Georgia Form 500 Schedule 3 Instructions

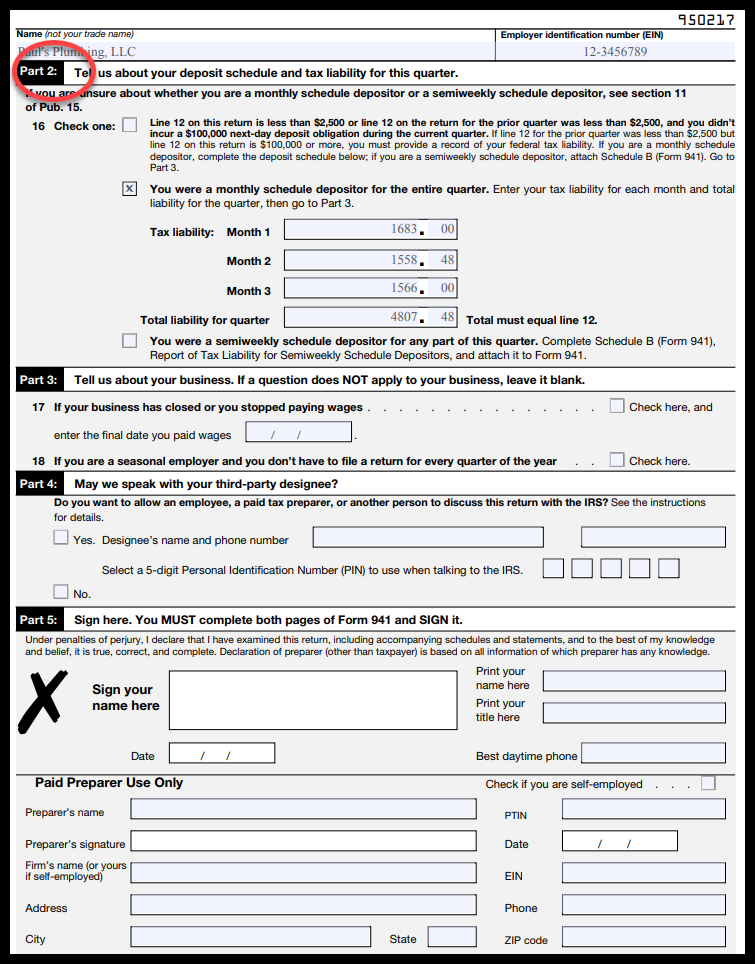

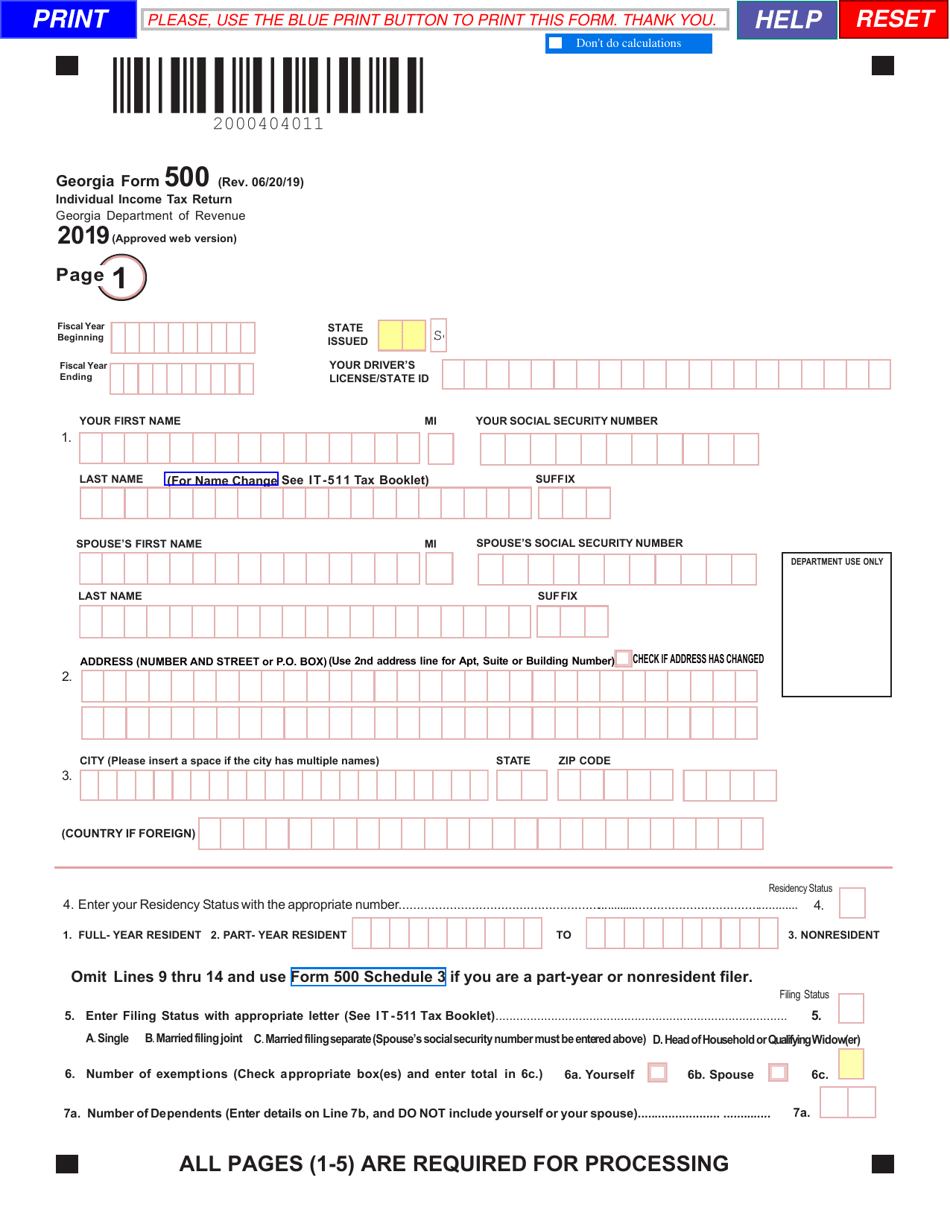

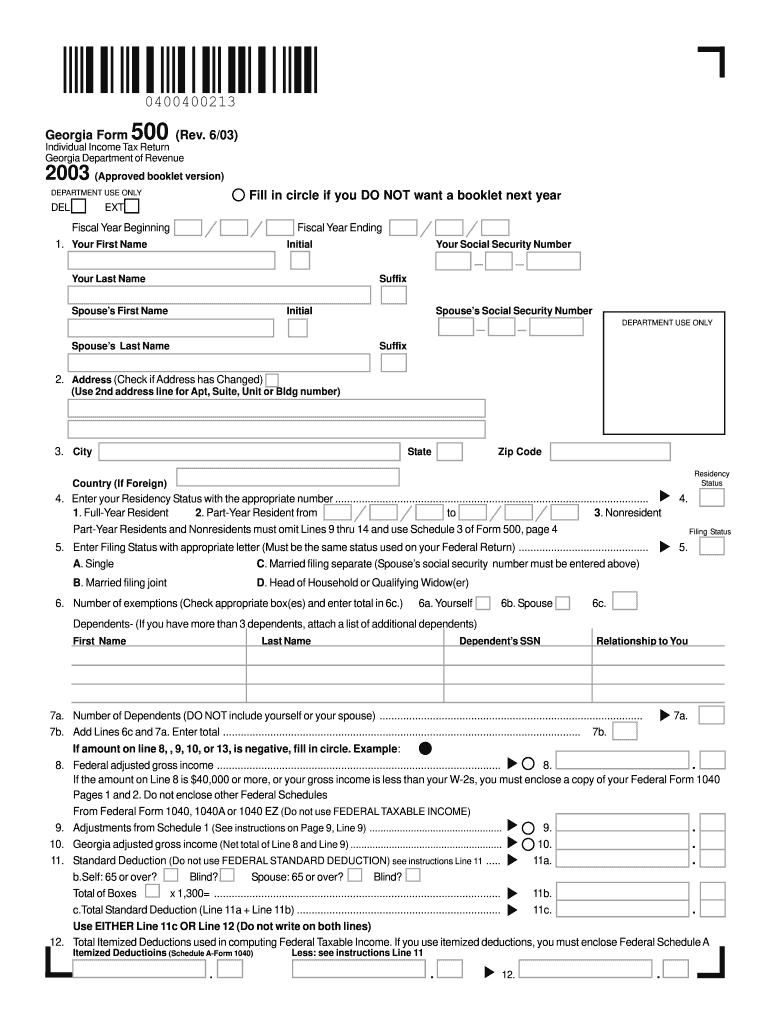

Georgia Form 500 Schedule 3 Instructions - Complete your federal return before starting your georgia return. Form schedule 2b, georgia tax credits. 08/02/21) amended individual income tax return georgia department of revenue use this form for the 2021 tax year only. Web ga 500/schedule 3 information. Web form 500 instructions include all completed schedules with your georgia return. Part year resident and non residents who recieve income from a georgia source are required to file a georia form 500 and complete. Web forms in tax booklet: Starting in tax year 2020, if the ga itemized box is checked, the full amount. Enter filing status with appropriate letter (see it. Web form 500 schedule 2, georgia tax credits.

