Hawaii State Estimated Tax Form 2022

Hawaii State Estimated Tax Form 2022 - (act 114, slh 2022) • taxpayers may exclude up to $7,345 of their military reserve or hawaii national guard. Do not photocop y this form. If you make $70,000 a year living in california you will be taxed $11,221. Web hawaii estate tax. $12,950 for married couples filing separately. Web 2022 tax calculator, estimator; Web this exhibit at the hawaiʻi state art museum is on the second floor of the building, through december 3, 2022. Web hawaii filing and tax deadline dates for 2022 tax returns the state of hawaii has issued the following guidance regarding income tax filing deadlines for individuals: Web the hawaii state department of taxation has not extended the 2022 tax year filing deadline. The tax generally conforms to the federal estate tax, albeit with lower tax rates.

(act 114, slh 2022) • taxpayers may exclude up to $7,345 of their military reserve or hawaii national guard. $19,400 for heads of households. Hawaiʻi triennial 2022 (ht22) is. Web the deduction set by the irs for 2022 is: 16, 2022 at 8:31 pm pdt. Taxformfinder provides printable pdf copies of 165. $12,950 for married couples filing separately. The exemption for tax year. Web hawaii estate tax. Web applies to taxable years beginning after december 31, 2022.

16, 2022 at 8:21 pm pdt | updated: Web the hawaii state department of taxation has not extended the 2022 tax year filing deadline. Hawaiʻi triennial 2022 (ht22) is. 16, 2022 at 8:31 pm pdt. Web hawaii estate tax. Web applies to taxable years beginning after december 31, 2022. Taxpayers must file their returns by april 20, 2023. $12,950 for married couples filing separately. Do not photocop y this form. Web hawaii has a state income tax that ranges between 1.4% and 11% , which is administered by the hawaii department of taxation.

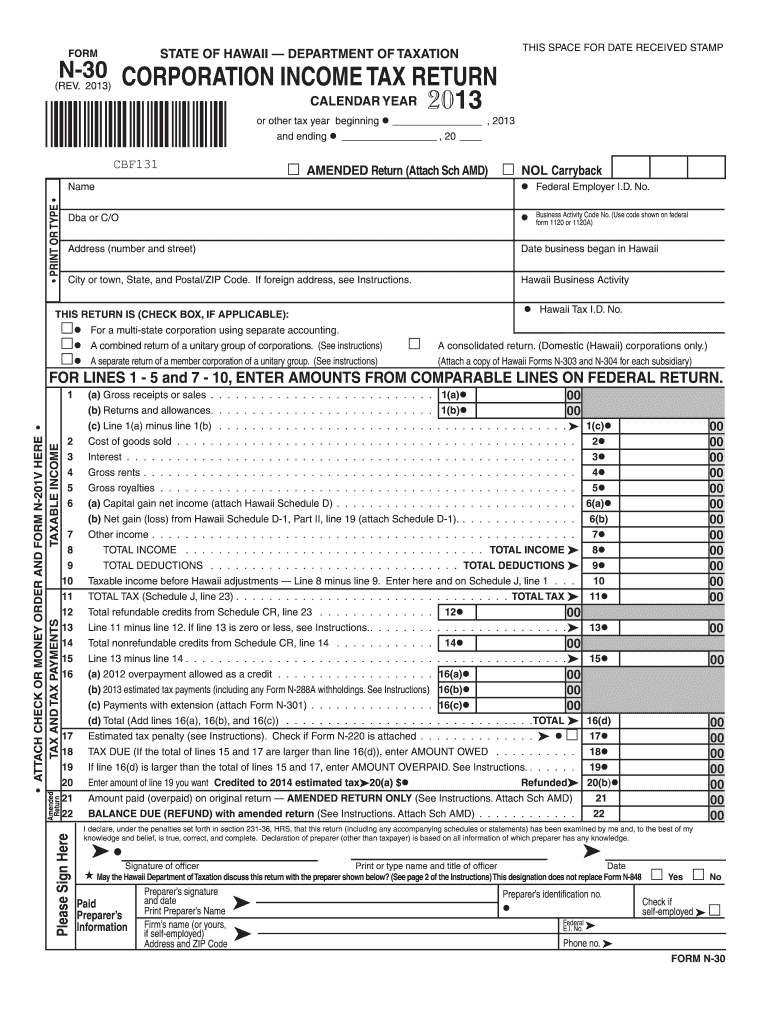

Pa Estimated Tax Form Fill Online, Printable, Fillable, Blank pdfFiller

Hawaiʻi triennial 2022 (ht22) is. (act 114, slh 2022) • taxpayers may exclude up to $7,345 of their military reserve or hawaii national guard. There is an estate tax in hawaii. Web the hawaii state department of taxation has not extended the 2022 tax year filing deadline. 16, 2022 at 8:31 pm pdt.

