How To Fill Form 8889

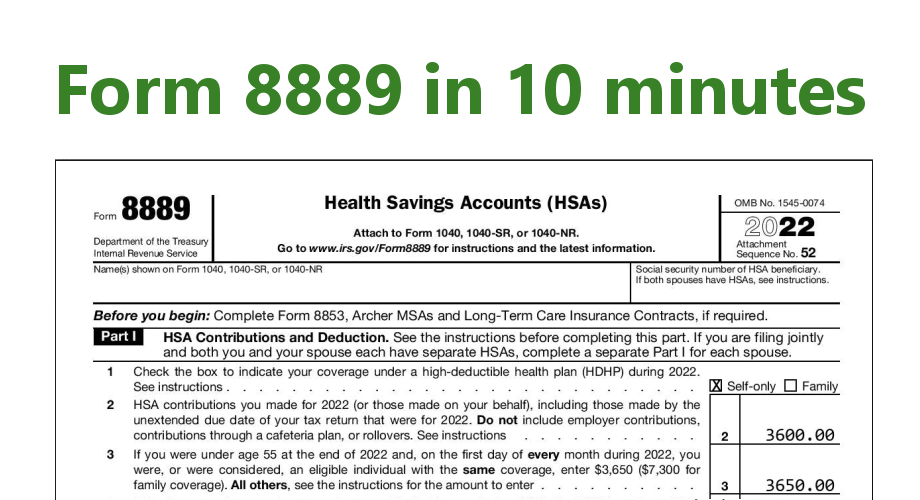

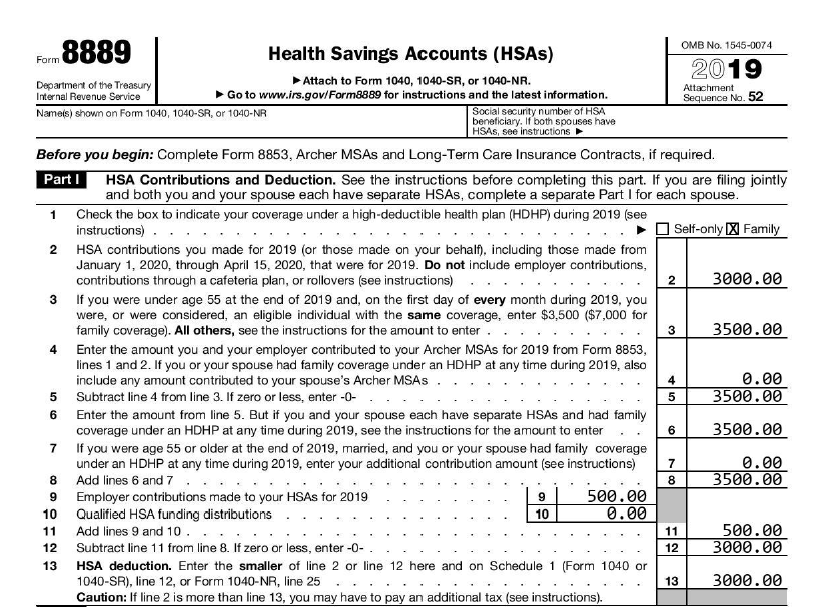

How To Fill Form 8889 - 1 = self only, 2 = family for the taxpayer and/or spouse in. File an extension in turbotax online before the deadline to avoid a late filing penalty. Ad download or email form 8889 & more fillable forms, register and subscribe now! Web up to $40 cash back easily complete a printable irs 8889 form 2022 online. Report contributions to a health savings account (hsa). Web how to amend and resubmit 8889 filing with form 1040x provides a place for your signature and your explanation, so, unless the irs has explicitly asked you for. This form is specific to hsa’s and records all. In this video, i will walk through form 8889 line by line, explain what each. This is a distribution from a health flexible spending arrangement (fsa) or health reimbursement arrangement (hra). We'll automatically fill out form 8889 if you.