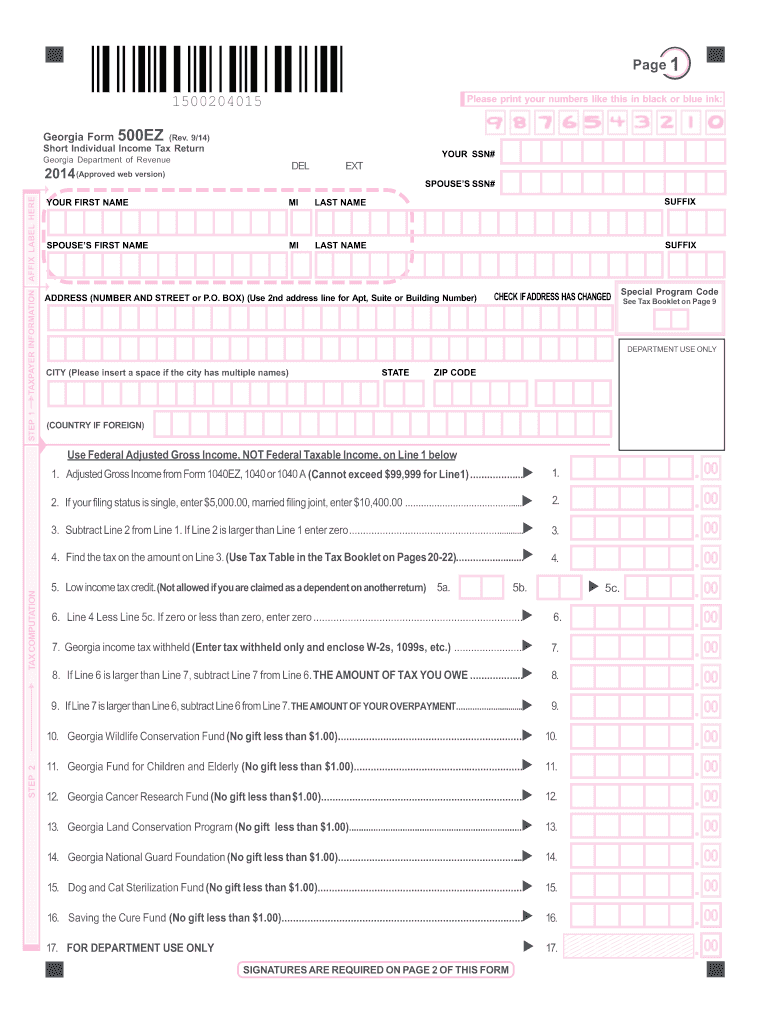

Web georgia form 500x (rev. Web form 500 schedule 2, georgia tax credits. Individual income tax return (short version) tax return: Schedule 1, line 14 must be completed in order for line 9 on form 500 page 2 to populate. Complete your federal return before starting your georgia return. Schedule 1, line 14 must be completed in order for line 9 on. Web ga 500/schedule 3 information. Web form 500 instructions include all completed schedules with your georgia return. (use 2nd address line for apt, suite or building number) last name suffix. Part year resident and non residents who recieve income from a georgia source are required to file a georia form 500 and complete.

