How To File Form 4361

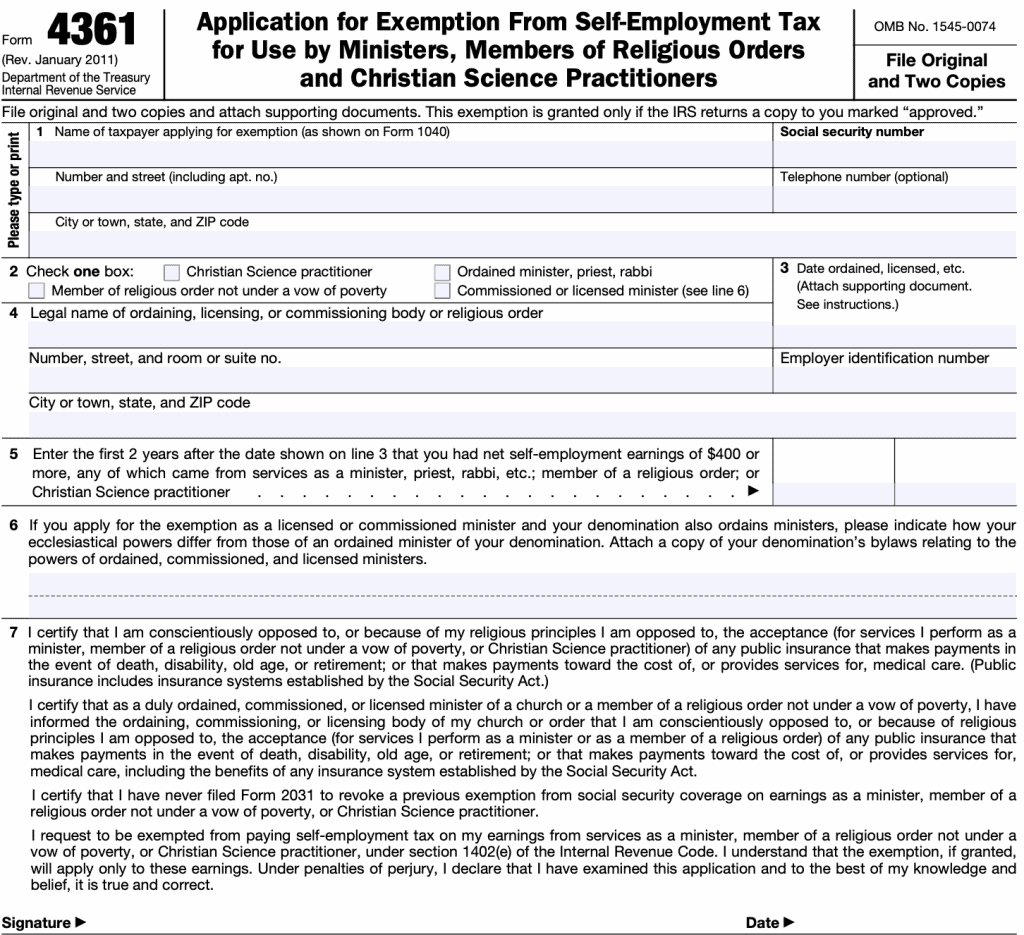

How To File Form 4361 - Web form 4361 is an irs document that is used by ministers to opt out of public insurance programs. Before your application can be approved, the irs must verify that you are aware of the grounds for exemption. You can view the form itself here. How to file form 4361 to claim your exemption. A member of a religious order who has not taken a vow of. The minister must be ordained, licensed, or commissioned by a church or religious denomination. 4) must file an irs form 4361. Let’s start with step by step instructions for irs form 4361. So, you need to submit your form 4361 by october 15, 2019. • a member of a religious order who has not taken a vow of poverty;

You will be asked about your housing allowance and whether or not you have an approved form 4361. 4) must file an irs form 4361. Web in this article, we’ll walk through irs form 4361 so you can better understand: 3) must be opposed to receiving social security benefits on the basis of their religious principles or because they are conscientiously oppose to it. Web in order to opt out, the minister must file form 4361 no later than the due date (with extensions) for the tax return for the second year in which the minister had net ministerial income of $400 or more. A member of a religious order who has not taken a vow of. An ordained, commissioned, or licensed minister of a church; How to complete this tax form. So, you need to submit your form 4361 by october 15, 2019. • a member of a religious order who has not taken a vow of poverty;

How to file form 4361 to claim your exemption. Web a minister who wishes to be exempt from social security/medicare tax must file a form 4361 with the irs for approval. You will be asked about your housing allowance and whether or not you have an approved form 4361. Web in this article, we’ll walk through irs form 4361 so you can better understand: How to complete this tax form. That was april 15, 2019, but you could file an extension until october 15, 2019. Oct 04, 2015 really not a great idea. A member of a religious order who has not taken a vow of. You can view the form itself here. Web in order to opt out, the minister must file form 4361 no later than the due date (with extensions) for the tax return for the second year in which the minister had net ministerial income of $400 or more.

