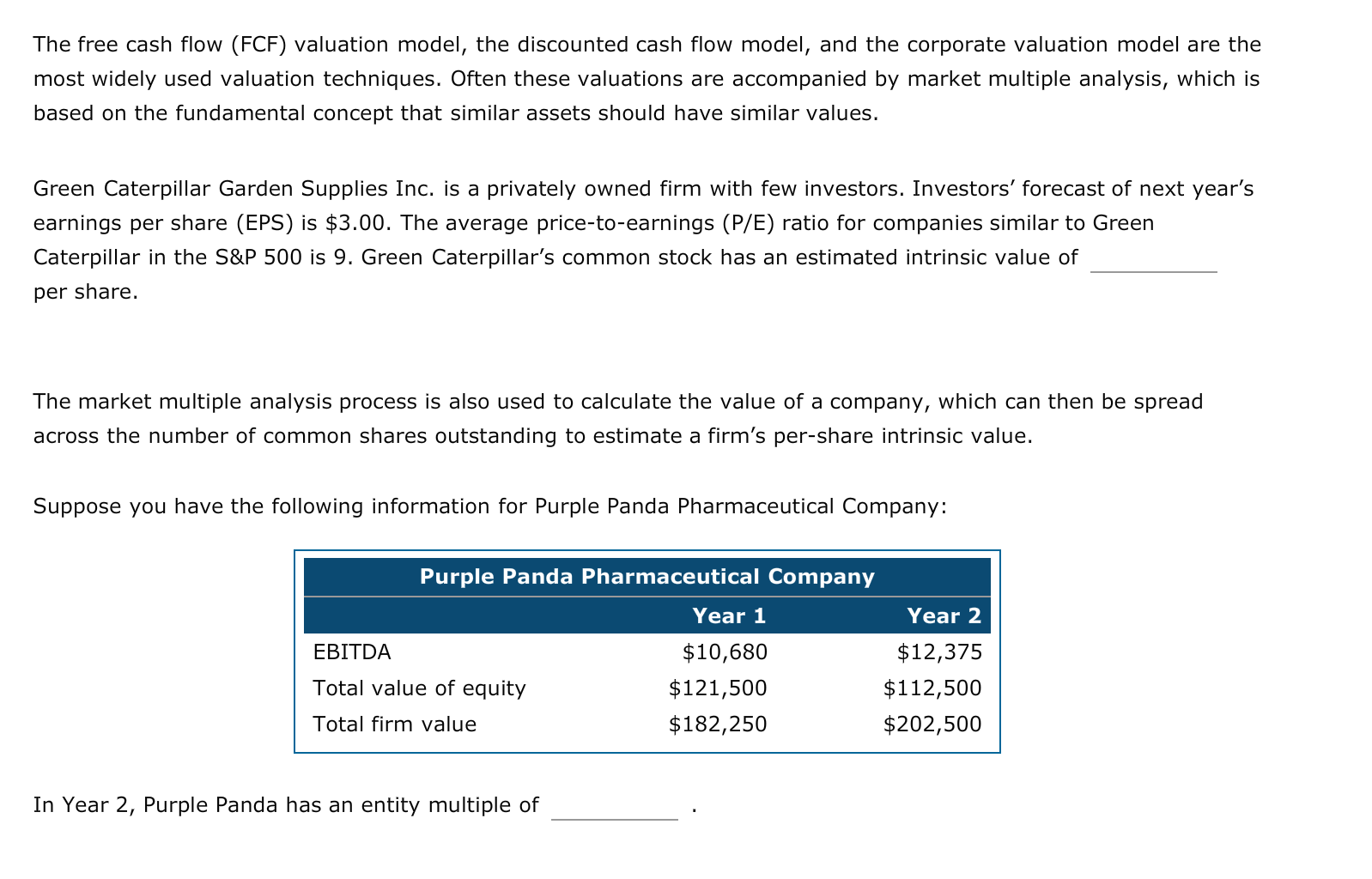

Solved The free cash flow (FCF) valuation model, the

2 pts question 14 mmp incorporated generated fcf in the most recently completed year of $700,000. We expect fcf to grow by 10% in year 1, 8% in year 2 and 7% in year three. Mmp incorporated generated fcf in the most recently completed year of $700,000. In this section, we will delve into the topic of calculating free cash.

