How To File Form 8936

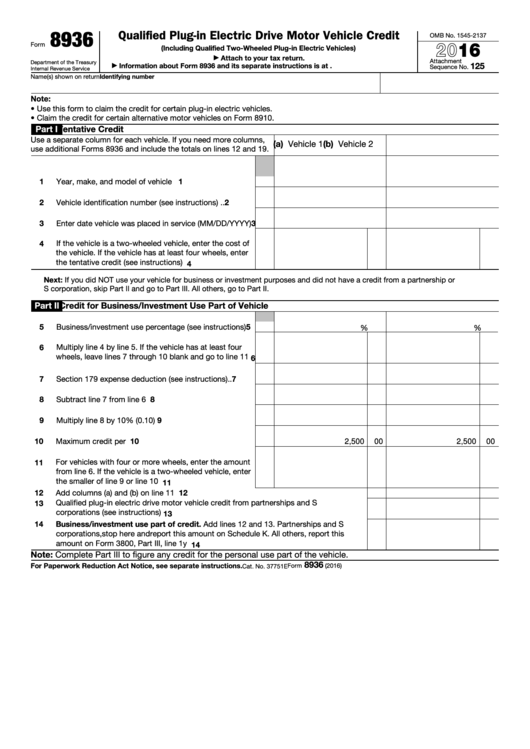

How To File Form 8936 - In part i, part ii, part iii and part iv enter the information about the vehicle. Web 0:00 / 8:51 • intro electric vehicle tax credits on irs form 8936 jason d. Web to generate form 8936: It added income limits, price caps and other provisions, including a requirement that battery. Type 8936w to highlight the form 8936 wks and click ok. Web to elect the credit under the prior rules you must elect the credit on your 2022 tax return after you take delivery of the vehicle. Press f6 to bring up open forms. Knott 14.5k subscribers join subscribe 277 share 15k views 1 year ago #electricvehicle #taxcredit for 2022 updates to. Web chevrolet the inflation reduction act of 2022 overhauled the ev tax credit, worth up to $7,500. Depending on the date the vehicle is delivered, you can claim the credit on your original, superseding, or amended 2022 tax return.

Press f6 to bring up open forms. Web chevrolet the inflation reduction act of 2022 overhauled the ev tax credit, worth up to $7,500. Web 0:00 / 8:51 • intro electric vehicle tax credits on irs form 8936 jason d. Type 8936w to highlight the form 8936 wks and click ok. Depending on the date the vehicle is delivered, you can claim the credit on your original, superseding, or amended 2022 tax return. In part i, part ii, part iii and part iv enter the information about the vehicle. It added income limits, price caps and other provisions, including a requirement that battery. Web to generate form 8936: Web to elect the credit under the prior rules you must elect the credit on your 2022 tax return after you take delivery of the vehicle. Knott 14.5k subscribers join subscribe 277 share 15k views 1 year ago #electricvehicle #taxcredit for 2022 updates to.

Press f6 to bring up open forms. Web to generate form 8936: Knott 14.5k subscribers join subscribe 277 share 15k views 1 year ago #electricvehicle #taxcredit for 2022 updates to. Web chevrolet the inflation reduction act of 2022 overhauled the ev tax credit, worth up to $7,500. Depending on the date the vehicle is delivered, you can claim the credit on your original, superseding, or amended 2022 tax return. Type 8936w to highlight the form 8936 wks and click ok. Web 0:00 / 8:51 • intro electric vehicle tax credits on irs form 8936 jason d. In part i, part ii, part iii and part iv enter the information about the vehicle. On the create new copy line enter the description of the vehicle and select create. It added income limits, price caps and other provisions, including a requirement that battery.

Form 8936 Qualified Plugin Electric Drive Motor Vehicle Credit (2014

It added income limits, price caps and other provisions, including a requirement that battery. Web chevrolet the inflation reduction act of 2022 overhauled the ev tax credit, worth up to $7,500. Type 8936w to highlight the form 8936 wks and click ok. On the create new copy line enter the description of the vehicle and select create. Depending on the.