Do Amish Pay Taxes? How Taxation Impacts Traditional Communities

An ordained, commissioned, or licensed minister of a church; • a member of a religious order who has not taken a vow of poverty; Let’s start with step by step instructions for irs form 4361. You can view the form itself here. Web in this article, we’ll walk through irs form 4361 so you can better understand:

Form 1065 E File Requirements Universal Network

How to complete this tax form. Before your application can be approved, the irs must verify that you are aware of the grounds for exemption. Anonymous merely changing churches does not reset the two year window of opportunity. An ordained, commissioned, or licensed minister of a church; 3) must be opposed to receiving social security benefits on the basis of.

Fill Free fillable Form 4361 Application for Exemption From Self

An ordained, commissioned, or licensed minister of a church; • a member of a religious order who has not taken a vow of poverty; Oct 04, 2015 really not a great idea. Or • a christian science practitioner. The minister must be ordained, licensed, or commissioned by a church or religious denomination.

Hecht Group Why Churches Don’t Have To Pay Personal Property Taxes

Before your application can be approved, the irs must verify that you are aware of the grounds for exemption. Web a minister who wishes to be exempt from social security/medicare tax must file a form 4361 with the irs for approval. • a member of a religious order who has not taken a vow of poverty; Let’s start with step.

U.S. TREAS Form treasirs43612003

Oct 04, 2015 really not a great idea. Web a minister who wishes to be exempt from social security/medicare tax must file a form 4361 with the irs for approval. Web that means that your first tax year is 2017 and your second tax year is 2018, so you have to file form 4361 by the due date for your.

Form 201 Files

Web in order to opt out, the minister must file form 4361 no later than the due date (with extensions) for the tax return for the second year in which the minister had net ministerial income of $400 or more. • an ordained, commissioned, or licensed minister of a church; 3) must be opposed to receiving social security benefits on.

Opt Out of Social Security Form 4361

3) must be opposed to receiving social security benefits on the basis of their religious principles or because they are conscientiously oppose to it. How to file form 4361 to claim your exemption. Web 1) must be an ordained, commissioned, or licensed by a church. Web that means that your first tax year is 2017 and your second tax year.

17 [PDF] FORM 4361 APPROVAL FREE PRINTABLE DOCX 2020 ApprovalForm2

Oct 04, 2015 really not a great idea. Web 1) must be an ordained, commissioned, or licensed by a church. That was april 15, 2019, but you could file an extension until october 15, 2019. How to file form 4361 to claim your exemption. 4) must file an irs form 4361.

IRS Form 4361 Exemption From SelfEmployment Tax

An ordained, commissioned, or licensed minister of a church; So, you need to submit your form 4361 by october 15, 2019. • a member of a religious order who has not taken a vow of poverty; Web a minister who wishes to be exempt from social security/medicare tax must file a form 4361 with the irs for approval. A member.

고정자산대장 데이터관리 프로그램 엑셀데이터

• an ordained, commissioned, or licensed minister of a church; How to complete this tax form. Web that means that your first tax year is 2017 and your second tax year is 2018, so you have to file form 4361 by the due date for your 2018 tax return. That was april 15, 2019, but you could file an extension.

Web In This Article, We’ll Walk Through Irs Form 4361 So You Can Better Understand:

A member of a religious order who has not taken a vow of. Web form 4361 is an irs document that is used by ministers to opt out of public insurance programs. How to complete this tax form. An ordained, commissioned, or licensed minister of a church;

Oct 04, 2015 Really Not A Great Idea.

How to file form 4361 to claim your exemption. 4) must file an irs form 4361. • an ordained, commissioned, or licensed minister of a church; Web 1) must be an ordained, commissioned, or licensed by a church.

Web That Means That Your First Tax Year Is 2017 And Your Second Tax Year Is 2018, So You Have To File Form 4361 By The Due Date For Your 2018 Tax Return.

Web in order to opt out, the minister must file form 4361 no later than the due date (with extensions) for the tax return for the second year in which the minister had net ministerial income of $400 or more. The minister must be ordained, licensed, or commissioned by a church or religious denomination. • a member of a religious order who has not taken a vow of poverty; 3) must be opposed to receiving social security benefits on the basis of their religious principles or because they are conscientiously oppose to it.

So, You Need To Submit Your Form 4361 By October 15, 2019.

You can view the form itself here. Web a minister who wishes to be exempt from social security/medicare tax must file a form 4361 with the irs for approval. You will be asked about your housing allowance and whether or not you have an approved form 4361. Before your application can be approved, the irs must verify that you are aware of the grounds for exemption.

![17 [PDF] FORM 4361 APPROVAL FREE PRINTABLE DOCX 2020 ApprovalForm2](https://3.bp.blogspot.com/-qTJKFRd5GAA/UhiL9mr-pTI/AAAAAAAA6HQ/lxfIrVan3Go/s1600/IMG_4361.jpg)