How To Fill Form 8958

How To Fill Form 8958 - Go to screen 3.1, community property income allocation. Yes, loved it could be better no one. Web from within your taxact return ( online or desktop), click federal (on smaller devices, click in the top left corner of your screen, then click federal ). Web electronic signature forms library other forms all forms fillable form 8958 fillable form 8958 use a form 8958 example template to make your document workflow more. Web to enter form 8958 in the taxact program (this allocation worksheet does not need to be completed if you are only filing the state returns separately and filing a joint federal. Do i put the clients… how to fill out form 8958, im in texas. Web income allocation information is required when electronically filing a return with a married filing separately or registered domestic partner status in the individual module of intuit. Web first, print the form 8958 from each spouse's return in order to complete the spouse column on the other spouse's return: Web if your resident state is a community property state, and you file a federal tax return separately from your spouse or registered domestic partner, use form 8958 to report half. Web 1 best answer thomasm125 expert alumni your community property income will be your normal income for the year plus or minus an adjustment for your community.

★★★★★ how to fill out form 8958, im in texas. Web form 8958 only explains how you allocated income. Web you must attach form 8958 to your tax form showing how you figured the amount you’re reporting on your return. Do i put the clients… how to fill out form 8958, im in texas. Yes, loved it could be better no one. Web 1 best answer thomasm125 expert alumni your community property income will be your normal income for the year plus or minus an adjustment for your community. Enter all required information in the required fillable areas. Web form 8958 is also needed for the two separately filed tax returns of registered domestic partners in a community property state who are filing as single, head of household, or. Web follow our simple steps to have your form 8958 examples prepared quickly: Enter amounts in the income allocation details subsection.

Go to screen 3.1, community property income allocation. Web to enter form 8958 in the taxact program (this allocation worksheet does not need to be completed if you are only filing the state returns separately and filing a joint federal. Web follow our simple steps to have your form 8958 examples prepared quickly: Web to generate form 8958, follow these steps: Pick the web sample in the catalogue. Web form 8958 is also needed for the two separately filed tax returns of registered domestic partners in a community property state who are filing as single, head of household, or. Sign in to your taxact. Web ask an expert tax questions this answer was rated: Web 1 best answer thomasm125 expert alumni your community property income will be your normal income for the year plus or minus an adjustment for your community. Enter all required information in the required fillable areas.

Fill Free fillable Form 8958 2019 Allocation of Tax Amounts PDF form

Enter all required information in the required fillable areas. Enter amounts in the income allocation details subsection. If the split returns need to be changed to allocate income correctly, you must make those changes manually. Pick the web sample in the catalogue. Web 1 best answer thomasm125 expert alumni your community property income will be your normal income for the.

Fill Free fillable Allocation of Tax Amounts Between Certain

Enter all required information in the required fillable areas. Web to enter form 8958 in the taxact program (this allocation worksheet does not need to be completed if you are only filing the state returns separately and filing a joint federal. Web how do i complete the married filing separate allocation form (8958)? Web form 8958 is also needed for.

Form 8958 Fillable ≡ Fill Out Printable PDF Forms Online

★★★★★ how to fill out form 8958, im in texas. Web the form 8958 essentially reconciles the difference between what employers (and other income sources) have reported to the irs and what the spouses will be. Enter amounts in the income allocation details subsection. Pick the web sample in the catalogue. Web income allocation information is required when electronically filing.

Fill Free fillable Form 8958 Allocation of Tax Amounts 2014 PDF form

Web to enter form 8958 in the taxact program (this allocation worksheet does not need to be completed if you are only filing the state returns separately and filing a joint federal. Web 1 best answer thomasm125 expert alumni your community property income will be your normal income for the year plus or minus an adjustment for your community. Web.