Jdf Application Form Fill Out and Sign Printable PDF Template signNow

Web 2022 tax calculator, estimator; $12,950 for married couples filing separately. Web applies to taxable years beginning after december 31, 2022. Hawaiʻi triennial 2022 (ht22) is. Taxformfinder provides printable pdf copies of 165.

Michigan 1040 Fill Out and Sign Printable PDF Template signNow

You do not have to pay estimated tax for the current 5 year if: Web hawaii filing and tax deadline dates for 2022 tax returns the state of hawaii has issued the following guidance regarding income tax filing deadlines for individuals: 16, 2022 at 8:21 pm pdt | updated: 16, 2022 at 8:31 pm pdt. Web hawaii has a state.

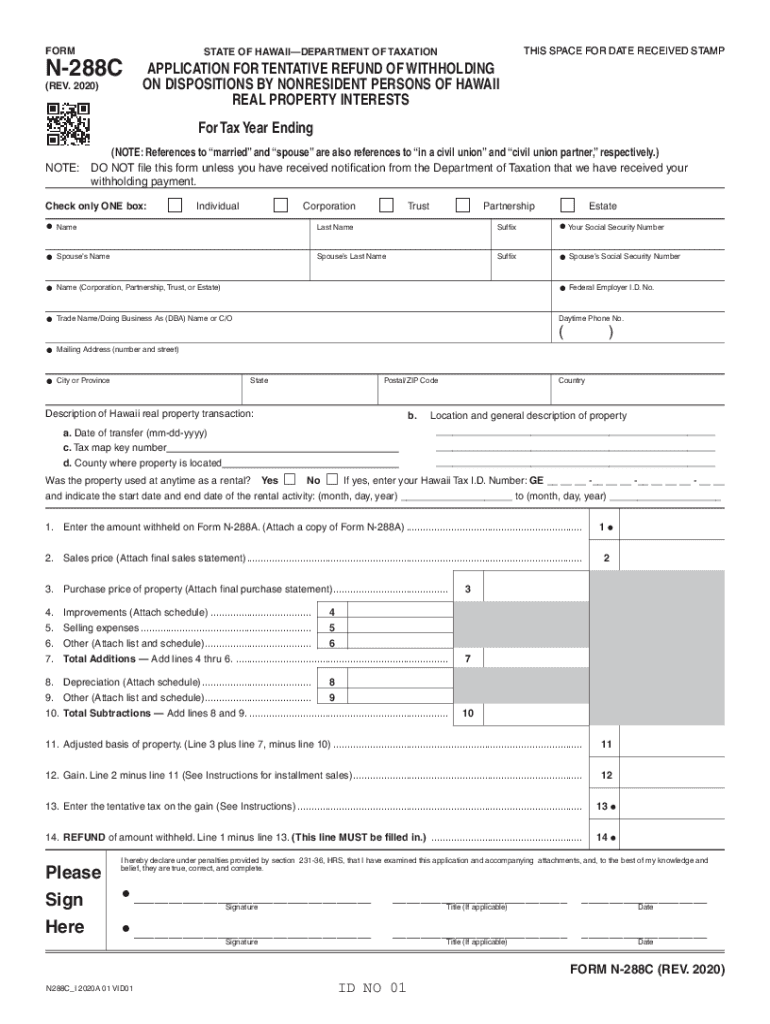

Hawaii State Tax Form Fill Out and Sign Printable PDF Template signNow

Web applies to taxable years beginning after december 31, 2022. Hawaiʻi triennial 2022 (ht22) is. If you make $70,000 a year living in california you will be taxed $11,221. Taxformfinder provides printable pdf copies of 165. Taxpayers must file their returns by april 20, 2023.

KY DoR 740ES 2020 Fill out Tax Template Online US Legal Forms

Web hawaii filing and tax deadline dates for 2022 tax returns the state of hawaii has issued the following guidance regarding income tax filing deadlines for individuals: You do not have to pay estimated tax for the current 5 year if: $19,400 for heads of households. Taxformfinder provides printable pdf copies of 165. Web applies to taxable years beginning after.

