How To Get Form 3922

How To Get Form 3922 - If you purchased espp shares, your employer will send you form 3922, transfer of stock acquired through an employee stock purchase plan. Web form 3922, transfer of stock acquired through an employee stock purchase plan under section 423 (c) solved • by intuit • 415 • updated july 14, 2022. Review and transmit it to. Enter the required information to file form 3922; Web 8 minute read file for less and get more. Your company transfers the legal title of a share of stock, and the option is exercised under an employee stock purchase plan. Web your employer will send you form 3922, transfer of stock acquired through an employee stock purchase plan under section 423 (c), if you purchased espp stock. Web march 15, 2021 2:36 pm the information on form 3922 would be helpful to insure that you account for your employee stock purchase plan (espp) share sales. If you purchased espp shares, your employer will send you form 3922, transfer of stock acquired through an employee stock purchase. Web step by step guidance if you participate in an employee stock purchase plan, you probably will receive irs form 3922 from your employer at the end of the tax.

If you purchased espp shares, your employer will send you form 3922, transfer of stock acquired through an employee stock purchase. Web form 3922 transfer of stock acquired through an employee stock purchase plan under section 423(c) is for informational purposes only and isn't entered into your return. Web irs form 3922 is for informational purposes only and isn't entered into your return. Sign in or open turbotax 2. Web you are required to file a 3922 if: This needs to be reported on your tax return. Web 1 best answer. Web step by step guidance if you participate in an employee stock purchase plan, you probably will receive irs form 3922 from your employer at the end of the tax. Your company transfers the legal title of a share of stock, and the option is exercised under an employee stock purchase plan. Get started for free stock options and stock purchase plans are a popular way for employers to pad an.

Web form 3922 transfer of stock acquired through an employee stock purchase plan under section 423(c) is for informational purposes only and isn't entered into your return. If you purchased espp shares, your employer will send you form 3922, transfer of stock acquired through an employee stock purchase. If you purchased espp shares, your employer will send you form 3922, transfer of stock acquired through an employee stock purchase plan. For privacy act and paperwork reduction act notice, see the current version of the general instructions for certain. Web form 3922 is an irs form that is used to report the transfer of stock acquired pursuant to an employee stock purchase plan (espp). Your max tax refund is guaranteed. Web you are required to file a 3922 if: Enter the required information to file form 3922; See part l in the current version of the general instructions. Get started for free stock options and stock purchase plans are a popular way for employers to pad an.

Da Form 3822 20202022 Fill and Sign Printable Template Online US

Web step by step guidance if you participate in an employee stock purchase plan, you probably will receive irs form 3922 from your employer at the end of the tax. This needs to be reported on your tax return. Review and transmit it to. Web your employer will send you form 3922, transfer of stock acquired through an employee stock.

3922 2020 Public Documents 1099 Pro Wiki

Review and transmit it to. Click on take me to my return. If you purchased espp shares, your employer will send you form 3922, transfer of stock acquired through an employee stock purchase plan. Get started for free stock options and stock purchase plans are a popular way for employers to pad an. Web form 3922 transfer of stock acquired.

Requesting your TCC for Form 3921 & 3922

Complete irs tax forms online or print government tax documents. Web form 3922, transfer of stock acquired through an employee stock purchase plan under section 423 (c) solved • by intuit • 415 • updated july 14, 2022. In order for a transfer of stock to be. Ad access irs tax forms. See part l in the current version of.

What Is IRS Form 3922?

Select form 3922 from your dashboard; Click on take me to my return. Web you are required to file a 3922 if: If you purchased espp shares, your employer will send you form 3922, transfer of stock acquired through an employee stock purchase plan. Web form 3922, transfer of stock acquired through an employee stock purchase plan under section 423.

Conceptual Photo about Form 3922 Transfer of Stock Acquired through an

Web form 3922 transfer of stock acquired through an employee stock purchase plan under section 423 (c) is for informational purposes only and isn't entered into your return. Web for internal revenue service center file with form 1096. Sign in or open turbotax 2. Web complete form 3922 are the most current general instructions for certain information returns and the.