Form 8936 2022 2023

Type 8936w to highlight the form 8936 wks and click ok. On the create new copy line enter the description of the vehicle and select create. Depending on the date the vehicle is delivered, you can claim the credit on your original, superseding, or amended 2022 tax return. Knott 14.5k subscribers join subscribe 277 share 15k views 1 year ago.

What Is Form 8936 Plugin Electric Drive Motor Vehicle Credit?

Web 0:00 / 8:51 • intro electric vehicle tax credits on irs form 8936 jason d. On the create new copy line enter the description of the vehicle and select create. Type 8936w to highlight the form 8936 wks and click ok. Press f6 to bring up open forms. Web to generate form 8936:

Form 8936 Edit, Fill, Sign Online Handypdf

Web to generate form 8936: It added income limits, price caps and other provisions, including a requirement that battery. In part i, part ii, part iii and part iv enter the information about the vehicle. Depending on the date the vehicle is delivered, you can claim the credit on your original, superseding, or amended 2022 tax return. Web chevrolet the.

How to File Form 8936 for Business & Personal Use of EV Tax Credit

Web to generate form 8936: Type 8936w to highlight the form 8936 wks and click ok. Web chevrolet the inflation reduction act of 2022 overhauled the ev tax credit, worth up to $7,500. In part i, part ii, part iii and part iv enter the information about the vehicle. Web to elect the credit under the prior rules you must.

Federal Tax Credit Electric Car

On the create new copy line enter the description of the vehicle and select create. Web chevrolet the inflation reduction act of 2022 overhauled the ev tax credit, worth up to $7,500. Type 8936w to highlight the form 8936 wks and click ok. Web to elect the credit under the prior rules you must elect the credit on your 2022.