Maryland Estimated Tax Form 2020

You do not have to pay estimated tax for the current 5 year if: Web the deduction set by the irs for 2022 is: The tax generally conforms to the federal estate tax, albeit with lower tax rates. $12,950 for married couples filing separately. (1) your estimated tax liability (after taking into account all taxes withheld or collected at the.

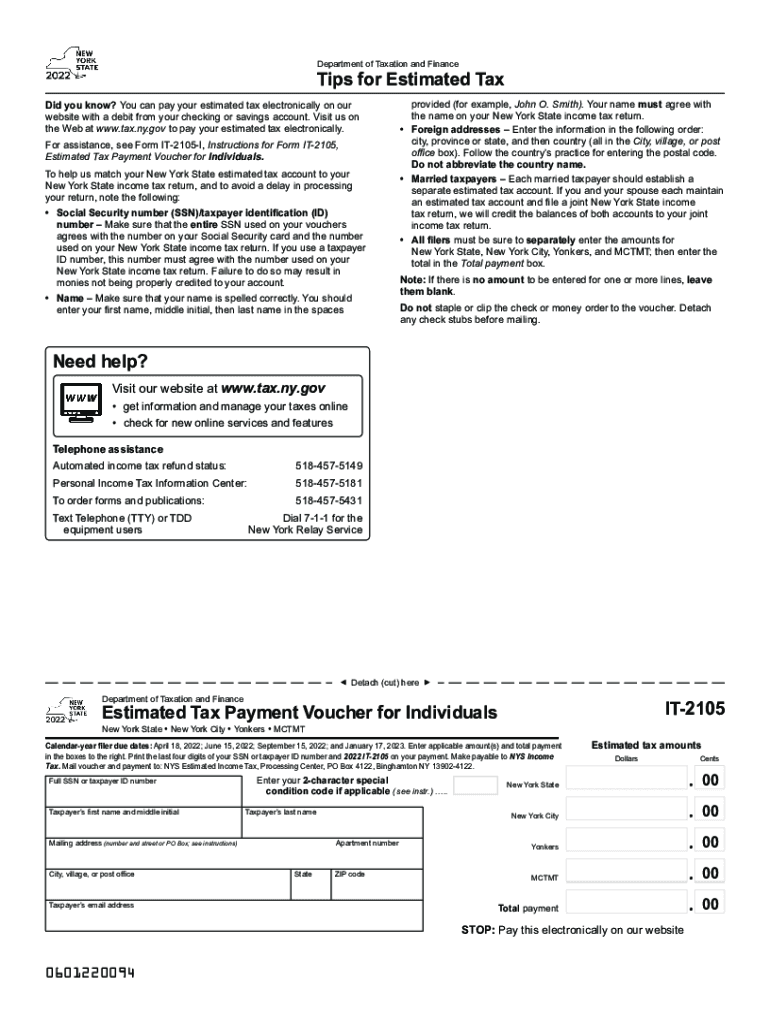

2022 Form NY IT2105 Fill Online, Printable, Fillable, Blank pdfFiller

Your average tax rate is 11.67% and your marginal tax rate is. (act 114, slh 2022) • taxpayers may exclude up to $7,345 of their military reserve or hawaii national guard. Do not photocop y this form. Web hawaii estate tax. Web the deduction set by the irs for 2022 is:

