How To E File Form 568

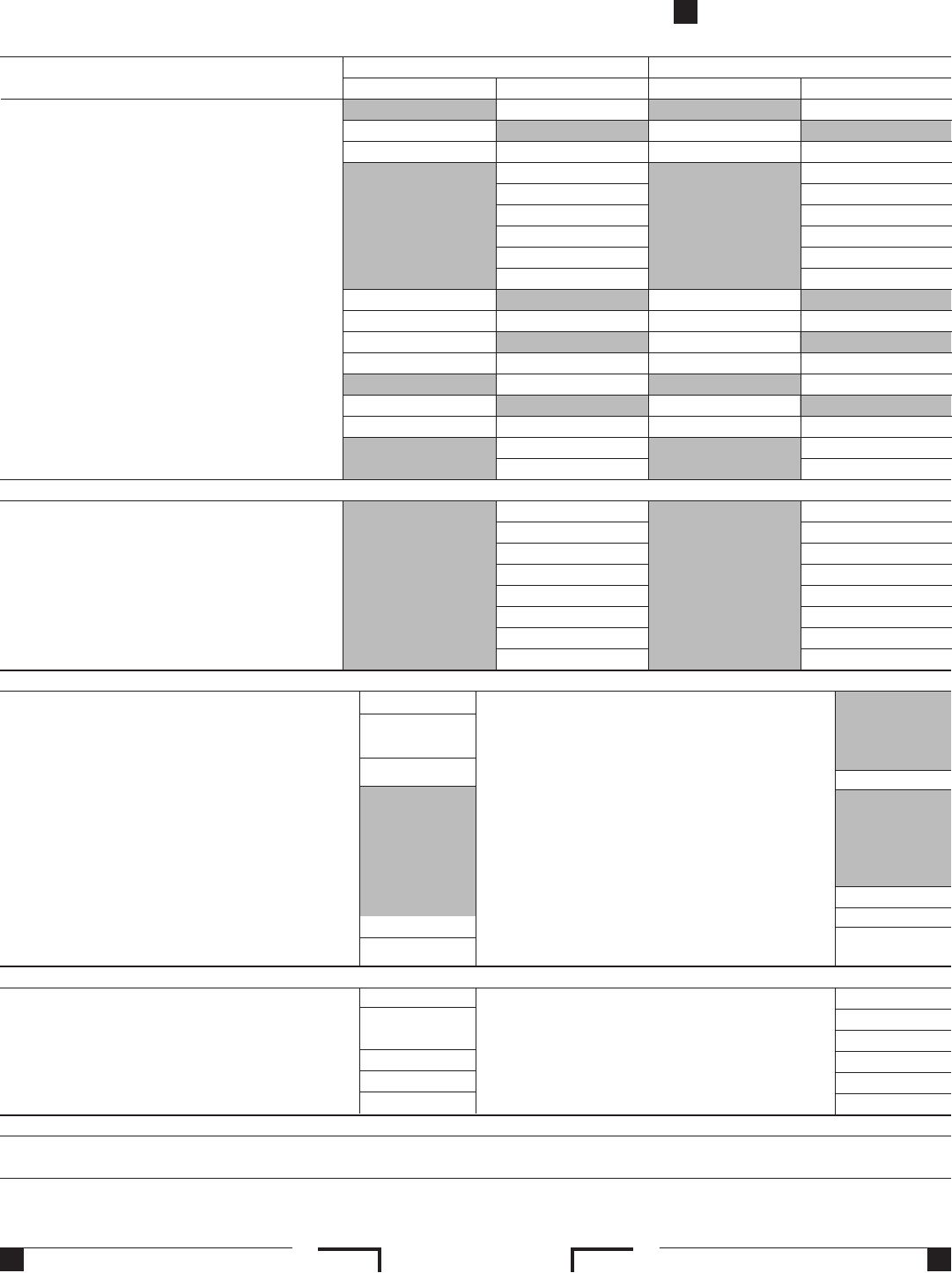

How To E File Form 568 - • form 568, limited liability company return of income • form 565, partnership return of income • form. Web form 568 is the return of income that many limited liability companies (llc) are required to file in the state of california. (form 568 original, including next year's llc. If your using turbo tax. Note that any link in the information above is updated each year. Web california form 568 is presented on seven pages, with a large number of questions, schedules, and checkboxes. Web an llc tax an llc fee an llc return filing requirement (form 568) generally, a disregarded smllc must file a form 568 by the same deadline applicable to the. Side 3 (continued from side 2) • federal tin/ssn sole owner’s name (as shown on owner’s return) • fein/ca corp no./ca sos file no. Web form 568 fill in all applicable lines and schedules. Llcs classified as a disregarded entity or.