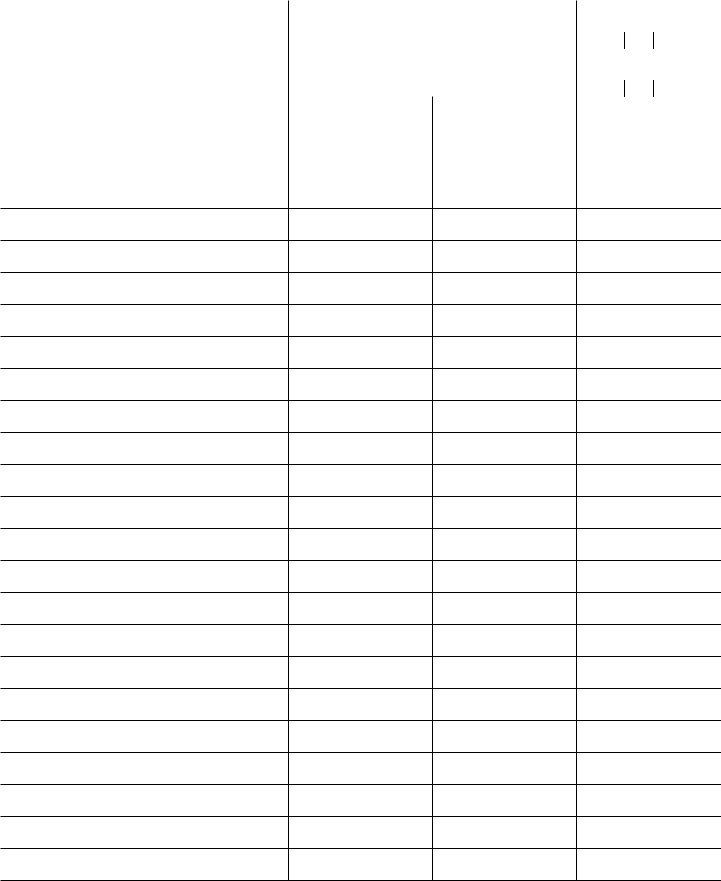

View topic ARF's guide to international shipping . Keypicking

Web first, print the form 8958 from each spouse's return in order to complete the spouse column on the other spouse's return: Web from within your taxact return ( online or desktop), click federal (on smaller devices, click in the top left corner of your screen, then click federal ). Go to screen 3.1, community property income allocation. Web form.

8958 Fill Online, Printable, Fillable, Blank pdfFiller

Web if your resident state is a community property state, and you file a federal tax return separately from your spouse or registered domestic partner, use form 8958 to report half. Web first, print the form 8958 from each spouse's return in order to complete the spouse column on the other spouse's return: Web electronic signature forms library other forms.