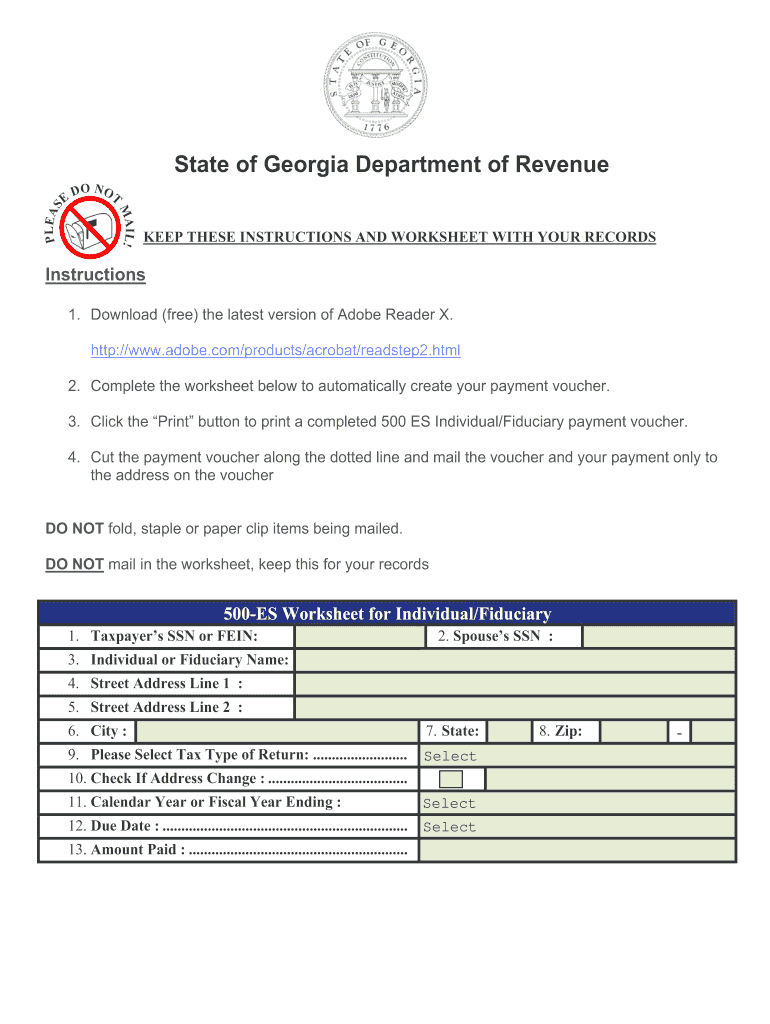

Web georgia department of revenue save form. Web form 500, form 500ez, it560, 500es, 525tv, form ind cr 2009 individual income tax 500 and 500ez forms and general instructions state of georgia department of. All forms must be printed and mailed to address listed on the form. Enter filing status with appropriate letter (see it. Individual income tax return (short version) tax return: Starting in tax year 2020, if the ga itemized box is checked, the full amount. Web forms in tax booklet: 08/02/21) amended individual income tax return georgia department of revenue use this form for the 2021 tax year only. Web form 500 schedule 2, georgia tax credits. Web georgia form 500x (rev.