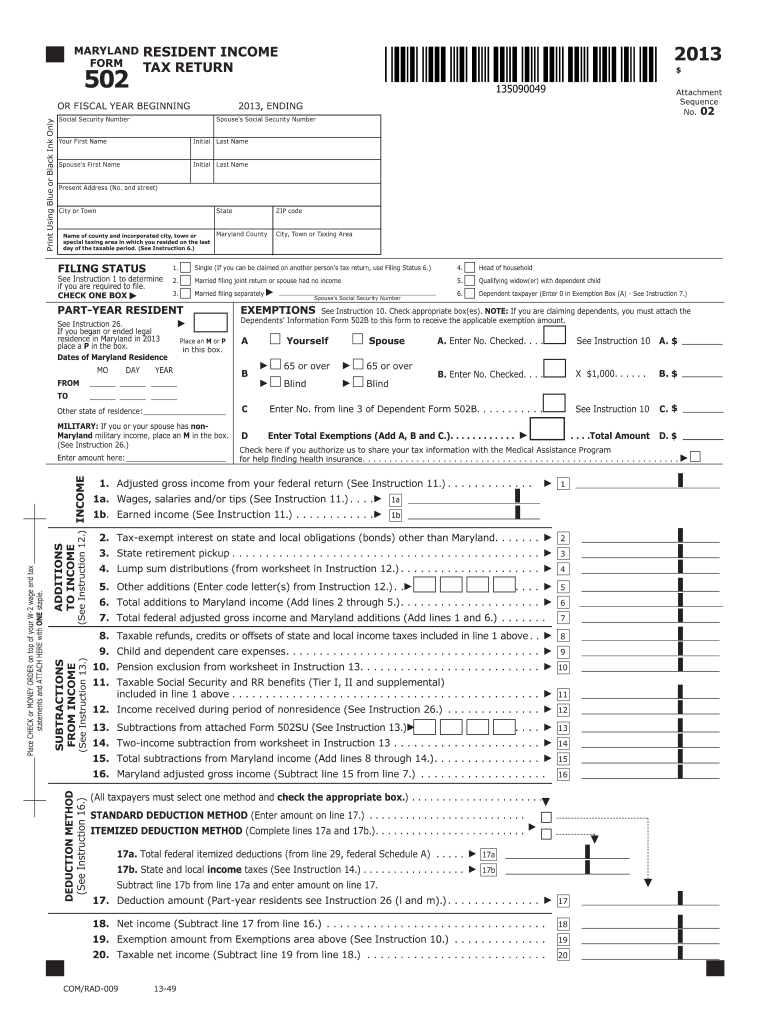

Fillable Md 502 Form Fill Out and Sign Printable PDF Template signNow

(act 114, slh 2022) • taxpayers may exclude up to $7,345 of their military reserve or hawaii national guard. Web the deduction set by the irs for 2022 is: Do not photocop y this form. The tax generally conforms to the federal estate tax, albeit with lower tax rates. The exemption for tax year.

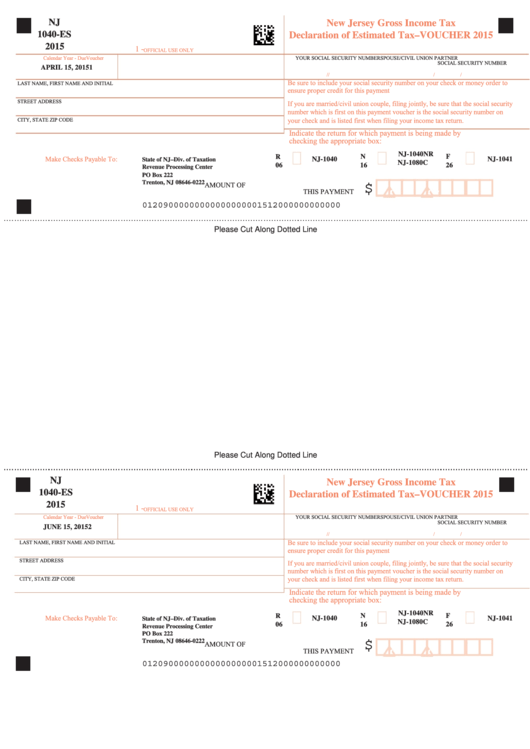

Fillable Form 1040Es New Jersey Gross Tax Declaration Of

$12,950 for married couples filing separately. $19,400 for heads of households. 16, 2022 at 8:31 pm pdt. Taxformfinder provides printable pdf copies of 165. If you make $70,000 a year living in california you will be taxed $11,221.