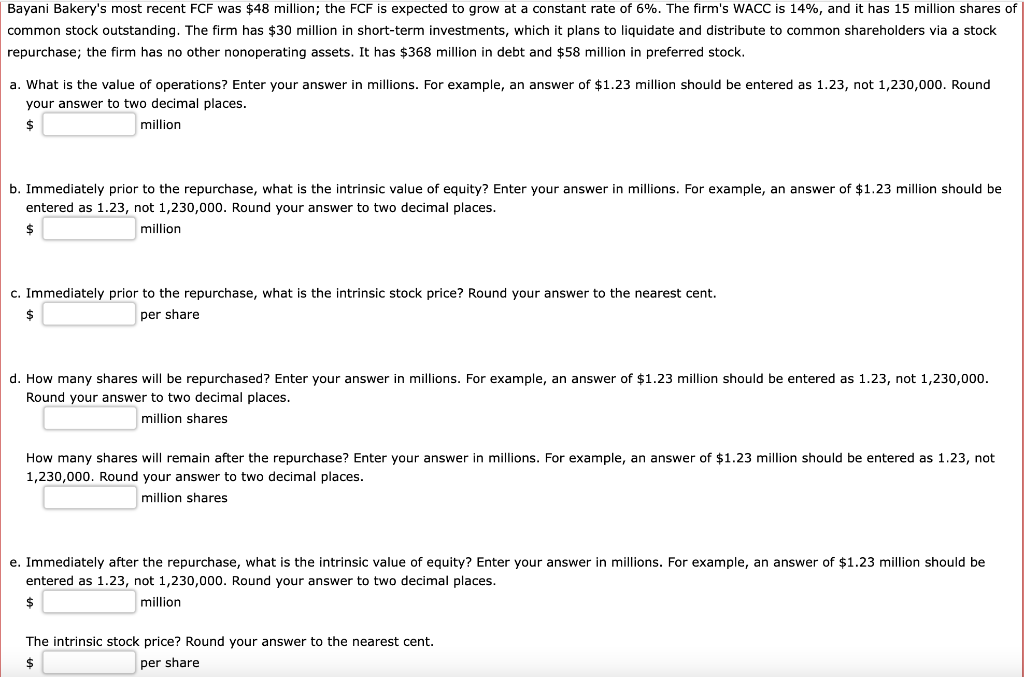

Solved Bayani Bakery's most recent FCF was 48 million; the

We expect fcf to grow by 10% in year 1, 8% in year 2 and 7% in year three. Beginning in year four, fcf will begin to grow at. We expect fcf to grow by 10% in year 1, 8% in year 2 and. 2 pts question 14 mmp incorporated generated fcf in the most recently completed year of $700,000..

The Power of Free Cash Flow Yield Pacer ETFs

Mmp incorporated generated fcf in the most recently completed year of $700,000. Mmp incorporated generated fcf in the most recently completed year of $700,000. We expect fcf to grow by 10% in. In this section, we will delve into the topic of calculating free cash flow (fcf) and explore various methods and formulas used in the. We expect fcf to.

Free Cash Flow (FCF) Explanation & Examples New Constructs

2 pts question 14 mmp incorporated generated fcf in the most recently completed year of $700,000. Mmp incorporated generated fcf in the most recently completed year of $700,000. We expect fcf to grow by 10% in. In this section, we will delve into the topic of calculating free cash flow (fcf) and explore various methods and formulas used in the..

We Expect Fcf To Grow By 10% In Year 1, 8% In Year 2 And.

We expect fcf to grow by 10% in year 1, 8% in year 2 and. 2 pts question 14 mmp incorporated generated fcf in the most recently completed year of $700,000. In this section, we will delve into the topic of calculating free cash flow (fcf) and explore various methods and formulas used in the. We expect fcf to grow by 10% in year 1, 8% in year 2 and 7% in year three.

Beginning In Year Four, Fcf Will Begin To Grow At.

Mmp incorporated generated fcf in the most recently completed year of $700,000. Mmp incorporated generated fcf in the most recently completed year of $700,000. We expect fcf to grow by 10% in.