How Long Does It Take To Form A 501C3

How Long Does It Take To Form A 501C3 - By contrast, form 1023 can take between 3 and 6 months for processing, and it could take up to a year. Web applications for nonprofit status must be submitted online to the irs. As you might suspect, form 1023 is appropriate for large or highly complex organizations and the irs scrutinizes these applications carefully before sending out a. Web how long does it take to process an application for exemption? Applications are processed as quickly as possible. Web how long does it take for a 501(c)(3) to be approved? Sometimes it takes a little less; How long does it take for a 501c3 to be approved? Web generally, organizations required to apply for recognition of exemption must notify the service within 27 months from the date of their formation to be treated as described in section 501 (c) (3) from the date formed. This documentation often makes 501c3 applications 100 pages or longer.

Web how long does it take to process an application for exemption? Web updated june 30, 2023 reviewed by lea d. As you might suspect, form 1023 is appropriate for large or highly complex organizations and the irs scrutinizes these applications carefully before sending out a. Web generally, organizations required to apply for recognition of exemption must notify the service within 27 months from the date of their formation to be treated as described in section 501 (c) (3) from the date formed. By contrast, form 1023 can take between 3 and 6 months for processing, and it could take up to a year. How long does it take for a 501c3 to be approved? The process can be delayed, however, for reasons ranging from simple errors on the application to issues concerning the qualification of the organization for exemption. See the top ten reasons for delay in processing applications. Web applications for nonprofit status must be submitted online to the irs. Applications are processed as quickly as possible.

Web how long does it take to process an application for exemption? Sometimes it takes a little less; As you might suspect, form 1023 is appropriate for large or highly complex organizations and the irs scrutinizes these applications carefully before sending out a. This documentation often makes 501c3 applications 100 pages or longer. By contrast, form 1023 can take between 3 and 6 months for processing, and it could take up to a year. See the top ten reasons for delay in processing applications. Applications are processed as quickly as possible. Web generally, organizations required to apply for recognition of exemption must notify the service within 27 months from the date of their formation to be treated as described in section 501 (c) (3) from the date formed. Web how long does it take for a 501(c)(3) to be approved? The process can be delayed, however, for reasons ranging from simple errors on the application to issues concerning the qualification of the organization for exemption.

Irs Form 501c3 Ez Universal Network

How long does it take for a 501c3 to be approved? This documentation often makes 501c3 applications 100 pages or longer. Web updated june 30, 2023 reviewed by lea d. Applications are processed as quickly as possible. By contrast, form 1023 can take between 3 and 6 months for processing, and it could take up to a year.

Forming A 501c3 In Florida Form Resume Examples vq1Pq5rKkR

Sometimes it takes a little less; As you might suspect, form 1023 is appropriate for large or highly complex organizations and the irs scrutinizes these applications carefully before sending out a. Web applications for nonprofit status must be submitted online to the irs. See the top ten reasons for delay in processing applications. This documentation often makes 501c3 applications 100.

N 400 Form Sample Form Resume Examples ojYqb6JOVz

Web how long does it take to process an application for exemption? This documentation often makes 501c3 applications 100 pages or longer. Web updated june 30, 2023 reviewed by lea d. Web applications for nonprofit status must be submitted online to the irs. See the top ten reasons for delay in processing applications.

501c3onestop 501c3 Where To Get Started?

As you might suspect, form 1023 is appropriate for large or highly complex organizations and the irs scrutinizes these applications carefully before sending out a. Web updated june 30, 2023 reviewed by lea d. Sometimes it takes a little less; Web applications for nonprofit status must be submitted online to the irs. This documentation often makes 501c3 applications 100 pages.

