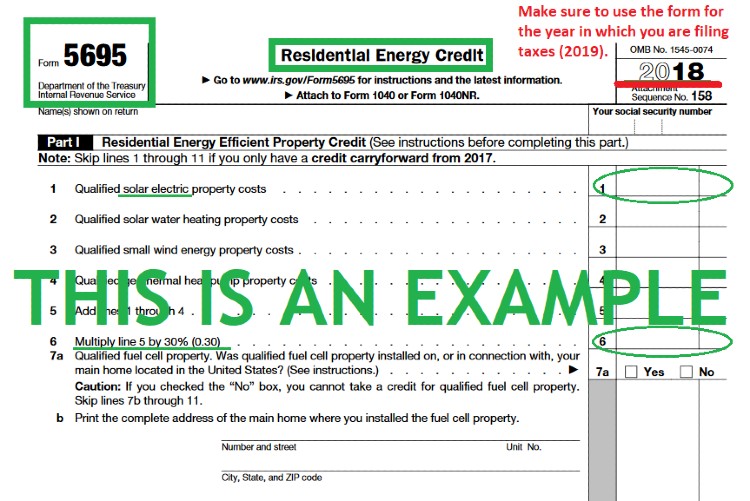

How Do I Get Form 5695

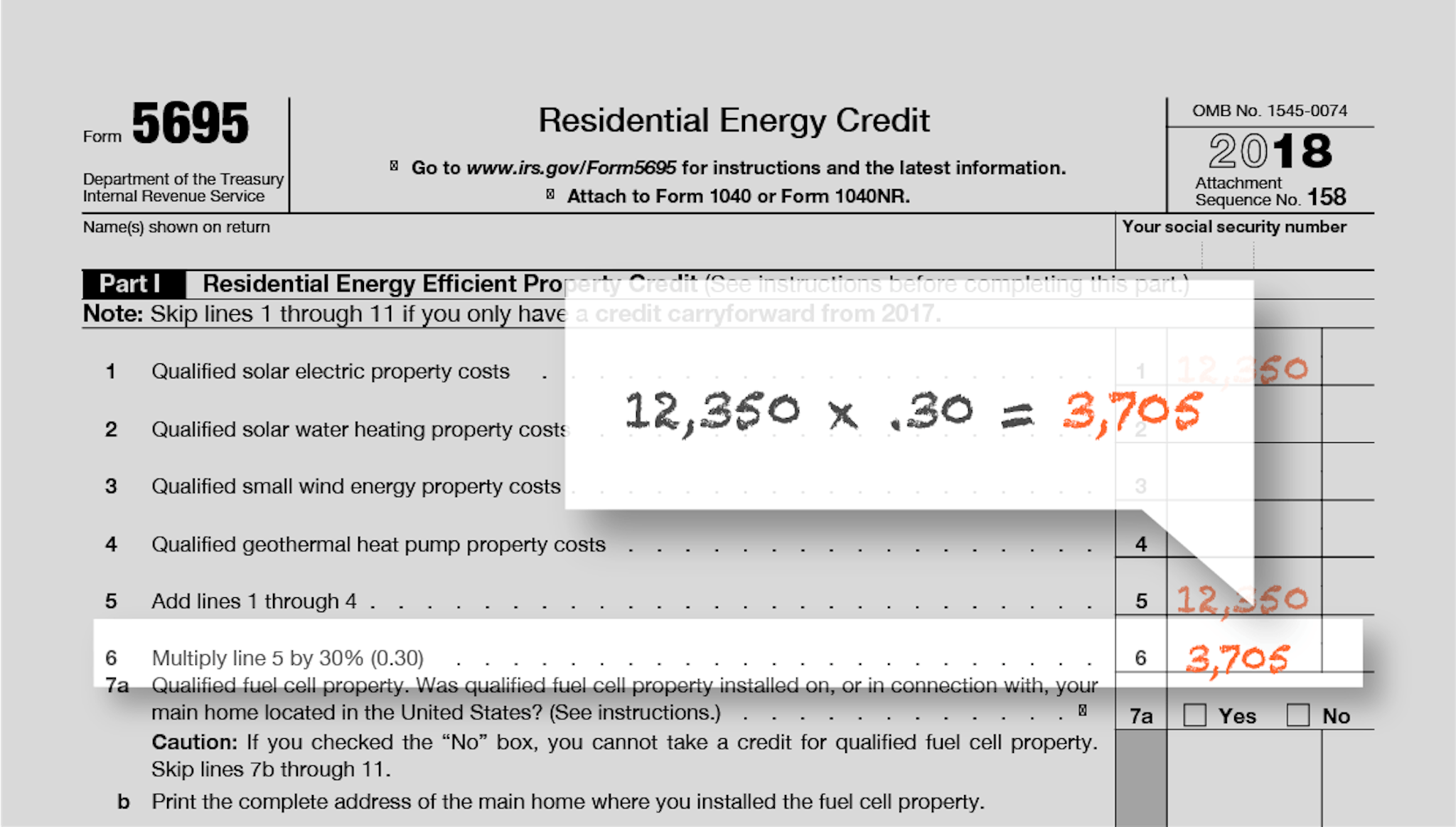

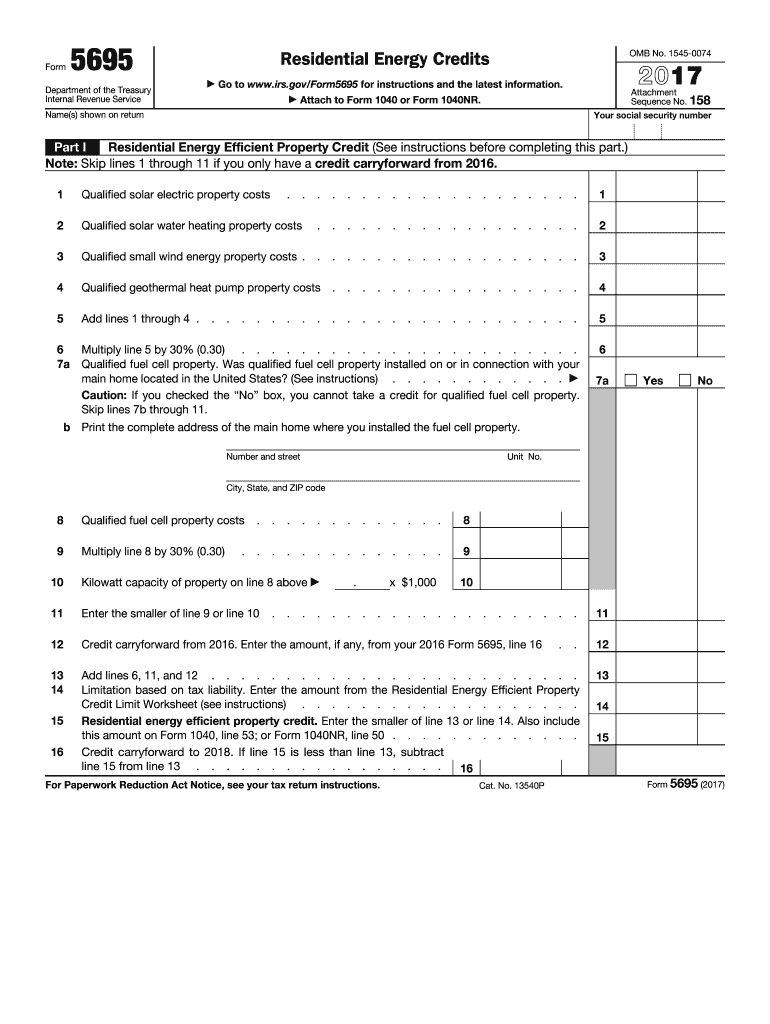

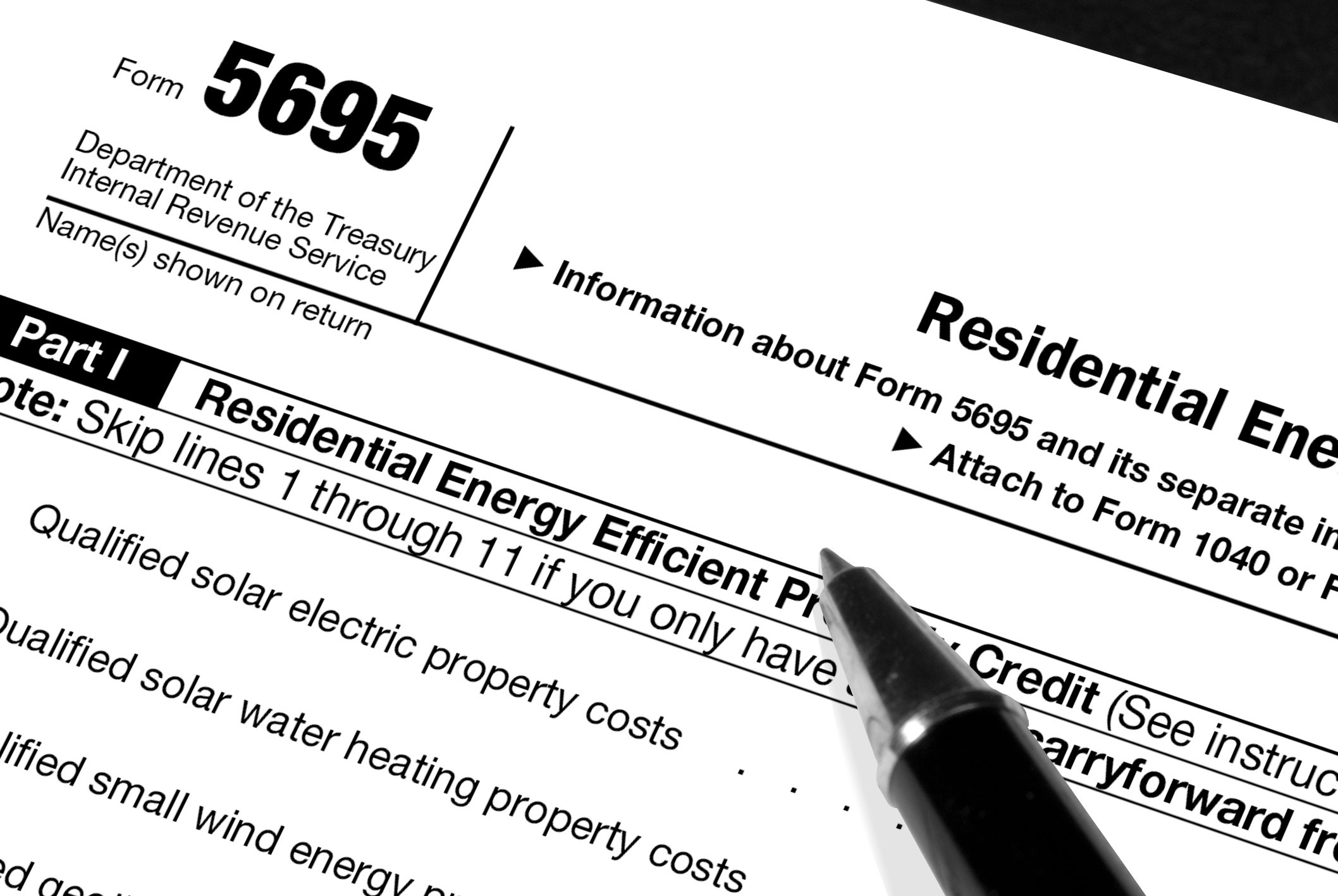

How Do I Get Form 5695 - Web to enter the amount for form 5695, line 22a: To enter qualified fuel cell property costs: You’ll need four forms to file for the credit, which can be. In the topic box, highlight 5695, residential energy credit, then click go. Complete, edit or print tax forms instantly. Web for improvements installed in 2022 or earlier: Ad register and subscribe now to work on your irs form 5695 & more fillable forms. In the search bar, type 5695. & more fillable forms, try for free now! Web form 5695 (residential energy credits) is used to calculate tax credits for energy efficient improvements and alternative energy equipment.

Web in order to complete form 5695, you'll need to know exactly how much you spent on the qualified home improvements. Web get answers to frequently asked questions about entering information from form 5695, residential energy credits, in the individual module of intuit proconnect. Form 5695 won't generate if the credit amount has been overridden. Yes, you can carry any unused residential solar energy credits forward to 2022. You’ll need four forms to file for the credit, which can be. Form 5695 claiming residential energy credits with form 5695 jo willetts, ea director, tax resources. To add or remove this. Web the residential energy credits are: Web jackson hewitt irs forms form 5695 irs forms: Also use form 5695 to take any residential energy.

Form 5695 claiming residential energy credits with form 5695 jo willetts, ea director, tax resources. Web to enter the amount for form 5695, line 22a: Rate free missouri form 5695. In the search bar, type 5695. Keywords relevant to mo form 5695 missouri. & more fillable forms, register and subscribe now! Web january 11, 2022 12:09 pm. Web to enter form 5695 information in taxact: Ad register and subscribe now to work on your irs form 5695 & more fillable forms. Web in order to complete form 5695, you'll need to know exactly how much you spent on the qualified home improvements.