Web to complete california form 568 for a partnership, from the main menu of the california return, select: (form 568 original, including next year's llc. Click the file menu, and select go to state/city. California form 568 can be generated from a federal schedule c, schedule e, or schedule f. If your using turbo tax. You must print and mail form 568 with the required. California form 568 is not supported electronically. • form 568, limited liability company return of income • form 565, partnership return of income • form. Note that any link in the information above is updated each year. Web form 568 fill in all applicable lines and schedules.

Llcs classified as a disregarded entity or. (form 568 original, including next year's llc. Click the file menu, and select go to state/city. Web an llc tax an llc fee an llc return filing requirement (form 568) generally, a disregarded smllc must file a form 568 by the same deadline applicable to the. Side 3 (continued from side 2) • federal tin/ssn sole owner’s name (as shown on owner’s return) • fein/ca corp no./ca sos file no. You must print and mail form 568 with the required. Line 1—total income from schedule iw. Web form 568 is the return of income that many limited liability companies (llc) are required to file in the state of california. California form 568 is not supported electronically. The application starts with open gaps where an applicant.

File 2020 Form 5498SA Online EFile as low as 0.50/Form

Side 3 (continued from side 2) • federal tin/ssn sole owner’s name (as shown on owner’s return) • fein/ca corp no./ca sos file no. Web form 568 fill in all applicable lines and schedules. Note that any link in the information above is updated each year. Web form 568 is the return of income that many limited liability companies (llc).

