How To Form A Reit

How To Form A Reit - Income tax return for real estate investment trusts corporation, trusts, and associations electing to be treated as real estate investment trusts file this form to report their income, gains, losses, deductions, credits, certain penalties and income tax liability. Web specifically, a company must meet the following requirements to qualify as a reit: How must a real estate company be organized to qualify as a reit? Web how do you start a reit? At least 75 percent of the company’s assets must be invested in real estate. Derive at least 75% of gross income. In order to be considered a reit, a company must meet certain criteria: First steps in forming a reit. Web how reits work. How to invest in real estate investment trusts real estate investment trusts are a way for you to invest in commercial real estate property.

First steps in forming a reit. Web how to form a reit real estate investment trust companies. Web investment products real estate investment trusts (reits) what are reits? These organizations must adhere to numerous organizational and operational requirements. You, along with any partners, must first create a corporation that will later become the reit. How must a real estate company be organized to qualify as a reit? You should get the help of an attorney for this part. First, you organize your company as a. Forming a reit is relatively simple, morrison & foerster says. Draft a private placement memorandum (ppm).

Web how reits work. It must be governed by directors or trustees and its shares must be transferable. Reit must be formed in one of the 50 states or the district of columbia as an entity taxable for federal purposes as a corporation. Forming a reit is relatively simple, morrison & foerster says. Irs compliance requirement for reits. First, you organize your company as a. Web decide what type of reit you want to form form a taxable entity. Income tax return for real estate investment trusts corporation, trusts, and associations electing to be treated as real estate investment trusts file this form to report their income, gains, losses, deductions, credits, certain penalties and income tax liability. Web investment products real estate investment trusts (reits) what are reits? How to invest in real estate investment trusts real estate investment trusts are a way for you to invest in commercial real estate property.