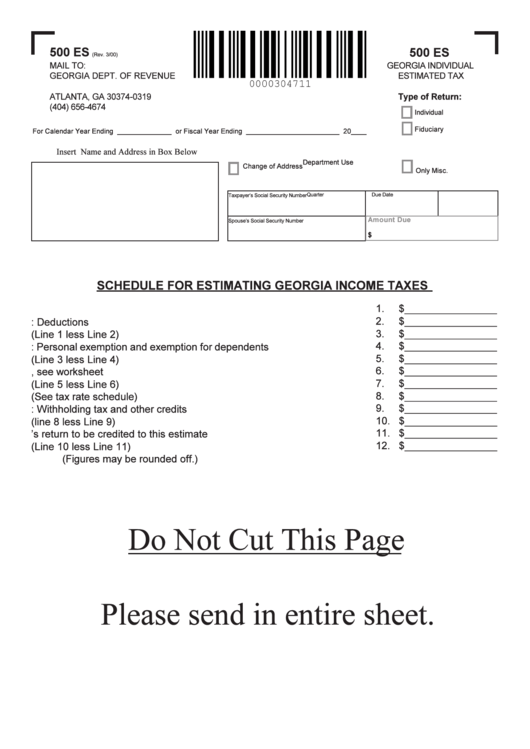

Estimated Tax Payments 2021 Fill Online, Printable, Fillable

Web forms in tax booklet: Web georgia form 500x (rev. Web form 500 instructions include all completed schedules with your georgia return. Web form 500 schedule 2, georgia tax credits. All forms must be printed and mailed to address listed on the form.

State Tax Form 500ez Instructions bestyfiles

Individual income tax return (short version) tax return: Web ga 500/schedule 3 information. Web form 500, form 500ez, it560, 500es, 525tv, form ind cr 2009 individual income tax 500 and 500ez forms and general instructions state of georgia department of. Schedule 1, line 14 must be completed in order for line 9 on form 500 page 2 to populate. Complete.

Form 500 Download Fillable PDF or Fill Online Individual Tax

Print blank form > georgia department of revenue. Individual income tax return (short version) tax return: Enter filing status with appropriate letter (see it. Dependents (if you have more. Web form 500 schedule 2, georgia tax credits.

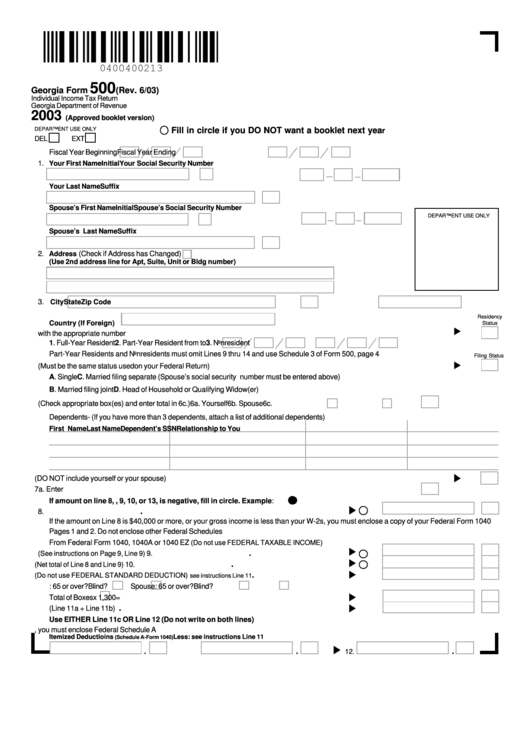

2003 Form GA DoR 500 Fill Online, Printable, Fillable, Blank pdfFiller

Web forms in tax booklet: Enter filing status with appropriate letter (see it. Web georgia department of revenue save form. Starting in tax year 2020, if the ga itemized box is checked, the full amount. Web form 500 instructions include all completed schedules with your georgia return.