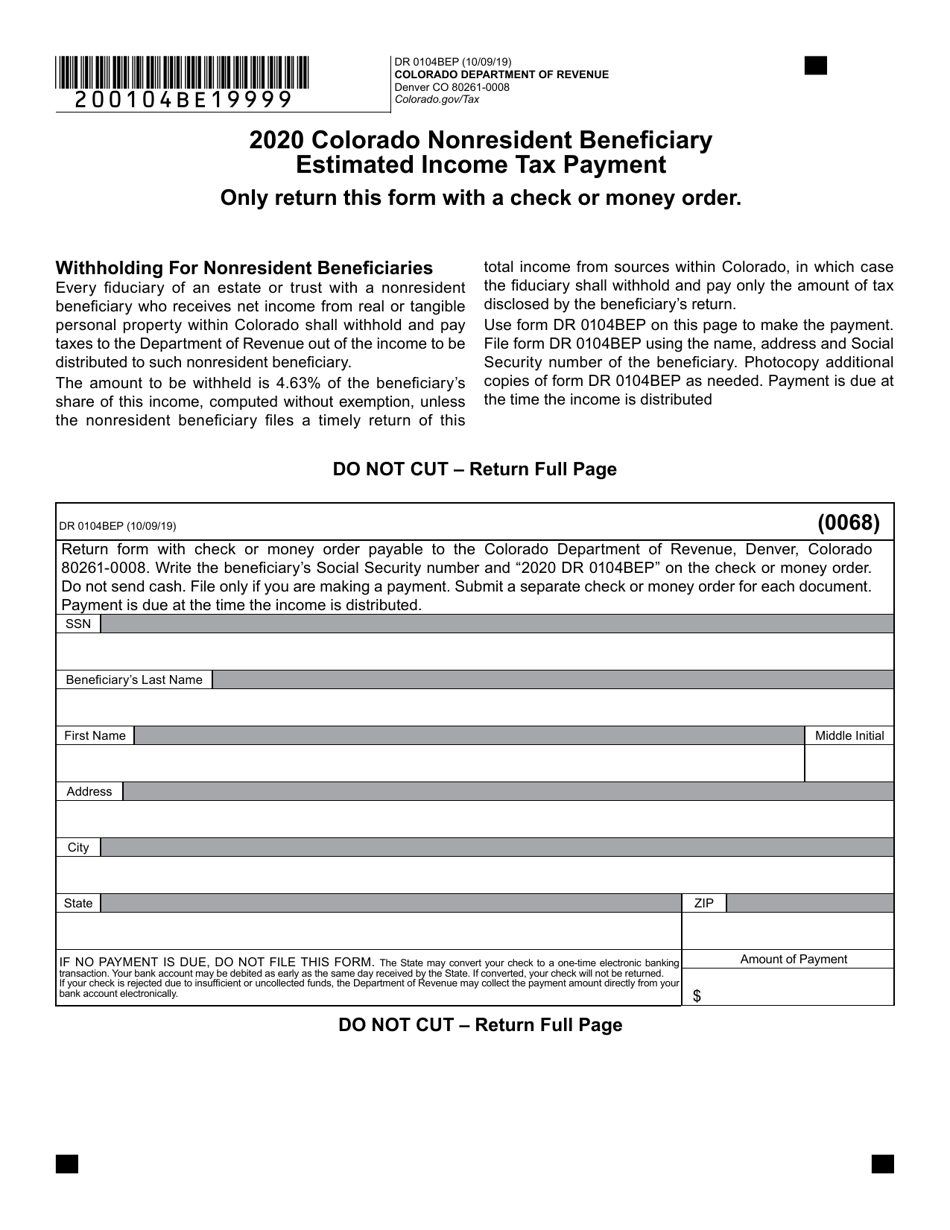

Form DR0104BEP Download Fillable PDF or Fill Online Colorado

Web hawaii filing and tax deadline dates for 2022 tax returns the state of hawaii has issued the following guidance regarding income tax filing deadlines for individuals: 16, 2022 at 8:31 pm pdt. You do not have to pay estimated tax for the current 5 year if: The exemption for tax year. $12,950 for married couples filing separately.

Hawaiʻi Triennial 2022 (Ht22) Is.

The tax generally conforms to the federal estate tax, albeit with lower tax rates. 16, 2022 at 8:31 pm pdt. Web hawaii filing and tax deadline dates for 2022 tax returns the state of hawaii has issued the following guidance regarding income tax filing deadlines for individuals: 16, 2022 at 8:21 pm pdt | updated:

Web Hawaii Estate Tax.

Web 2022 tax calculator, estimator; Web applies to taxable years beginning after december 31, 2022. Taxformfinder provides printable pdf copies of 165. Web the hawaii state department of taxation has not extended the 2022 tax year filing deadline.

Do Not Photocop Y This Form.

$19,400 for heads of households. If you make $70,000 a year living in california you will be taxed $11,221. Your average tax rate is 11.67% and your marginal tax rate is. (1) your estimated tax liability (after taking into account all taxes withheld or collected at the source) for the.

Web The Deduction Set By The Irs For 2022 Is:

You do not have to pay estimated tax for the current 5 year if: Taxpayers must file their returns by april 20, 2023. Web this exhibit at the hawaiʻi state art museum is on the second floor of the building, through december 3, 2022. The exemption for tax year.