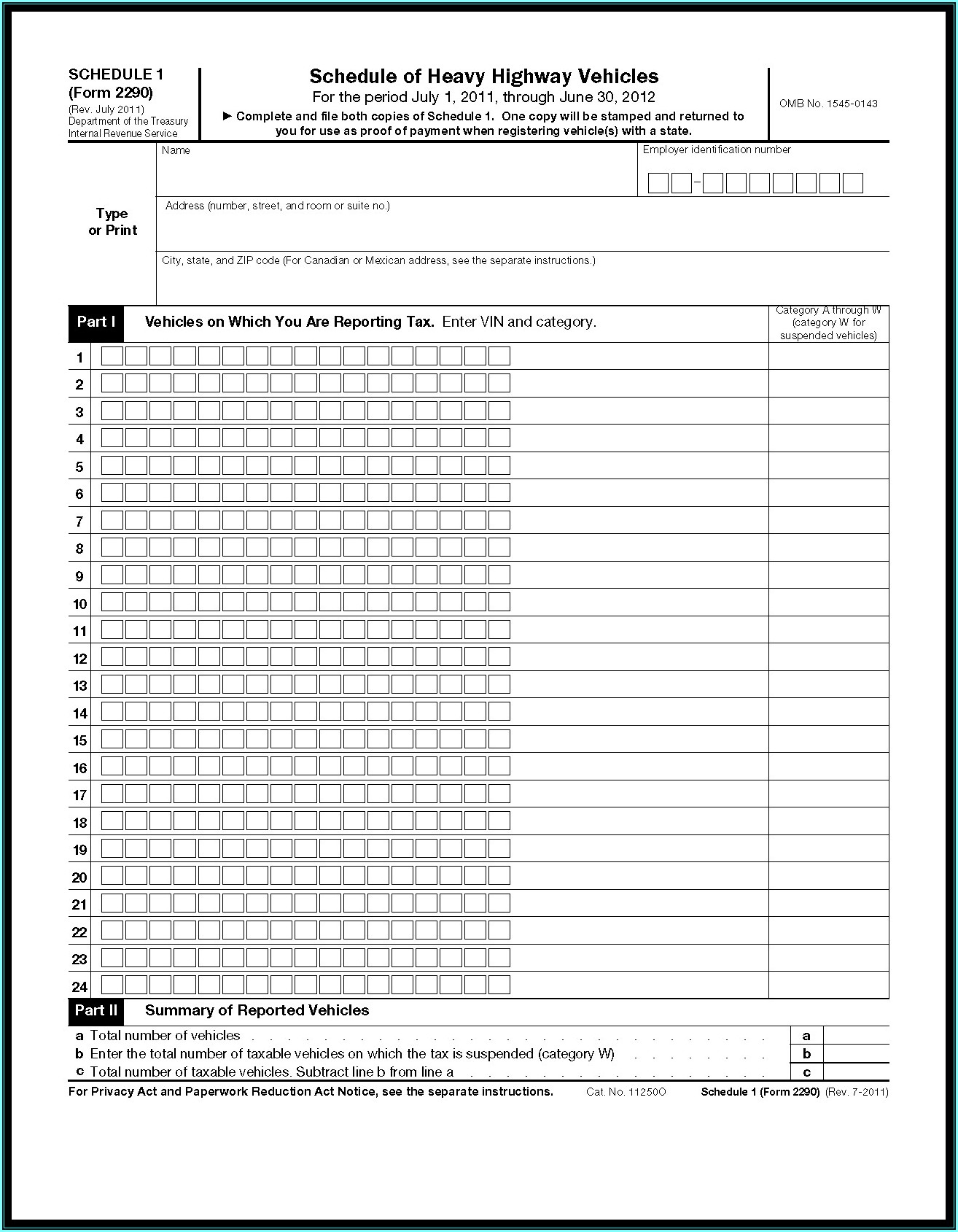

E File Form 2290 Irs Form Resume Examples Wk9yzrvY3D

California form 568 can be generated from a federal schedule c, schedule e, or schedule f. Llcs classified as a disregarded entity or. Enter any items specially allocated to the members on the applicable line of. California form 568 is not supported electronically. If your using turbo tax.

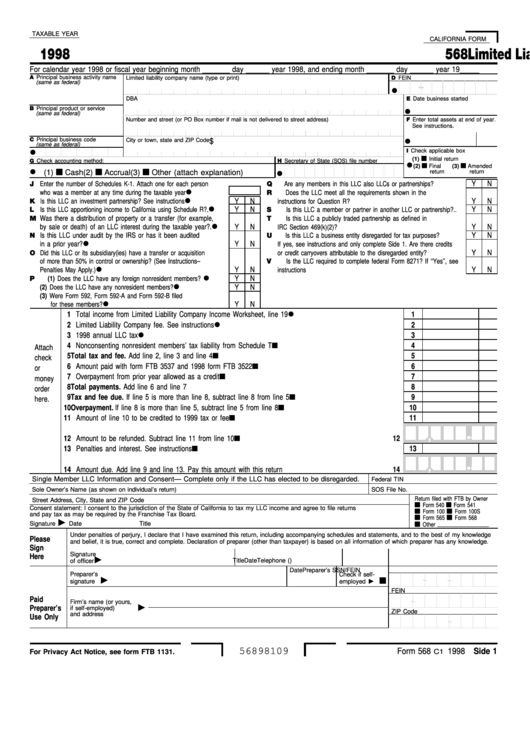

Fillable Form 568 Limited Liability Company Return Of 1998

Side 3 (continued from side 2) • federal tin/ssn sole owner’s name (as shown on owner’s return) • fein/ca corp no./ca sos file no. Web form 568 fill in all applicable lines and schedules. You must print and mail form 568 with the required. Enter any items specially allocated to the members on the applicable line of. California form 568.

2013 Form 568 Limited Liability Company Return Of Edit, Fill

The application starts with open gaps where an applicant. Llcs classified as a disregarded entity or. Side 3 (continued from side 2) • federal tin/ssn sole owner’s name (as shown on owner’s return) • fein/ca corp no./ca sos file no. Web to complete california form 568 for a partnership, from the main menu of the california return, select: Note that.

E File Tax Form 7004 Universal Network

The application starts with open gaps where an applicant. Web up to $40 cash back do whatever you want with a 2021 form 568 limited liability company return of income. Web form 568 is the return of income that many limited liability companies (llc) are required to file in the state of california. Web an llc tax an llc fee.

