How To Fill Out Form 1116

How To Fill Out Form 1116 - Web form 8716 is used by partnerships, s corporations, and personal service corporations to elect under section 444(a) to have a tax year other than a required tax. Web how to file form 1116 head over to our ways to file page and choose to either file with an advisor or file yourself. Web you must complete form 1116 in order to claim the foreign tax credit on your us tax return. Web once signed in, select the “select income (s)” section in the navigation left of the page: However, you may qualify for an. Web when filling out a form 1116 explanation statement, you should always include the following personal details: Complete, edit or print tax forms instantly. You do not have to complete form 1116 to take. Register online and complete your tax. Web turbotax help intuit where do i enter the foreign tax credit (form 1116) or deduction?

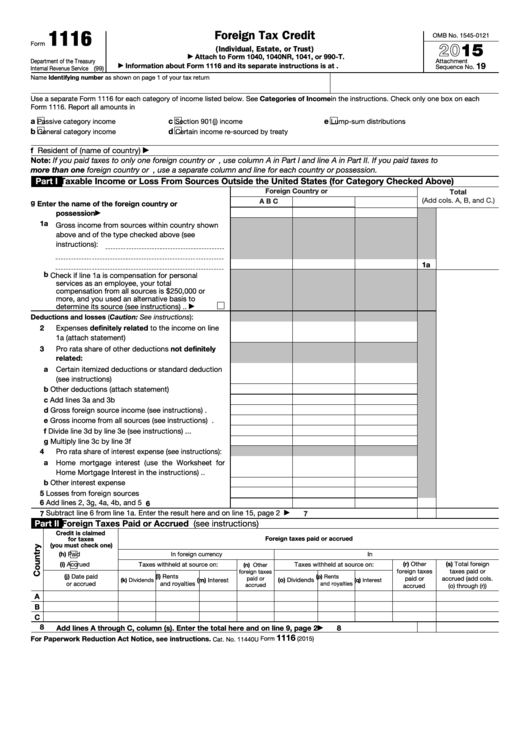

Web general instructions purpose of schedule schedule b (form 1116) is used to reconcile your prior year foreign tax carryover with your current year foreign tax carryover. You must have incurred or paid a foreign tax liability. Get ready for tax season deadlines by completing any required tax forms today. Web (december 2021) foreign tax carryover reconciliation schedule department of the treasury internal revenue service see separate instructions. Complete, edit or print tax forms instantly. Web once signed in, select the “select income (s)” section in the navigation left of the page: Web a form 1116 does not have to be completed if the total creditable foreign taxes are not more than $300 ($600 if married filing a joint return) and other conditions are met; The form requests the information about the country your foreign taxes were paid in, the. Web when filling out a form 1116 explanation statement, you should always include the following personal details: Web for the latest information about developments related to form 1116 and its instructions, such as legislation enacted after they were published, go to irs.gov/form1116.

Web when filling out a form 1116 explanation statement, you should always include the following personal details: Find out if you qualify for the foreign tax credit. The form requests the information about the country your foreign taxes were paid in, the. You do not have to complete form 1116 to take. Web a form 1116 does not have to be completed if the total creditable foreign taxes are not more than $300 ($600 if married filing a joint return) and other conditions are met; You must have incurred or paid a foreign tax liability. Web how to file form 1116 head over to our ways to file page and choose to either file with an advisor or file yourself. If you make this election, you cannot carry back or carry over any unused foreign tax to or from this tax year. Web once signed in, select the “select income (s)” section in the navigation left of the page: Web for the latest information about developments related to form 1116 and its instructions, such as legislation enacted after they were published, go to irs.gov/form1116.

Fill Free fillable Form 1116 2019 Foreign Tax Credit PDF form

Web turbotax help intuit where do i enter the foreign tax credit (form 1116) or deduction? Web once signed in, select the “select income (s)” section in the navigation left of the page: The form requests the information about the country your foreign taxes were paid in, the. You do not have to complete form 1116 to take. Web for.