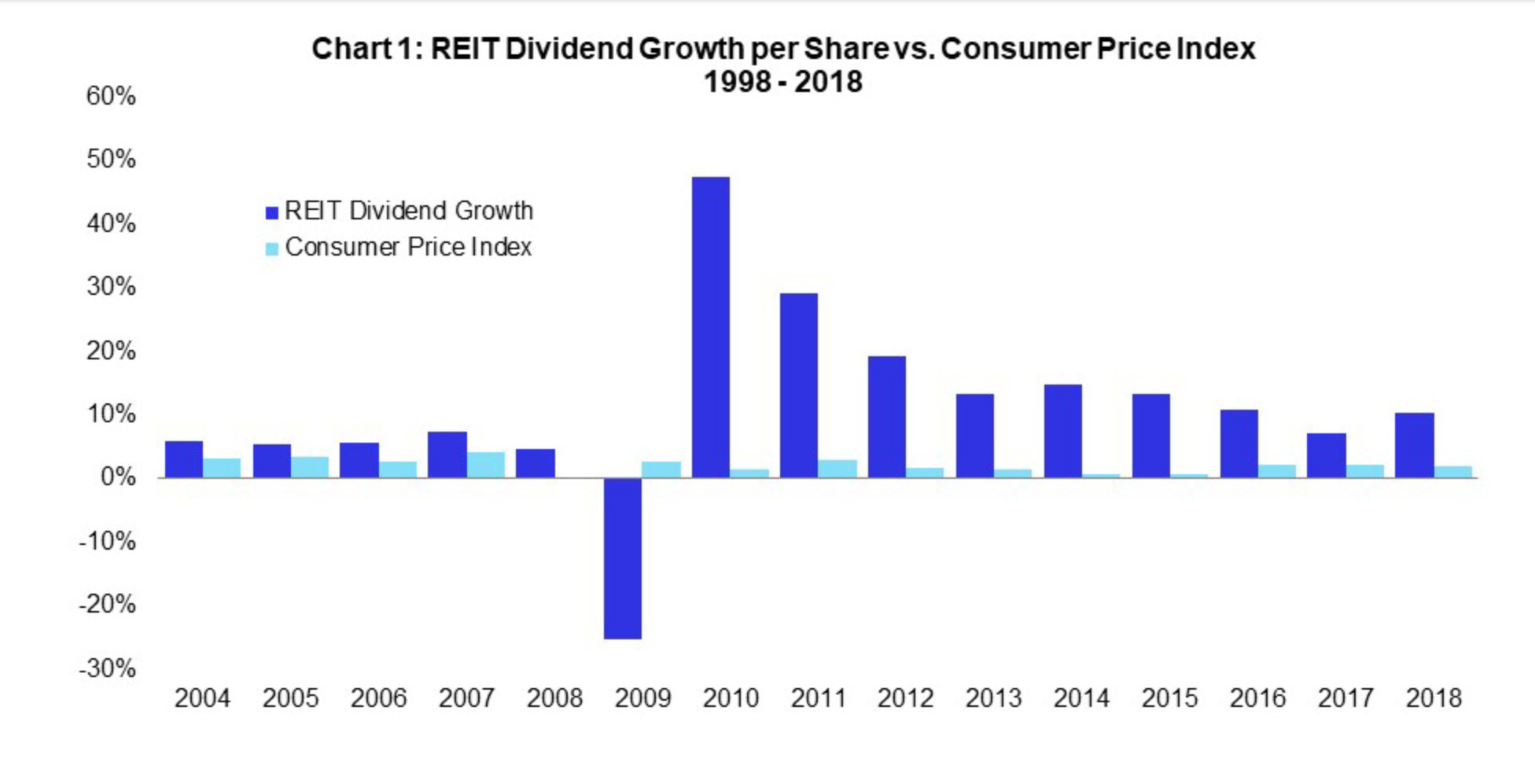

REIT Index Explained How to Understand and Make Money Using REITs/REIT

Web how do you start a reit? Reit must be formed in one of the 50 states or the district of columbia as an entity taxable for federal purposes as a corporation. In order to be considered a reit, a company must meet certain criteria: You should get the help of an attorney for this part. Derive at least 75%.