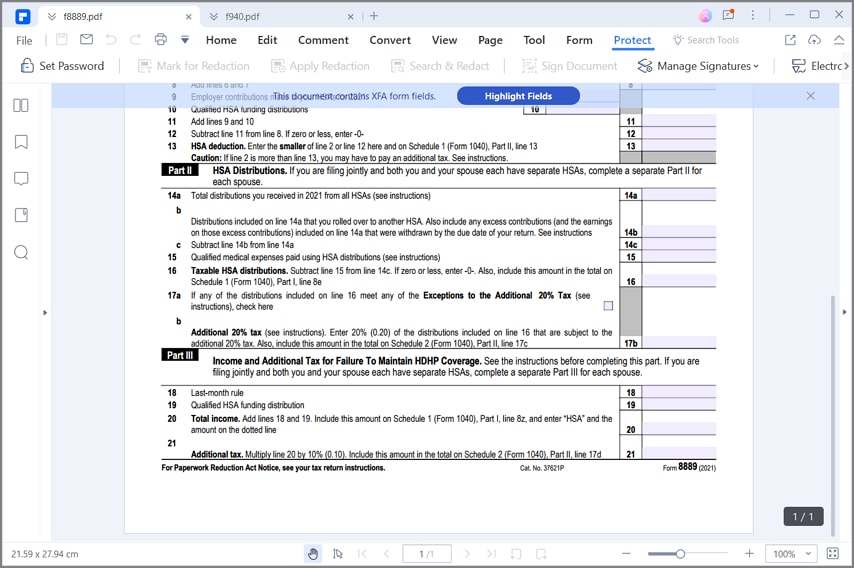

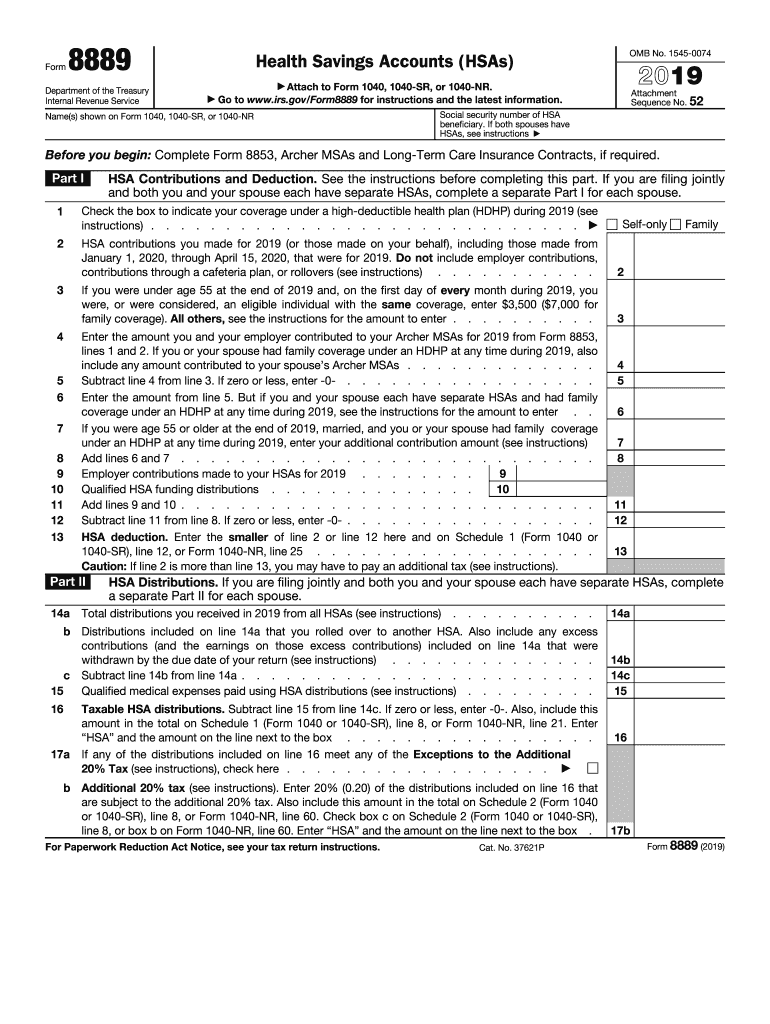

Web the hard and fast rule is if money is going into or out of your health savings account, you need to file form 8889 for the tax year in which that spending occurred. Health savings account (hsa) is used to report hsa contributions, distributions, and withdrawals. This form is specific and documents all of. Complete, edit or print tax forms instantly. Get ready for this year's tax season quickly and safely with pdffiller! Web up to $40 cash back easily complete a printable irs 8889 form 2022 online. We'll automatically fill out form 8889 if you. Web if you made contributions to or distributions from your hsa in 2019, you will need to file the federal tax form 8889. Web from the 8889 doc. This is a distribution from a health flexible spending arrangement (fsa) or health reimbursement arrangement (hra).