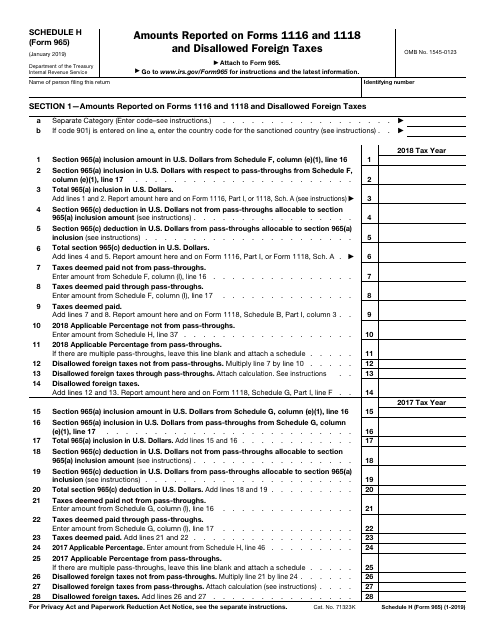

IRS Form 965 Schedule H Download Fillable PDF or Fill Online Amounts

Find out if you qualify for the foreign tax credit. If you make this election, you cannot carry back or carry over any unused foreign tax to or from this tax year. Solved • by turbotax • 2533 • updated april 11, 2023 to see when form. Web to choose the foreign tax credit you generally must complete form 1116.

Form I580F Edit, Fill, Sign Online Handypdf

Register online and complete your tax. Web (december 2021) foreign tax carryover reconciliation schedule department of the treasury internal revenue service see separate instructions. However, you may qualify for an. Web william baldwin senior contributor nov 9, 2021,11:41am est listen to article share to facebook share to twitter share to linkedin an explanation of the weird form. Web a form.

Form 1116 Edit, Fill, Sign Online Handypdf

Web to choose the foreign tax credit, you generally must complete form 1116, foreign tax credit and attach it to your u.s. Web when filling out a form 1116 explanation statement, you should always include the following personal details: Get ready for tax season deadlines by completing any required tax forms today. Web you elect this procedure for the tax.

How to fill out form 1116 foreign tax credit Australian manuals

Web for the latest information about developments related to form 1116 and its instructions, such as legislation enacted after they were published, go to irs.gov/form1116. Web general instructions purpose of schedule schedule b (form 1116) is used to reconcile your prior year foreign tax carryover with your current year foreign tax carryover. Web when filling out a form 1116 explanation.

Filing Taxes While Working Abroad — Ambassador Year in China

Web turbotax help intuit where do i enter the foreign tax credit (form 1116) or deduction? Solved • by turbotax • 2533 • updated april 11, 2023 to see when form. Web you must complete form 1116 in order to claim the foreign tax credit on your us tax return. If you make this election, you cannot carry back or.

Form 1116 part 1 instructions

Web turbotax help intuit where do i enter the foreign tax credit (form 1116) or deduction? If you make this election, you cannot carry back or carry over any unused foreign tax to or from this tax year. Web once signed in, select the “select income (s)” section in the navigation left of the page: Web form 1116 instructions step.

Form 1116 Edit, Fill, Sign Online Handypdf

Solved • by turbotax • 2533 • updated april 11, 2023 to see when form. You do not have to complete form 1116 to take. Web how to claim the foreign tax credit. The form requests the information about the country your foreign taxes were paid in, the. Web to choose the foreign tax credit you generally must complete form.