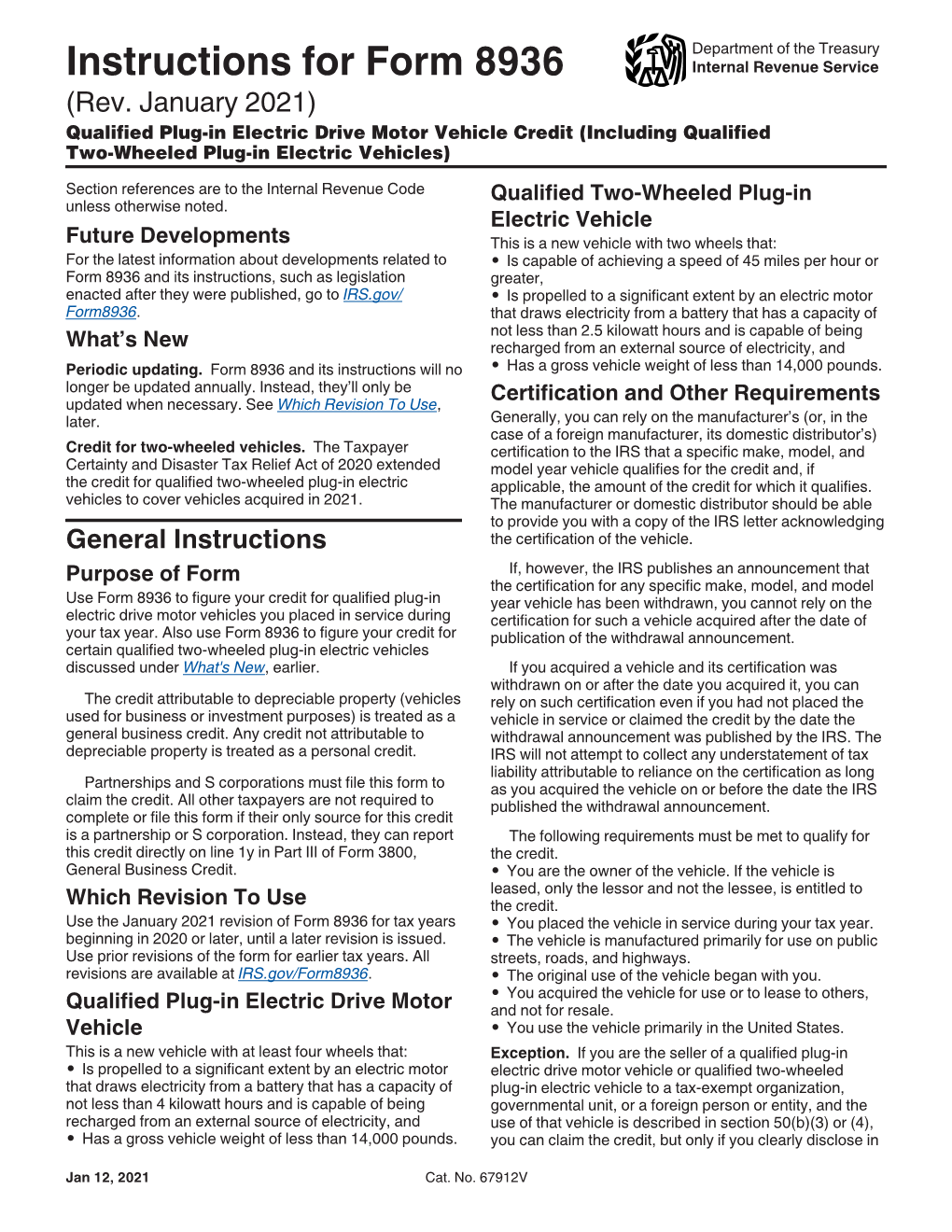

Instructions for Form 8936 (Rev. January 2021) DocsLib

Web to generate form 8936: In part i, part ii, part iii and part iv enter the information about the vehicle. Web chevrolet the inflation reduction act of 2022 overhauled the ev tax credit, worth up to $7,500. On the create new copy line enter the description of the vehicle and select create. Knott 14.5k subscribers join subscribe 277 share.

Fillable Form 8936 Qualified PlugIn Electric Drive Motor Vehicle

Web to elect the credit under the prior rules you must elect the credit on your 2022 tax return after you take delivery of the vehicle. On the create new copy line enter the description of the vehicle and select create. Press f6 to bring up open forms. Depending on the date the vehicle is delivered, you can claim the.

Form 8396 Mortgage Interest Credit Definition

Press f6 to bring up open forms. Web to generate form 8936: Type 8936w to highlight the form 8936 wks and click ok. Knott 14.5k subscribers join subscribe 277 share 15k views 1 year ago #electricvehicle #taxcredit for 2022 updates to. On the create new copy line enter the description of the vehicle and select create.

Filing Tax Returns & EV Credits Tesla Motors Club

Type 8936w to highlight the form 8936 wks and click ok. Web to elect the credit under the prior rules you must elect the credit on your 2022 tax return after you take delivery of the vehicle. Web to generate form 8936: Web 0:00 / 8:51 • intro electric vehicle tax credits on irs form 8936 jason d. In part.

Web To Elect The Credit Under The Prior Rules You Must Elect The Credit On Your 2022 Tax Return After You Take Delivery Of The Vehicle.

On the create new copy line enter the description of the vehicle and select create. Knott 14.5k subscribers join subscribe 277 share 15k views 1 year ago #electricvehicle #taxcredit for 2022 updates to. Press f6 to bring up open forms. Web chevrolet the inflation reduction act of 2022 overhauled the ev tax credit, worth up to $7,500.

In Part I, Part Ii, Part Iii And Part Iv Enter The Information About The Vehicle.

Type 8936w to highlight the form 8936 wks and click ok. Web 0:00 / 8:51 • intro electric vehicle tax credits on irs form 8936 jason d. Web to generate form 8936: It added income limits, price caps and other provisions, including a requirement that battery.

:max_bytes(150000):strip_icc()/car-charging-at-electric-vehicle-station-1316428504-d9dfb89a0f8a4873b7dc0284646bea41.jpg)

:max_bytes(150000):strip_icc()/ScreenShot2021-02-09at12.51.04PM-6f772fddc89f4ef9a4fdb81e432d57d8.png)