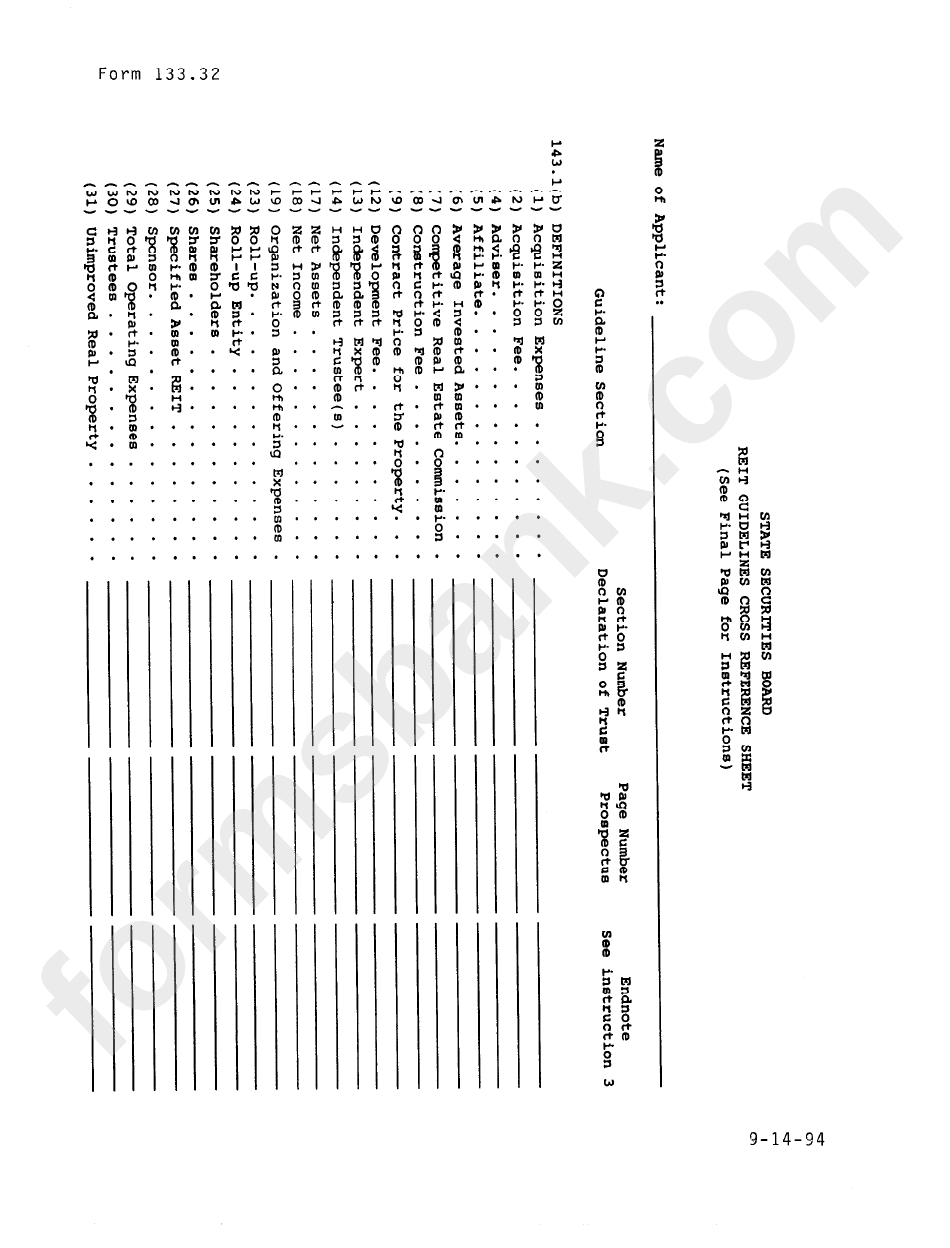

Form 133.22 Reit Guidelines Cross Reference Sheet 1994 printable

Web how to form a reit real estate investment trust companies. Income tax return for real estate investment trusts corporation, trusts, and associations electing to be treated as real estate investment trusts file this form to report their income, gains, losses, deductions, credits, certain penalties and income tax liability. Forming a reit is relatively simple, morrison & foerster says. It.