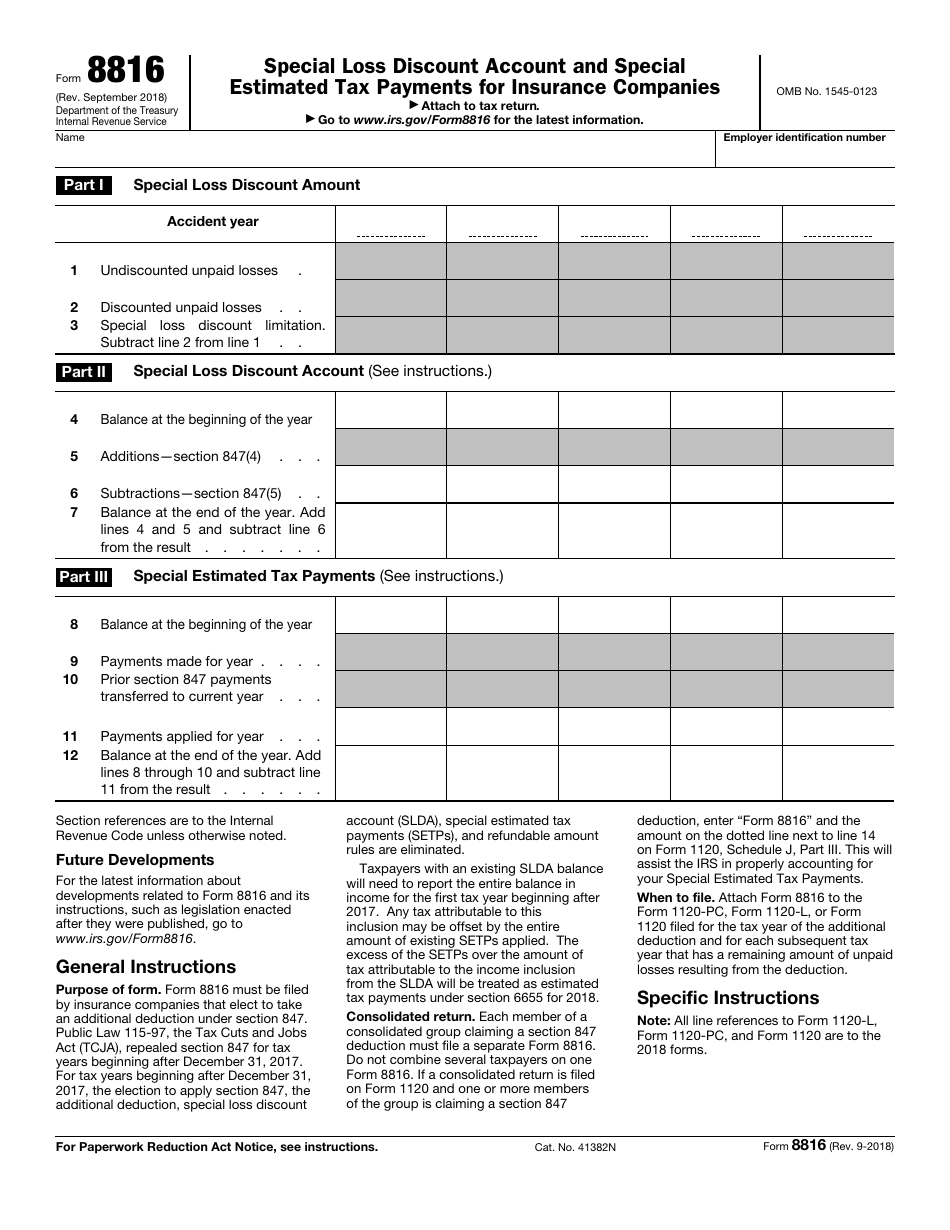

IRS Form 8816 Download Fillable PDF or Fill Online Special Loss

The form requests the information about the country your foreign taxes were paid in, the. Web how to file form 1116 head over to our ways to file page and choose to either file with an advisor or file yourself. Web william baldwin senior contributor nov 9, 2021,11:41am est listen to article share to facebook share to twitter share to.

Fillable Form 1116 Foreign Tax Credit printable pdf download

Web how to claim the foreign tax credit. Web form 8716 is used by partnerships, s corporations, and personal service corporations to elect under section 444(a) to have a tax year other than a required tax. Web to choose the foreign tax credit you generally must complete form 1116 and attach it to your form 1040. You must have incurred.

The Form Requests The Information About The Country Your Foreign Taxes Were Paid In, The.

Get ready for tax season deadlines by completing any required tax forms today. Web for the latest information about developments related to form 1116 and its instructions, such as legislation enacted after they were published, go to irs.gov/form1116. Web turbotax help intuit where do i enter the foreign tax credit (form 1116) or deduction? Web you must complete form 1116 in order to claim the foreign tax credit on your us tax return.

File Form 1116, Foreign Tax Credit, To Claim The Foreign Tax Credit If You Are An Individual, Estate Or Trust, And You Paid Or.

Web form 8716 is used by partnerships, s corporations, and personal service corporations to elect under section 444(a) to have a tax year other than a required tax. However, you may qualify for an. Web how to file form 1116 head over to our ways to file page and choose to either file with an advisor or file yourself. Register online and complete your tax.

Web Form 1116 Instructions Step One:

Web to choose the foreign tax credit you generally must complete form 1116 and attach it to your form 1040. Find out if you qualify for the foreign tax credit. Web how to claim the foreign tax credit. Complete, edit or print tax forms instantly.

Once You Enter Your Income, You’ll Be Asked If It Has Been Taxed Outside The Us, And.

Web general instructions purpose of schedule schedule b (form 1116) is used to reconcile your prior year foreign tax carryover with your current year foreign tax carryover. Web (december 2021) foreign tax carryover reconciliation schedule department of the treasury internal revenue service see separate instructions. Web once signed in, select the “select income (s)” section in the navigation left of the page: Web a form 1116 does not have to be completed if the total creditable foreign taxes are not more than $300 ($600 if married filing a joint return) and other conditions are met;