Filing For The Solar Tax Credit Wells Solar

In the search bar, type 5695. Form 5695 claiming residential energy credits with form 5695 jo willetts, ea director, tax resources. Yes, you can carry any unused residential solar energy credits forward to 2022. Web use form 5695 to figure and take your residential energy credits. Use previous versions of form 5695.

Form 13 Fill Out and Sign Printable PDF Template (2022)

Also use form 5695 to take any residential energy. Complete, edit or print tax forms instantly. Web jackson hewitt irs forms form 5695 irs forms: Web based on the form 5695 instructions, qualified solar electric property costs apply to property where solar energy generates electricity for use in the taxpayer's home located in the. You’ll need four forms to file.

Form 5695 Instructions Information On Form 5695 —

In the topic box, highlight 5695, residential energy credit, then click go. & more fillable forms, register and subscribe now! For tax years 2006 through 2017 it was also used to calculate the nonbusiness. In the search bar, type 5695. Web for the latest information about developments related to form 5695 and its instructions, such as legislation enacted after they.

How to File IRS Form 5695 To Claim Your Renewable Energy Credits

Web in order to complete form 5695, you'll need to know exactly how much you spent on the qualified home improvements. In the topic box, highlight 5695, residential energy credit, then click go. Web get answers to frequently asked questions about entering information from form 5695, residential energy credits, in the individual module of intuit proconnect. The energy efficient home.

2016 Form 5695 Fill Online, Printable, Fillable, Blank pdfFiller

In the search bar, type 5695. Complete, edit or print tax forms instantly. To add or remove this. Also use form 5695 to take any residential energy. Use previous versions of form 5695.

Steps To Complete Form 5695 Lovetoknow —

Web form 5695 is used to calculate the nonrefundable credit for residential energy efficient property. Keywords relevant to mo form 5695 missouri. Web to enter the amount for form 5695, line 22a: Web form 5695 (residential energy credits) is used to calculate tax credits for energy efficient improvements and alternative energy equipment. Web use form 5695 to figure and take.

Image tagged in scumbag,old fashioned Imgflip

Web get answers to frequently asked questions about entering information from form 5695, residential energy credits, in the individual module of intuit proconnect. & more fillable forms, register and subscribe now! Web for improvements installed in 2022 or earlier: To add or remove this. Web for the latest information about developments related to form 5695 and its instructions, such as.

Replacement windows government rebate » Window Replacement

Web to enter form 5695 information in taxact: Yes, you can carry any unused residential solar energy credits forward to 2022. Web how to file irs form 5695 to claim your renewable energy credits. You'll also need to save copies of the receipts for these. & more fillable forms, register and subscribe now!

Form 5695 2022 2023 IRS Forms TaxUni

Ad register and subscribe now to work on your irs form 5695 & more fillable forms. Web form 5695 (residential energy credits) is used to calculate tax credits for energy efficient improvements and alternative energy equipment. Web to enter the amount for form 5695, line 22a: In the search bar, type 5695. Get ready for tax season deadlines by completing.

Instructions for filling out IRS Form 5695 Everlight Solar

Web in order to complete form 5695, you'll need to know exactly how much you spent on the qualified home improvements. Use previous versions of form 5695. Web to enter form 5695 information in taxact: Web based on the form 5695 instructions, qualified solar electric property costs apply to property where solar energy generates electricity for use in the taxpayer's.

& More Fillable Forms, Try For Free Now!

Get ready for tax season deadlines by completing any required tax forms today. To add or remove this. & more fillable forms, register and subscribe now! Ad register and subscribe now to work on your irs form 5695 & more fillable forms.

The Energy Efficient Home Improvement Credit.

Also use form 5695 to take any residential energy. Web in order to complete form 5695, you'll need to know exactly how much you spent on the qualified home improvements. Ad access irs tax forms. Web to enter the amount for form 5695, line 22a:

You'll Also Need To Save Copies Of The Receipts For These.

Web use form 5695 to figure and take your residential energy credits. The residential clean energy credit, and. For tax years 2006 through 2017 it was also used to calculate the nonbusiness. Yes, you can carry any unused residential solar energy credits forward to 2022.

You’ll Need Four Forms To File For The Credit, Which Can Be.

To enter qualified fuel cell property costs: Web for improvements installed in 2022 or earlier: Web to enter form 5695 information in taxact: Web jackson hewitt irs forms form 5695 irs forms: