How To File Form 7004 Online

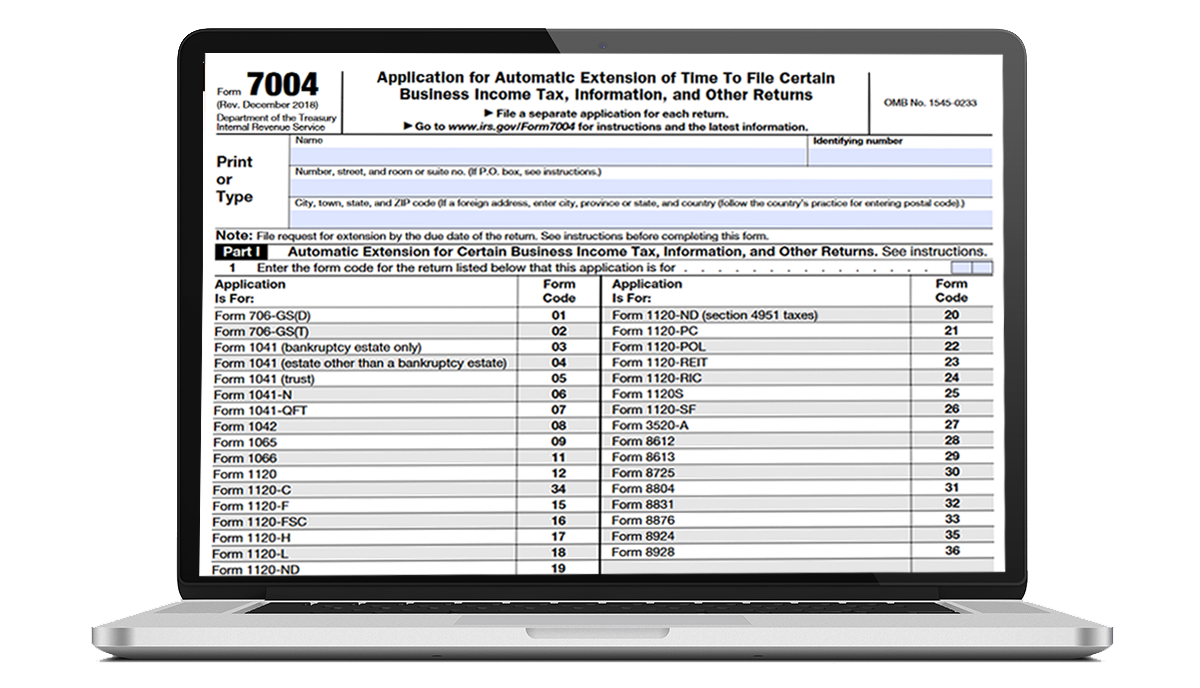

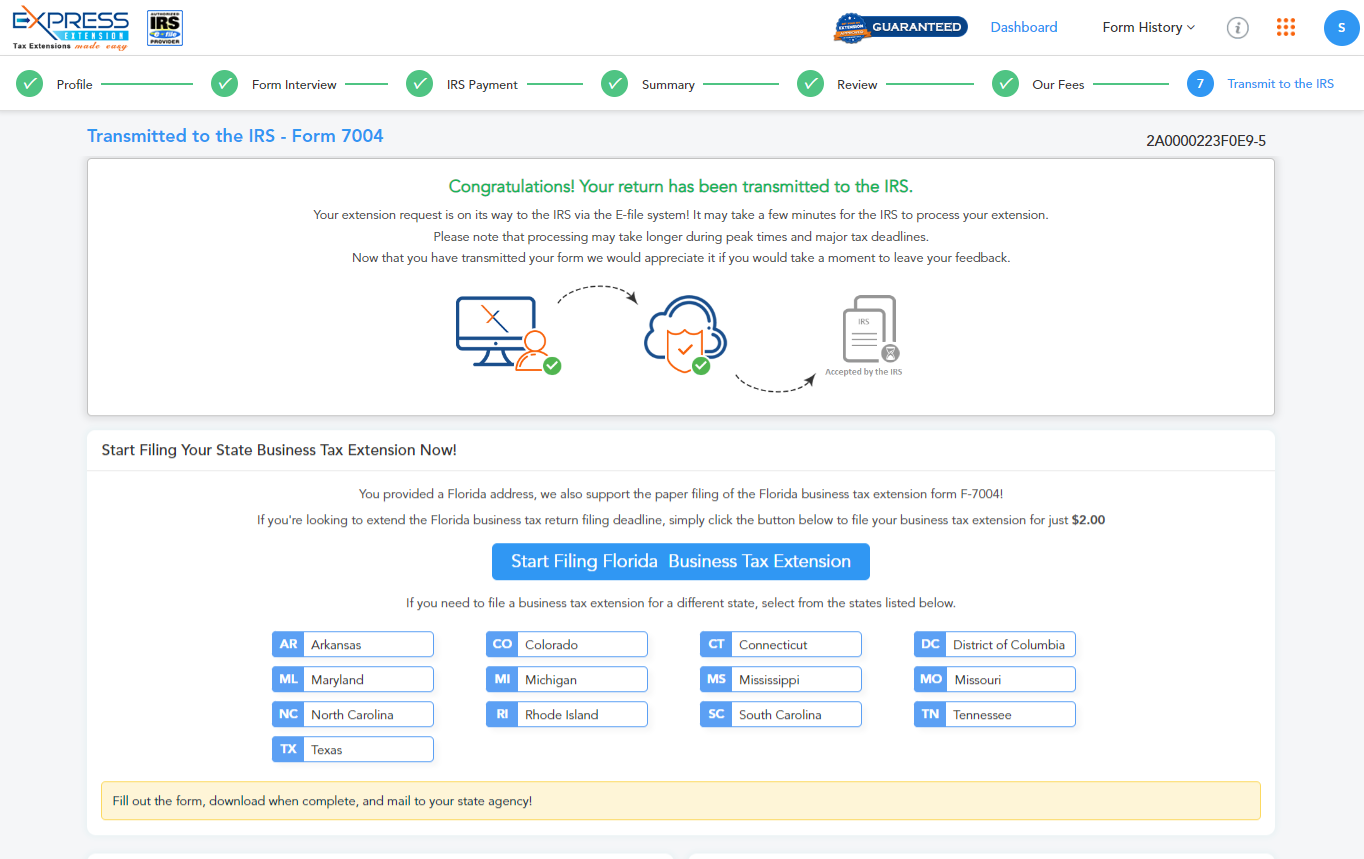

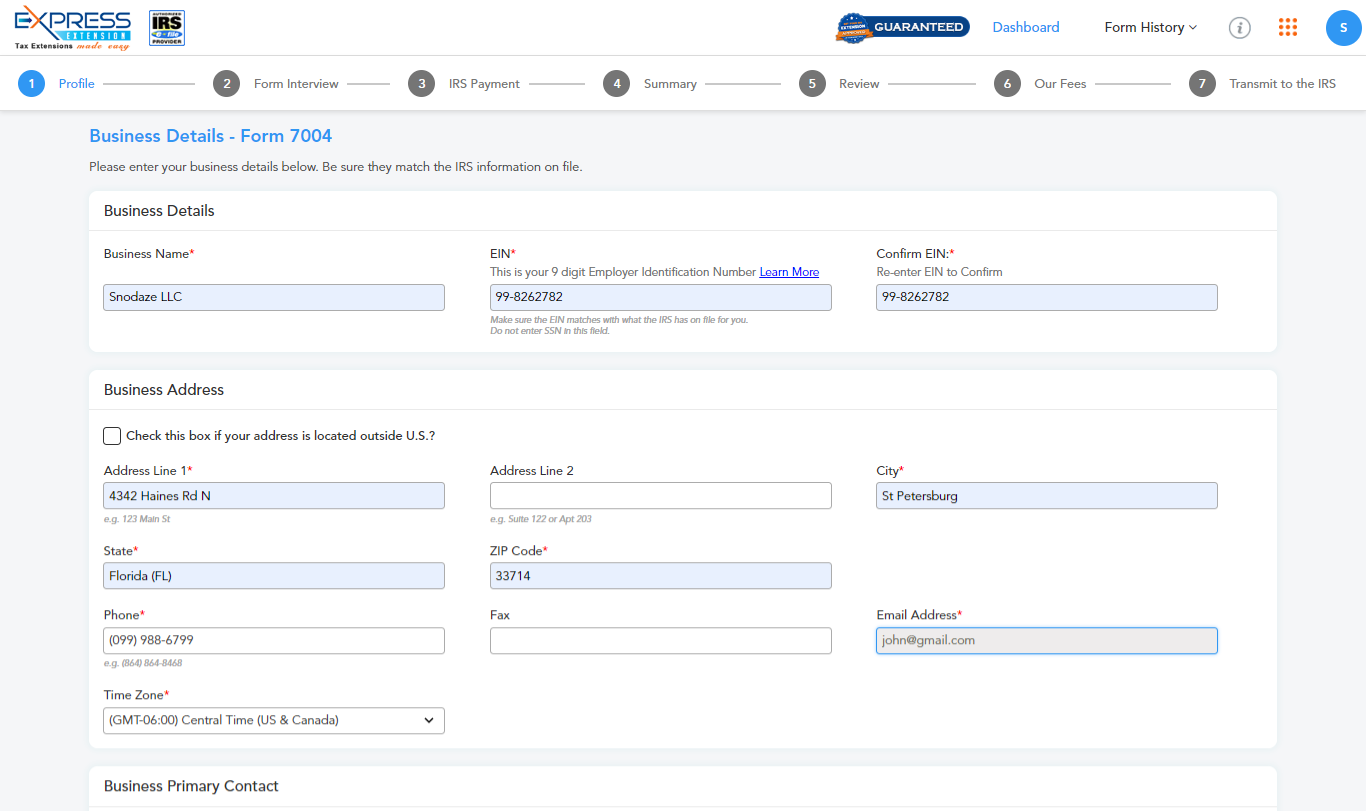

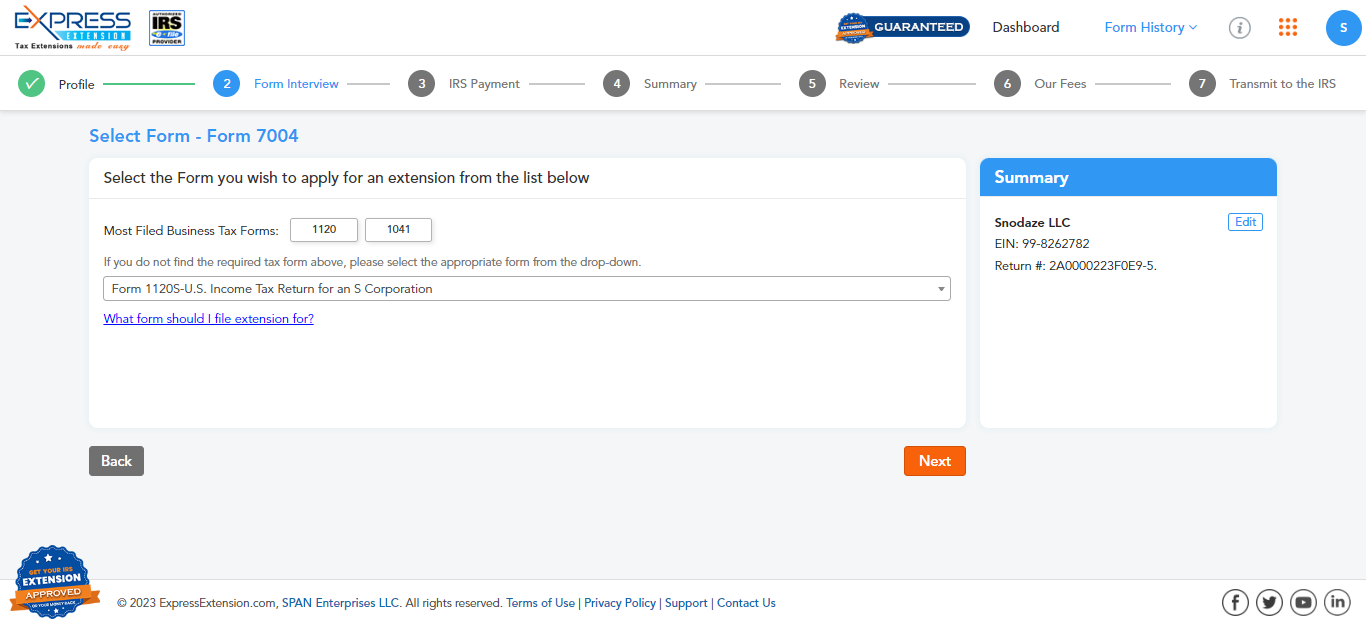

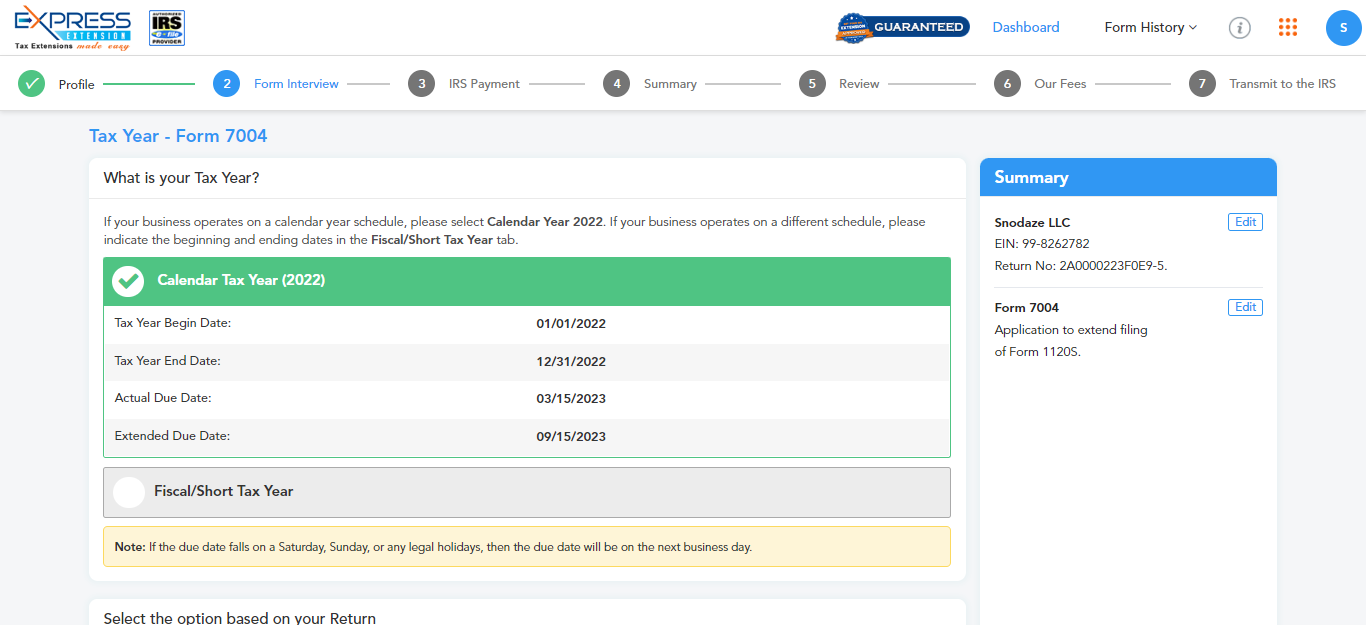

How To File Form 7004 Online - All the returns shown on form 7004 are eligible for an automatic extension of time to file from the due date of the return. Web do i need to file ssa 7004? You may obtain a record of your earnings history by establishing an online social security account on the social security website. Web information about form 7004, application for automatic extension of time to file certain business income tax, information, and other returns, including recent updates, related forms, and instructions on how to file. Web how and where to file. 3 select the tax year. Enter business details step 2: Select the appropriate form from the table below to determine where to send the form 7004, application for automatic extension of time to file certain business income tax, information, and other returns 5 transmit your form to the irs start filing now. Select business entity & form step 3:

Select the appropriate form from the table below to determine where to send the form 7004, application for automatic extension of time to file certain business income tax, information, and other returns Web how and where to file. 5 transmit your form to the irs start filing now. 4 enter tax payment details. 2 select business entity & form. Web information about form 7004, application for automatic extension of time to file certain business income tax, information, and other returns, including recent updates, related forms, and instructions on how to file. Web use the chart to determine where to file form 7004 based on the tax form you complete. 3 select the tax year. Form 1041 6 monthsform 1120 follow these steps to print a 7004 in turbotax business: Select business entity & form step 3:

Select business entity & form step 3: You may obtain a record of your earnings history by establishing an online social security account on the social security website. Web use the chart to determine where to file form 7004 based on the tax form you complete. Irs form 7004 extends the filing deadline for another: Form 7004 can be filed electronically for most returns. Select the appropriate form from the table below to determine where to send the form 7004, application for automatic extension of time to file certain business income tax, information, and other returns 4 enter tax payment details. 3 select the tax year. Web how and where to file. For details on electronic filing, visit irs.gov/efile7004.

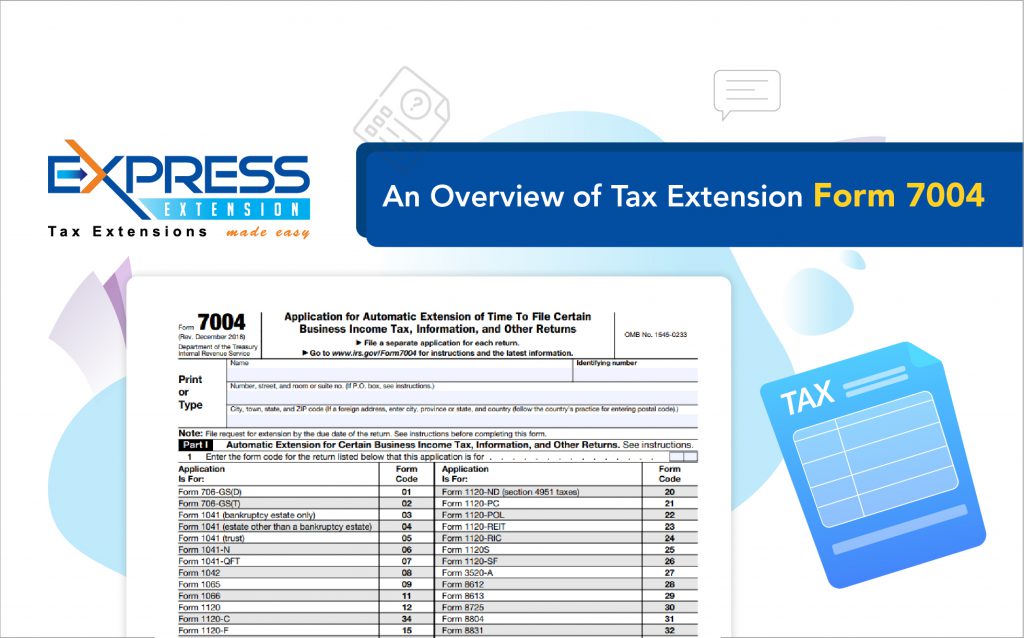

An Overview of Tax Extension Form 7004 Blog ExpressExtension

For details on electronic filing, visit irs.gov/efile7004. 2 select business entity & form. 5 transmit your form to the irs start filing now. Form 7004 can be filed electronically for most returns. Filing form ssa 7004 is completely optional.

File Form 7004 Online 2023 Business Tax Extension Form

Jump to extend how do i file a tax extension? Enter business details step 2: Web do i need to file ssa 7004? 4 enter tax payment details. Irs form 7004 extends the filing deadline for another:

File IRS Tax Extension Form 7004 Online TaxBandits Fill Online

Irs form 7004 extends the filing deadline for another: Web how do i file form 7004, application for automatic extension of time to file certain business income tax, information, and other returns? Form 7004 is used to request an automatic extension to file the certain returns. You may obtain a record of your earnings history by establishing an online social.

File Form 7004 Online 2021 Business Tax Extension Form

2 select business entity & form. Select the tax year step 4: Select business entity & form step 3: All the returns shown on form 7004 are eligible for an automatic extension of time to file from the due date of the return. 5 transmit your form to the irs start filing now.

EFile 7004 Online 2022 File Business Tax extension Form

Web do i need to file ssa 7004? Jump to extend how do i file a tax extension? 4 enter tax payment details. Select business entity & form step 3: For details on electronic filing, visit irs.gov/efile7004.

EFile IRS Form 7004 How to file 7004 Extension Online

Select the appropriate form from the table below to determine where to send the form 7004, application for automatic extension of time to file certain business income tax, information, and other returns Jump to extend how do i file a tax extension? 2 select business entity & form. Web how and where to file. Form 7004 can be filed electronically.

E File Form 7004 Online Universal Network

5 transmit your form to the irs start filing now. Web use the chart to determine where to file form 7004 based on the tax form you complete. 2 select business entity & form. Form 1041 6 monthsform 1120 follow these steps to print a 7004 in turbotax business: 3 select the tax year.

EFile IRS Form 7004 How to file 7004 Extension Online

4 enter tax payment details. Form 7004 can be filed electronically for most returns. For details on electronic filing, visit irs.gov/efile7004. 2 select business entity & form. Enter tax payment details step 5:

EFile IRS Form 7004 How to file 7004 Extension Online

Irs form 7004 extends the filing deadline for another: Select the appropriate form from the table below to determine where to send the form 7004, application for automatic extension of time to file certain business income tax, information, and other returns 3 select the tax year. 4 enter tax payment details. Web do i need to file ssa 7004?

EFile IRS Form 7004 How to file 7004 Extension Online

Form 7004 is used to request an automatic extension to file the certain returns. Web use the chart to determine where to file form 7004 based on the tax form you complete. 3 select the tax year. 2 select business entity & form. Web how do i file form 7004, application for automatic extension of time to file certain business.

Select The Appropriate Form From The Table Below To Determine Where To Send The Form 7004, Application For Automatic Extension Of Time To File Certain Business Income Tax, Information, And Other Returns

Irs form 7004 extends the filing deadline for another: 3 select the tax year. Web do i need to file ssa 7004? You may obtain a record of your earnings history by establishing an online social security account on the social security website.

4 Enter Tax Payment Details.

Enter tax payment details step 5: Form 7004 is used to request an automatic extension to file the certain returns. 5 transmit your form to the irs start filing now. Web information about form 7004, application for automatic extension of time to file certain business income tax, information, and other returns, including recent updates, related forms, and instructions on how to file.

2 Select Business Entity & Form.

Enter business details step 2: Web use the chart to determine where to file form 7004 based on the tax form you complete. Web how do i file form 7004, application for automatic extension of time to file certain business income tax, information, and other returns? Form 7004 can be filed electronically for most returns.

All The Returns Shown On Form 7004 Are Eligible For An Automatic Extension Of Time To File From The Due Date Of The Return.

For details on electronic filing, visit irs.gov/efile7004. Form 1041 6 monthsform 1120 follow these steps to print a 7004 in turbotax business: Jump to extend how do i file a tax extension? Web how and where to file.