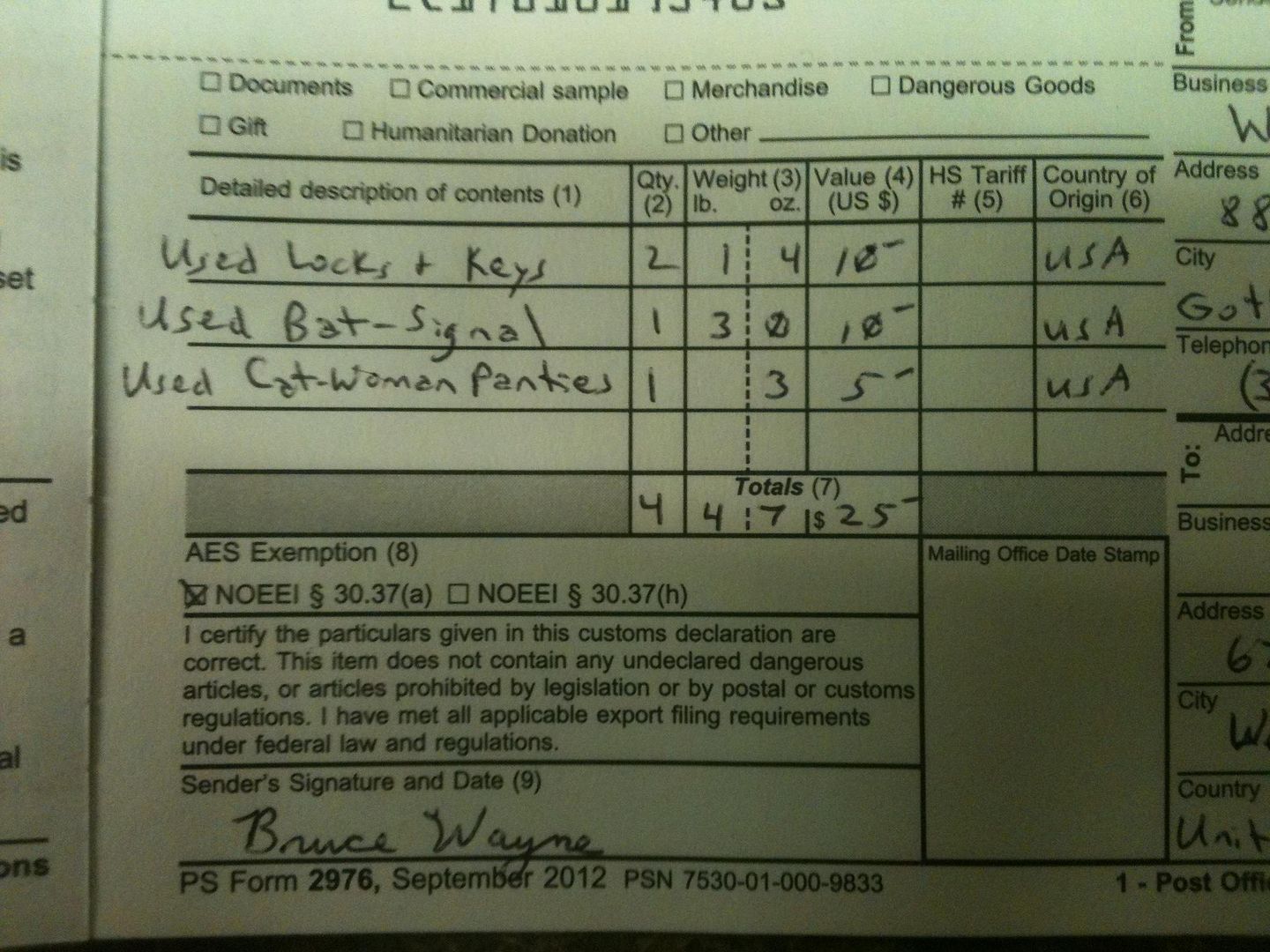

IRS Form 5558 A Guide to Fill it the Right Way

Web follow our simple steps to have your form 8958 examples prepared quickly: Pick the web sample in the catalogue. Go to screen 3.1, community property income allocation. Web form 8958 is also needed for the two separately filed tax returns of registered domestic partners in a community property state who are filing as single, head of household, or. Enter.

IRS 1040 Imagen de archivo libre de regalías Imagen 3946196

Web from within your taxact return ( online or desktop), click federal (on smaller devices, click in the top left corner of your screen, then click federal ). Web 1 best answer thomasm125 expert alumni your community property income will be your normal income for the year plus or minus an adjustment for your community. Web to enter form 8958.

Community property / Form 8958 penalty for r/tax

Web the form 8958 essentially reconciles the difference between what employers (and other income sources) have reported to the irs and what the spouses will be. Web form 8958 is also needed for the two separately filed tax returns of registered domestic partners in a community property state who are filing as single, head of household, or. Pick the web.

Form 8958 Allocation of Tax Amounts between Certain Individuals in

Go to screen 3.1, community property income allocation. Web electronic signature forms library other forms all forms fillable form 8958 fillable form 8958 use a form 8958 example template to make your document workflow more. If the split returns need to be changed to allocate income correctly, you must make those changes manually. Do i put the clients… how to.

If The Split Returns Need To Be Changed To Allocate Income Correctly, You Must Make Those Changes Manually.

Web 1 best answer thomasm125 expert alumni your community property income will be your normal income for the year plus or minus an adjustment for your community. Web to enter form 8958 in the taxact program (this allocation worksheet does not need to be completed if you are only filing the state returns separately and filing a joint federal. Web ask an expert tax questions this answer was rated: Web to generate form 8958, follow these steps:

Web Form 8958 Is Also Needed For The Two Separately Filed Tax Returns Of Registered Domestic Partners In A Community Property State Who Are Filing As Single, Head Of Household, Or.

★★★★★ how to fill out form 8958, im in texas. Web the form 8958 essentially reconciles the difference between what employers (and other income sources) have reported to the irs and what the spouses will be. Web from within your taxact return ( online or desktop), click federal (on smaller devices, click in the top left corner of your screen, then click federal ). Web electronic signature forms library other forms all forms fillable form 8958 fillable form 8958 use a form 8958 example template to make your document workflow more.

Web First, Print The Form 8958 From Each Spouse's Return In Order To Complete The Spouse Column On The Other Spouse's Return:

Web if your resident state is a community property state, and you file a federal tax return separately from your spouse or registered domestic partner, use form 8958 to report half. Yes, loved it could be better no one. Web income allocation information is required when electronically filing a return with a married filing separately or registered domestic partner status in the individual module of intuit. Do i put the clients… how to fill out form 8958, im in texas.

Web You Must Attach Form 8958 To Your Tax Form Showing How You Figured The Amount You’re Reporting On Your Return.

Go to screen 3.1, community property income allocation. Pick the web sample in the catalogue. Sign in to your taxact. Web how do i complete the married filing separate allocation form (8958)?