How To Fill Out Form 8880

How To Fill Out Form 8880 - From the main menu of the tax return (form 1040) select: I'm not even sure if i qualify for it yet my turbo tax says i do. Web use form 8880 to figure the amount, if any, of your retirement savings contributions credit (also known as the saver's credit). Web only fill out and submit form 8880 if you meet every guideline for your income and your retirement savings plan. There are important eligibility requirements to. Web see form 8880, credit for qualified retirement savings contributions, for more information. Depending on your adjusted gross income. Web according to the instructions for form 8880, distributions not from a traditional or roth ira, or an elective deferral plan, shouldn't be included. To suppress the spouse’s credit. Credits retirement savings credit (8880) note:

Web to download the form 8880 in printable format and to know about the use of this form, who can use this form 8880 and when one should use this form 8880 form. Web see form 8880, credit for qualified retirement savings contributions, for more information. Click the button get form to open it and begin modifying. Web how do i fill out a form 8880? Because of this i don't know how to even proceed. Depending on your adjusted gross income. Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. Try it for free now! Web there are several ways to submit form 4868. Web according to the instructions for form 8880, distributions not from a traditional or roth ira, or an elective deferral plan, shouldn't be included.

Web how do i fill out a form 8880? There are important eligibility requirements to. Edit, sign and save irs 8880 form. I'm not even sure if i qualify for it yet my turbo tax says i do. How you can submit the irs 8880 on the internet: Web only fill out and submit form 8880 if you meet every guideline for your income and your retirement savings plan. Complete, edit or print tax forms instantly. Because of this i don't know how to even proceed. Two key pieces of information you need before. Knott 13.4k subscribers join subscribe 2.9k views 1 year ago.