IRS Form 3922 Software 289 eFile 3922 Software

Web form 3922 is an irs form that is used to report the transfer of stock acquired pursuant to an employee stock purchase plan (espp). Select form 3922 from your dashboard; Review and transmit it to. Web to add form 3922 (transfer of stock acquired through employee stock purchase plan.): For privacy act and paperwork reduction act notice, see the.

What Is IRS Form 3922?

Web 1 best answer. Complete irs tax forms online or print government tax documents. Enter the required information to file form 3922; Your max tax refund is guaranteed. Sign in or open turbotax 2.

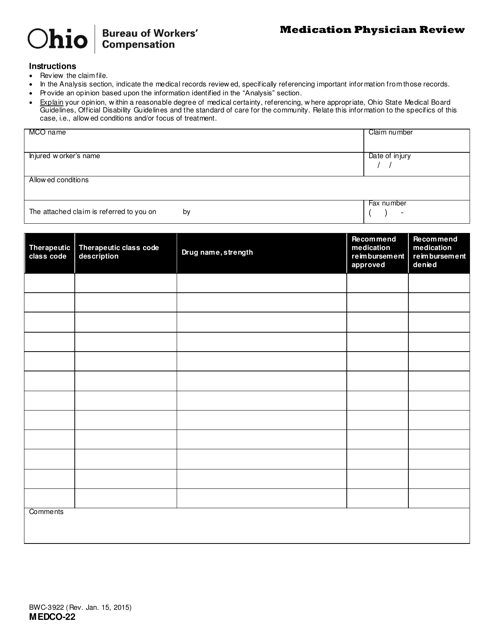

Form MEDCO22 (BWC3922) Download Printable PDF or Fill Online

Complete, edit or print tax forms instantly. In order for a transfer of stock to be. Get started for free stock options and stock purchase plans are a popular way for employers to pad an. Web for internal revenue service center file with form 1096. This needs to be reported on your tax return.

Laser Tax Form 3922 Copy A Free Shipping

Enter the required information to file form 3922; If you purchased espp shares, your employer will send you form 3922, transfer of stock acquired through an employee stock purchase. Review and transmit it to. Click on take me to my return. This needs to be reported on your tax return.

Form 3922 Transfer of Stock Acquired Through An Employee Stock

If you purchased espp shares, your employer will send you form 3922, transfer of stock acquired through an employee stock purchase. Review and transmit it to. In order for a transfer of stock to be. Web form 3922, transfer of stock acquired through an employee stock purchase plan under section 423 (c) solved • by intuit • 415 • updated.

Complete, Edit Or Print Tax Forms Instantly.

Web form 3922 transfer of stock acquired through an employee stock purchase plan under section 423(c) is for informational purposes only and isn't entered into your return. Web step by step guidance if you participate in an employee stock purchase plan, you probably will receive irs form 3922 from your employer at the end of the tax. Web form 3922 is an irs form that is used to report the transfer of stock acquired pursuant to an employee stock purchase plan (espp). Review and transmit it to.

If You Purchased Espp Shares, Your Employer Will Send You Form 3922, Transfer Of Stock Acquired Through An Employee Stock Purchase Plan.

Get started for free stock options and stock purchase plans are a popular way for employers to pad an. Web to add form 3922 (transfer of stock acquired through employee stock purchase plan.): Web irs form 3922 is for informational purposes only and isn't entered into your return. If you purchased espp shares, your employer will send you form 3922, transfer of stock acquired through an employee stock purchase.

Select Form 3922 From Your Dashboard;

Web you are required to file a 3922 if: Sign in or open turbotax 2. Additionally, the irs encourages you to designate an account number for all forms 3922 that you file. Web complete form 3922 are the most current general instructions for certain information returns and the most current instructions for forms 3921 and 3922.

Keep The Form For Your Records Because You’ll Need The Information When You Sell, Assign, Or.

Your company transfers the legal title of a share of stock, and the option is exercised under an employee stock purchase plan. This needs to be reported on your tax return. For privacy act and paperwork reduction act notice, see the current version of the general instructions for certain. Complete irs tax forms online or print government tax documents.