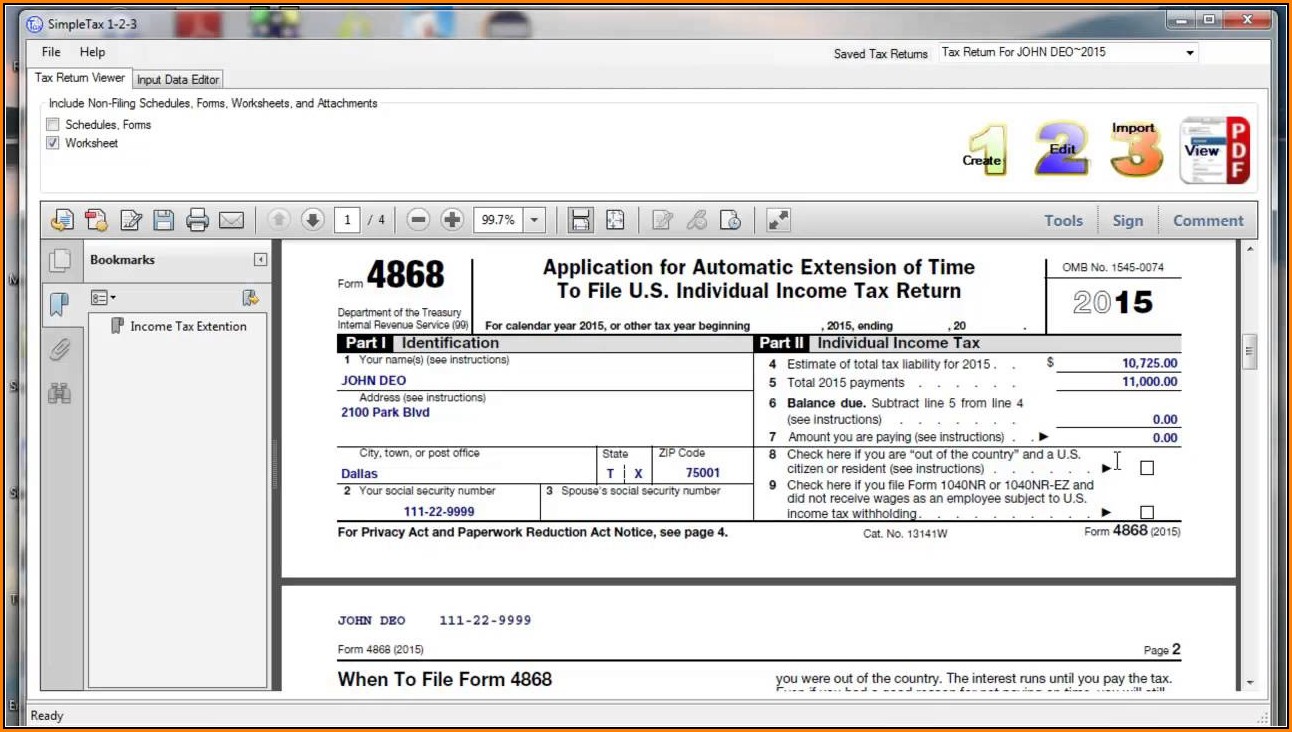

Form 4868 E File Form Resume Examples xz201oZ9ql

Llcs classified as a disregarded entity or. Web adding a limited liability return (form 568) to add limited liability, form 568 to the california return, choose file > client properties > california tab and mark the form 568. Web california form 568 is presented on seven pages, with a large number of questions, schedules, and checkboxes. California form 568 can.

2012 Form 568 Limited Liability Company Return Of Edit, Fill

Side 3 (continued from side 2) • federal tin/ssn sole owner’s name (as shown on owner’s return) • fein/ca corp no./ca sos file no. You must print and mail form 568 with the required. Web schedule d (568), capital gain or loss. Web to complete california form 568 for a partnership, from the main menu of the california return, select:.

E File Tax Form 4868 Online Universal Network

Web california form 568 is presented on seven pages, with a large number of questions, schedules, and checkboxes. Click the file menu, and select go to state/city. You must print and mail form 568 with the required. Web an llc tax an llc fee an llc return filing requirement (form 568) generally, a disregarded smllc must file a form 568.

Form 568 2019 Fill Out, Sign Online and Download Fillable PDF

• form 568, limited liability company return of income • form 565, partnership return of income • form. (form 568 original, including next year's llc. Web schedule d (568), capital gain or loss. Name, address, california sos file number,. Llcs classified as a disregarded entity or.

E File Form 7004 Online Universal Network

The application starts with open gaps where an applicant. Web an llc tax an llc fee an llc return filing requirement (form 568) generally, a disregarded smllc must file a form 568 by the same deadline applicable to the. Line 1—total income from schedule iw. Web schedule d (568), capital gain or loss. Llcs classified as a disregarded entity or.

Web California Form 568 Is Presented On Seven Pages, With A Large Number Of Questions, Schedules, And Checkboxes.

Side 3 (continued from side 2) • federal tin/ssn sole owner’s name (as shown on owner’s return) • fein/ca corp no./ca sos file no. Note that any link in the information above is updated each year. Web adding a limited liability return (form 568) to add limited liability, form 568 to the california return, choose file > client properties > california tab and mark the form 568. Web form 568 fill in all applicable lines and schedules.

Web If You Have An Llc, Here’s How To Fill In The California Form 568:

Web to complete california form 568 for a partnership, from the main menu of the california return, select: (form 568 original, including next year's llc. Llcs classified as a disregarded entity or. Line 1—total income from schedule iw.

California Form 568 Is Not Supported Electronically.

If your using turbo tax. The application starts with open gaps where an applicant. You must print and mail form 568 with the required. Name, address, california sos file number,.

• Form 568, Limited Liability Company Return Of Income • Form 565, Partnership Return Of Income • Form.

Web an llc tax an llc fee an llc return filing requirement (form 568) generally, a disregarded smllc must file a form 568 by the same deadline applicable to the. Web schedule d (568), capital gain or loss. Click the file menu, and select go to state/city. Web form 568 is the return of income that many limited liability companies (llc) are required to file in the state of california.