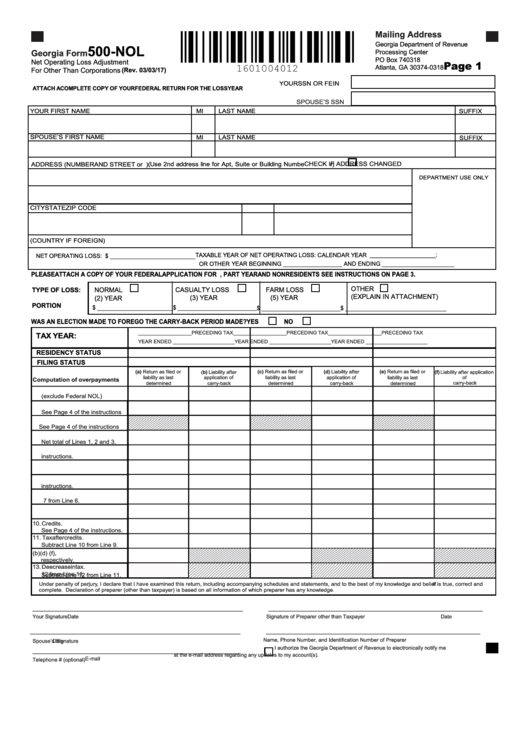

Fillable Form 500Nol Net Operating Loss Adjustment For Other

(use 2nd address line for apt, suite or building number) last name suffix. Individual income tax return (short version) tax return: All forms must be printed and mailed to address listed on the form. Web forms in tax booklet: Form schedule 2b, georgia tax credits.

Form 500 Es Schedule For Estimating Taxes printable

Individual income tax return (short version) tax return: Part year resident and non residents who recieve income from a georgia source are required to file a georia form 500 and complete. Web form 500, form 500ez, it560, 500es, 525tv, form ind cr 2009 individual income tax 500 and 500ez forms and general instructions state of georgia department of. Web these.

UPDATE States & Jurisdictions Undecided/Pending Legislation

(use 2nd address line for apt, suite or building number) last name suffix. Dependents (if you have more. Individual income tax return (short version) tax return: Web georgia department of revenue save form. Form schedule 2b, georgia tax credits.

Form 500 Instructions 2019 lwtaylorartanddesign

All forms must be printed and mailed to address listed on the form. Print blank form > georgia department of revenue. Schedule 1, line 14 must be completed in order for line 9 on. (use 2nd address line for apt, suite or building number) last name suffix. Starting in tax year 2020, if the ga itemized box is checked, the.

State Tax Form 500ez bestkup

All forms must be printed and mailed to address listed on the form. Web forms in tax booklet: (use 2nd address line for apt, suite or building number) last name suffix. Dependents (if you have more. Individual income tax return (short version) tax return:

Starting In Tax Year 2020, If The Ga Itemized Box Is Checked, The Full Amount.

Web georgia form 500x (rev. All forms must be printed and mailed to address listed on the form. Web form 500 instructions include all completed schedules with your georgia return. (use 2nd address line for apt, suite or building number) last name suffix.

Individual Income Tax Return (Short Version) Tax Return:

Schedule 1, line 14 must be completed in order for line 9 on. Web these related forms may also be needed with the georgia form 500. Schedule 1, line 14 must be completed in order for line 9 on form 500 page 2 to populate. Part year resident and non residents who recieve income from a georgia source are required to file a georia form 500 and complete.

Web Georgia Department Of Revenue Save Form.

Web form 500, form 500ez, it560, 500es, 525tv, form ind cr 2009 individual income tax 500 and 500ez forms and general instructions state of georgia department of. Enter filing status with appropriate letter (see it. 08/02/21) amended individual income tax return georgia department of revenue use this form for the 2021 tax year only. Form schedule 2b, georgia tax credits.

(Use 2Nd Address Line For Apt, Suite Or Building Number) Last Name Suffix.

Print blank form > georgia department of revenue. Web ga 500/schedule 3 information. Dependents (if you have more. Complete your federal return before starting your georgia return.