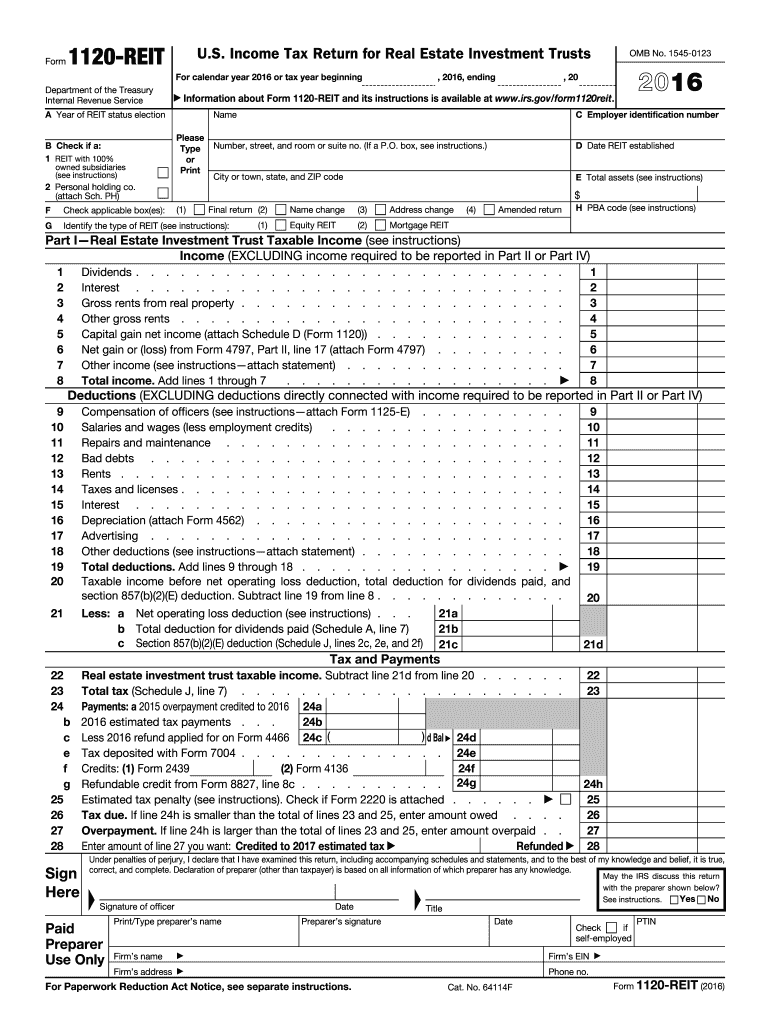

Form 1120REIT Tax Return for Real Estate Investment Trusts

You should get the help of an attorney for this part. Income tax return for real estate investment trusts corporation, trusts, and associations electing to be treated as real estate investment trusts file this form to report their income, gains, losses, deductions, credits, certain penalties and income tax liability. Web investment products real estate investment trusts (reits) what are reits?.

How To Form REIT? Forming a Real Estate Investment Trust Nareit

Web decide what type of reit you want to form form a taxable entity. Income tax return for real estate investment trusts corporation, trusts, and associations electing to be treated as real estate investment trusts file this form to report their income, gains, losses, deductions, credits, certain penalties and income tax liability. Web how to form a reit real estate.

Form 1120REIT Tax Return for Real Estate Investment Trusts

It must be governed by directors or trustees and its shares must be transferable. Invest at least 75% of total assets in real estate, cash, or u.s. At least 75 percent of the. Web how do you start a reit? Real estate investment trust companies are corporations that make their profits.