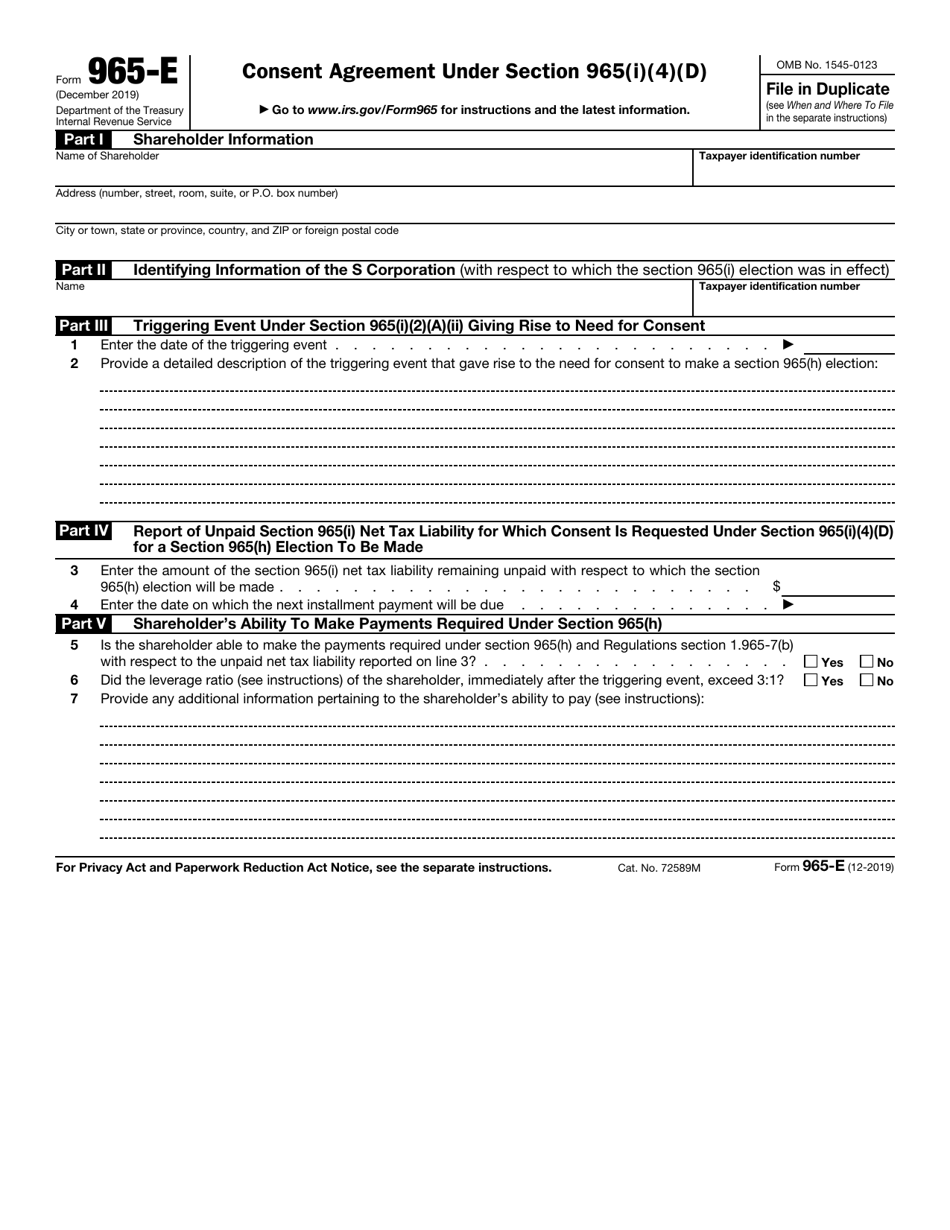

IRS Form 965E Download Fillable PDF or Fill Online Consent Agreement

Web form 8800 is used to qualify for an additional tax credit, up to $1,000, if you contributed to a retirement account; Depending on your adjusted gross income. If you contribute to a retirement plan at work (401(k),. Knott 13.4k subscribers join subscribe 2.9k views 1 year ago. Taxpayers can file form 4868 by mail, but remember to get your.

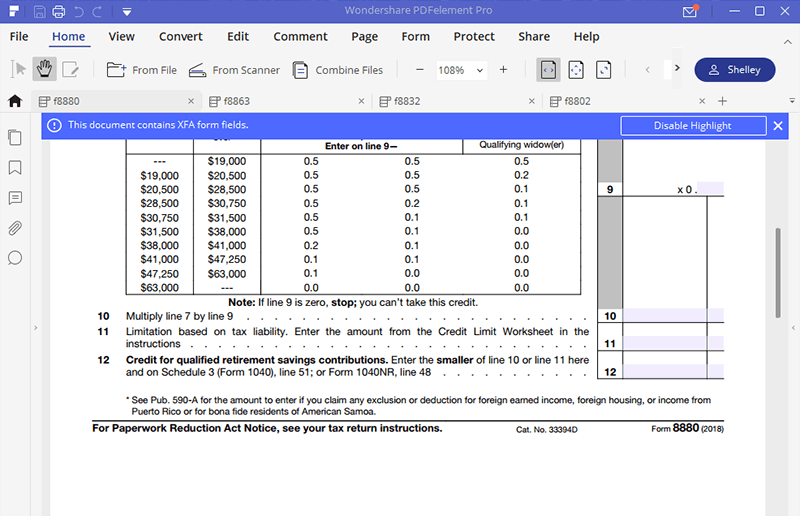

IRS Form 8880 Get it Filled the Right Way

Credits retirement savings credit (8880) note: Two key pieces of information you need before. Web instructions for entering form 8880 in taxslayer pro: Web use form 8880 to figure the amount, if any, of your retirement savings contributions credit (also known as the saver's credit). How you can submit the irs 8880 on the internet:

Education credit form 2017 Fill out & sign online DocHub

To suppress the spouse’s credit. Credits retirement savings credit (8880) note: Because of this i don't know how to even proceed. Web 3 min read january 17, 2017 editor’s note: Web form 8800 is used to qualify for an additional tax credit, up to $1,000, if you contributed to a retirement account;