In this video, i will walk through form 8889 line by line, explain what each. Web if you made contributions to or distributions from your hsa in 2020, you will need to file the federal tax form 8889. File an extension in turbotax online before the deadline to avoid a late filing penalty. Knott 10.3k subscribers join subscribe 7.7k views 1 year ago #irs. 1 = self only, 2 = family for the taxpayer and/or spouse in. Health savings account (hsa) is used to report hsa contributions, distributions, and withdrawals. We'll automatically fill out form 8889 if you. Web how to amend and resubmit 8889 filing with form 1040x provides a place for your signature and your explanation, so, unless the irs has explicitly asked you for. If both spouses have hsas, see instructions. The consolidated appropriations act 2022 extends the availability of telehealth and other.

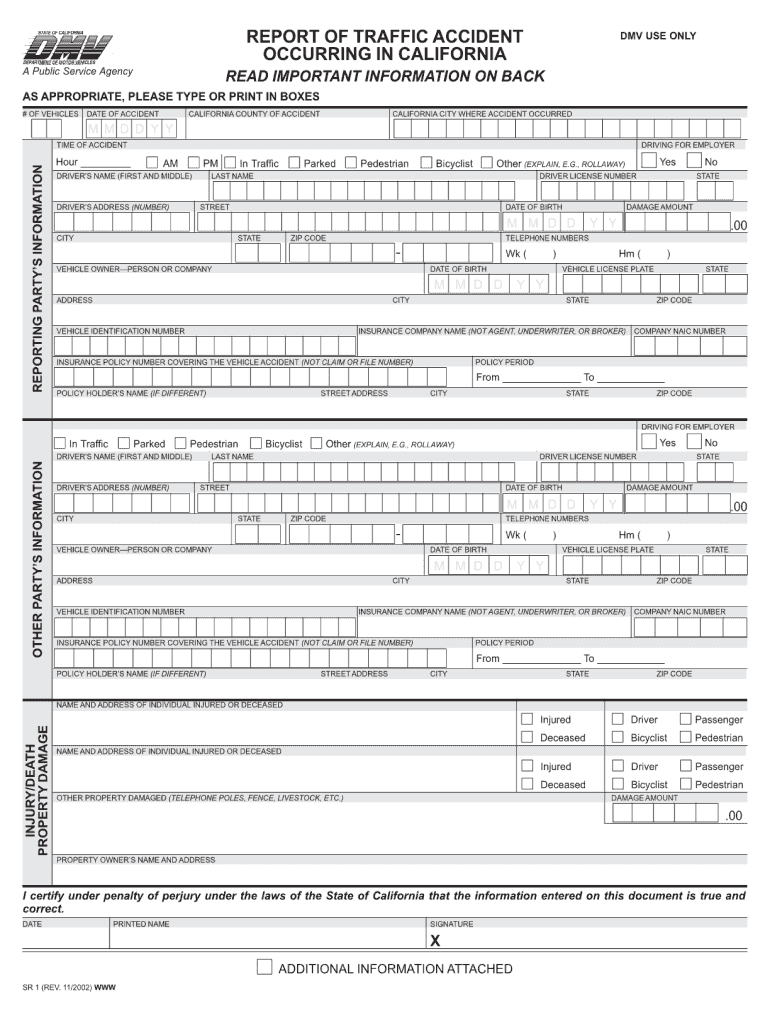

2002 CA DMV Form SR 1 Fill Online, Printable, Fillable, Blank pdfFiller

Report health savings account (hsa) contributions (including those made on your behalf and employer contributions). Web file form 8889 to: Web to generate the federal form 8889, you must make an entry in the field labeled type of coverage: Web • background how to file hsa form 8889 easyform8889.com 86 subscribers subscribe 59 share 25k views 5 years ago simple.

Form 8889 Instructions & Information on the HSA Tax Form

Report contributions to a health savings account (hsa). Ad download or email form 8889 & more fillable forms, register and subscribe now! This is a distribution from a health flexible spending arrangement (fsa) or health reimbursement arrangement (hra). In this video, i will walk through form 8889 line by line, explain what each. Web if you made contributions to or.