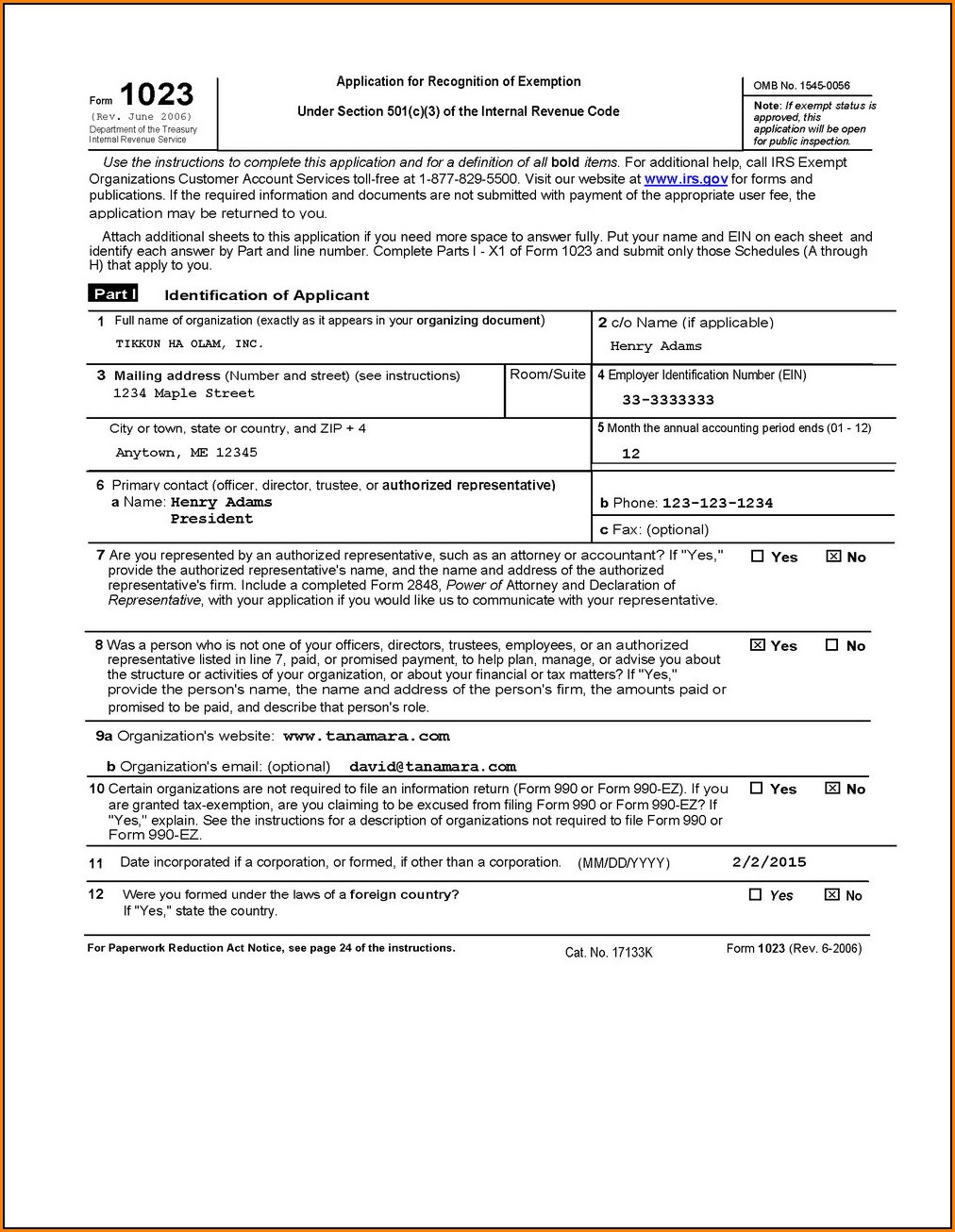

Irs 501c3 Form 1023 Form Resume Examples EvkBMrPO2d

By contrast, form 1023 can take between 3 and 6 months for processing, and it could take up to a year. This documentation often makes 501c3 applications 100 pages or longer. Web applications for nonprofit status must be submitted online to the irs. Web updated june 30, 2023 reviewed by lea d. Web generally, organizations required to apply for recognition.

How To Form A 501c3 In Illinois Form Resume Examples Dp3OwwL30Q

Web how long does it take to process an application for exemption? See the top ten reasons for delay in processing applications. Web updated june 30, 2023 reviewed by lea d. Applications are processed as quickly as possible. As you might suspect, form 1023 is appropriate for large or highly complex organizations and the irs scrutinizes these applications carefully before.

How To Form A 501c3 In Pa Form Resume Examples

Applications are processed as quickly as possible. Web generally, organizations required to apply for recognition of exemption must notify the service within 27 months from the date of their formation to be treated as described in section 501 (c) (3) from the date formed. Web applications for nonprofit status must be submitted online to the irs. This documentation often makes.

How To Form A 501c3 In New Jersey Form Resume Examples

The process can be delayed, however, for reasons ranging from simple errors on the application to issues concerning the qualification of the organization for exemption. Web applications for nonprofit status must be submitted online to the irs. Applications are processed as quickly as possible. Web how long does it take to process an application for exemption? See the top ten.

Forming A 501c3 In Illinois Form Resume Examples o7Y3z039BN

This documentation often makes 501c3 applications 100 pages or longer. Applications are processed as quickly as possible. Web updated june 30, 2023 reviewed by lea d. Web how long does it take to process an application for exemption? See the top ten reasons for delay in processing applications.

501C3 APPLICATION FORM

Web generally, organizations required to apply for recognition of exemption must notify the service within 27 months from the date of their formation to be treated as described in section 501 (c) (3) from the date formed. Web applications for nonprofit status must be submitted online to the irs. Sometimes it takes a little less; See the top ten reasons.

By Contrast, Form 1023 Can Take Between 3 And 6 Months For Processing, And It Could Take Up To A Year.

Web how long does it take for a 501(c)(3) to be approved? Web updated june 30, 2023 reviewed by lea d. Sometimes it takes a little less; See the top ten reasons for delay in processing applications.

The Process Can Be Delayed, However, For Reasons Ranging From Simple Errors On The Application To Issues Concerning The Qualification Of The Organization For Exemption.

Applications are processed as quickly as possible. Web applications for nonprofit status must be submitted online to the irs. Web how long does it take to process an application for exemption? Web generally, organizations required to apply for recognition of exemption must notify the service within 27 months from the date of their formation to be treated as described in section 501 (c) (3) from the date formed.

How Long Does It Take For A 501C3 To Be Approved?

This documentation often makes 501c3 applications 100 pages or longer. As you might suspect, form 1023 is appropriate for large or highly complex organizations and the irs scrutinizes these applications carefully before sending out a.