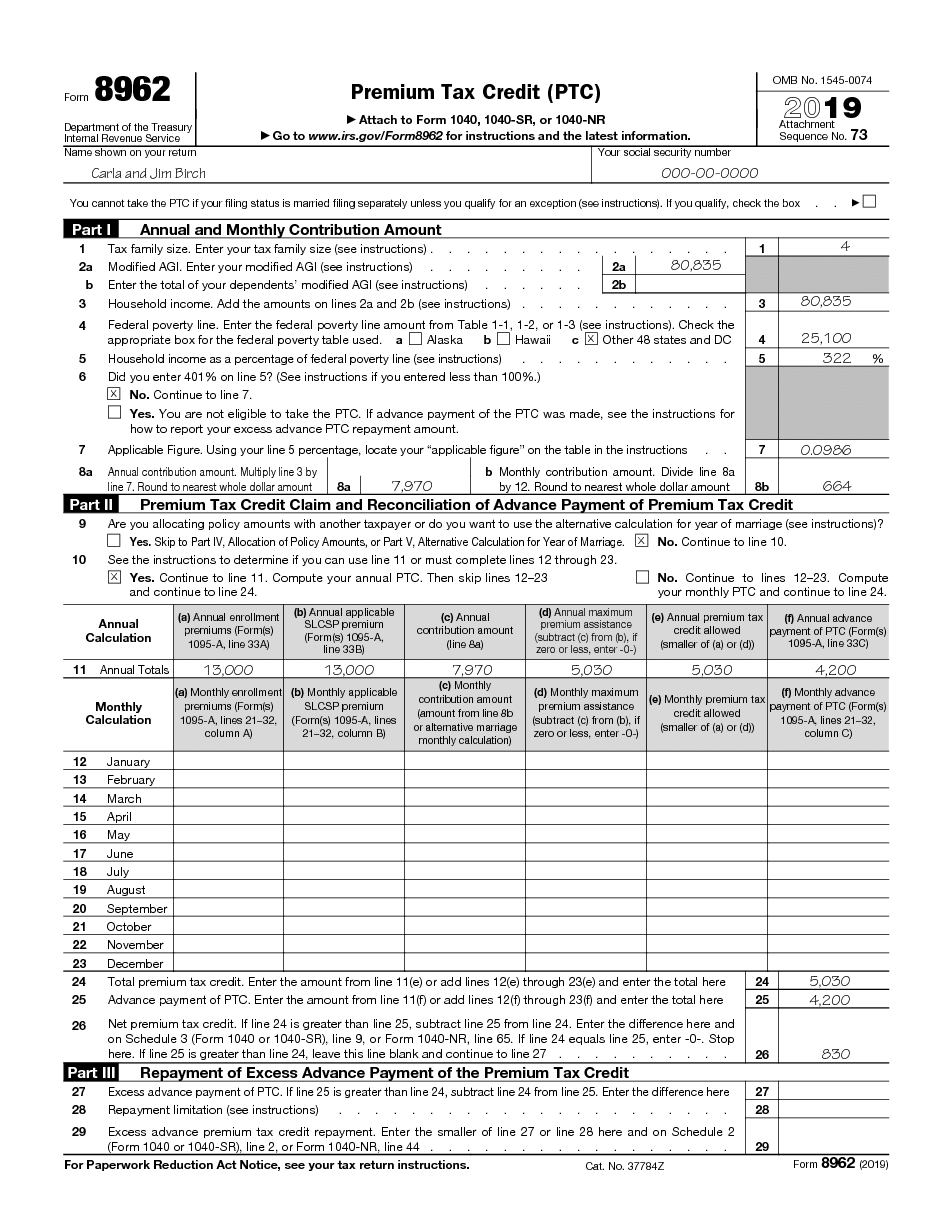

IRS 8962 Form Printable 2020 📝 Get Tax Form 8962 Printable Blank in PDF

There are important eligibility requirements to. Because of this i don't know how to even proceed. Try it for free now! Web follow these guidelines to quickly and properly fill in irs 8880. Web how do i fill out a form 8880?