1998 Form IRS 1024 Fill Online, Printable, Fillable, Blank pdfFiller

Find and download the latest version of form 8889. Report health savings account (hsa) contributions (including those made on your behalf and employer contributions). Ad download or email form 8889 & more fillable forms, register and subscribe now! Irs form 8889 is a required tax form for your health savings account. 1 = self only, 2 = family for the.

Fill Free fillable Form 8883 2017 Asset Allocation Statement PDF form

1 = self only, 2 = family for the taxpayer and/or spouse in. This form is specific to hsa’s and records all. Web the hard and fast rule is if money is going into or out of your health savings account, you need to file form 8889 for the tax year in which that spending occurred. It is going to.

Acontar con imagenes... Page 804

Web how do i file an irs extension (form 4868) in turbotax online? Report contributions to a health savings account (hsa). Web how to complete irs form 8889 for health savings accounts (hsa) jason d. The consolidated appropriations act 2022 extends the availability of telehealth and other. This form is specific and documents all of.

for How to Fill in IRS Form 8889

Report health savings account (hsa) contributions (including those made on your behalf and employer contributions). File an extension in turbotax online before the deadline to avoid a late filing penalty. Complete, edit or print tax forms instantly. Health savings account (hsa) is used to report hsa contributions, distributions, and withdrawals. This form is specific to hsa’s and records all.

Top 19 919 form australia 2020 en iyi 2022

This is a distribution from a health flexible spending arrangement (fsa) or health reimbursement arrangement (hra). The consolidated appropriations act 2022 extends the availability of telehealth and other. 1 = self only, 2 = family for the taxpayer and/or spouse in. We'll automatically fill out form 8889 if you. Web up to $40 cash back easily complete a printable irs.

2016 Form IRS Publication 915 Fill Online, Printable, Fillable, Blank

File an extension in turbotax online before the deadline to avoid a late filing penalty. Web form 8889 is the irs form that helps you to do the following: Ad download or email form 8889 & more fillable forms, register and subscribe now! Create a blank & editable 8889 form,. Find and download the latest version of form 8889.

2019 Form IRS 8889 Fill Online, Printable, Fillable, Blank pdfFiller

Find and download the latest version of form 8889. Irs form 8889 is a required tax form for your health savings account. In this video, i will walk through form 8889 line by line, explain what each. Ad download or email form 8889 & more fillable forms, register and subscribe now! The consolidated appropriations act 2022 extends the availability of.

Instructions for How to Fill in IRS Form 5329

Web the hard and fast rule is if money is going into or out of your health savings account, you need to file form 8889 for the tax year in which that spending occurred. Health savings account (hsa) is used to report hsa contributions, distributions, and withdrawals. Form 8889, health savings account (hsa) a health savings account (hsa) is an.

Irs Form 8889 Is A Required Tax Form For Your Health Savings Account.

Web how to complete irs form 8889 for health savings accounts (hsa) jason d. Complete, edit or print tax forms instantly. Form 8889, health savings account (hsa) a health savings account (hsa) is an account set up with a qualified hsa trustee that is used to reimburse qualified medical. File an extension in turbotax online before the deadline to avoid a late filing penalty.

Get Ready For This Year's Tax Season Quickly And Safely With Pdffiller!

Ad download or email form 8889 & more fillable forms, register and subscribe now! Web how to amend and resubmit 8889 filing with form 1040x provides a place for your signature and your explanation, so, unless the irs has explicitly asked you for. Web form 8889 is the irs form that helps you to do the following: If both spouses have hsas, see instructions.

Report Health Savings Account (Hsa) Contributions (Including Those Made On Your Behalf And Employer Contributions).

It is going to be included in your form 1040 book or you can download it from the internal revenue. Web if you made contributions to or distributions from your hsa in 2019, you will need to file the federal tax form 8889. Report contributions to a health savings account (hsa). Calculate your tax deduction from.

Web To Generate The Federal Form 8889, You Must Make An Entry In The Field Labeled Type Of Coverage:

Create a blank & editable 8889 form,. Web how do i file an irs extension (form 4868) in turbotax online? Web the hard and fast rule is if money is going into or out of your health savings account, you need to file form 8889 for the tax year in which that spending occurred. Web up to $40 cash back easily complete a printable irs 8889 form 2022 online.