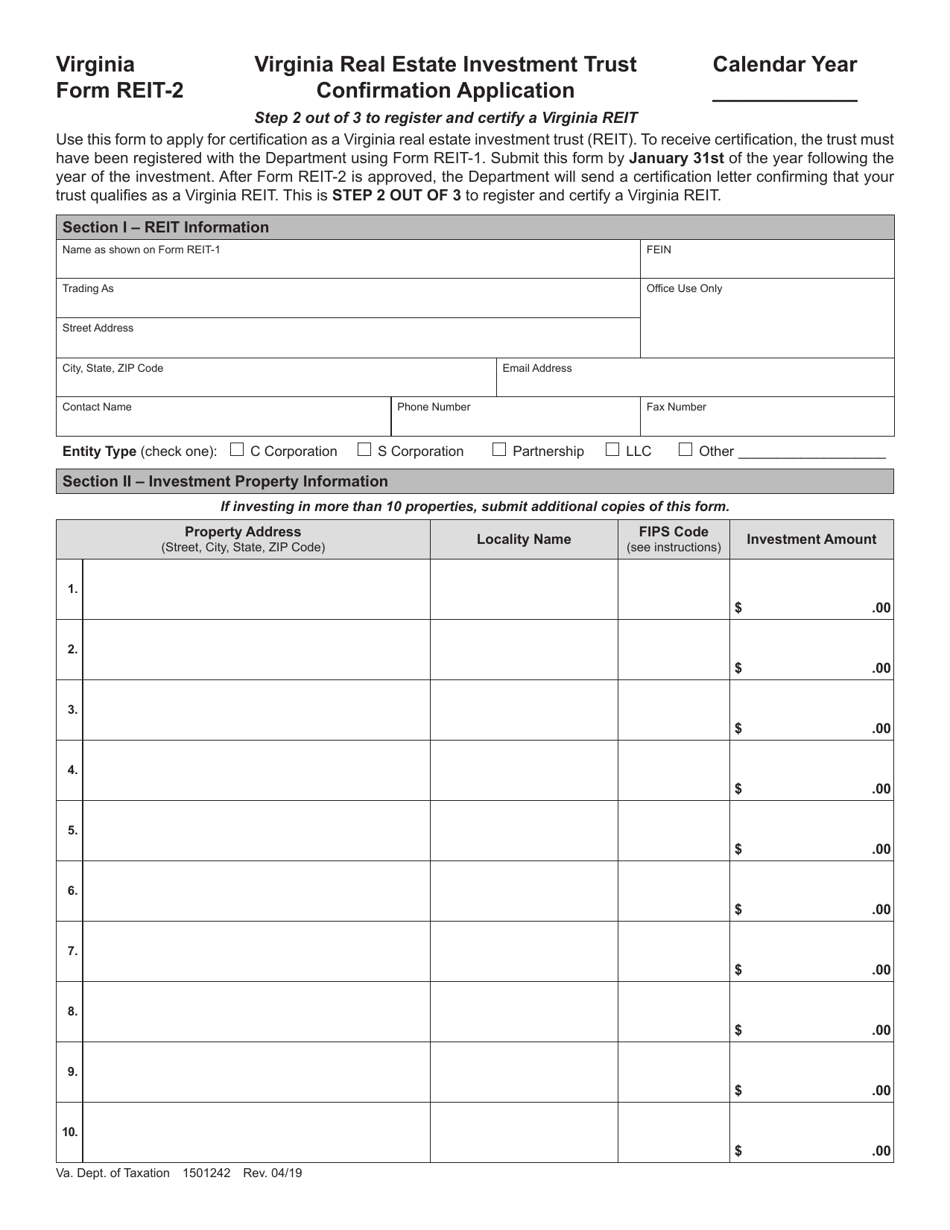

Form REIT2 Download Fillable PDF or Fill Online Virginia Real Estate

How must a real estate company be organized to qualify as a reit? At least 75 percent of the company’s assets must be invested in real estate. Irs compliance requirement for reits. You, along with any partners, must first create a corporation that will later become the reit. In order to be considered a reit, a company must meet certain.

Form 1120REIT Tax Return for Real Estate Investment Trusts

At least 75 percent of the. Web investment products real estate investment trusts (reits) what are reits? How must a real estate company be organized to qualify as a reit? Irs compliance requirement for reits. You, along with any partners, must first create a corporation that will later become the reit.

Instructions for Form 1120 REIT, U.S. Tax Return for Real Esta…

How to invest in real estate investment trusts real estate investment trusts are a way for you to invest in commercial real estate property. In order to be considered a reit, a company must meet certain criteria: Forming a reit is relatively simple, morrison & foerster says. Web how to form a reit real estate investment trust companies. Income tax.

Form 1120 REIT Irs Fill Out and Sign Printable PDF Template signNow

These organizations must adhere to numerous organizational and operational requirements. At least 75 percent of the. Web how to form a reit real estate investment trust companies. Income tax return for real estate investment trusts corporation, trusts, and associations electing to be treated as real estate investment trusts file this form to report their income, gains, losses, deductions, credits, certain.

Instructions for Form 1120 REIT, U.S. Tax Return for Real Esta…

How to invest in real estate investment trusts real estate investment trusts are a way for you to invest in commercial real estate property. Real estate investment trust companies are corporations that make their profits. Draft a private placement memorandum (ppm). First, you organize your company as a. Reit must be formed in one of the 50 states or the.

First Steps In Forming A Reit.

First, you organize your company as a. These organizations must adhere to numerous organizational and operational requirements. How must a real estate company be organized to qualify as a reit? Web specifically, a company must meet the following requirements to qualify as a reit:

Web Investment Products Real Estate Investment Trusts (Reits) What Are Reits?

How to invest in real estate investment trusts real estate investment trusts are a way for you to invest in commercial real estate property. At least 75 percent of the company’s assets must be invested in real estate. Web decide what type of reit you want to form form a taxable entity. In order to be considered a reit, a company must meet certain criteria:

Real Estate Investment Trust Companies Are Corporations That Make Their Profits.

You, along with any partners, must first create a corporation that will later become the reit. Derive at least 75% of gross income. Web how do you start a reit? Income tax return for real estate investment trusts corporation, trusts, and associations electing to be treated as real estate investment trusts file this form to report their income, gains, losses, deductions, credits, certain penalties and income tax liability.

Reit Must Be Formed In One Of The 50 States Or The District Of Columbia As An Entity Taxable For Federal Purposes As A Corporation.

Web 7 steps to forming your own reit decide on the type of reit form a taxable entity draft a private placement memorandum find potential investors convert your management company into a reit maintain compliance start investing in assets legalzoom #1 choice for helping start and grow small businesses. Irs compliance requirement for reits. You should get the help of an attorney for this part. Web how to form a reit real estate investment trust companies.