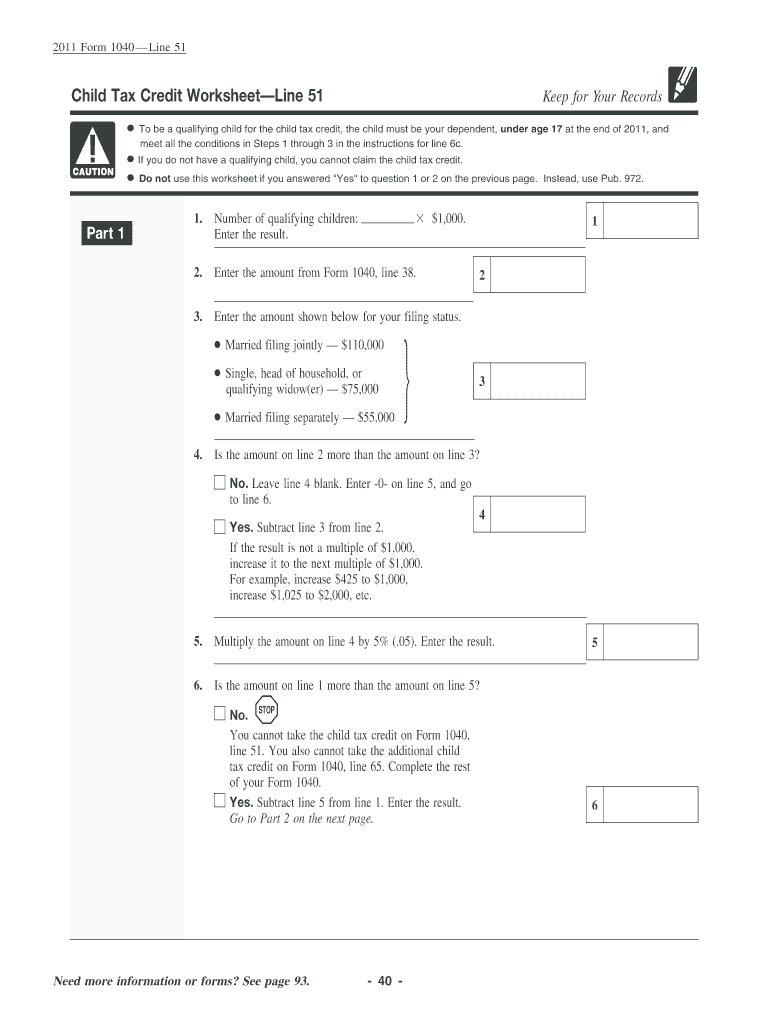

Child Tax Credit Worksheet Parents, this is what happens to your

Depending on your adjusted gross income. Enter 1 in 1=student or dependent, 2=not a student [o]. From the main menu of the tax return (form 1040) select: Web see form 8880, credit for qualified retirement savings contributions, for more information. Such as ira, roth ira, 401 (k) or other similar.

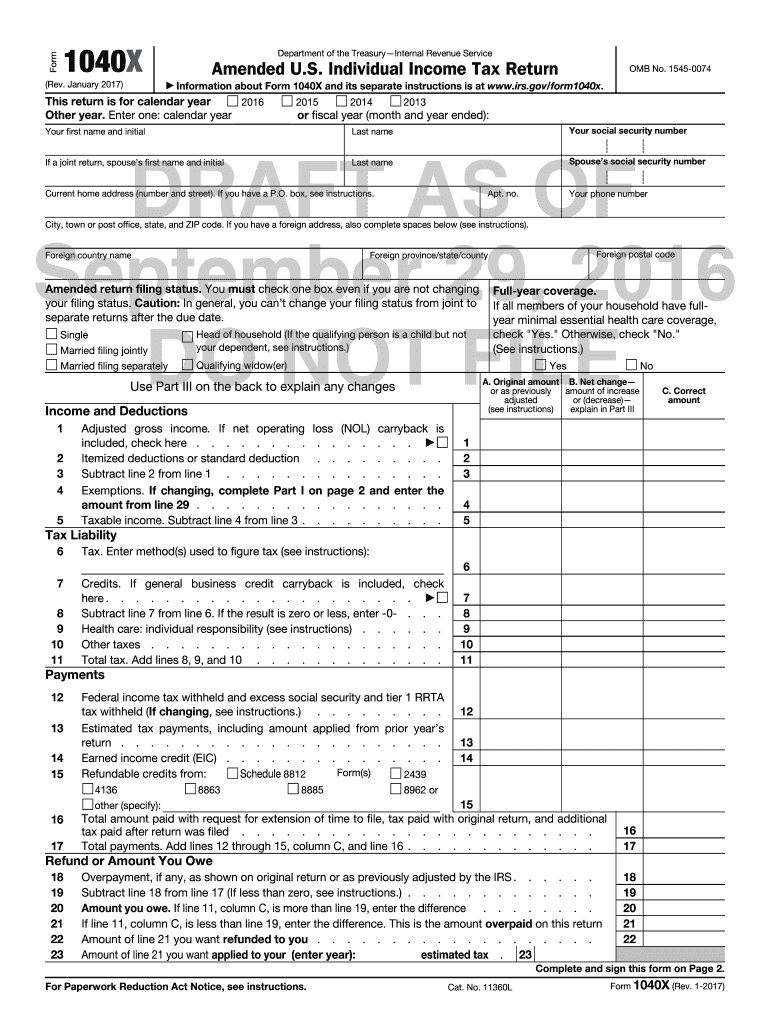

1040X Fill Out and Sign Printable PDF Template signNow

Knott 13.4k subscribers join subscribe 2.9k views 1 year ago. Because of this i don't know how to even proceed. Try it for free now! Web 3 min read january 17, 2017 editor’s note: Such as ira, roth ira, 401 (k) or other similar.

Credit Limit Worksheet credit limit worksheet Fill Online

Web see form 8880, credit for qualified retirement savings contributions, for more information. There are important eligibility requirements to. Because of this i don't know how to even proceed. Two key pieces of information you need before. Depending on your adjusted gross income.

IRS Form 8880 Get it Filled the Right Way

Enter 1 in 1=student or dependent, 2=not a student [o]. Try it for free now! Web according to the instructions for form 8880, distributions not from a traditional or roth ira, or an elective deferral plan, shouldn't be included. Such as ira, roth ira, 401 (k) or other similar. Web see form 8880, credit for qualified retirement savings contributions, for.

2010 Form IRS 8718 Fill Online, Printable, Fillable, Blank pdfFiller

Enter 1 in 1=student or dependent, 2=not a student [o]. Web follow these guidelines to quickly and properly fill in irs 8880. Try it for free now! There are important eligibility requirements to. Edit, sign and save irs 8880 form.

8880 Form ≡ Fill Out Printable PDF Forms Online

Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. Enter 1 in 1=student or dependent, 2=not a student [o]. This credit can be claimed in addition to any ira. Web only fill out and submit form 8880 if you meet every guideline for your income and your retirement savings plan..

Web See Form 8880, Credit For Qualified Retirement Savings Contributions, For More Information.

There are important eligibility requirements to. Web 51 votes what makes the 8880 form legally valid? Uslegalforms allows users to edit, sign, fill & share all type of documents online. From the main menu of the tax return (form 1040) select:

Complete, Edit Or Print Tax Forms Instantly.

Web 3 min read january 17, 2017 editor’s note: Enter 1 in 1=student or dependent, 2=not a student [o]. Web according to the instructions for form 8880, distributions not from a traditional or roth ira, or an elective deferral plan, shouldn't be included. As the society takes a step away from office work, the execution of paperwork increasingly takes place electronically.

Edit, Sign And Save Irs 8880 Form.

How you can submit the irs 8880 on the internet: Web only fill out and submit form 8880 if you meet every guideline for your income and your retirement savings plan. Web to download the form 8880 in printable format and to know about the use of this form, who can use this form 8880 and when one should use this form 8880 form. Try it for free now!

I'm Not Even Sure If I Qualify For It Yet My Turbo Tax Says I Do.

Web in the left section list, select retirement savings contributions credit (8880). Web how do i fill out a form 8880? Upload, modify or create forms. Web follow these guidelines to quickly and properly fill in irs 8880.